there has been a bunch of "hootin 'n hollering" about the effect that Elon's 2012 shares are doing, as he is acquiring 23,737,050 shares, and dispersing around 12,000,000 shares, (taxes and acquisition) (acquired and previously owned) around $12.8 Billion in sales (all numbers are rough, but close.)

So far he has, as per SEC from 4's, acquired ~16 million of the 23.8 million

however if you look at the March, 2018 there is a 4-5x tsunami coming, the next earthquake is in the process of happening

20,264,042 (pre-split) shares were possible by 2028

this was done when Tesla the company was valued at ==> $59 billion <==, not $1+ Trillion, so one of the series of $50 Billion milestones was to get to a value of $650 Billion, done

This set has been far exceeded

@The Accountant has been following this and pointed out that a number of other milestones have been hit, more most likely by Q4

Elon and Tesla have until 2028 to hit the milestones, but in under 4 years a lot have been hit already, some exceeded

here is a ==>__hypothetical__<== scenerio based on the 2018 documents

The salient numbers are

Elon will get another 101,320,210 shares, in 12 tranches

their fixed cost at $70/share will be $7.1 Billion

He is _only_ allowed to sell these shares to cover cost to acquire and taxes

::assumption Tesla goes up in 10% increments between now and the 12 tranches

They would then have a _taxable_ value of $181 Billion

of the 101 million shares, Elon will need to sell around _58 million_ shares to cover acquisition costs and tax costs, but is precluded from selling any more for a minimum of 5 years.

and, more or less, bottom line, he should be worth well over $600+ Billion by 2028, if the stock price appreciates in 10% increments

Elon would end up, after acquisition costs and taxes, with an additional 43 million shares,

this would add another 101 million shares to the 1 billion (1,000 million) shares, diluting around 10%, BUT the stock price will/should/might appreciate 300% so a negligible cost

(those of us whom are 30 - 100 baggers will take a tiny nick)

additionally

I find it extremely suspect and bothering that the SEC feels the necessity to officially state

"Please note that fails-to-deliver can occur for a number of reasons on both long and short sales. Therefore, fails-to-deliver are not necessarily the result of short selling, and are

not evidence of abusive short selling or “naked” short selling"

unless they are getting "heat" from a lot of folks, about that specific actuality

| | | | | FIXED | | | possible | | |

| Date | now to 2028 | | | COST | | | stock price | Taxed Value | |

| 1 | TBD | 8,443,351 | A | $70.00 | $591,068,332 | | | $1,000 | $8,443,350,833 | |

| 2 | TBD | 8,443,351 | A | $70.00 | $591,068,332 | | | $1,100 | $9,287,685,917 | |

| 3 | TBD | 8,443,351 | A | $70.00 | $591,068,332 | | | $1,210 | $10,216,454,508 | |

| 4 | TBD | 8,443,351 | A | $70.00 | $591,068,332 | | | $1,331 | $11,238,099,959 | |

| 5 | TBD | 8,443,351 | A | $70.00 | $591,068,332 | | | $1,464 | $12,361,909,955 | |

| 6 | TBD | 8,443,351 | A | $70.00 | $591,068,332 | | | $1,611 | $13,598,100,951 | |

| 7 | TBD | 8,443,351 | A | $70.00 | $591,068,332 | | | $1,772 | $14,957,911,046 | |

| 8 | TBD | 8,443,351 | A | $70.00 | $591,068,332 | | | $1,949 | $16,453,702,150 | |

| 9 | TBD | 8,443,351 | A | $70.00 | $591,068,332 | | | $2,144 | $18,099,072,365 | |

| 10 | TBD | 8,443,351 | A | $70.00 | $591,068,332 | | | $2,358 | $19,908,979,602 | |

| 11 | TBD | 8,443,351 | A | $70.00 | $591,068,332 | | | $2,594 | $21,899,877,562 | |

| 12 | TBD | 8,443,351 | A | $70.00 | $591,068,332 | | | $2,853 | $24,089,865,318 | |

| | 101,320,210 | | total | $7,092,819,981 | | | | $180,555,010,166 | appx tax value |

| | | | cost | | | | | $95,694,155,388 | appx 53% tax owed |

| date | 0.569 | | | | to be | | price | $102,786,975,369 | needed |

| 1 | TBD | 4,806,715 | D | | $4,806,715,196 | dispersed | | TBD | | |

| 2 | TBD | 4,806,715 | D | | $5,287,386,715 | dispersed | | TBD | | |

| 3 | TBD | 4,806,715 | D | | $5,816,125,387 | dispersed | | TBD | | |

| 4 | TBD | 4,806,715 | D | | $6,397,737,926 | dispersed | | TBD | | |

| 5 | TBD | 4,806,715 | D | | $7,037,511,718 | dispersed | | TBD | | |

| 6 | TBD | 4,806,715 | D | | $7,741,262,890 | dispersed | | TBD | | |

| 7 | TBD | 4,806,715 | D | | $8,515,389,179 | dispersed | | TBD | | |

| 8 | TBD | 4,806,715 | D | | $9,366,928,097 | dispersed | | TBD | | |

| 9 | TBD | 4,806,715 | D | | $10,303,620,907 | dispersed | | TBD | | |

| 10 | TBD | 4,806,715 | D | | $11,333,982,997 | dispersed | | TBD | | |

| 11 | TBD | 4,806,715 | D | | $12,467,381,297 | dispersed | | TBD | | |

| 12 | TBD | 4,806,715 | D | | $13,714,119,427 | dispersed | | TBD | | |

| | Sell to pay tax | | | | | | | | |

| | 57,680,582 | | | $102,788,161,737 | | | | | |

| | excess left over | | -$1,186,369 | | | | POTENTIAL VALUE | | |

| | 43,639,628 | | | | | | | OF Elon's shares | |

| | | | | | | | | $628,084,049,322 | |

| | | | | | | | | by 2028 | |

| | | | | | | | | | |

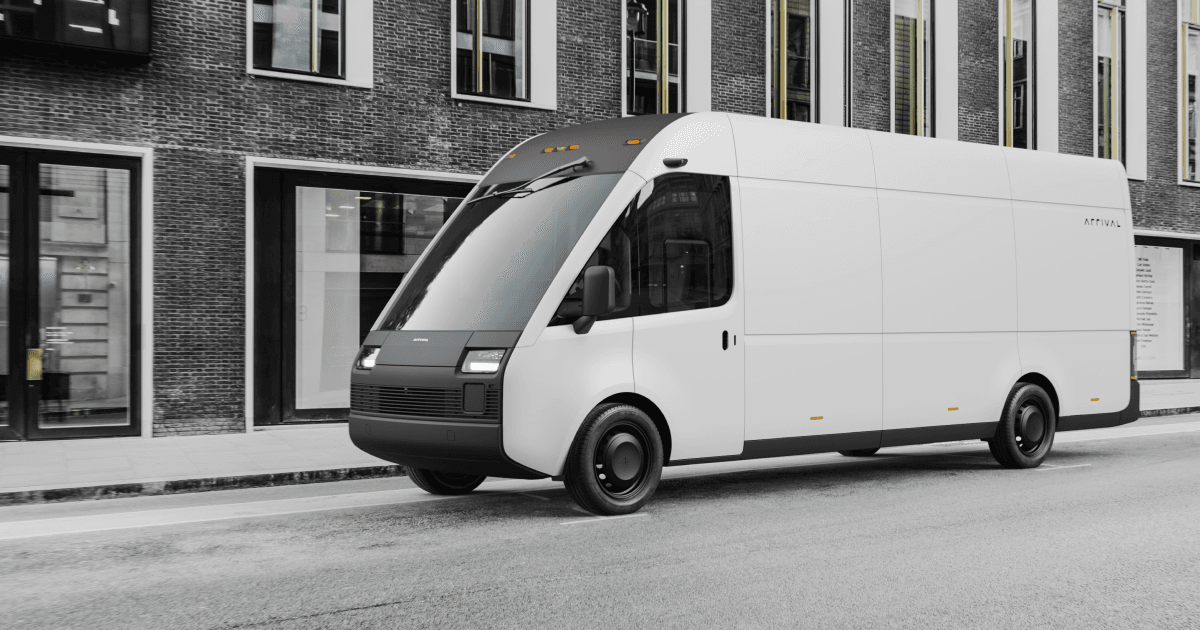

arrival.com