DarthPierce

Member

Is the bottom 768.48? That would be a fibonacci down from 1243.49. Hope the bounce is hard!

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

Perhaps you might want to understand the source:

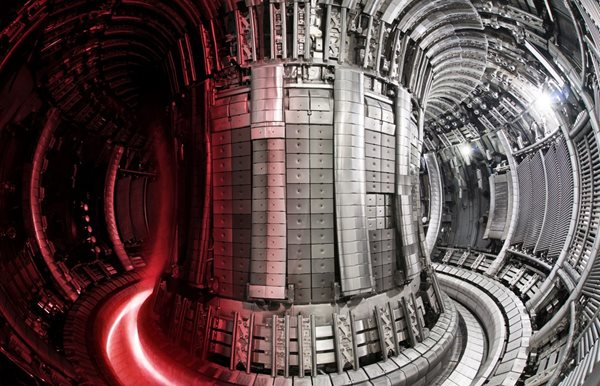

It is indeed ‘huge news’. Given that my post was about possible future disruption of the status quo, this accomplishment, sustained energy production in a tokamok, followed the first demonstration of fusion power production in 1991.

Fusion world | JET makes history, again

The JET tokamak has achieved a first-ever sustained, high-confinement plasma using the same wall materials and fuel mix that ITER will use. The results aligned[...]www.iter.org

What has happened proves that the physics works in a man-made device. Sustainable happened this year announced this month. Nobody knows how long it may be before there might be commercial production, probably not in my lifetime. ITER has proven it indeed can be done.

Now it is engineering. I repeat, nobody knows when this will be commercial. As usual with ‘impossible’ things that are known to be feasible, eventually we now can have a really clean nuclear energy source.

Shortzes?Shortzes just took out the YTD low:

Edit: Support hasn't shown up as of 11:19

View attachment 772895

Still don't know if you guys are all jokingYes. Shortzes.

Sure there will be some of us who do not want to give up car ownership, those of us who can't change or are set in our ways, but kids born today will very likely never own their own car. Or if they do it will be like owning a horse, for purely recreational reasons.

The mass economics are the reason TaaS will take over the auto market in time, it will simply be a cheaper and more convenient way to get around. Now, if you believe Tesla is in the lead to develop FSD and become a first mover in this new market genre, then wouldn't it be wise to own stock in Tesla today, before this huge disruption begins?

Cathy bought some TSLA yesterday. Maybe why it's down. /sI missed a chance to cash in some TSLA gains in the $900s, pay off my house. Unfortunately I think TSLA is headed to about the $600s. The market is flattening out this stock in anticipation of monetary tightening plus the easing of supply shortages across the auto industry, which will slow the rise in Tesla ASPs. I've been invested in TSLA for a long time, so I've seen this movie before. I'm not going to panic sell at lowball prices.

At least TSLA is holding up a lot better than the junk stocks in the rest of Cathie Woods' portfolio. Every cycle there's a new cohort of "superstar" "genius" fund managers who hit on some strategy that works for one cycle, and then never really works again. Eddie Lampert, David Einhorn, John Paulson, the list goes on and on, and now Cathie Wood.

Short sellers. TSLAQ / hedge fundsStill don't know if you guys are all joking

Yes this helps thanks. It's big picture which suits Investors just fine. I needed the reminder (just like you probably needed to write it).Been a hot minute since I've been on this thread. Let's think about the fundamental story of Tesla:

Tesla Specific (short term)

- Achieving 50% growth this year is possible without Austin or Berlin

- Austin and Berlin are soon to be "officially" online, while Shanghai is increasing capacity (all incremental growth)

- The Chip shortage backdrop and supply chain issues will resolve this year (probably late Q2/early Q3) while Tesla already navigated and got more efficient with the issues last year. This implies that when the environment normalizes Tesla is positioned to do business more efficiently

- Similar story above applies to Tesla Energy while still not a "meaningful" part of the business I believe this will be a trojan horse and be the next phase of growth. There is something to be said about having your residence powered 100% off the sun and having backup that requires little to no maintenance. Once this lever is pulled when supply catches up with demand, Tesla Energy will grow a ton

Tesla Specific (medium to long)

- Product roadmap - there's a lot of BS about how the 25k car project is shelved. Nothing could be further from the truth. The Tesla design team in Shanghai is hiring like gangbusters specifically for this design. Why Shanghai you may wonder? Well most of the luxury car manufacturers have design teams in Shanghai and compact cars are incredibly popular in Asia so... who better to design in than the ones who use it most. The only other variables outside of design to make this thing profitable is powertrain and cell capacity. By the time this thing is ready (2 years hopefully), it'll be made profitably and there will be enough cell capacity to support the demand

- Cybertruck - it's coming whether you like it or not and it will coincide with the timing of the other manfacturers to have a meaningful impact. Right now the only one worth their weight is Rivian in terms of production ramp. In addition, I'm fairly certain there's so many orders the first year or year and a half of production is probably sold through. Cash in the bank

- Halo Car - Roadster 2023 will be important to reinvigorate the brand and take the crown again from whoever is king next year (chances are a RiMac Nevera), more of a flex but also free advertising without paying for it

- Tesla Energy - I think the deployments will really continue to grow and all the associated technology with it will lead to an influx of high margin sales. Battery + Solar Panels/Roof. If Tesla indeed decides to scale up their Heat Pumps in their vehicles to home. You have a one stop shop for Home Energy and HVAC needs. On top of this Autobidder is really promising software in commercial applications

- Tesla Fleet/Semi - Fleet sales are going to be increasingly important. This helps Tesla in advertising and conversion of "visiting customers" to real customers. Hertz is just the beginning

- Volume growth - Installed capacity and more gigafactories will ultimately get Tesla to the 30m cars a year mark by the end of the decade. Each Gigafactory rollout has been physically faster. The only roadblocks are regulatory

- FSD/AI/Tesla bot - This is longish term but man when it comes it's going to be a doozy. Tesla has all the pieces but just needs time to improve and get everything together

So why am I reiterating the above. Well it's because if you look at the overall markets you'd think the world is burning and you see some of your major Tesla bulls becoming super deflated

- Russia invading and trying to take Crimea (they've attempted this in 2014), money talks all else walks. They can only keep this up for so long and Russia's main ally in China isn't stupid enough to enter WW3

- Rates are rising. Pretty sure this is priced in and the Fed continues to monitor data if there's a drastic rise to stave off inflation it will stay for a long while. If there's a "step up" rate which chances are what would happen it's not the end of the world

The above are the 2 main variables that are affecting TSLA. It's giving cold feet to institutional investors paired with lack of a bulleted clear plan from Tesla on product road map/achieving volume growth (IMO rightfully so because they should be able to see it) is causing this massive compression in price. On the retail side we're seeing absolute near 2013/14 levels of FUD but the goal posts have moved from demand to supply to FSD/false promises. Meanwhile Tesla is a cash cow with the capability of hypergrowth. This is like AAPL when the iPhone came out. Everybody was focused on the hardware while for much of the decade Apple built the eco system of multiple cash cows using the iPhone as a gateway drug. At the end of the day is Tesla worth 1T at the bare minimum. IMO absolutely but right now there's too much FUD to see it.

Anyway not financial advice and disclosure : I'm 110% into TSLA with my recent margin positions bleeding. Invest knowing your risk tolerance. I hope this post helps. I'm not worried in the short run and I do agree with Gary Black on Twitter where TSLA can hit valuations without FSD and just on pure growth alone in the EV Market which will organically grow significantly and Tesla is positioned Geographically and capacity wise to take advantage of it.

I don't think so, but today is all about the macros trying to hold support it would seem. I was impatiently watching QQQ bounce off of 334. Remember that QQQ was at a high, when Tesla was this past Nov to Jan.Still don't know if you guys are all joking

It’s uncanny. Every time I make a post this happens. You would think I would learn not to waste my time. Sorry for being part of the problem on this forum. I’ll try my best to stay in the background and just be a reader of the great posts on here. Odds are this post will be deleted too. Oh wellMod: Millions of milliseconds ago, the mods collectively banned discussion of FSD in this thread. We promised harsh sanctions. The post that started the 19 deleted posts gets the sanction. Doesn't matter that the individual is usually a good contributor, 'cuz we're serious. --ggr

It can be frustrating but I don't think it's personal. We all tend to get off topic at times and there is a point where it's for the best to reel it in I think.It’s uncanny. Every time I make a post this happens. You would think I would learn not to waste my time. Sorry for being part of the problem on this forum. I’ll try my best to stay in the background and just be a reader of the great posts on here. Odds are this post will be deleted too. Oh well

Ya, no complaint. Didn't even realize I mentioned FSD today. Sorry.Just want to take a moment to thank all the MODS for their tireless efforts to keep this forum useable. TMC's Investor Round-table is truly one of the few places left on the internet where the 'bird do not rule the roost (and *sugar* up the joint).

Well okay, maybe they do mess up the floor, but at least we have MODS to sweep up afterward, dirty job though it is.

Profound thanks. You guys rock.

Cheers!

Post lunch rally? I'm getting a much better understanding of the aversion many here have to margin buying this month. I'm not sure it's worth the stress.