Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

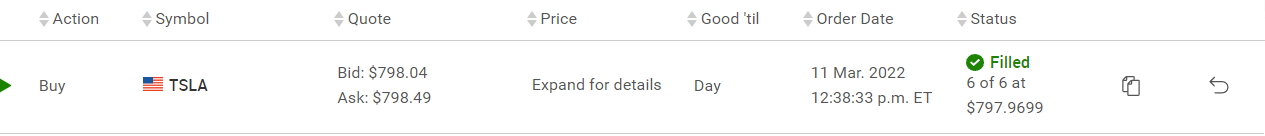

I am taking this opportunity to sell covered calls and then use the proceeds to pick up additional shares. Bought 5 more this morning, making it 18 shares so far this month.

You know, lemons and lemonade....

You know, lemons and lemonade....

Millions spent on real estate, millions invested in getting a politically sanctioned monopoly.View attachment 779425

Tesla Set the Model for Selling EVs; Ford, VW and Others Want to Follow

Executives at traditional car makers view the pivot to electric vehicles as a chance to modernize the way vehicles are priced and sold—and that has dealers worried.www.wsj.com

View attachment 779431

They can sell the real estate, they can't ever get that money back they spent on their local politician.

Aren’t you worried about getting Called Out at these low prices?I am taking this opportunity to sell covered calls and then use the proceeds to pick up additional shares. Bought 5 more this morning, making it 18 shares so far this month.

You know, lemons and lemonade....

henchman24

Active Member

The market is pretty much paralyzed right now with the situation in Ukraine. Movement there will be the driver for the near future. As long as there is major risk there, the big money will stay on the sidelines. Any chart, EMA, MA, RSI, etc would all be thrown away if a resolution came there. The moment that happens, the market will jump in a heartbeat.

Going into next week, we also have the fed decision where a week ago bets moved right to a 25 point increase and have slowly shifted back to a 50 point increase. If the 50 comes to fruition, more bleeding will happen. If 25 happens, there should be a small uptick that'll probably be short lived. Either way on that though, we are waiting on something to happen in Ukraine. As long as that is happening, we are in a mostly sideways but tilting down market with wild volatility.

Going into next week, we also have the fed decision where a week ago bets moved right to a 25 point increase and have slowly shifted back to a 50 point increase. If the 50 comes to fruition, more bleeding will happen. If 25 happens, there should be a small uptick that'll probably be short lived. Either way on that though, we are waiting on something to happen in Ukraine. As long as that is happening, we are in a mostly sideways but tilting down market with wild volatility.

henchman24

Active Member

This is really the way to go IMO. I've gathered up an extra leap and have enough funds to grab another when I feel the time is right.I am taking this opportunity to sell covered calls and then use the proceeds to pick up additional shares. Bought 5 more this morning, making it 18 shares so far this month.

You know, lemons and lemonade....

StarFoxisDown!

Well-Known Member

Just a FYI, for the S&P to go down to where he's pointing or go down as much as everyone is fearing, it would take Apple/Microsoft/Goggle/FB all crashing. Otherwise, it's actually pretty much impossible. The collection of those 5 stocks make up too much of the revenue and especially earnings of the S&P.Chicken Genius provides analysis of the current state of affairs, along with his plans based upon his concerns.

TLDW:

Key takeaways, he has two investment portfolios, Long-term and Itchy-fingers.

- He is HODLing his long-term stocks, knowing that over the next few years TSLA (and others) will hold up well, despite the turmoil due to recent events.

- He is selling his short term Itchy-fingers stock holdings and considering other plays that traditionally favor this sort of environment.

If you take out those 5, the S&P is already deep in bear market territory (20%+ from ATH). Not saying the S&P/Nasdaq can't take the dive lower since it very well could. But those 5 stocks, especially Apple, need to crash for it to happen.

WolfHero

Member

Took out emergency medical $ reserve and bought some more to round out to even round number of chairs HODL

Same exactly!Proud owner of 10 new BOO.BS

(Edit: Drats! I forgot, same thing happened at 420.69)

Last edited:

If somebody buys the "naked short" do the shares in their portfolio vanish? The shares vanish or have the number of shares increased. Someone holds the "bag".Not exactly. There are 'naked shorts'. There are 'fail to deliver'. Similar but not identical. For popular reference check GameStop.

ZachF

Active Member

I wonder how many fewer gallons of gas is burned with each additional Tesla car on average?

It takes about 20 million EVs on the road to reduce oil consumption by about 1 million bpd.

Don’t see how you can be so bearish in regards to a company whose products are so difficult to criticize.

TL;dr: The pros: all the very important things we all know about…performance, tech, value, ease of use.

The negatives: the silly things we all put up with…he doesn’t live near a service center, panel gaps, he’s a boomer and thinks buttons are luxurious so he prefers Audi and BMW ‘luxury’

TL;dr: The pros: all the very important things we all know about…performance, tech, value, ease of use.

The negatives: the silly things we all put up with…he doesn’t live near a service center, panel gaps, he’s a boomer and thinks buttons are luxurious so he prefers Audi and BMW ‘luxury’

StarFoxisDown!

Well-Known Member

Pretty easy to see to meDon’t see how you can be so bearish in regards to a company whose products are so difficult to criticize.

TL;dr: The pros: all the very important things we all know about…performance, tech, value, ease of use.

The negatives: the silly things we all put up with…he doesn’t live near a service center, panel gaps, he’s a boomer and thinks buttons are luxurious so he prefers Audi and BMW ‘luxury’

A classic example of "I enjoy the product, including my wife who will never drive anything other than Tesla for the future...........but my company is paid off to have a artificially low PT on Tesla"

Do you mean, worried about a snap back in SP to higher than my strike price and getting my shares called away?Aren’t you worried about getting Called Out at these low prices?

Yes, I am slightly concerned. But I am only selling CCs on a portion of my shares. And the strike price I set is out of the money. So if the CCs are in play, that means my portfolio has done well. And I will deal with rolling them further out if that's what it takes.

There is a small risk that the SP rises so quickly that rolling up and out isn't a viable long term option. That's the risk I'm willing to take to accumulate more shares at these depressed prices.

ZachF

Active Member

Rivian Missed on both top and bottom line

54m revenue vs 61m expected

-4.83EPS vs -1.97 expected

Wait, did they lose $4b+ in a single quarter!?!?

I really do not get why he would write this article? He has a bearish view on $TSLA and he owns 2 Teslas? Something's gotta give here...either Bernstein is forcing his hand (Unknown reasons) to be bearish or he's just clueless....and he seems like he's semi smart.Don’t see how you can be so bearish in regards to a company whose products are so difficult to criticize.

TL;dr: The pros: all the very important things we all know about…performance, tech, value, ease of use.

The negatives: the silly things we all put up with…he doesn’t live near a service center, panel gaps, he’s a boomer and thinks buttons are luxurious so he prefers Audi and BMW ‘luxury’

So if Tesla builds 2 million vehicles in 2022, that saves 100,000 barrels per day, then that sounds pretty good.It takes about 20 million EVs on the road to reduce oil consumption by about 1 million bpd.

ZachF

Active Member

The people shorting TSLA could have made exponentially more money just HODL TSLA and selling after 5 to 10 years. The accumulated gains could have put an oil derrick, small refinery, and natural gas drill and pump in everyone's backyard. Instead we are stuck with solar panels that provide energy for free and no oily mess.

Most people shorting Tesla could have performed better burying their money in holes i the yard, even if they forgot where they buried a lot of it…

StealthP3D

Well-Known Member

The market really is fascinating.

Tesla has had nothing but positive tangible catalysts like gas prices driving orders up 100%, expansion of existing factories towards spectacular volumes, 2 brand-new cutting edge factories eminently opening, nimble,and advanced plans or long-term contracts for all the relevant latest material and component "shortages" AND dreamy financial performance and forecasts. The world is currently and literally in chaos due to the lack of more of Tesla's various products. It's quite an amazing time for the company looking forward....and yet, as I write this, TSLA is 4x below QQQ and F...GM is GREEN. So, while I have always felt that I understand Tesla far better than most, how can others really be this clueless? HODL.

Most people still view EV's as something being forced by concerns about climate change, an expensive and less than optimum compromise. They don't understand EV's make sense on every level, they think it's a sacrifice to switch to EV's for the sake of the environment.

Because of this misunderstanding, they see the war in Ukraine and all the economic sanctions as taking precedence, something that will temporarily remove the urgency to transition. That, combined with the uncertainty people feel about the future, is all it takes to remove the shine of a company with a valuation that many see as only making sense in an optimistic, utopian future, a future many see as further away than ever. They can't see how Tesla makes sense in a less prosperous future.

The fact remains, market valuations are a product of all investors, and many of them are incredibly dumb and unable to see the bigger picture. That's OK, it's normal and expected. Just know that time has a way of revealing all.

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Replies

- 6

- Views

- 5K

- Replies

- 6

- Views

- 11K

- Locked

- Replies

- 27K

- Views

- 3M