As $1,090 was yesterday, $1,080 seems to be this morning's magic number for our friendly neighborhood spoofers. Low volume making their game child's play. Someone is using a sell order of 1,000 shares (being put in and pulled) to hold the price down.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

2daMoon

Mostly Harmless

As $1,090 was yesterday, $1,080 seems to be this morning's magic number for our friendly neighborhood spoofers. Low volume making their game child's play. Someone is using a sell order of 1,000 shares (being put in and pulled) to hold the price down.

Looks like a great day...

to go ride my bike, instead of watching the SP.

HODL

very similar conversation with my brother been telling him no brainer since $500's ... recent drop to $700 told him to DCA ...Wow! If someone has to sell it all just to buy a Taycan, either they are a real newbie here or they were far too conservative and didn't understand Elon Musk and Tesla when it was a no-brainer less than three years ago at $36/share.

For the record, a few days ago I told my brother TSLA was still a no-brainer at $1000.

he texts me the day split was announced " I guess i should have bought more TSLA" he is trying to time the bottom .. when he could just DCA

it is a viscous cycle especially if you sort of understand a company but you have not done the HW required for conviction ... at that point you are not really sure and will miss multiples of growth which he already has missed a 2X in less than a year (correction he did not miss he full 2X but his trying to time the market has reduced his potential gains significantly )

still a no brainer

Last edited:

Knightshade

Well-Known Member

It is not about selling TSLA or not selling TSLA. It is about how much TSLA you sell and for what exactly?

Do you sell a third now to buy your first house and go off debt and rent completely?

Hell yeah!

Why use YOUR money that could be making way more than 3-5% annually to pay for the house, when you can use the banks money at 3-5%?

lafrisbee

Active Member

She did not Pause and then go "APRIL FOOLS!"Last night my wife and I are watching NBC and in between the many drug commercials they played a Hyundai Ioniq commercial

Wife: "Looks like its time to sell the Tesla Stock"

Me: [triggered]

Me: "No way! They have to pay for advertising! Tesla doesn't even have to pay for commercials, that's an advantage!"

Wife: "OMG, you're totally brainwashed"

Me: "What? That's a reason Tesla is able to make more money"

Wife: "Yeah right." [mocking me] 'Tesla is gonna be 100% of the market, blah blah"

Me: "Lol I didn't say that. But I think they will be able to maintain their share of the EV market"

Wife: "I've talked to people at work. They say they are going to wait for EVs from the brands they like"

Me: "Some might, but there won't even be that many EVs available from other companies"

Wife: "You sound like nut. I can't believe we have all our money tied up in this stock"

And then...

Wife: "You know, what don't you just go

S

E

C

!"

I thought that was where she was headed....

I've been asked for advice regarding investing in Tesla by three people close to me, and I told them to buy and hold on numerous occassions with the stock being anywhere between $200 and $900 so far, as long as they were comfortable with the idea of losing everything they put in, kind of the standard warning for anyone putting money into the market (or it should be, anyway). Thing is, apparantly its extremely difficult to buy and hold even a portion of your stock. One actually bought and hold, and is quite happy right now. The other two decided to exit their positions to secure a measly profit in order to get back in cheaper at a later point, or because they felt the need to buy other stock instead (now deep in the red). While doing so, they kept asking me for advice, which was, and I quote: "DO NOT EXIT COMPLETELY, YOU WILL REGRET IT". So, one of them is still waiting for a good entry point (yes, really), and the other lucked out and actually caught a downswing purchase. No matter how many times I tell him that this doesn't work in the long run, he should just buy and hold part of his investment, he welcomes my wisdom and then does the opposite.very similar conversation with my brother been telling him no brainer since $500's ... recent drop to $700 told him to DCA ...

he texts me the day split was announced " I guess i should have bought more TSLA" he is trying to time the bottom .. when he could just DCA

it is a viscous cycle especially is you sort of understand a company but you have not done the HW required for conviction ... at that point you are not really sure and will miss multiples of growth which he already has missed a 2X in less than a year

still a no brainer

Its a bit frustrating sometimes, so, I hope this makes for a somewhat enjoyable read, and maybe serve as a warning for people considering helping family and friends. You might instead be helping them (or even yourself) sleep less and worry more and, if you're not as lucky as me, get blamed for stocks performing poorly. Tread carefully.

PS: What's DCA? Acronyms suck.

It's dollar cost averaging. And participants have been warned many times not to use abbreviations that are not unquestionably going to be understood by all.I've been asked for advice regarding investing in Tesla by three people close to me, and I told them to buy and hold on numerous occassions with the stock being anywhere between $200 and $900 so far, as long as they were comfortable with the idea of losing everything they put in, kind of the standard warning for anyone putting money into the market (or it should be, anyway). Thing is, apparantly its extremely difficult to buy and hold even a portion of your stock. One actually bought and hold, and is quite happy right now. The other two decided to exit their positions to secure a measly profit in order to get back in cheaper at a later point, or because they felt the need to buy other stock instead (now deep in the red). While doing so, they kept asking me for advice, which was, and I quote: "DO NOT EXIT COMPLETELY, YOU WILL REGRET IT". So, one of them is still waiting for a good entry point (yes, really), and the other lucked out and actually caught a downswing purchase. No matter how many times I tell him that this doesn't work in the long run, he should just buy and hold part of his investment, he welcomes my wisdom and then does the opposite.

Its a bit frustrating sometimes, so, I hope this makes for a somewhat enjoyable read, and maybe serve as a warning for people considering helping family and friends. You might instead be helping them (or even yourself) sleep less and worry more and, if you're not as lucky as me, get blamed for stocks performing poorly. Tread carefully.

PS: What's DCA? Acronyms suck.

Tailwinds keep piling up. Defense production act for battery materials, new MPG requirements etc. I have no idea what the bears are thinking. (if they even can)

DCA - dollar cost average

You can't build real confidence for someone. I'm sure we all have similar experiences. I tell people the same, if you think you can't stomach losing half of your money, just buy index funds.I've been asked for advice regarding investing in Tesla by three people close to me, and I told them to buy and hold on numerous occassions with the stock being anywhere between $200 and $900 so far, as long as they were comfortable with the idea of losing everything they put in,

PS: What's DCA? Acronyms suck.

DCA - dollar cost average

its a pretty common acronym in investing did not think it required explanation on investor threadIt's dollar cost averaging. And participants have been warned many times not to use abbreviations that are not unquestionably going to be understood by all.

Artful Dodger

"Neko no me"

Last night my wife and I are watching NBC and in between the many drug commercials they played a Hyundai Ioniq commercial

Wife: "Looks like its time to sell the Tesla Stock"

Tell her the about the $129 "bty-coolant change" in the Ioniq... Required at their

Because, you know, oil changes.

First, it's not an acronym but an abbreviation - I'd not have said that but you're questioning me. Second, it is a matter of pride that this thread encompasses a very large number of non-Americans and non-native English speakers, and common courtesy should prevail. Third, it's a rule of this thread.its a pretty common acronym in investing did not think it required explanation on investor thread

Knightshade

Well-Known Member

Tell her the about the $129 "bty-coolant change" in the Ioniq... Required at theirstealershipsdealerships or else your warranty is void.

Because, you know, oil changes.

This is another factually untrue post from you, an unfortunate trend of late.

You can not legally require paying for dealership service as a condition of a new car warranty in the US.

You can require someone does the required maintenance- but you can't require the dealer does it.

Just as changing your own oil on an ICE vehicle, instead of paying the dealer, does not "void your warranty" either.

BTW- the coolant change on the EV Ioniq is once every 120,000 miles.

For contrast, the Tesla Model S originally called for a coolant change much more often.

It's lifetime now, but it was every 4 years/48k miles up through ~mid 2019.

Last edited:

adiggs

Well-Known Member

I've been asked for advice regarding investing in Tesla by three people close to me, and I told them to buy and hold on numerous occassions with the stock being anywhere between $200 and $900 so far, as long as they were comfortable with the idea of losing everything they put in, kind of the standard warning for anyone putting money into the market (or it should be, anyway). Thing is, apparantly its extremely difficult to buy and hold even a portion of your stock. One actually bought and hold, and is quite happy right now. The other two decided to exit their positions to secure a measly profit in order to get back in cheaper at a later point, or because they felt the need to buy other stock instead (now deep in the red). While doing so, they kept asking me for advice, which was, and I quote: "DO NOT EXIT COMPLETELY, YOU WILL REGRET IT". So, one of them is still waiting for a good entry point (yes, really), and the other lucked out and actually caught a downswing purchase. No matter how many times I tell him that this doesn't work in the long run, he should just buy and hold part of his investment, he welcomes my wisdom and then does the opposite.

Its a bit frustrating sometimes, so, I hope this makes for a somewhat enjoyable read, and maybe serve as a warning for people considering helping family and friends. You might instead be helping them (or even yourself) sleep less and worry more and, if you're not as lucky as me, get blamed for stocks performing poorly. Tread carefully.

PS: What's DCA? Acronyms suck.

When people ask me the additional thing I have to say is that my own view on TSLA is 10x from here by 2030. So yes - $10k/share is on the horizon (MHO, not-advice), and I'm invested based on that. That doesn't make me right, I can lose my shirt, etc.. Whether this one proves to be right or not, I've been telling people 10x from "here" (wherever we were at, at the time) for 10 years. I've been right twice so far (we've been up 10x, two times so far

And yet - without digging deeply into the company and getting to know it as an investor, pretty much nobody has acted on that. Now I'm busy trying to explain to people why Tesla is (again MHO) the safest stock to be investing in, not the most lunatic fringe crazy. People confuse volatility with risk (a confusion that modern financial management / advice is based on, so its not hard to see why) and see huge volatility in TSLA share price.

The volatility is there for real, but for buy and hold the volatility doesn't matter. What is the actual risk on Tesla? Will the company have a cash flow problem for the foreseeable future that would risk the ability to stay in business? No.

- Tesla might have the problem of too much cash coming up, despite investing as much as they want on everything that they want.

Does the company have a demand problem that might necessitate slowing down production? No.

- The opposite - something like 6+ months of production is already spoken for by people waiting for the car they've ordered to be built and delivered.

Is Elon a reason not to invest? Maybe.

- For me personally its an important reason TO invest.

- But I also see the point of view that he brings too much volatility along for the ride. As if Tesla exists without Elon.

- For these folks, I tell them that Elon Time is a real thing. Short term schedule prognostications - I take those as guesses that will almost certainly be wrong. Consider them to be the 50% confidence schedule estimate in a project plan - if everything happens as mapped out without anything going wrong, then that'll be what happens. It doesn't.

-- Simultaneously, in Elon Time, Elon conceives of and executes the seemingly impossible, over and over. He says he can land orbital class boosters. He was years late on that (boo, hiss) and is the only person (company) on Earth that can do it at all, much less doing it so often now that its barely worth noting individual landings.

-- And lastly - Elon is a package deal. You get it all to get some of it.

So short term schedule - late. Long term impossible - routine.

I invest in the long term and the impossible that Elon makes routine. Which still hasn't, that I've noticed, persuaded anybody to research more deeply. Even with my help. Ah well.

In the case of your second sentence, however, the full story is somewhat worse than the truth as you write. That is, for some time now automakers - assuredly in cahoots with dealers - have written their auto manuals in such a fashion as to make it seem as though what @Artful Dodger is the truth. In other words, they're dissembling; they're tergiversating. And there is a special place in Hell for those.This is another factually untrue post from you, an unfortunate trend of late.

You can not legally require paying for dealership service as a condition of a new car warranty in the US.

You can require someone does the required maintenance- but you can't require the dealer does it.

Just as changing your own oil on an ICE vehicle, instead of paying the dealer, does not "void your warranty" either.

BTW- the coolant change on the EV Ioniq is once every 120,000 miles.

For contrast, the Tesla Model S originally called for a coolant change every 48,000 miles.

It's lifetime now, but it was every 4 years/48k miles up through ~mid 2019.

larmor

Active Member

This is not an uncommon conversation. However discussing the merits of increasing margins in the auto industry in setting of a global pandemic, supply chain issues, and skyrocketing gas and oil prices is not sexy. The market is irrational, but over the course of years, higher margins coupled with increased volume and increased production is the marker that the market holds all companies to.Last night my wife and I are watching NBC and in between the many drug commercials they played a Hyundai Ioniq commercial

Wife: "Looks like its time to sell the Tesla Stock"

Me: [triggered]

Me: "No way! They have to pay for advertising! Tesla doesn't even have to pay for commercials, that's an advantage!"

Wife: "OMG, you're totally brainwashed"

Me: "What? That's a reason Tesla is able to make more money"

Wife: "Yeah right." [mocking me] 'Tesla is gonna be 100% of the market, blah blah"

Me: "Lol I didn't say that. But I think they will be able to maintain their share of the EV market"

Wife: "I've talked to people at work. They say they are going to wait for EVs from the brands they like"

Me: "Some might, but there won't even be that many EVs available from other companies"

Wife: "You sound like nut. I can't believe we have all our money tied up in this stock"

And then...

Wife: "You know, what don't you just go

S

E

C

!"

DFibRL8R

Active Member

Are signatures exempt? If not I have been flagrantly in violation with use of the abbreviation VIN.Third, it's a rule of this thread.

I think one the main issues to people new to investing is now knowing what to listen to. You list many good points, and I can talk all day about how and why Tesla is going to become so very much bigger, more profitable and cause the downfall of laggards in the industry, but those with little knowledge of the company which just write it off as me being gullible, as if I'm peddling Elon's insane future dreams as actual truth. Looking back, they can see that crazy high production targets that were deemed impossible have already been met, but surely the next set of impossible targets won't be achieved?When people ask me the additional thing I have to say is that my own view on TSLA is 10x from here by 2030. So yes - $10k/share is on the horizon (MHO, not-advice), and I'm invested based on that. That doesn't make me right, I can lose my shirt, etc.. Whether this one proves to be right or not, I've been telling people 10x from "here" (wherever we were at, at the time) for 10 years. I've been right twice so far (we've been up 10x, two times so far).

And yet - without digging deeply into the company and getting to know it as an investor, pretty much nobody has acted on that. Now I'm busy trying to explain to people why Tesla is (again MHO) the safest stock to be investing in, not the most lunatic fringe crazy. People confuse volatility with risk (a confusion that modern financial management / advice is based on, so its not hard to see why) and see huge volatility in TSLA share price.

The volatility is there for real, but for buy and hold the volatility doesn't matter. What is the actual risk on Tesla? Will the company have a cash flow problem for the foreseeable future that would risk the ability to stay in business? No.

- Tesla might have the problem of too much cash coming up, despite investing as much as they want on everything that they want.

Does the company have a demand problem that might necessitate slowing down production? No.

- The opposite - something like 6+ months of production is already spoken for by people waiting for the car they've ordered to be built and delivered.

Is Elon a reason not to invest? Maybe.

- For me personally its an important reason TO invest.

- But I also see the point of view that he brings too much volatility along for the ride. As if Tesla exists without Elon.

- For these folks, I tell them that Elon Time is a real thing. Short term schedule prognostications - I take those as guesses that will almost certainly be wrong. Consider them to be the 50% confidence schedule estimate in a project plan - if everything happens as mapped out without anything going wrong, then that'll be what happens. It doesn't.

-- Simultaneously, in Elon Time, Elon conceives of and executes the seemingly impossible, over and over. He says he can land orbital class boosters. He was years late on that (boo, hiss) and is the only person (company) on Earth that can do it at all, much less doing it so often now that its barely worth noting individual landings.

-- And lastly - Elon is a package deal. You get it all to get some of it.

So short term schedule - late. Long term impossible - routine.

I invest in the long term and the impossible that Elon makes routine. Which still hasn't, that I've noticed, persuaded anybody to research more deeply. Even with my help. Ah well.

Yes, yes they will. I can't convince 'em, so "Ah well it is".

Very Important Number!Are signatures exempt? If not I have been flagrantly in violation with use of the abbreviation VIN.

jkirkwood001

Active Member

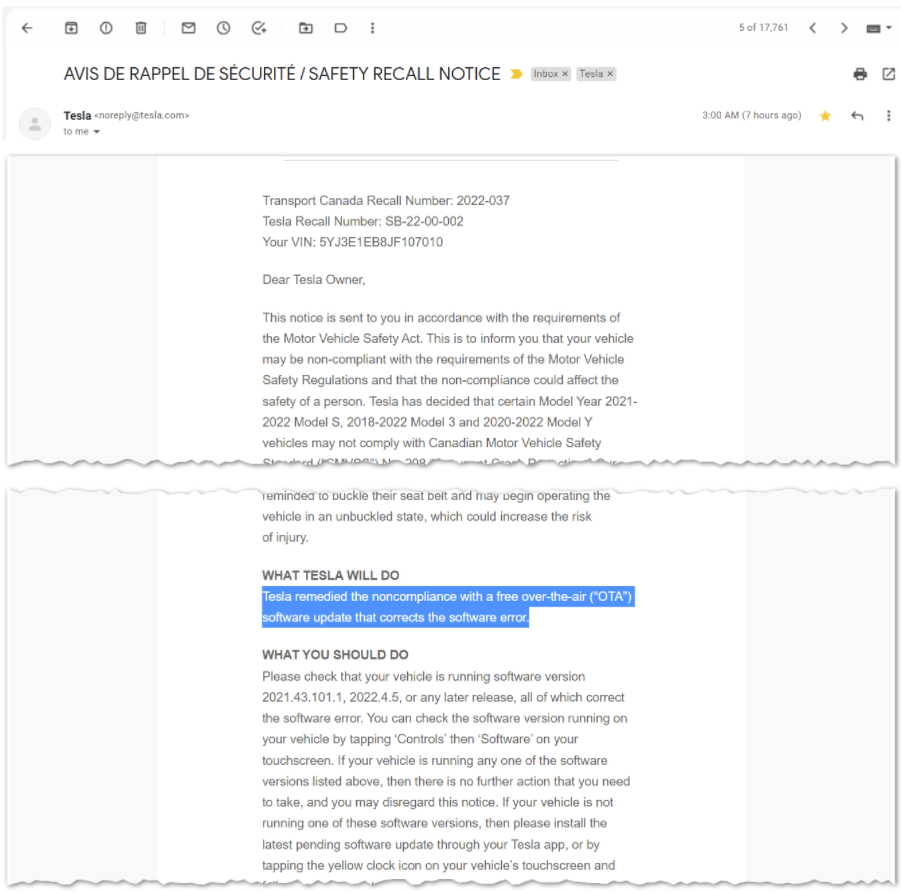

Anybody else get this?

Today, Transport Canada advised me of a recall on my 2018 Model 3, a seat belt warning. Uh-oh.

But read on:

"Tesla remedied the noncompliance with a free over-the-air (“OTA”) software update that corrects the software error."

So basically, Transport Canada is warning me - via Tesla - about a problem my manufacturer has already fixed.

Will the benefits never cease!

Today, Transport Canada advised me of a recall on my 2018 Model 3, a seat belt warning. Uh-oh.

But read on:

"Tesla remedied the noncompliance with a free over-the-air (“OTA”) software update that corrects the software error."

So basically, Transport Canada is warning me - via Tesla - about a problem my manufacturer has already fixed.

Will the benefits never cease!

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K