I like the sound of this ($2300 PT now by far the highest on the Street):

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

BrownOuttaSpec

Active Member

Not quite the highest, but definitely near the top of the list:I like the sound of this ($2300 PT now by far the highest on the Street):

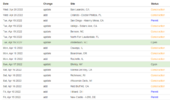

Tesla Price Targets

woodisgood

Optimustic Pessimist

I like the sound of this ($2300 PT now by far the highest on the Street):

If only anyone listened to Trip…

Maybe, but ICE production was impacted, too, so not sure the net penalties should have gone up so much.I've been thinking about the $0.4B jump in pollution credits Tesla booked this quarter. I interpret it as a bonus for Tesla managing to maintain production during Covid while other manufacturers falter in their EV production plans and have to come to Tesla to make up the regulatory difference.

Thought about that way, Tesla's performance during Covid and the supply crunches has added another 0.5 Gigafactory or so to to its eventual manufacturing capacity, multiplied by say 50 years of production.

And now for a wild number: 0.5 GF * 1M cars/factory*year * 50 year factory lifetime * $10k profit per car ...

= 250 Billion bonus prize. Not bad Tesla, not bad.

Someone on the call mentioned a change in CAFE calculations. I haven’t found what that refers to yet. And, as I mentioned earlier, EU emissions penalties got more severe this year, too.

Last edited:

But deliveries are up both on a quarterly and yearly basis. Superchargers need to keep up with deliveries.Depends on your frame of reference, if you compare quarter over quarter it is down, but if you compare year over year it is up.

The real metric would be to know how often a supercharger station is full (all stalls occupied). I think the goal should be for full supercharger stations to be extremely rare.

I suspect that at this time, the problem is getting a little worse rather than better.

henchman24

Active Member

There was a gamma squeeze that happened to push back up above 1100... and the macro environment kinda sucks right now. It will all correct in time. Tesla just showed (again) that it is the safe haven in growth stocks. Just like the rally from mid-March to early April where Tesla lead the Nasdaq, on the next leg up.... it'll do it again (and likely gamma squeeze a bit). If the Fed doesn't raise 75 bps in May and/or inflation dies down... Tesla will be at ATHs in a very short order. If the proverbial rabbit is pulled out of the hat for Q2, we could see a monster summer too.Blowout Q and we're still below levels from earlier this month

TheTalkingMule

Distributed Energy Enthusiast

I'm waiting for JPMorgan to raise TSLA from $85 to $86.I like the sound of this ($2300 PT now by far the highest on the Street):

StealthP3D

Well-Known Member

Thank you @colettimj (link) and @Usain (link) for pulling together the Supercharger numbers to confirm my suspicion that that roll out of additional superchargers isn't really accelerating (yet). Hopefully this will change as EVs are becoming more accepted by people/governments each day. Tesla cant build a new SuC location if the property owners don't allow them.

That's not right. The numbers listed there are for fully commissioned Supercharger deployments, ready to use. The acceleration of network buildout mentioned during the call will show up in completed deployments in coming quarters, not in Q1. It can take a year or more from start to finish, depending upon permitting, weather constraints, etc. In large areas of North America underground utilities are seasonal business because the ground can be frozen or covered in snow. So it's not surprising the numbers of completed installs would be lower in Q1. This acceleration of installs is too recent of a development to show up in Q1 numbers.

Look for acceleration of visible network growth through the summer and fall.

Artful Dodger

"Neko no me"

This is legal basis to get rid of this nuisance of a man. Right?

No, but his habitual use of the words "essentially" and "we believe" is de facto proof that GoJo has a mouse in his pocket.

Cheers to the longs!

BrownOuttaSpec

Active Member

I think the reinstated fines is what was referenced (article from March 29th):Maybe, but ICE production was impacted, too, so not sure the net penalties should have gone up so much.

Someone on the call mentioned a change in CAFE calculations. I haven’t found what that refers to yet. And, as I mentioned earlier, EU emissions penalties got more sever this year, too.

Feds reinstate higher fines for automakers failing to meet mpg standards

It's been a long time coming. Enforcement had been delayed after automaker lobbying, triggering a lawsuit from California.

"The NHTSA's final rule, which takes effect 60 days after it is published, reinstated the higher penalties and increased them beginning with the 2022 model year. The NHTSA hasn't collected fines for model years 2019 through 2021 while the issue was under review."

Official ruling pdf (ruling on January 14, 2021):

I'm waiting for JPMorgan to raise TSLA from $85 to $86.

JPMorgan just published a "big" increase (the two main established laggards, JPMorgan and Citigroup, both went up about 20%), although still laughable. Here's the current tally of PTs on the Street:

Artful Dodger

"Neko no me"

You made me look. Still hanging hat on Competition is coming. Also pointing as puzzling that Tesla guided that Shanghai production would be flat in Q2.

Gene Munster parroted that line too on C'n'be'Seen Television yesterday. He said ~40K lost prod. But seemingly obliviousto the fact that there are 71 days left in Q2.

Tesla will run full bore w/o a break to catch up. Because there are 3 types of FAST:

- China FAST!

- Shanghai FAST!

- Tesla FAST!

Last edited:

TheTalkingMule

Distributed Energy Enthusiast

Here we are the day after blowout earnings and 4/29 $1150c is now cheaper than yesterday. I don't know why I bother buying YOLO's before the even I think will move the stock. You can just wait and get the same deal!I'll be buying my YOLOs Mon/Tues if any. I've sworn off fomo-like behavior, there's never a rush with TSLA. You can often even buy your YOLO calls the day AFTER blowout earnings as MM's try to keep a lid on things a couple days.

These guys who supposedly bought tons of $1150c for tomorrow are in for a good sweat. They need what.....$1085 today for any chance?I wasn't looking at $1050 today, but $1200c dipped a good bit lower than Monday's close. These guys probably bought near the bottom today for $18-20 and are looking for SP to cross $1150 the day after earnings.

Jesus, when you type it out like that it seems a pretty decent lock. Certainly greater than 50/50 shot to double your money IMO.

I wonder if that position alone was reason enough for the elgo pushdown from $1030 to $977 yesterday?

There was a gamma squeeze that happened to push back up above 1100... and the macro environment kinda sucks right now. It will all correct in time. Tesla just showed (again) that it is the safe haven in growth stocks. Just like the rally from mid-March to early April where Tesla lead the Nasdaq, on the next leg up.... it'll do it again (and likely gamma squeeze a bit). If the Fed doesn't raise 75 bps in May and/or inflation dies down... Tesla will be at ATHs in a very short order. If the proverbial rabbit is pulled out of the hat for Q2, we could see a monster summer too.

So for me, the important part is that Tesla has shown it doesn't deserve to get smashed like some of the other 2020 high flyers. I can go back to having my brain on autopilot and not worrying if a 5% dip is the start of a major crash or not. If we are flat or slightly down into Q2 I'll know I just need to wait a few months for it to rocket again.

larmor

Active Member

JP morgan PT is after 10:1 split.JPMorgan just published a "big" increase (the two main established laggards, JPMorgan and Citigroup, both went up about 20%), although still laughable. Here's the current tally of PTs on the Street:

As demonstrated by this from Supercharge.info for just part of AprilThat's not right. The numbers listed there are for fully commissioned Supercharger deployments, ready to use. The acceleration of network buildout mentioned during the call will show up in completed deployments in coming quarters, not in Q1. It can take a year or more from start to finish, depending upon permitting, weather constraints, etc. In large areas of North America underground utilities are seasonal business because the ground can be frozen or covered in snow. So it's not surprising the numbers of completed installs would be lower in Q1. This acceleration of installs is too recent of a development to show up in Q1 numbers.

Look for acceleration of visible network growth through the summer and fall.

supercharge.info

woodisgood

Optimustic Pessimist

So for me, the important part is that Tesla has shown it doesn't deserve to get smashed like some of the other 2020 high flyers. I can go back to having my brain on autopilot and not worrying if a 5% dip is the start of a major crash or not. If we are flat or slightly down into Q2 I'll know I just need to wait a few months for it to rocket again.

Agree there’s a definite floor around 1T now. Split and this ER have cemented that. Macros hardly a concern now aside from calamitous events eg nuclear war.

Tony Sagonachi(sp?j casting doubt on the 20 million vehicles goal saying 7 to 12 million is their expectation. Sees difficulties until their are more than 2 high volume models for the market.

Artful Dodger

"Neko no me"

I think the reinstated fines is what was referenced (article from March 29th):

Feds reinstate higher fines for automakers failing to meet mpg standards

It's been a long time coming. Enforcement had been delayed after automaker lobbying, triggering a lawsuit from California.www.greencarreports.com

"The NHTSA's final rule, which takes effect 60 days after it is published, reinstated the higher penalties and increased them beginning with the 2022 model year. The NHTSA hasn't collected fines for model years 2019 through 2021 while the issue was under review."

Official ruling pdf (ruling on January 14, 2021):

Not sure about this. Zach was specific on the conference call that it was about a 1-time CAFE change, not NHTSA. Futher, those NHTSA fines for failing to meet fuel efficency standards would be payable to the U.S. Gov't right, not to Tesla.

Perhaps we'll find out more in the 10-Q

Cheers!

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K