It only affects Tesla stocks as we see Elon is doing everything to weather any kind of recession storm. Here are a couple of issues that may come up.So let's say we are in a recession, how does that negativity impact Tesla *exactly*?

This hand wringing while having incredible demand is odd.

1. Recession may cause supply chain disruptions as poorly managed part of the supply chain goes under.

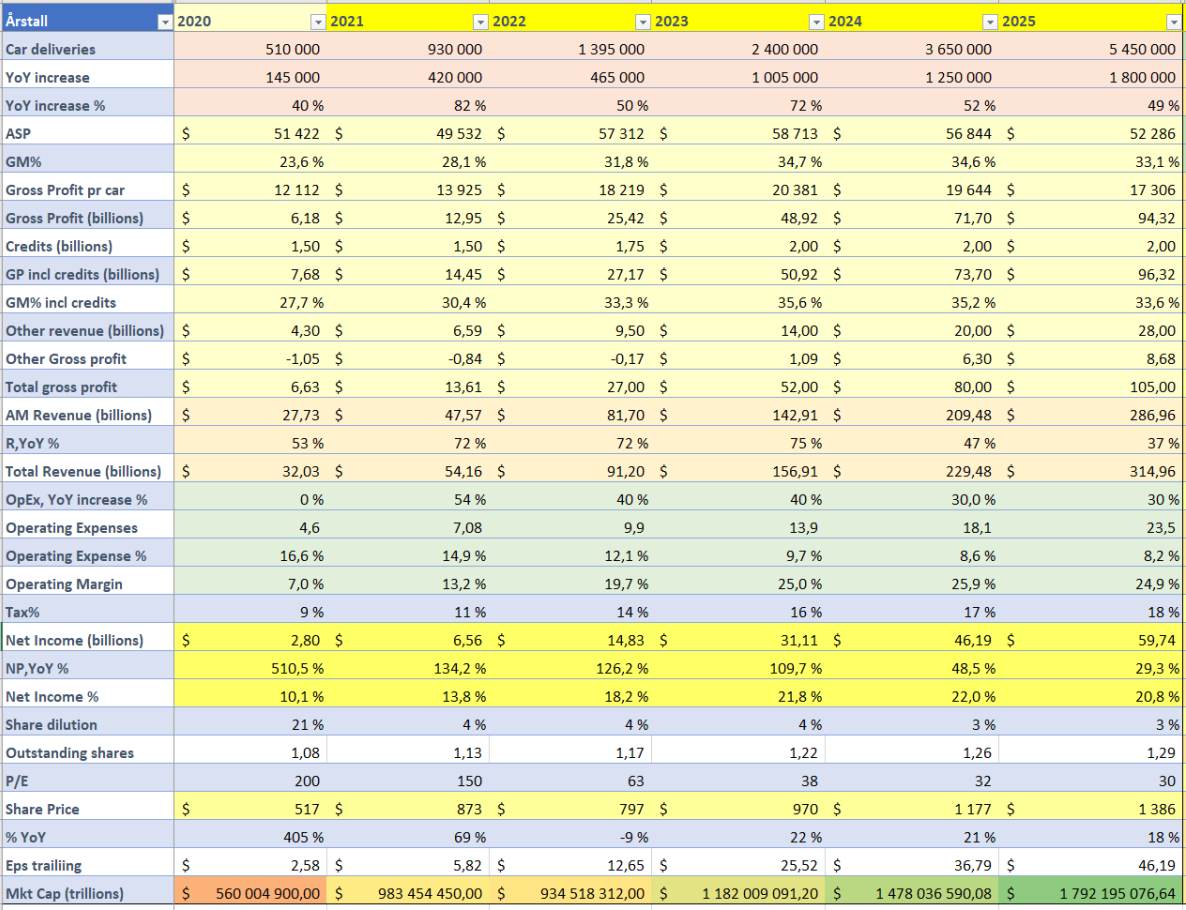

2. It compresses the multiples of all companies as major big ones project lower than expected earnings. Of course exceptional companies will follow with the compression or else in a sea of companies like Google with a PE of 20, a Tesla with a PE of 200 seems ridiculous even with the growth.