StateoftheArt

Banned

It is why he is exposing Twitter. It is a propaganda tool. Elon knows exactly what he is doing. Light is the best disinfectant.

Titter is trapped.

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

It is why he is exposing Twitter. It is a propaganda tool. Elon knows exactly what he is doing. Light is the best disinfectant.

"I want TSLA to outperform it's BETA!"Sure 3X the beta. Let’s go for 4X!

What was that about TSLA showing strength. Fridays outperformance more than negated and the trend continues.

YOU ARE A CHEEKY LITTLE SUB! I won't be fooled by that. Crank up the spanking machine.Ok, the tweeter talk torture is getting to be too much.

I forgot my safe word but I'd like to say it.

Cyberducks!

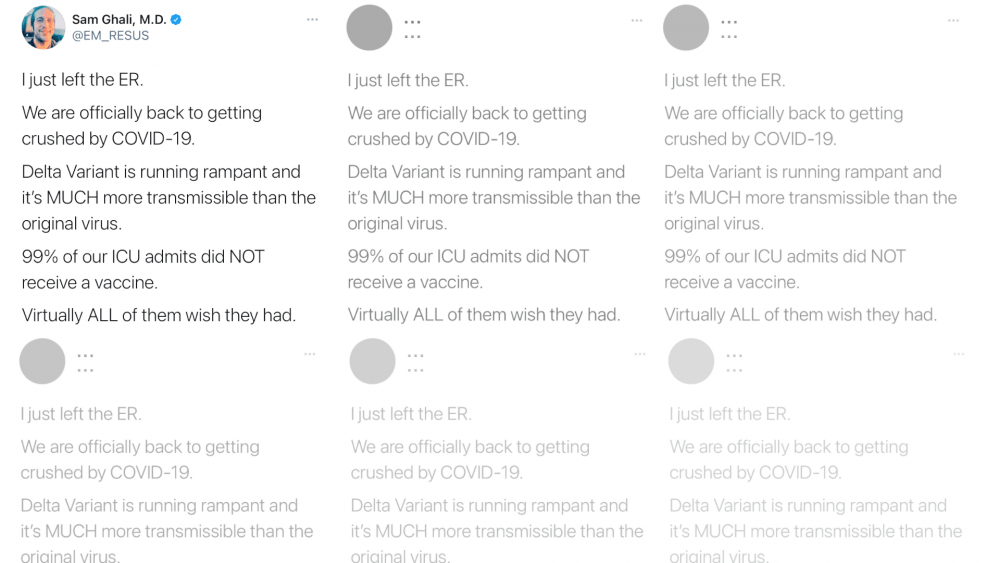

That's informative, I wasn't aware of the particular issue here. But I would say copy paste without setting out that you were doing so is merely another type of disinformation as it would inflate one incident into many. People doing it isn't somehow better than bots doing it.This kind of crap does not belong on this board. It is a part of an intentional misinformation campaign, and now being used for secondary effect. None of the posters here are actually bots. They are real humans trying to work against covid vaccination and science.

Copypasta of an ICU doctor’s tweet stokes COVID-19 skepticism by mimicking bot-like behavior

Introduction The spread of the Delta variant of SARS-CoV-2 has put many countries back on high alert. Both the U.S. and the U.K. have seen the Delta variant become the predominant cause of COVID-19 cases. However,healthfeedback.org

That is correct in the abstract. However there is a fair amount of ambiguity in "Company Material Adverse Effect" and a few other clauses. Since the wording of all this is definitely not quite typical there is quite a large opportunity for debate, or so it seems to me. I am NOT a lawyer. I have been around numerous mergers, some of them exceedingly disputatious. Although the Delaware Court of Chancery has some unusual features it also has had some losses in the Delaware Supreme Court on the express issue of whether a disclosure not made would have altered the purchaser intent to proceed.This has already been explained before.

In M&A law, DD is what you do before you make your offer

You say "I want to buy your company, and I need this info to determine how much I think it's worth and then I may, depending on the info, make an offer"

Typically a bunch of NDAs then get signed, they answer your questions, and you decide if you want to still make an offer- and for how much.

That's what DD is- it happens before the offer, in order for you be able to confidently name the price you're willing to pay.

Elon skipped right to the offer.

He didn't "waive" DD- he just skipped it.

Due Diligence In Mergers And Acquisitions - Business Benefits Group

Learn about due diligence in the mergers and acquisitions process, what you can expect during the process, and why it is important to execute properly.www.bbgbroker.com

The only data the agreement requires Twitter to provide is that needed to close the purchase-- not data needed to decide if the offer was a good idea in the first place. That ship has sails when you make the offer.

And since markets are open now I'd strongly encourage any reples to move to:

Elon & Twitter

Sigh, I guess I have to explain this to Elon again. The monetizable daily active user number is generated by an algorithm designed to exclude bots. There are bots on the platform that are not counted as mDAUs. In fact Twitter has an API which allows bots. Also, do think bots tweet more or less...teslamotorsclub.com

Monday is going to be awesome!

I think Musk figures he'll get $44 billion worth of memes out of it so it's all good.Man I’m just loving this Twitter rally. Amazing rally. Best I’ve ever seen. Can’t even beat Apple

I’m confused….analysts after analyst said the moment Elon walked away, $100 would be added to the share price. Gee…..I wonder if wall st is just full of _____.

Dear god no one quote with an actual response on Twitter and it’s effects. We all know how this game is played. No one should be surprised at the stock action today. Wall st clearly still control of this stock. Can’t even beat its beta at this point.

It didn’t even take that much volume to drop the stock like a stone

Hard for anyone to try and claim the whole thing isn’t rigged when TSLA is down nearly as much as Twitter…..even though the worst case for Elon has already been priced into TSLA.Monday is not awesome.

The reason why Tsla is down is no reason. The L shape chart of Tesla happened to many stocks this AM from all of cathie woods pick to Disney. Volatility is how money is made which means everything goes up and down for no reasons beside sucking in Yolo retails and scare them into selling 2 days later.Hard for anyone to try and claim the whole thing isn’t rigged when TSLA is down nearly as much as Twitter…..even though the worst case for Elon has already been priced into TSLA.

I am enjoying watching Gary and other try to come up with excuses for TSLA trading like a dog. How about you guys just admit how much damage can be done with naked shorting and spoofing……..but of course according to Gary, there’s always a “reason” TSLA is down. Can’t ever be wall st using illegal trading tactics

FWIW....at least $701 was defended

Call me crazy but I’m pretty sure both of these things were things everyone and their mom was aware of…….before the market opened for trading todayWhether we like it or not, Twitter is affecting tesla stock in a negative way.

That plus Bitcoin were unnecessary adventures.

it seems whenever Elon is elated about tesla’s success

or overcoming a difficult problem,

he seeks another even more dangerous challenge.

Right on cue Gary with his attempt to excuse illegal and corrupt wall st trading.

For now…. This week will get volatile