Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

Don't forget Huawei is the largest 5G vendor in almost all areas that do not have non-tariff barriers:Everybody that is in partnership with Huawei pretty much fits that bill, which is to say many of the Chinerse auto manufacturers. In may not be under one company mfg/design roof but it is under a lot of pairs of roofs. People in the West are unused to waking up and realising that China is ahead of them, rather than behind them, and it can come as quite a surprise. Quite apart from being one of the leading players in handsets & base stations, Huawei already does solar, battery, car/home infotainment and is pushing towards a full-car-OS with autonomy. Oh, and Huawei are pushing into chip design with paired fab solutions as well.

China is absolutely intent on achieving strategic autonomy from the West.

Homepage - FusionSolar Global

Huawei FusionSolar provides new generation string inverters with smart management technology to create a fully digitalized Smart PV Solution.solar.huawei.comHomepage - FusionSolar Global

Huawei FusionSolar provides new generation string inverters with smart management technology to create a fully digitalized Smart PV Solution.solar.huawei.com

Geely's Geometry adopts Huawei's HarmonyOS for its next car

Huawei might have a chance rivaling Android Auto and Apple's CarPlay in China.www.arenaev.com

Huawei dives into chip production to battle U.S. clampdown

Telecom equipment maker is partnering with fellow blacklisted companiesasia.nikkei.com

Huawei 5G Core Continues to Rank No.1

GlobalData recently released a report entitled 5G Mobile Core: Competitive Landscape Assessment. The assessment concluded that Huawei 5G Core portfolio is the strongest

www.huawei.com

Transforming Smart Grids with FTTM | Huawei Enterprise

Many electric grid operators are using POL to build smart, sustainable communications networks, driving digital transformation and enabling FTTM scenarios.

e.huawei.com

The typical Western reaction is to assume they're stealing Western technology, as @petit_bateau is pointing out, it is easy to ignore just how far ahead Chinese companies are.

There are perfectly logical reasons for that success that are not nefarious (I am not suggesting there has been none of that).

In 1979 there was:

- no real electrical grid outside mostly, Beijing and Shanghai;

-no national financial clearing system (they had one bank, The People's Bank of China, and the effective work-around tolerated was the use of then Master Charge as a 'clearing system', but more commonly dealt through Hong Kong and Macao);

-no real auto manufacturing.

-Still suffering from the Great Leap Forward.

-Most of the serious Chinese intellectual talent had gone to Taiwan, Singapore and wherever else they could go.

Then they decided to take economic development and non-capitalist-capitalism seriously.

Thus the railroad network, highway network, vehicle manufacturing all were built from nothing, as were huge cities.

One such city, Shenzen, was in 1979 the place where Hong Kong residents made illegal transactions with China and a single shop in Hong Kong, Chinese Arts & Craft, was one of the primary sources of foreign earnings for China. (note: I still have some things I bought in those two places at the time). Shenzen is perhaps the easiest single place to look to understand 1979 vs 2022:

Shenzhen | History, Population, Attractions, & Facts

Shenzhen, Wade-Giles romanization Shen-chen, city, south-central Guangdong sheng (province), southeastern China. It lies along the coast of the South China Sea and immediately north of Hong Kong. In 1979 Shenzhen was a small border city of some 30,000 inhabitants that served as a customs stop...

www.britannica.com

The singular advantages of Tesla is the singular advantages of China also:

- nearly zero installed base, for anything. Starting from zero one can avoid the 'sunk cost' fallacy.

-a huge source of highly educated and capable people. Both Tesla and China recruited people who knew how to do things and were highly motivated. Tesla recruited initially from Silicon Valley and the East Bay, both accustomed to weird startups. China recruited from Chinese who had emigrated too Taiwan, Silicon Valley and all over the world. Both ended out requiting highly determined 'best and brightest'.

One of the best examples of China's approach to technology is this:

Reprint: China and the World’s Greatest Smart Grid Opportunity

China goes big in grid, and it’s all about transmission, distribution automation and smart meters.

I have posted about the approach to development rather than automotive specifically because the approach is the one clear reason why:

- Tesla and Elon do well in China and have less risk there than do others;

-That is why Chinese automakers are already adopting GigaPresses (btw: remember that IDRA si Chinese owned);

-That is why Chinese BEV and solar specialists like Jinko, BYD, and smaller ones like Chery and JAC are rapidly expanding BEV and Solar markets globally, but are mostly invisible to North America and most of Europe;

- That is why State Grid, Huawei and others enter markets with great success with fast following by users fo their advances;

-That is why Belt & Road is such a huge advantage for national economies and China too.

All of this is part of the explanation of how , as @petit_bateau just said:

"China is absolutely intent on achieving strategic autonomy from the West."

Tesla is certainly benefitting from all that. Despite serious problems and periodic internal convulsions the trajectory is continuing. From a distance it is easy to overstate the risks.

OTOH:

There is Taiwan, the Spratlys, Vladivostok & Amur. There arealso periodic trade issues and intellectual property arguments, plus sometimes violent opposition by many in China who are non-Han or speak other than Mandarin (i.e. Standard Northern Mandarin) as their first language.

Those who forecast imminent collapse of the present national government may overstate those weaknesses and impediments. Still, major changes in Chinese policy and leadership can and do happen quite abruptly. That is possible. There is immense resilience but in the Chinese economic and logistic resources, so it would be surprising were that to happen.

Despite that, relations with the US are deteriorating, in my opinion primarily because of the myopia of geriatric leadership. That presents greater risk to the US than to China, in my opinion.

[as usual these are my opinions. I think them to be well informed but they are still opinions, not facts. Please do your own research ]

I wish we had something like Model X or Model S to "compete" with non-economy vehicle from GM....

To get to my point, in the future Tesla might benefit from having higher priced deluxe versions of the 3 and Y, along with lower priced plainer versions. If priced appropriately, this could give them similar average margin per car, higher unit sales, higher total margin, and some room to delay introduction of a new cheaper vehicle that might have lower margins than previous vehicles.

Knightshade

Well-Known Member

They say the solution is just tightening the fastners more... So they were just under torqued. The question is why. Did they spec it wrong or was the assembly station setup incorrectly?

Either way, first mass prod. vehicle it's not totally unreasonable something like this might happen... but what is Toyotas excuse for a similar screw up with wheels falling off their first BEV after having generations of experience manufacturing cars?

You sure it's 1-2 years and not longer? Tesla managed to make a gross profit on the freaken roadster! They had positive gross margins on 3k Model S deliveries. Rivian has over a -100% gross margins

I mean, as you note- costs go down as you scale production... One would HOPE the price raises (that they are 1-2 years from being able to actually charge) and other cost reductions get them to at least even by then... but without more insight into the internal financials that is likely not public (and not certain) I don't know that you can answer that definitively right now.

I do know they actually looked like they were gonna hit the 25k they guided for- unlike say GM who appears on track to miss that goal for Lyriq production by an hilariously large #

Further discussion (if desired) prob. to here?

All discussion of Rivian Automotive

I wonder how many shifts they have running right now at the Illinois plant

Has Tesla reduced their Lease rates?

For a base Model 3, with $4,500 down, it's $499/month. It's $700/month to buy with the same $4,500 down. The two monthly payments used to be almost the same. Are they finally incentivizing leases or acknowledging high resale values? Definitely a demand lever if true!

For a base Model 3, with $4,500 down, it's $499/month. It's $700/month to buy with the same $4,500 down. The two monthly payments used to be almost the same. Are they finally incentivizing leases or acknowledging high resale values? Definitely a demand lever if true!

JRP3

Hyperactive Member

Reference:There is this stuff called wind power that is most common in Winter.

To answer this question, Jacobson considered 24 large renewable-only (WWS) grid regions across 143 nations throughout the world. He found low-cost solutions everywhere he looked. In large cold regions, such as in Canada, Russia, Europe, the United States and China, the increased demand for heating was frequently accompanied by rising wind energy output.

In the coldest of times, wind energy production heats up | Stanford News

Using the latest climate and energy models, Mark Jacobson shows that wind energy production increases during the coldest spells when heat demand is highest and can help prevent cold weather–related blackouts.

Can you post a screenshot? im seeing $519/month in CA.Has Tesla reduced their Lease rates?

For a base Model 3, with $4,500 down, it's $499/month. It's $700/month to buy with the same $4,500 down. The two monthly payments used to be almost the same. Are they finally incentivizing leases or acknowledging high resale values? Definitely a demand lever if true!

cab

Active Member

Weekend "off topic", but my wife and I were at the Texas state fair on opening day about a week ago. The fair (which is huge if you've never been....and fattening), also has a "new car" show. The manufacturers participating in the show has dwindled over the years (as it has for all new car shows across the globe), but several were still there. At these shows I try to observe the amount of attention the EVs get relative to everything else. In general, they have often been largely ignored by anyone but EV geeks.

This time was different. People were actually climbing in them and spending time with them. I would hear comments like "that's the new electric Mustang" (Mach e), or "this is cool...it's electric". The NEWER EVs were getting most of the attention including the Mach e, Kia EV6 and Hummer EV (this one was swamped). GM, surprisingly, had a display (you could not get to the cars) showing the new electric Silverado, Blazer and Equinox...and frankly the Blazer and Equinox looked pretty good - I was just surprised they had them there at all. The Bolt and Bolt EUV were both actually getting some traffic too. Ironically, the F150 lightning was in a corner (could not get to it) and largely ignored as it appeared to be the homeliest trim level.

Now, admittedly, vehicles like the giant Jeep Wagoneer got a lot more traffic, but still...encouraging and a notable change from my perspective, and as we all know "other" manufacturers handle the advertising for Tesla.

This time was different. People were actually climbing in them and spending time with them. I would hear comments like "that's the new electric Mustang" (Mach e), or "this is cool...it's electric". The NEWER EVs were getting most of the attention including the Mach e, Kia EV6 and Hummer EV (this one was swamped). GM, surprisingly, had a display (you could not get to the cars) showing the new electric Silverado, Blazer and Equinox...and frankly the Blazer and Equinox looked pretty good - I was just surprised they had them there at all. The Bolt and Bolt EUV were both actually getting some traffic too. Ironically, the F150 lightning was in a corner (could not get to it) and largely ignored as it appeared to be the homeliest trim level.

Now, admittedly, vehicles like the giant Jeep Wagoneer got a lot more traffic, but still...encouraging and a notable change from my perspective, and as we all know "other" manufacturers handle the advertising for Tesla.

insaneoctane

Well-Known Member

If your NPV "China" case is accurate, I should move my investment elsewhere with a predicted SP of $398 in 2030, which doesn't even revisit our current 52-week high by the end of the decade...hell, it means that I won't even break even on one lot of TSLA that I bought in January until 2029....I've had a look at the possible implications of stronger than expected competition from China (or anywhere, but most likely China) and the results are on the BEV Competition thread at post #4834. This link will take you to the correct page, but you will then need to scroll down to get to the right post.

Tesla BEV Competition Developments

..... but Munro is a highly experienced automotive engineer who knows what he's talking about. Until the subject turns to electronics or software. Fortunately he leans more on other staff members in those areas these days.teslamotorsclub.com

Last edited:

Artful Dodger

"Neko no me"

Doing my part for Q4..ordered the wife a M3P

Nice! Did you receive an estimated delivery date?

Cheers!

insaneoctane

Well-Known Member

Hmmmm. It looks like the US delivery dates are pulling in? I just jumped on the site now, configured the "cheapest" ($69.5K!) model Y and it showed Est. Delivery: Dec 2022 - Apr 2023. I don't remember 2022 being possible last time I did this?Nice! Did you receive an estimated delivery date?

Cheers!

petit_bateau

Active Member

I try to explore these things from a variety of perspectives, if only to understand the viewpoints of others. If nothing else this gives better insight into why large fund managers might be reluctant to jump into Tesla too much. My underlying base case forecast is also more conservative than some others.If your NPV "China" case is accurate, I should move my investment elsewhere with a predicted SP of $398 in 2030, which doesn't even revisit our current 52-week high by the end of the decade...hell, it means that I won't even break even on one lot of TSLA that I bought in January until 2029....

I don't think any such thing as a risk-free investment exists for small beer investors like myself. We have to form a view and manage our own portfolio of risks thoughtfully bearing in mind our own individual & family conditions and circumstances.

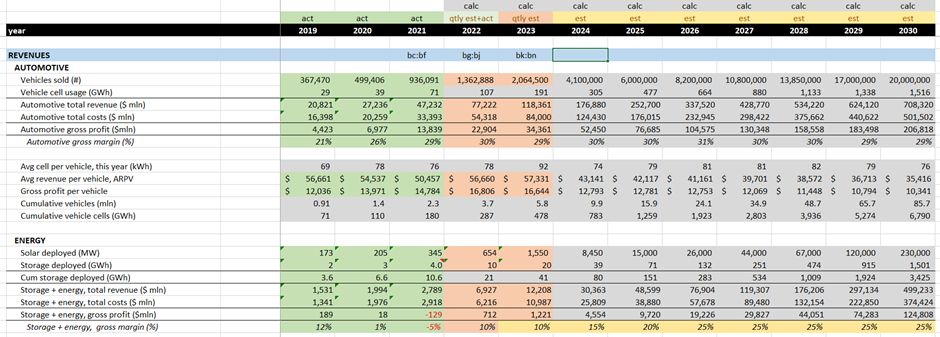

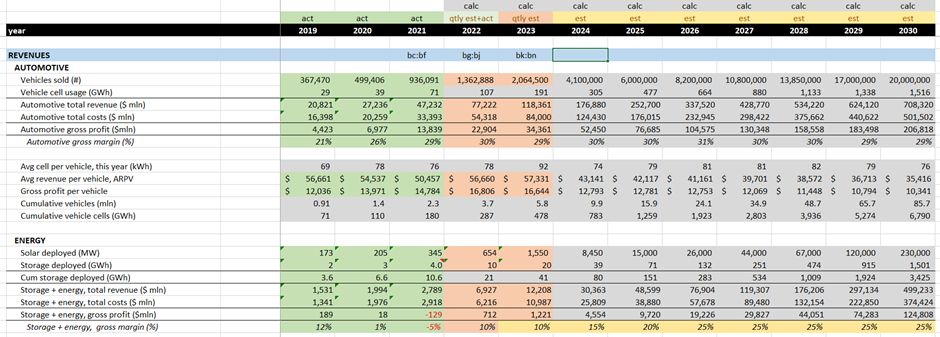

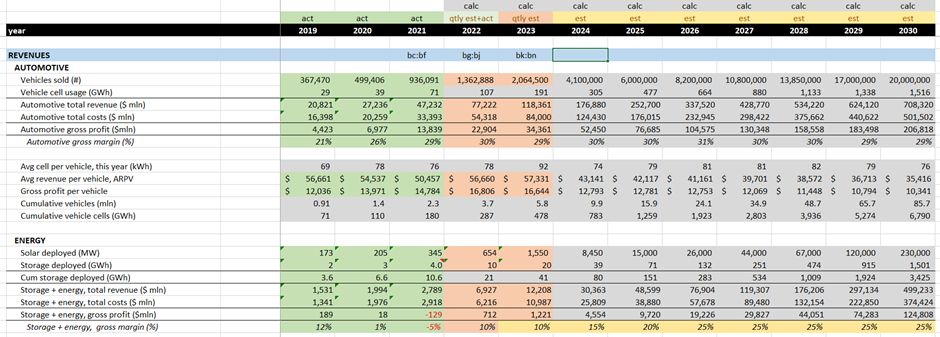

To do this sort of thing properly one puts a probalistic spread onto the key variables using something like CrystalBall. However if you look at the 2030 numbers I pulled together the 2 scenarios x 2 valuation methods yields : $1953, $1322, $589, $398. That gives an indication of the possible range of outcomes.

This sort of stuff is never easy except in hindsight.

ZachF

Active Member

I've had a look at the possible implications of stronger than expected competition from China (or anywhere, but most likely China) and the results are on the BEV Competition thread at post #4834. This link will take you to the correct page, but you will then need to scroll down to get to the right post.

Tesla BEV Competition Developments

..... but Munro is a highly experienced automotive engineer who knows what he's talking about. Until the subject turns to electronics or software. Fortunately he leans more on other staff members in those areas these days.teslamotorsclub.com

The political climate where the west just sits by and allows large amounts of Chinese EVs to be imported no longer exists. This isn’t 2006 anymore.

Hell, all the US has to do is match the 25% tariff that the Chinese put on American autos and that ends it right there.

Just yesterday Biden clamped down harder on semiconductor tech transfers. The anti-China sentiment is multipolar and rising, and China only has itself to blame.

petit_bateau

Active Member

Such a trade war would have a lot of other economic consequences. The overall result of those would likely - just from the perspective of a shareholder - lead to an equivalent loss of value.The political climate where the west just sits by and allows large amounts of Chinese EVs to be imported no longer exists. This isn’t 2006 anymore.

Hell, all the US has to do is match the 25% tariff that the Chinese put on American autos and that ends it right there.

Just yesterday Biden clamped down harder on semiconductor tech transfers. The anti-China sentiment is multipolar and rising, and China only has itself to blame.

Even so this reduced case has Tesla in 2030 at 15m/yr vehicles and 20% GM. That is still bonkers growth.

These things are never easy.

I disagree, Tesla’s 20M target in 2030 already modeled strong Chinese competition, heck, they might have only modeled Chinese competition.I've had a look at the possible implications of stronger than expected competition from China (or anywhere, but most likely China) and the results are on the BEV Competition thread at post #4834. This link will take you to the correct page, but you will then need to scroll down to get to the right post.

Tesla BEV Competition Developments

..... but Munro is a highly experienced automotive engineer who knows what he's talking about. Until the subject turns to electronics or software. Fortunately he leans more on other staff members in those areas these days.teslamotorsclub.com

Chinese will eventually flood world markets with EVs in all caliber, this is not news to Tesla, and should not suddenly lower their projections by 25%.

IMHO 20M in 2030 is already very conservative, my prediction would be 25M-30M from Tesla then Chinese take almost all the rest and leave some for Korean. Most of those 50+ years old brands will stay but got controlled by Chinese.

So in short, Chinese competition is expected and would only drop Tesla production projections from even higher to 20M, no further.

All this is assuming FSD is not solved in 2030, which is unlikely IMO. Once FSD is solved, all projections can be thrown out of the window.

petit_bateau

Active Member

Are you able to share your valuation model ?I disagree, Tesla’s 20M target in 2030 already modeled strong Chinese competition, heck, they might have only modeled Chinese competition.

Chinese will eventually flood world markets with EVs in all caliber, this is not news to Tesla, and should not suddenly lower their projections by 25%.

IMHO 20M in 2030 is already very conservative, my prediction would be 25M-30M from Tesla then Chinese take almost all the rest and leave some for Korean. Most of those 50+ years old brands will stay but got controlled by Chinese.

So in short, Chinese competition is expected and would only drop Tesla production projections from even higher to 20M, no further.

All this is assuming FSD is not solved in 2030, which is unlikely IMO. Once FSD is solved, all projections can be thrown out of the window.

The biggest challenge investing in a high PE stock such as TSLA is that, since by definition a high PE is awarded by the market based on future earnings, the market can assign a wildly different value at any given time based on differing assumptions about future events. It’s not irrational that the SP is now $223, nor would it be irrational if it was currently $666.

BUT, just because the range of rational prices is very wide doesn’t mean there aren’t better or worse times to invest. I believe this is an incredibly good time to invest based on two factors:

1) the current SP is well below what an average PE would be based on our projections of future profits, and

2) more importantly, those future profits are very imminent!

There have been great entry points before (e.g. early 2020 and mid 2021) but the future earnings justifying that were over a year into the future. A lot can happen in a year (and did! e.g. Covid factory shutdowns).

But now the future earnings justifying a higher SP are the CURRENT QUARTER. At the latest we will know with certainty by January how profitable Q4 will be, but it is likely we will have strong indications earlier — perhaps as soon as in a few weeks during the earnings call, when we will get a good glimpse into likely margins and production for Q4.

The first point above speaks to how tightly the spring is coiled. The second point speaks to how imminent a release of the spring is likely to be.

Together, they paint a powerful picture of the potential near future of the SP.

Of course, black swans (including deep recessions) can come out of nowhere, so be careful out there!

BUT, just because the range of rational prices is very wide doesn’t mean there aren’t better or worse times to invest. I believe this is an incredibly good time to invest based on two factors:

1) the current SP is well below what an average PE would be based on our projections of future profits, and

2) more importantly, those future profits are very imminent!

There have been great entry points before (e.g. early 2020 and mid 2021) but the future earnings justifying that were over a year into the future. A lot can happen in a year (and did! e.g. Covid factory shutdowns).

But now the future earnings justifying a higher SP are the CURRENT QUARTER. At the latest we will know with certainty by January how profitable Q4 will be, but it is likely we will have strong indications earlier — perhaps as soon as in a few weeks during the earnings call, when we will get a good glimpse into likely margins and production for Q4.

The first point above speaks to how tightly the spring is coiled. The second point speaks to how imminent a release of the spring is likely to be.

Together, they paint a powerful picture of the potential near future of the SP.

Of course, black swans (including deep recessions) can come out of nowhere, so be careful out there!

ZachF

Active Member

Such a trade war would have a lot of other economic consequences. The overall result of those would likely - just from the perspective of a shareholder - lead to an equivalent loss of value.

Even so this reduced case has Tesla in 2030 at 15m/yr vehicles and 20% GM. That is still bonkers growth.

These things are never easy.

Trade war is already here and will only escalate. Anti CCP sentiment is bipartisan now here in the US.

The west has seen how stupid it was to make themselves dependent on bellicose fascist dictatorships as the Europe-Russia relationship has recently shown.

China needs the western market more than the west needs the Chinese market, and China needs western tech more than the west needs Chinese tech. The trade war will hurt them more than the west.

Xi bringing all the worst Black Mirror episodes to life and turning China into an increasingly dystopian nightmare surveillance state is going to crush the Chinese capacity for innovation.

I really think a lot of people here massively underestimate how terrible Xi is.

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K