Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

Todesbuckler

Member

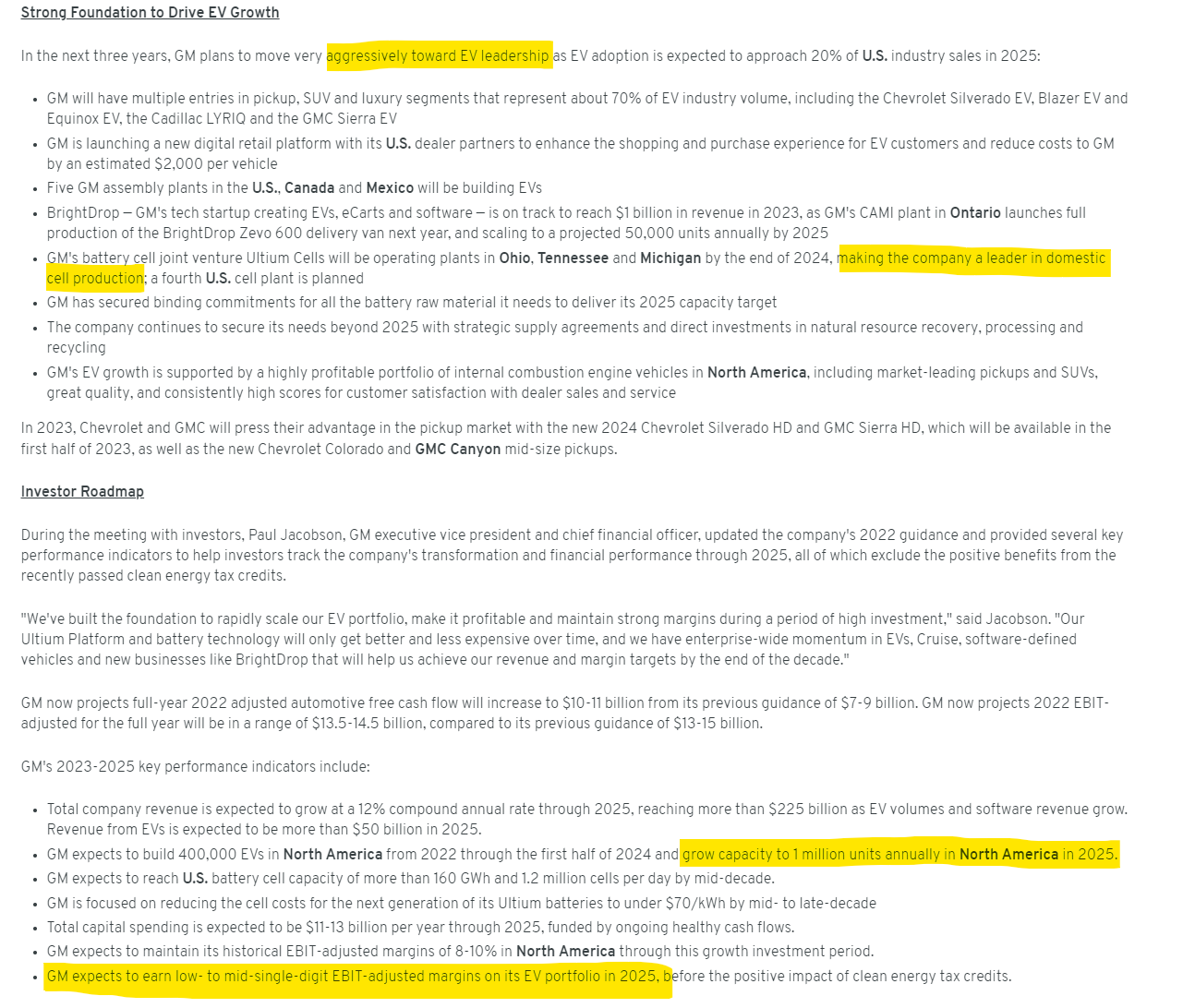

GM update on their EV plans. Funny what they think EV leadership would look like in 2025:

1 million units in North America with mid-single-digit EBIT margins

Link: GM Raises 2022 Guidance and Expects North American EV Portfolio to be Profitable in 2025 as Annual Capacity Tops 1 Million | General Motors Company

1 million units in North America with mid-single-digit EBIT margins

Link: GM Raises 2022 Guidance and Expects North American EV Portfolio to be Profitable in 2025 as Annual Capacity Tops 1 Million | General Motors Company

FSDtester#1

Craves Electrolytes

I can double your assertion. I worked for Chevrolet for 7 years and this is exactly their model and many other dealers. They usually look for good deals on trade ins and then send to service to do all the perfunctory things, and call that a "pack".I have relatives that own a Volvo dealership. About 2-3 years ago one of them (who is quite anti-Tesla) told me it was common knowledge in the industry that used Tesla were good cars to buy at auto actions because they were typically in very good condition and were known to easily sell for higher markups. Auto dealerships buy much of their used stock at from big auto wholesale auction houses.

OK, so these GM dealers "serviced" them before re-selling them. That includes a good wash and polish, vacuuming and general clean-up service, checking tire pressures and filling up the windshield washer fluid. GM dealerships must be more technologically advanced than I thought! /s

So for example they take a car on trade for 30k, they send to service who does very little to make sure the cars are safe and clean. They "pack" $2500 to $3500, that goes straight to service bottom line with a cost of around $500.

This is how service makes a good chunk of their money outside warranty claims and the occasional customer pay. When enough trades don't come in they always have a dedicated buyer who spends all their time at auctions looking for good deals and cars they think will turn around fast on the lot. Once they buy 2 to 5 cars in a day, they send a hauler to pick those up and bring to service, for guess what, the "pack".

Then for example a $30k net purchase at auction, plus $3k service pack, plus hauling, plus markup, they put on lot for a list price of 37,901. Hoping to net the used car department around 3K. Don't forget the dealer fees on top of that.

Pro tip: Whenever used car shopping at any dealer, if the last digit in the price is 1, it means it's new inventory, and they are less likely to negotiate. If it's a "4", it means old inventory and is slated to be auctioned off. Some dealers use different numbers at the end but usually the higher, the older. It's a trick for the salespeople to try and sell the old inventory first, on which they usually add incentives to the commissions of the salespeople since sending cars to auction generally loses the used car department $$.

I've been helping several friends purchase 3s and Ys. I was just on the website. What's up with all the demo models? I thought that was an end of quarter thing. Refresh on the way?

Def a "demand problem"I've been helping several friends purchase 3s and Ys. I was just on the website. What's up with all the demo models? I thought that was an end of quarter thing. Refresh on the way?

/s

Drumheller

Active Member

Maybe cycling the showrooms to 2023 models.I've been helping several friends purchase 3s and Ys. I was just on the website. What's up with all the demo models? I thought that was an end of quarter thing. Refresh on the way?

Thekiwi

Active Member

Imo 2 things need to occur tho one is more important than the other.

1. Demand fear needs to leave, which won't happen until recession is over. Everyone telling people how ridiculous the forward PE but doesn't account for what is pricing in, which is no where near 50% yoy growth for next year due to a recession. Not many companies are guiding up from all these earnings. Wallstreet are not taking Teslas guide seriously because Musk is always overly optimistic. Musk then said 2023 will be rough, and his stance on recession killing companies is still the same. So people will take " our companies are well positioned" as "bankruptcy is not on the table".

2. Musk needs to buy some Tesla. This is a symbol that he is confident with twitters financials and the overhang should finally be over.

So for the stock get out of the mud, we need some of these things to happen.

I would say even in a recession Tesla will still sell every car they produce in 2023 (excepting the growing inventory in transit from “ending the wave”), so the unit growth is still supply limited rather than demand limited.

The question is however what price & gross margin those cars will sell for, which the market is rightly more legitimately concerned about.

Tesla selling 2.5 million units at $50k ASP & 20% GM will be valued differently by the market than 2.5 million units at $55k ASP & 30% GM (purely hypothetical numbers, not a projection).

Elon has stated they will choose volume over profits if that choice needs to be made, which is an excellent choice while the EV land grab still has years to run, and production capacity increase is still the priority - no point slowing down production expansion due to a recession that lasts for a relatively short period.

RobDickinson

Active Member

Yep this, in China they want to control their demand so they can supply almost direct from the factory (excluding exports) and with 30% margins they can do this pretty easily, we've seen how a small decrease in price impacts the competition hardThe question is however what price & gross margin those cars will sell for, which the market is rightly more legitimately concerned about.

StarFoxisDown!

Well-Known Member

The counter to this though which seemingly all of Wall St is either forgetting or just choosing to ignore is that it's not just a possibility, but the most likely outcome that Tesla will sell 2.5 million units at $50k ASP with 30% GM (using your numbers example).I would say even in a recession Tesla will still sell every car they produce in 2023 (excepting the growing inventory in transit from “ending the wave”), so the unit growth is still supply limited rather than demand limited.

The question is however what price & gross margin those cars will sell for, which the market is rightly more legitimately concerned about.

Tesla selling 2.5 million units at $50k ASP & 20% GM will be valued differently by the market than 2.5 million units at $55k ASP & 30% GM (purely hypothetical numbers, not a projection).

Elon has stated they will choose volume over profits if that choice needs to be made, which is an excellent choice while the EV land grab still has years to run, and production capacity increase is still the priority - no point slowing down production expansion due to a recession that lasts for a relatively short period.

That's because of depreciation/amortization of not just Berlin/Austin bringing the cost per per down as they increase production rates, but also the expansion out of Shanghai. Let's not forget that Shanghai for 2 straight quarters has only been running at 50-60% of production. Thus gross margins were hurt in Q2 and Q3 because the cost of Shanghai were spread across fewer vehicles. Depreciation/Amortization was a headwind to gross margins in Shanghai in Q3. That will be reversed in a pretty big way in Q4.

While it won't make a difference for Q1 and likely Q2, The Megapack factory will go through a major reduction in costs due to much higher production that will also help gross margins instead of being a drag on them.

The other thing that Wall St apparently doesn't want to talk about is the effects of IRA, There's been plenty of analysis and time for analysis to be have been done by now to at least get a ballpark about how Tesla's earnings going forward, starting with Q1, will be bolstered by the IRA. I mean even taking a pretty conservative approach ballparking the benefits to Tesla from the IRA bolsters Tesla's earnings and margins considerably.

We could even be looking at a scenario of 2023 ASP of say 46-47k and still have 30% gross margin, maybe even in the 31-33% range because of the credits that come directly back to Tesla from the IRA, not the EV credit that goes to the customer.

Last edited:

Stretch2727

Engineer and Car Nut

GM update on their EV plans. Funny what they think EV leadership would look like in 2025:

1 million units in North America with mid-single-digit EBIT margins

Link: GM Raises 2022 Guidance and Expects North American EV Portfolio to be Profitable in 2025 as Annual Capacity Tops 1 Million | General Motors Company

View attachment 875647

I watched most of the presentation and what struck me was just more of the same from GM.

-Enormous number of EV models to satisfy every possible market segment.

-Organizationally doing much like they have done in the past. Yeah we moved the transmission engineers to EV drivetrain as they both have gears!

-Some efficiencies on scaling one architecture for many platforms. This is occurring as they have somewhat of a clean sheet for EV's launching in a short period but nothing really innovative.

-Still lots of new ICE vehicles coming as they need to provide the profits to fund EV's.

-No real discussion of more vertical integration, except for the partnerships on making batteries.

-The solution for the dealer problem is GM now holds the inventory in local fulfillment and the dealer can get the vehicle in a few days. They expect to save $2K per vehicle but I really doubt it as someone still needs to hold the inventory and associated cost. Reminds me of the Chrysler inventory "banks" just prior to their first bankruptcy.

Kind of what I would expect. Nothing that really stood out as innovative or doing things different to take advantage of the transition. The message was "we are big bad GM and we are bigger and stronger than anyone and we got this handled".

larmor

Active Member

And a costco membership so they can get the batteries. "Batteries secured."I watched most of the presentation and what struck me was just more of the same from GM.

-Enormous number of EV models to satisfy every possible market segment.

-Organizationally doing much like they have done in the past. Yeah we moved the transmission engineers to EV drivetrain as they both have gears!

-Some efficiencies on scaling one architecture for many platforms. This is occurring as they have somewhat of a clean sheet for EV's launching in a short period but nothing really innovative.

-Still lots of new ICE vehicles coming as they need to provide the profits to fund EV's.

-No real discussion of more vertical integration, except for the partnerships on making batteries.

-The solution for the dealer problem is GM now holds the inventory in local fulfillment and the dealer can get the vehicle in a few days. They expect to save $2K per vehicle but I really doubt it as someone still needs to hold the inventory and associated cost. Reminds me of the Chrysler inventory "banks" just prior to their first bankruptcy.

Kind of what I would expect. Nothing that really stood out as innovative or doing things different to take advantage of the transition. The message was "we are big bad GM and we are bigger and stronger than anyone and we got this handled".

"Represents 70% of industry volume"?? Is that some weird metric where your market share is based on weight of all the cars you have on offer? Because the chances they will have 40% of actual sales is pretty slim at the current rate.GM update on their EV plans. Funny what they think EV leadership would look like in 2025:

1 million units in North America with mid-single-digit EBIT margins

Link: GM Raises 2022 Guidance and Expects North American EV Portfolio to be Profitable in 2025 as Annual Capacity Tops 1 Million | General Motors Company

View attachment 875647

Even their own numbers don't match up. Tesla's current North America production is around 750k/ year. Even if GM hits their 1m vehicles per year mark and Tesla's volume stands still, GM is only at 58% of GM+Tesla's North American volume.

Am I reading this metric wrong? What exactly is "Industry Volume"?

RobDickinson

Active Member

How many shares of GM do we need to own for a class action suite? asking for a friend.

How many shares of GM do we need to own for a class action suite? asking for a friend.

Shareholders don't win class action lawsuits, lawyers do.

It's easy enough to find a sucker with a couple shares to be your client.

I read it as those models represent 70% of passenger vehicle types. So at best, they could capture 70% of the BEV market with those models. Wonder how much they will actually capture with the SEXY CT lineup? Using their number of 20% of total US market being BEVs in 2025. Total US market in 2025 should be around 15 to 20M (maybe higher, but being conservative). 20% would be 3M to 4M. Tesla will most likely sell 2M+ in the US, not to mention Robotaxi penetration into total rideshare miles."Represents 70% of industry volume"?? Is that some weird metric where your market share is based on weight of all the cars you have on offer? Because the chances they will have 40% of actual sales is pretty slim at the current rate.

Even their own numbers don't match up. Tesla's current North America production is around 750k/ year. Even if GM hits their 1m vehicles per year mark and Tesla's volume stands still, GM is only at 58% of GM+Tesla's North American volume.

Am I reading this metric wrong? What exactly is "Industry Volume"?

I'd guess, if GM is still around, to capture about 1 to 3% market share in 2025. Anything more than 100k and I'd be surprised.

You are assuming Tesla is still at 750k. Their calculation is based on taking away Tesla sales, not ICE sales. Can you imagine their own EVs taking away ICE sales? That will cause share price implosion."Represents 70% of industry volume"?? Is that some weird metric where your market share is based on weight of all the cars you have on offer? Because the chances they will have 40% of actual sales is pretty slim at the current rate.

Even their own numbers don't match up. Tesla's current North America production is around 750k/ year. Even if GM hits their 1m vehicles per year mark and Tesla's volume stands still, GM is only at 58% of GM+Tesla's North American volume.

Am I reading this metric wrong? What exactly is "Industry Volume"?

So any company claiming to be the leader at a certain time using a production rate that doesn't make sense, that's because you need to assume Tesla sales will go down because they are the competition and EV adoption stays flat.

Mmmmm. Lithium…

www.tesmanian.com

www.tesmanian.com

Tesla Opens Recruitment for Construction of Lithium Refinery Plant in Texas

Tesla begins recruiting for the construction of its lithium refinery plant(s) in Corpus Christi, Texas. The company is looking for an Area Superintendent and an Area Construction Manager, who will be the key employees in operations related to the construction of the factory.

I'm watching the GM Investor day.

GM President Mark Reuss is making a point they have serviced 11,000 Tesla's because GM dealers are so trusted. It's a growing business for them!

He did not say what service they do but my best guess buying tires?

My guess is doing the once over on a Tesla trade in before selling it again. So, yeah, tires, and filling up the blinker fluid.

Captkerosene

Member

I spent my life working in an industry that destroyed capital. (Airlines.) The auto industry is remarkably similar.The comment doesn't make any sense. Why would Tesla be worth zero if FSD doesn't pan out? Sometimes Elon just says random things.

Southwest Airlines was the disruptor in my time (great CEO). Now, their employees are union, old and fat. (I can say that 'cause I'm old and fat too.)

Nothing to worry about as long as Elon stays around ... but, eventually gravity wins. That's what Elon sees IMO when he says that the car business has no value.

Contrast that with Google, Microsoft and Apple. The CEO doesn't matter. (How much have these companies lost on moonshots?) These companies have durable competitive advantages. Even an idiot could run them and they'll do just fine. (Hyperbole.) Add Twitter to that list (with a little luck) after Elon undoes a decade of mismanagement.

FSD falls into the second group. Strong network effects and durable competitive advantages. That, and now Bot (along with having the world's best CEO) are the reasons I'm invested in TSLA.

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K