Don't forget the catalytic converter replacement for the one that obviously got stolen, as your Tesla doesn't have one... unfortunately some people (like my Aunt Marge... love her, but some times) probably would buy their malarkey.New belts, spark plugs, and timing chains. And the occasional underbody rust protection.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

Bet TSLA

Active Member

In context, where he was also mentioning how soon after Tesla everyone else would have autonomy, it was clear that what he meant was if everybody else has it but Tesla doesn't, then Tesla vehicles won't sell so the company won't be worth anything.The comment doesn't make any sense. Why would Tesla be worth zero if FSD doesn't pan out? Sometimes Elon just says random things.

It was pretty much a nonsense assertion regardless, so far as I could tell. Kind of like the "we were just a few weeks from bankruptcy" sensationalism. They were never anywhere near bankruptcy. What they may have been near was "we'll have to raise more money, so Elon's share of the company may get smaller".

StealthP3D

Well-Known Member

Elon has said many times that it's a given that Autonomy will happen. And he believes that (and obviously, so should everyone). It's not a matter of if, it's a matter of when.And then you have @ 38:35

So when Elon says Tesla's valuation would be huge if they solve it, and essentially zero if they don't, he is talking about a situation where another company develops generalized autonomy first. And the "essentially zero" was in contrast to the value of Tesla with FSD solved. It was said more to emphasize the value of a company with fully solved autonomy to that of a company without it. At least that's my take. Elon can be a little over-dramatic sometimes but maybe autonomy deserves that, at least from a long-term perspective, I don't know.

Drumheller

Active Member

Because most people are terrible at mathYeah that's my take on it but people seem to be taking it as literally worth zero.

Lots of choreography there, though undeniably the stock trades like crap.Seems pretty obvious to me that TSLA is being set up for a flash crash sometime between now and Q4 P/D numbers.

Wall St has been consistently pressuring it downwards and capping on any up days. I can't even remember the last time TSLA actually outperformed it's beta (on either red day or green day).

I'd put money on there being some sort of FUD that hedge funds are sitting on which will come out right after a huge bear raid. No clue how low they'll get it to go given Elon's antics adding to the lack of buying interest from institutional investors and macro's could be unsteady until the next CPI print comes in.

TSLA at a TTM PE of 56......they'll definitely test 50 and possibly test investor appetite for TSLA at a TTM PE of 40.......which puts us at 128'ish a share. If it hits something like that, it would probably be an intra-day low followed by major last two hours rally back up to something like 135-140/share.

But just in case you're on margin and/or wanting to use margin, this setup looks pretty likely. Wall St knows it has a limited time window before Q4's earnings drop TSLA's metrics (TTM PE and Forward PE) + TSLA likely initiating a buy back during Q1. Even if deliveries come in at the low end, the earnings growth will still make a huge impact to PE ratios. They know this. They can't control the macro's but they can definitely keep TSLA right at the edge of another leg lower and if the macro's cooperate with them, then the bear raid is on.

Would really wish Elon would do something symbolic here since the destruction in just the past 2 and half weeks is entirely on him. But he's more likely to sell more stock than to buy back or do something that actually helps the stock. I feel for anyone teetering on the edge of a margin call in a significant way. They're likely going to get wiped out

Blame Recession, valuation, Elon, competition, whatever…….

nonetheless tesla is a growth story that generates huge free cash flow

and priced at a reasonable valuation.

I mean everyone is sitting on the side line trying to figure out if Tesla is full of sugar about their guide. So a surprise to the upside is literally hitting guidance or close to it. It doesn't even have to be dead on, but a lot of people are afraid next year Tesla may only achieve 20% yoy growth or something due to the recession/high rates.I don't follow analysts, but when you mention "surprise to the upside", it implies analysts, LOL!. So my question is, have analysts been busy lowering their sales, revenue and profits targets based on recessionary pressures? Or only their share price targets?

I'm not exaggerating when I say I pay ZERO attention to brokerage analysts. I might see something posted here but it almost never hits my consciousness, at least not in any way that will leave a lasting memory. I try to keep the pollution out.

We now have multiple companies who not only have to revise their guide to the downside but had to do it in an emergency preannounced fashion prior to earnings. Many tech companies are announcing job cuts, cost tightening, and flattish or even contraction going forward. So yeah investors are skeptical about Tesla's guide especially when we don't have the month long backlog right now to create such a story.

Not literally, but basically (according to Elon)Yeah that's my take on it but people seem to be taking it as literally worth zero.

I think much of this likely stems from Elon getting things done often by figuring the worst will happen and then working backwards from there. If you believe Tesla will be worth basically zero without achieving full autonomy, that's great incentive to push to actually achieve full autonomy whether or not the assertion is true.

If you're an eternal optimist and think Tesla will be fine without FSD, where's the incentive to push right to the limit?

I'd apply a 0.01% chance as BH owns oil and ICE car companies. I get Munger is pro Tesla, but Buffett is simply not. Would be cool if it happened, but not holding my breath. BH owns a stake in Moody's so if Tesla is upgraded, maybe that changes the tune.

pretty interesting read about why Buffett and Munger might buy TSLA

As a refresher here's the top companies that BH owns

Mike Smith

Active Member

Elon has said the same thing many times before: owning a car without autonomy will be like owing a horse carriage. Horse carriage companies are worth about $0. What's bizarre is that none of the four interviewers (all fans and probably shareholders) thought to ask him to clarify.Yeah that's my take on it but people seem to be taking it as literally worth zero.

I'd put money on there being some sort of FUD

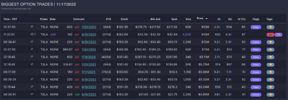

I noticed some very large bets on put leaps $Ms .. Can anyone who understands the flow comment, please. Is this ordinary?

Attachments

Last edited:

StealthP3D

Well-Known Member

I'm watching the GM Investor day.

GM President Mark Reuss is making a point they have serviced 11,000 Tesla's because GM dealers are so trusted. It's a growing business for them!

He did not say what service they do but my best guess buying tires?

I have relatives that own a Volvo dealership. About 2-3 years ago one of them (who is quite anti-Tesla) told me it was common knowledge in the industry that used Tesla were good cars to buy at auto actions because they were typically in very good condition and were known to easily sell for higher markups. Auto dealerships buy much of their used stock at from big auto wholesale auction houses.

OK, so these GM dealers "serviced" them before re-selling them. That includes a good wash and polish, vacuuming and general clean-up service, checking tire pressures and filling up the windshield washer fluid. GM dealerships must be more technologically advanced than I thought! /s

Last edited:

Why would BH not own Tesla because they own oil and ICE car companies? They were already big early investors in BYDI'd apply a 0.01% chance as BH owns oil and ICE car companies. I get Munger is pro Tesla, but Buffett is simply not. Would be cool if it happened, but not holding my breath. BH owns a stake in Moody's so if Tesla is upgraded, maybe that changes the tune.

As a refresher here's the top companies that BH owns

I'd say that hedging against oil and ICE companies is likely a good reason for them to own EVs as well

I'd apply a 0.01% chance as BH owns oil and ICE car companies. I get Munger is pro Tesla, but Buffett is simply not. Would be cool if it happened, but not holding my breath. BH owns a stake in Moody's so if Tesla is upgraded, maybe that changes the tune.

Maybe they're making Moody's hold back the investment grade rating until they're finished loading up

When GM service centers get certified as a Tesla service partner, it will be a cold day in...or another way to say it more simply is capitulation.I'm watching the GM Investor day.

GM President Mark Reuss is making a point they have serviced 11,000 Tesla's because GM dealers are so trusted. It's a growing business for them!

He did not say what service they do but my best guess buying tires?

If anyone wants to they can go here and get certified

I don't think BH hedges in the way that term is normally understood. For instance, if BH could be in a single stock that was fantastic, they probably would be.Why would BH not own Tesla because they own oil and ICE car companies? They were already big early investors in BYD

I'd say that hedging against oil and ICE companies is likely a good reason for them to own EVs as well

On the other hand, BH may invest because of the superior gross margin and the superior growth prospects.

However, much of the value of Tesla is tied to its technology. Keep in mind that they started investing in Apple only as they saw the market was not going through large technological changes. So don't expect a BH investment in Tesla for a while, if ever.

Last edited:

Emmisions testing/ certification centers (in states that do that) have to take all makes/ models. Teslas need road worthiness checks too.When GM service centers get certified as a Tesla service partner, it will be a cold day in...or another way to say it more simply is capitulation.

If anyone wants to they can go here and get certified

That's no longer true in Texas. Tesla only does Teslas. However, it's faster to go to the inspection only station down the street. Road worthiness means I didn't run over the operator in the inspection station.Emmisions testing/ certification centers (in states that do that) have to take all makes/ models. Teslas need road worthiness checks too.

Gigapress

Trying to be less wrong

Probable current run rate if this is true: 2M/year.From Near-future quarterly financial projections:

Based on VINs seen in the wild, Berlin may be at 3682/wk. If true—and that could be the case given the expectation of 5k/wk by end of year—then Troy’s prediction for Berlin is quite low.

S: 90k/mo

F: 48k/mo

B: 3.5k/wk * 30/7 = 15k/mo

T: 3k/wk * 30/7 = 13k/mo

Total: (90+48+15+13)*12 = 2M/yr.

Probable Dec 31st run rate with current trends and assumed ~5k/wk at B&T:

S: 92k/mo

F: 50k/mo

B: 21k/mo

T: 20k/mo

Total: 2.2M/year

I still don’t understand why so many here are modeling for like 2.2-2.4M for 2023.

Next year we probably permanently pass Suzuki, Mercedes-Benz, BMW and possibly Changan and Renault.

Top 15 Automakers in the World | Car Sales Rank Worldwide

Global car sales ranked by manufacturer. Worldwide sales leaders. Data includes yearly vehicles sold by top automakers. Toyota. VW. GM. Honda. Ford.

www.factorywarrantylist.com

Last edited:

Goldman bought some shares but then you look at them puts and calls!

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Replies

- 6

- Views

- 5K

- Replies

- 6

- Views

- 11K

- Locked

- Replies

- 27K

- Views

- 3M