I suspect this is the case. Have you ever plugged your tesla in and got a "charge error" message on your phone, saying that it would charge at reduced rates. I would imagine teslas continually measure resistance through the charge leads, which would indicate if there may be a poor connection, and likely the reason this failure is much less likely with teslas.To me it sounds like an arcing issue. With DC power and huge amounts of current, any oxidation on the contacts could quickly become an arc welder. You would think the EA charger circuitry would have some kind of arc detection circuitry to shut things down immediately. Perhaps the manufacturer needs to look at a better plating material for the contacts, or a lot more clamping pressure on the contacts to avoid a loose connection.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

I love the free charging aspect. Got my first Model S in 13, so never experienced anything else.As I suspect many of us have found, after having had two Teslas with Free connectivity and Supercharging inswitched to a Model S Plaid with neither. I never paid much attention to how much I used Supercharging. Since the last 11/2 years with the Plaid I realize I’ve used Supercharging rarely. Why? First, tge range is better so I always stay at hotels with free charging, charge at home, and only have needed to use Supercharging on the rare long daily trips.

Driving on road trips in Europe I always end out at Superchargers because of much, much higher typical driving speeds. Even so, I suspect it mostly has psychological value to charge for free. Obviously there are edge cases for which the value would be enormous, which are a main reason why Tesla discontinued the practice.

As an investor I favor the explicit pricing.

My plan was to keep our -19 Model X for only one year, but the free supercharging combined with the price increase have changed my mind.

(From a roadtrip in Europe. Paid 0 in charging, 99% charged on superchargers

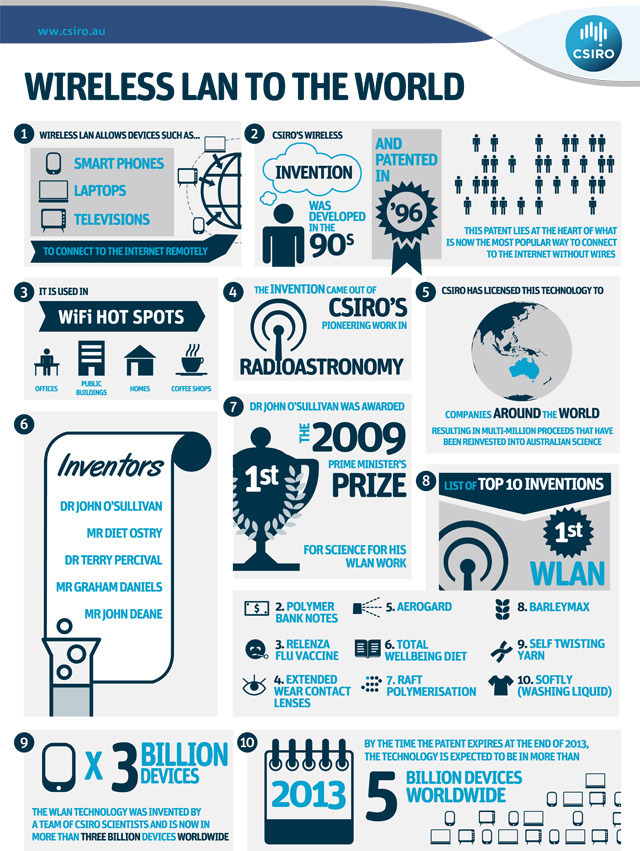

The article you linked clearly explains that all of the tech pre existed years before, and that CSIRO is just a very good patent troll. It is a very good article, with a poor and misleading title.I'm going to partially dispute this one

How the Aussie government "invented WiFi" and sued its way to $430 million

An Australian research organization owns patents vital to the WiFi standards.arstechnica.com

I'm glad we won, you US dudes can afford to pay us..

cliff harris

Member

I really dont think that we will see a new cheaper model at investor day. I think we might see details on this highland project, and that it will essentially be a way to make a super cheap version of the model 3. Its pretty clear that elon feels that introducing multiple models is more trouble than its worth. he even dislikes too many paint options for the same body!

I would guess that we see a new 'base' model 3 that is dramatically cheaper, with front+rear casting, 4680 structural pack, and possibly a smaller battery and shorter range.

There is not really enough clear water between the model 3 and the model Y. The Y is basically a taller model 3, with a different trunk. I reckon Tesla want to make the model 3 the entry level Tesla, followed by Y, then S/X, with definite price gaps to show the difference.

I DO think that Tesla are limiting their European sales by NOT having a compact car. Something shorter and definitely narrower, but that may be a while yet. There are plenty of legacy car companies to obliterate before Tesla has to focus its lazers on the compact car market. Until Texas and Berlin are fully ramped, I don't think this is a limit on growth though. (But I bet there is a compact tesla design hidden in some corner of freemont/shanghai already being worked on).

Also lets not forget the possibility of an optimus update for investors day. The last one was very last minute and touch-and-go. Even seeing the bot walking more confidently this time would be good.

I would guess that we see a new 'base' model 3 that is dramatically cheaper, with front+rear casting, 4680 structural pack, and possibly a smaller battery and shorter range.

There is not really enough clear water between the model 3 and the model Y. The Y is basically a taller model 3, with a different trunk. I reckon Tesla want to make the model 3 the entry level Tesla, followed by Y, then S/X, with definite price gaps to show the difference.

I DO think that Tesla are limiting their European sales by NOT having a compact car. Something shorter and definitely narrower, but that may be a while yet. There are plenty of legacy car companies to obliterate before Tesla has to focus its lazers on the compact car market. Until Texas and Berlin are fully ramped, I don't think this is a limit on growth though. (But I bet there is a compact tesla design hidden in some corner of freemont/shanghai already being worked on).

Also lets not forget the possibility of an optimus update for investors day. The last one was very last minute and touch-and-go. Even seeing the bot walking more confidently this time would be good.

It also is 28190/66= 124.1 miles per car. That implies using 22.16MPG for the mileage estimate you refer to. Sounds about right for 2017ish when I think that pic was taken.I haven't seen a pic of the Hawthorne Design Center "Supercharger Dashboard" in a while (the one below is from several years ago). You could estimate monthly usage from a heavily used site to get some idea of what it would take to offset with solar + storage.

I think I also saw some stats of overall energy for the whole network somewhere... maybe the annual report?

In-post Mod-inserted question: 372/66 = 5.6 gallons per car? Seems puny, 'tho I admit I'm used to the F-350's bottomless appetite.

Woop-D-Woop

Member

Attachments

2daMoon

Mostly Harmless

The article you linked clearly explains that all of the tech pre existed years before, and that CSIRO is just a very good patent troll. It is a very good article, with a poor and misleading title.

Elon's legal eagles should then follow suit to have Tesla reap the reward.

It was decided years ago that Marconi used Nicola Tesla's ideas when creating radio.

So, it was Tesla, in fact, that invented "wireless" (in the British vernacular).

/jk

Last edited:

ThisStockGood

Still cruising my Model S 70 2015

And you dare to post that on a TSLA investor board?! You know it is money right out of our pockets! /sI love the free charging aspect. Got my first Model S in 13, so never experienced anything else.

My plan was to keep our -19 Model X for only one year, but the free supercharging combined with the price increase have changed my mind.

(From a roadtrip in Europe. Paid 0 in charging, 99% charged on superchargers)

View attachment 901640

@CHGolferJim ,What is your technique for rolling LEAPs?

Yesterday I started by selling* my nicely-appreciated, farther OTM January 2025 $400 strike LEAPS that I bought just last week, because I wanted farther OTM ones, but the only ones available were January 2025 vs. the desired June 2025's - after selling, I made lower price bids for June 2025 $320 strike LEAPS. I made a series of 5 batches of buy orders, descending priced batches of bids down to low as $20.10 in case we do get our recession or whatever this year. Maybe I'll change some orders to even farther OTM June 2025 LEAPS as they become available on the Option Chain.

So now that the stock price seems to be dropping, I'm selling my older, earlier-expiring LEAPS first and then buying later- expiring LEAPS, the opposite of what I answered 2 days ago, when I said I was buying later-expiring LEAPS and then selling my older ones that expire sooner:

Nothing I try to do like this (timing my buys and sells) always works out in my favor, of course, in fact too often it leaves me somewhat stranded, but I feel pretty certain that THE OVERALL ROLLING TO LATER EXPIRING LEAPS is probably the right thing for me to do, IMHO.I just roll my LEAPS frequently before they get very old, I'm almost paranoid that there are LEAPS that expire 5 - 10 months later than mine, that I want to roll mine out to the latest expiration date offered just for less risk.

Today, since TSLA seems to be rising, I bought June 2025 Strike $240 LEAPS, then did a sell order for my January 2025 strike $300 and $200 LEAPS at a few dollars over the Last EX for the January 2025 strike 300 leaps. Though I didn't buy the later expiration LEAPS for the same as I sold my older LEAPS like @Papafox somehow manages to do, I felt like I'm still a little ahead in the exchange, and I sleep better nights knowing there's more time till expiration.

I'd buy some farther OTM strikes if they were available; their lower Delta making them cheaper initially, they'll make that up as Delta grows, essentially a sort of leverage assuming stock price rises, of course, over the next 18 - 29 months. If not, I'll keep rolling them.

My LEAPS were recently worth 1/10 of their all-time-high value (sniff) - but 10x my initial investment (YAY!)... Might just be Dunning-Kruger in action, but I feel good about what I'm doing, keeping it simple with my limited option knowledge.

Sorry so slow replying, @CHGolferJim .

Not advice.

Edit- To my way of thinking, maintaining more time before expiration = a longer ladder to bridge the un-seeable crevasses.

YMMV, I'd love other's thoughts and corrections.

This is not advice!

*Well after the stock price had already dropped more than I liked, lest anyone get jealous thinking I'm good at timing these things!

(Edited like 6 times in 10 minutes for clarity)

Last edited:

JusRelax

Active Member

Apparently, Moneyball's source added up the wrong two weeks to get the 20k number. The correct number for the 2 weeks is 10,852. Thus, for the month of January up through 1/29, the correct number is ~24k, which is still a record for first month of the quarter.

I don't know, producing dramatically cheaper 3/Y variants might not be a great move considering they will likely not be all that different in feel and form. Multiple models are there to hit different price points and each niche, and I personally very much hope the trigger is ready to be pulled on something significantly cheaper and different to move the vehicles necessary in the upcoming production targets.I really dont think that we will see a new cheaper model at investor day. I think we might see details on this highland project, and that it will essentially be a way to make a super cheap version of the model 3. Its pretty clear that elon feels that introducing multiple models is more trouble than its worth. he even dislikes too many paint options for the same body!

I would guess that we see a new 'base' model 3 that is dramatically cheaper, with front+rear casting, 4680 structural pack, and possibly a smaller battery and shorter range.

There is not really enough clear water between the model 3 and the model Y. The Y is basically a taller model 3, with a different trunk. I reckon Tesla want to make the model 3 the entry level Tesla, followed by Y, then S/X, with definite price gaps to show the difference.

I DO think that Tesla are limiting their European sales by NOT having a compact car. Something shorter and definitely narrower, but that may be a while yet. There are plenty of legacy car companies to obliterate before Tesla has to focus its lazers on the compact car market. Until Texas and Berlin are fully ramped, I don't think this is a limit on growth though. (But I bet there is a compact tesla design hidden in some corner of freemont/shanghai already being worked on).

Also lets not forget the possibility of an optimus update for investors day. The last one was very last minute and touch-and-go. Even seeing the bot walking more confidently this time would be good.

If the intent is just to continue pumping out 3s and Ys with slight tweaks or software limiters, I think there's a serious risk of the lineup being hit by further devaluation. Very interested in seeing what Investor Day brings.

thx1139

Active Member

At least get the manufacturer of the Mach-E correct. I am sure the unions love the built in Mexico Mach-E.I have far more confidence in GM to convince the current administration that their union-loving Mach-e SUV deserves to be reclassified to get that tasty subsidy $$$ than I ever would Tesla trying to do the same thing.

Artful Dodger

"Neko no me"

In case you know how to read it (I've never looked at one before) but didn't notice that a Tesla FORM 10-K is out - https://www.sec.gov/Archives/edgar/data/1318605/000095017023001409/tsla-20221231.htm

From the Tesla 2022 10-Q:

Note 14 – Income Taxes:

- As of December 31, 2022, we recorded a valuation allowance of $7.35 billion for the portion of the deferred tax asset that we do not expect to be realized.

- The valuation allowance on our net deferred taxes decreased by $1.73 billion in the year ended December 31, 2022, and increased by $6.14 billion and $974 million during the years ended December 31, 2021 and 2020, respectively.

- The changes in valuation allowance are primarily due to changes in U.S. deferred tax assets and liabilities incurred in the respective year.

- The decrease in the year ended December 31, 2022 included utilization of $13.57 billion net operating loss carry forwards to offset our 2022 U.S. taxable income.

Cheers!

In addition:From the Tesla 2022 10-Q:

Note 14 – Income Taxes:Attn: @mongo @The Accountant

- As of December 31, 2022, we recorded a valuation allowance of $7.35 billion for the portion of the deferred tax asset that we do not expect to be realized.

- The valuation allowance on our net deferred taxes decreased by $1.73 billion in the year ended December 31, 2022, and increased by $6.14 billion and $974 million during the years ended December 31, 2021 and 2020, respectively.

- The changes in valuation allowance are primarily due to changes in U.S. deferred tax assets and liabilities incurred in the respective year.

- The decrease in the year ended December 31, 2022 included utilization of $13.57 billion net operating loss carry forwards to offset our 2022 U.S. taxable income.

Cheers!

As of December 31, 2022, we had $18.0 billion of federal and $14.0 billion of state net operating loss carry-forwards available to offset future taxable income, some of which, if not utilized, will begin to expire in 2023 for federal and state purposes.

I'm sorry, I don't understand: are these new Tesla cars that are insured or cars insured with Tesla insurance?Apparently, Moneyball's source added up the wrong two weeks to get the 20k number. The correct number for the 2 weeks is 10,852. Thus, for the month of January up through 1/29, the correct number is ~24k, which is still a record for first month of the quarter.

CYBRTRK420

Member

New Tesla cars registered in China esentially (insured by regular 3rd parties)I'm sorry, I don't understand: are these new Tesla cars that are insured or cars insured with Tesla insurance?

Hock1

Member

There should be a separate site for Language EducationAnd here I was thinking what's important is that the whole discussion is OT.

Artful Dodger

"Neko no me"

Tesla's shares outstanding amount increased by a mere 6.35M shares in 2022 Q4. That represents a paltry 0.20% dilusion for common shareholders.

You should not, by default, be able to move an EV without all doors closed. Obviously, there can be an override in the menus, but it can't be a permanent selection. I say EVs, as this should easily be programable.Yep, and with all of that, neighbor's wife still did that. And I would not put it past my wife.

They are installing something BIG in to the Giga Austins Cathode building.

www.teslarati.com

www.teslarati.com

Tesla installs heavy-duty Sacmi machines at Giga Texas' cathode building

At the time the image was taken, one press seemed to have been installed while another was still being set up.

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K