2daMoon

Mostly Harmless

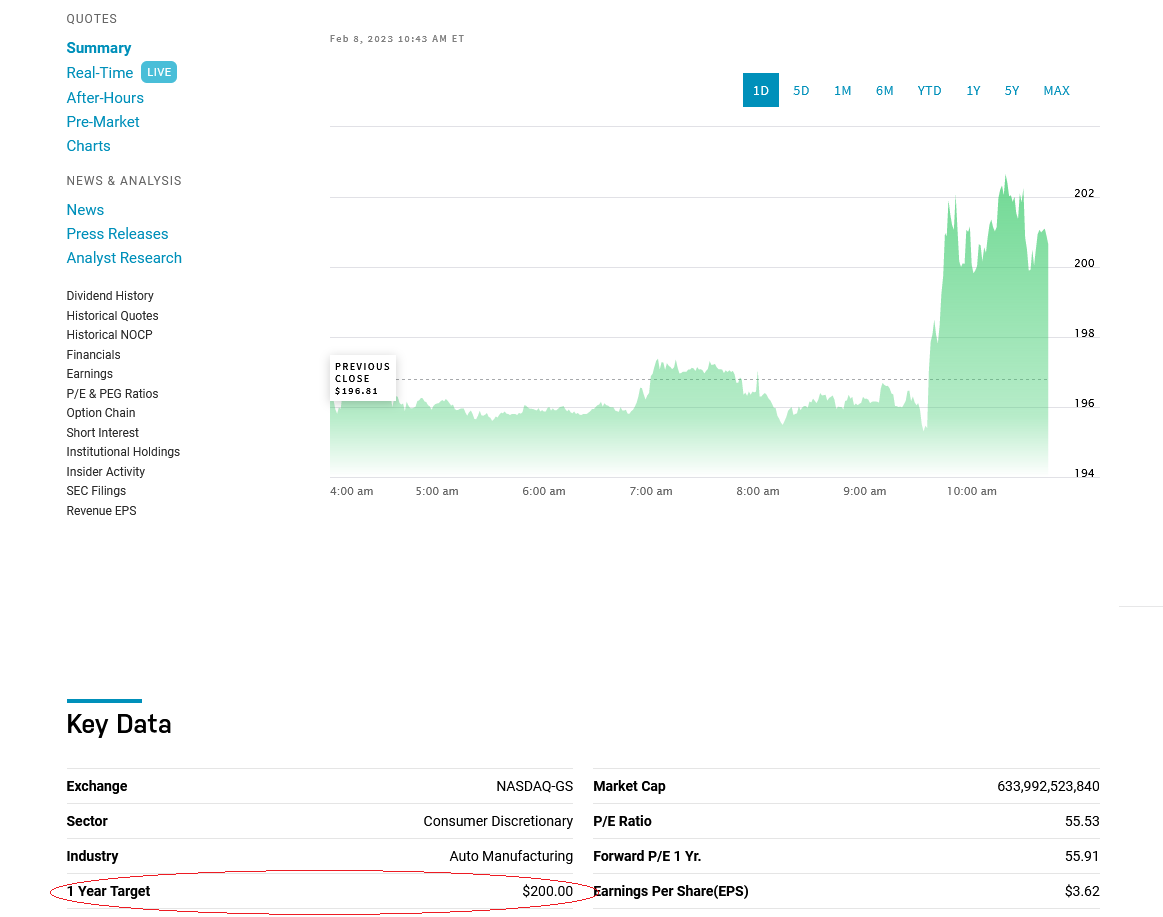

Something about this "Key Data" (circled) seems a mite out of touch today

...here's to hoping this post ages well.

...here's to hoping this post ages well.

Last edited:

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

I don't disagree, but I admire your bravery with forecasting.Once Tsla breaks $200, could happen today or tomorrow or pretty fast then $300 is in clear sight by March 1st

Not financial advice

Wallstreet understands everything Elon says. However his track record with gigantic promises like FSD, 4680s, semi, roadster, dojo and solar roof have been spotty. Elon always jump the gun and want you to "imagine a world" type scenario and we investors expect Wallstreet to model a future EPS with the potential or else "they don't get it". That's nonsense, everyone gets the vision, just not many believes in the execution.I'm excited about Investors Day. I'm even more excited about finally seeing Elon's Master Plan III. I don't expect wallstreet to get it, they never do...and, therefore, I don't expect the SP to even react positively as a result. But, I am excited to learn what I hope are significant objectives and further validation that my investment is brilliant. Excited for the HODLers

Wallstreet understands everything Elon says. However his track record with gigantic promises like FSD, 4680s, semi, roadster, dojo and solar roof have been spotty. Elon always jump the gun and want you to "imagine a world" type scenario and we investors expect Wallstreet to model a future EPS with the potential or else "they don't get it". That's nonsense, everyone gets the vision, just not many believes in the execution.

Only issue is that they don't work 365 days/year, esp in Giga Shanghai.

I'm a 'Glaswegian' by birth and upbringing, and now a Naturalized US citizen. Maybe we should all show the people of this Country how we feel about Tesla.View attachment 904712

It's not bravery...I don't disagree, but I admire your bravery with forecasting.

My expectations are low, (better chance of being surprised.)I'm even more excited about finally seeing Elon's Master Plan III.

I disagreed with your post because, while Wall Street droids may understand the words being spoken, it's clear to me that they do not always understand the implication... often by a long shot.Wallstreet understands everything Elon says. However his track record with gigantic promises like FSD, 4680s, semi, roadster, dojo and solar roof have been spotty. Elon always jump the gun and want you to "imagine a world" type scenario and we investors expect Wallstreet to model a future EPS with the potential or else "they don't get it". That's nonsense, everyone gets the vision, just not many believes in the execution.

Phew i thought they were going to give out battery factories if attendees checked under their seats ala Oprah.Munro said the total body side outer on rack in the picture represents 1 day of production.

Dahn is just looking at the timescale more from the standpoint of technology development and innovation instead of through the eyes of an impatient investor who wants mass production to begin two weeks ago.Did I miss the conversation on the bomb dropped in this Jeff Dahn video about 4680 progress?

"going from wet to dry electrode"

"bringing that equipment up to mass-production scale"

"those challenges are virtually now overcome"

at 51 min. Since it's from October, he must be oversimplifying what their progress is...

Yep.Stock has recovered a bit and now suddenly it seems that almost everyone is more jubelent than ever. I see this now in over hyping the event of March 1, as we have not gone through enough last year.

My advise is to keep your feet firmly on the ground and just see where it goes the coming months. Just see what Elon has to say on March 1 and don't get hyped-up by people posting here. Before you know it you will be thrown into the deep again, with investing your emergency fund (I am guilty of doing that last year) or even getting into margin.

Sorry, too wordy. - Tesla USA ahead of ICELooking forward to the day they put a sticker on the back saying:

"Another Vehicle From America's Most Successful Automaker"

This too.Combine that with a Master plan 3 that goes "over the head" of Wall street it might end up with a classic buy the rumor and sell the fact situation.

First: interactive investor:@unk45 I would be really grateful to take up your offer "If anyone really wants to know the arcane rules, several of us, including me, can provide all the excruciating detail." specifically in regard to two UK brokers who I think handle the vast majority of UK private retail shareholders:

- ii (interactive investor – the UK’s number one flat-fee investment platform) who are actually a US private equity front, so I'm sure they know how to run this angle

- Hargreaves Lansdown (Benefit from an award-winning investment service) who are never known to willingly turn down a profit

The vast majority of UK private retail shareholders who trade via those two brokers will be long-only, i.e. they hold their shares "free and clear", like myself. In the case of ii they don't offer options trading at all (Trade options at Interactive Investor) and I think HL is similar (I'm not sure, their fee structure never convinced me). Most UK retail options traders use spread betters as their platforms, not brokerages, unlike the USA.

I think UK retail is second only to US retail in being private holders of TSLA, so this is a question worth pursuing a little. In the past when I've tried to pursue it I've not found an answer. Certainly TSLA appears to be the #1 share choice of all UK private retail investments into USA. As you say this lack of an answer, is likely to be deliberate obfuscation !

So if you can figure out an answer that would likely be of great interest to a lot of folk in the UK.

Bottom line:

- I think UK retail TSLA shareholders are having their stocks lents out to TSLA shorts (via custodians), with no say in the matter;

- I think UK brokerages are profiting all of the short-lending fees, not passing through any to the specific named beneficiaries;

- And there is zero disclosure regarding this to UK retail TSLA shareholders from any of the UK retail brokerages.