lafrisbee

Active Member

Two Wrongs don't make a Right.2 Hummers is perfect, less batteries wasted.

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

Two Wrongs don't make a Right.2 Hummers is perfect, less batteries wasted.

You are over thinking it. It's very simple. Good news for Tesla means that it's actually portrayed as bad news with the help of large and small media companies. This volatility is what the short sellers profit from. I'm sure it's all just coincidental.Given the reaction we have seen today, what can we expect the week of earnings? (I'm new to TSLA, but very experienced otherwise.)

Most companies trade earnings week because until the report is released nobody knows... but here we have half the information. Great news, but Wall Street hates it.

So can we expect the same thing earnings week? Like the margin drops just a little, so profits are up a lot but the stock tanks because "margins dropping"?

Or are earnings weeks non-events for TSLA? Appreciate links or references to things I should read. (Searching for "earnings" is tough.)

For this quarter's earnings, we actually don't have half of the information. We have barely any information really. The P/D numbers are rather meaningless unless they came in significantly above or below expectations.Given the reaction we have seen today, what can we expect the week of earnings? (I'm new to TSLA, but very experienced otherwise.)

Most companies trade earnings week because until the report is released nobody knows... but here we have half the information. Great news, but Wall Street hates it.

So can we expect the same thing earnings week? Like the margin drops just a little, so profits are up a lot but the stock tanks because "margins dropping"?

Or are earnings weeks non-events for TSLA? Appreciate links or references to things I should read. (Searching for "earnings" is tough.)

LOL! SNL memetic slip-up. Franz von Holzhausen! Dang I can't fix it now.Hanz?

How about; mimicking the beauty of nature, the earth, and its crystalline/mineral structures?And the CT? What’s the aesthetic science behind that one? Human target practice? That’s how it makes me feel.

I am not a fan or critic of Troy but Interestingly, if you average his 10 forecasts, the number comes in at 422,600 - indeed very close to actuals.

I have not seen this posted yet or if it did then it got much less attention than deserved.

Earlier this week, it was reported that the Boring Company had quietly filed a request to the government to double the size of the Vegas Loop plan to 65 miles and 69 stations. Just look at the size of this beauty:

For this quarter's earnings, we actually don't have half of the information. We have barely any information really. The P/D numbers are rather meaningless unless they came in significantly above or below expectations.

The P/D numbers are meaningless in that we don't know how much the price cuts actually effected Tesla's gross and operating margins. You can't assume the % cut in Tesla's vehicle prices is equal to how much Tesla's margins/profits were cut because Tesla was still delivering cars in Q1 at materially lower sale prices than what was listed on the website since those orders were placed a while ago. How much of this dynamic evens out the price cuts is anybody's guess right now. But that will be the main driving force of Q1 earnings along with if COGS started dropping as well as gross margin and operating margin improvements at both Berlin and Austin due to them materially ramping in Q1 over Q4.

There's simply too many unknown dynamics at play in Q1 for anyone to really know what Q1 earnings are going to look like.

I feel like it typically goes in the opposite direction of what it does the 2 weeks prior to earnings. Meaning if it rises into earnings, it will generally fall afterwards. If it falls going into earnings, it will often rise afterwards. But obviously any surprises in the report override any pre-conceived ideas.Given the reaction we have seen today, what can we expect the week of earnings? (I'm new to TSLA, but very experienced otherwise.)

Most companies trade earnings week because until the report is released nobody knows... but here we have half the information. Great news, but Wall Street hates it.

So can we expect the same thing earnings week? Like the margin drops just a little, so profits are up a lot but the stock tanks because "margins dropping"?

Or are earnings weeks non-events for TSLA? Appreciate links or references to things I should read. (Searching for "earnings" is tough.)

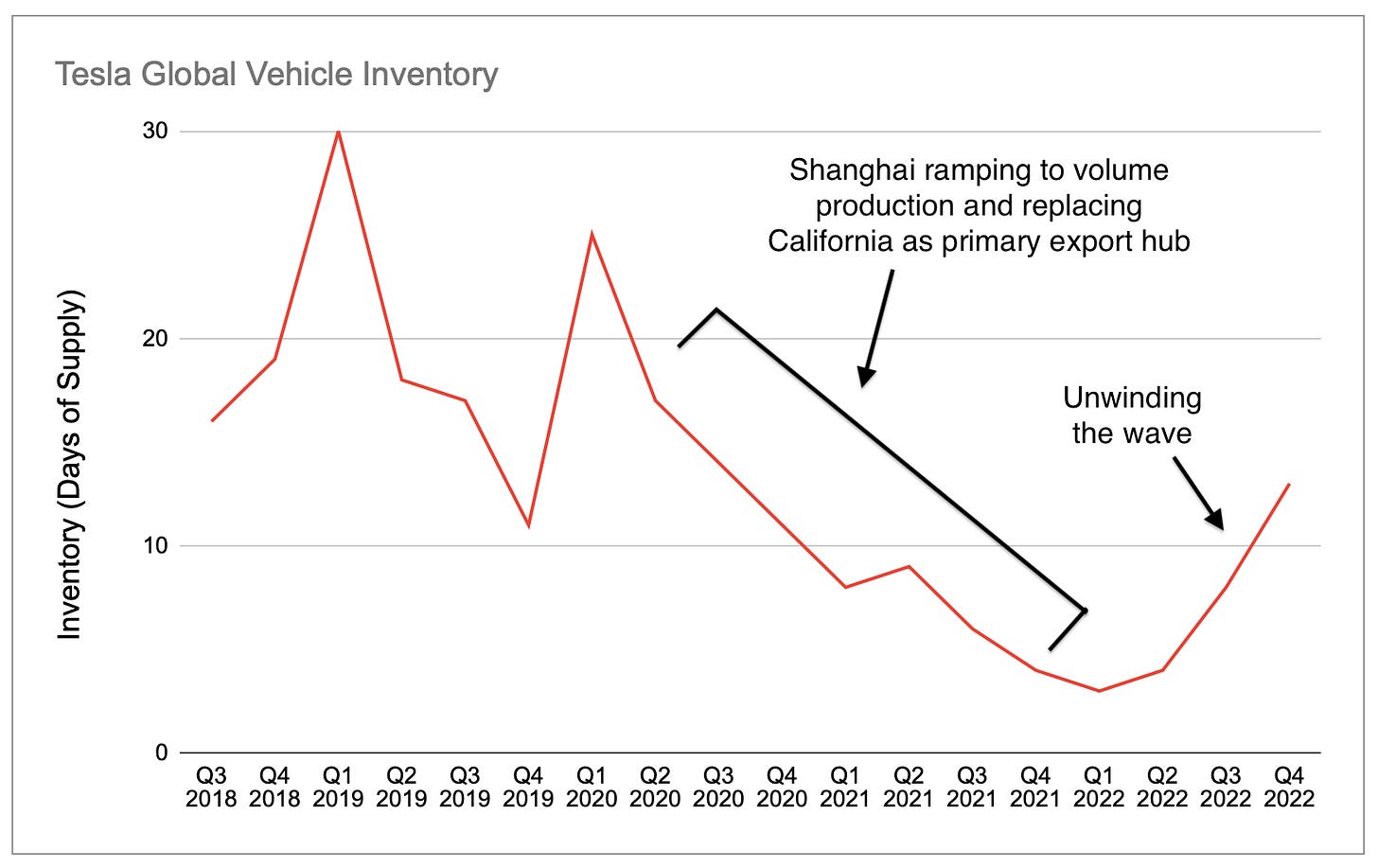

To add more context, here’s something I wrote in a blog article after Q4 results and it’s still true. It will be interesting to see where Tesla’s inventory stabilizes at when the wave has fully unwound and Berlin and Texas reduce the average transportation distance.Inventory at end of Q4-2022 was 70,249 being 13d of deliveries (i.e. sales, at 75d/qtr)

Q1-2023 increased inventory by 17,933 bringing it to 88,182.

88,182 / (422,875 / 75) = 88,182/5,638 = 15.6 days of sales, i.e. rounds to 16d

So overall this is not a particularly significant growth in inventory. Especially when considering that includes stock in transit on ships as well as rail and road transport, plus show rooms, plus holding centres. For example that would be only (say) 8-10 shiploads in total. So 4 ships at sea; 2 shiploads in factory parking lots awaiting loading; 2 shiploads at unloading sites; and 2 shiploads spread around (750+) showrooms and delivery centres. The point being pretty quickly you can very reasonably account for 88k units.

It looks to me like the inventory changes are beginning to stabilise as the wave has significantly unwound. At least that is how I (cautiously) interpret the data, and provided that nothing slips.

View attachment 924382

I feel Tesla will need to pull another Q1 2022 type of quarter out of its hat at this point to really detach itself from macro's and regain its long term trend line that started when the stock finally broke out of that 5 year trading range 4 years ago.I'm going to make a prediction for how TSLA will react after earnings on the 19th:

No matter how good nor how bad earnings come in at, TSLA will fall afterwards and both WS and the media will find something, anything to complain about from it.

Just a hunch.

I think he's traumatised by the whole BoD thing, he might go Full Greg at this rate...I think the pressure of running a growth-stock fund is getting the better of Ross.

Well auto analysts have witnessed the peaks and valley of sales from other auto throughout the past century. The typical cycle for a car without changing their platform is roughly 3-4 years. They don't think Tesla can outperform these patterns and are expecting just like the Model 3 and the S/X before it, the Cybertruck will take away some of the thunder away from the Model S3XY as that ramp into million units unless Tesla comes out with new refreshes. And if Tesla refreshes more, then that's a hit to gross margins just like how it hits big auto. The thinking is, big auto would LOVE to just pump out the same car over and over for a decade but they can't because sales go down the drain because people are always looking for the next new shiny thing. So Tesla's margins currently is just temporary because in the future they will have to refresh more which results in more R&D spend like big auto due to competition or just product staleness.It's been three full years since Tesla released a new product yet they've maintained a 50%/yr growth rate. The media and analysts seem to view this as a negative - even the ratings agencies ding them for it. Strange.

As point of reference, at 16 days of supply, Tesla matches their full year 2022 average.To add more context, here’s something I wrote in a blog article after Q4 results and it’s still true. It will be interesting to see where Tesla’s inventory stabilizes at when the wave has fully unwound and Berlin and Texas reduce the average transportation distance.

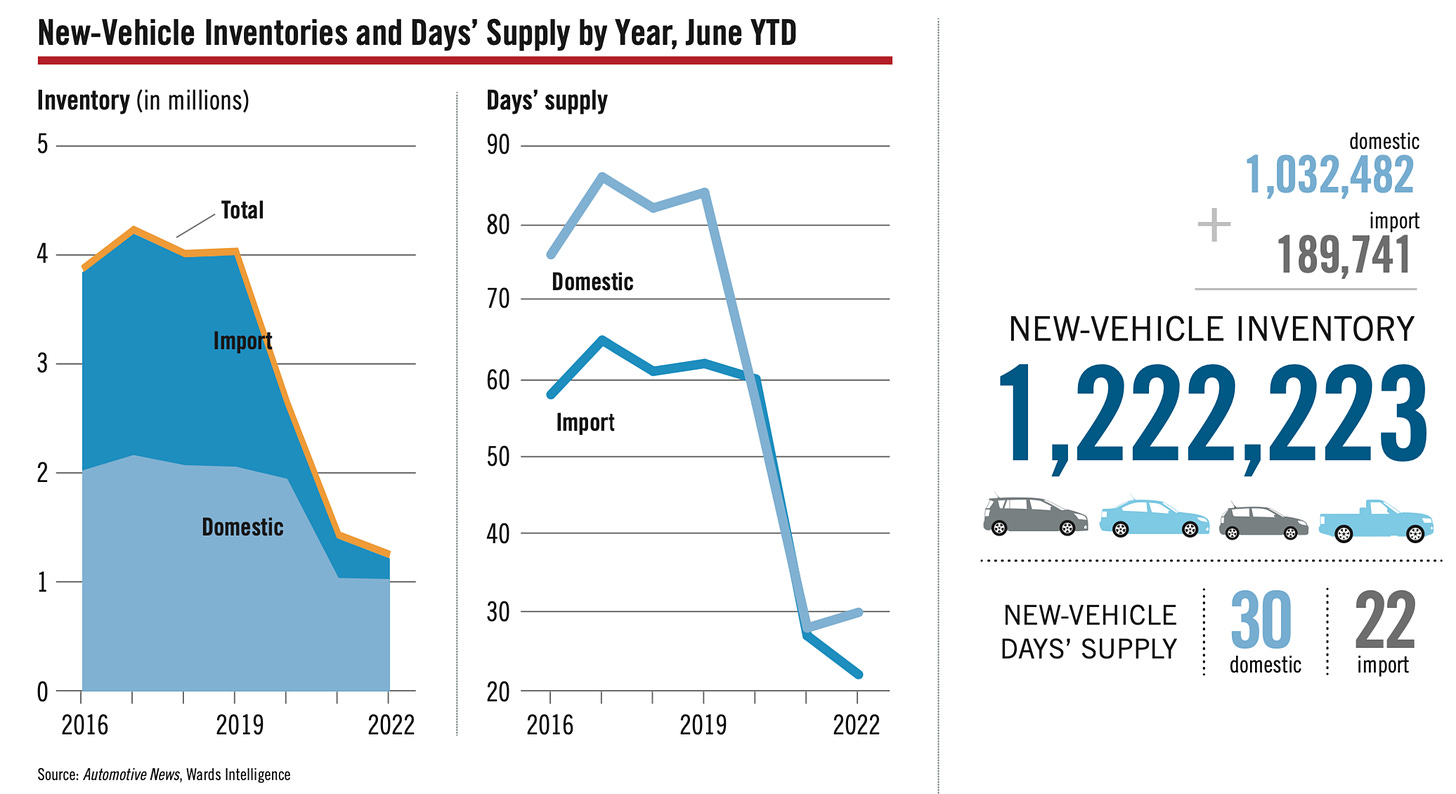

The National Automobile Dealers Association published in their mid-year 2022 NADA Data report this graphic showing that in 2016 - 2019, before the impacts of COVID, supply chain disruption, and Russia’s invasion of Ukraine, in the US the average dealership had around 60-85 days worth of inventory on lots and in transit. In stark contrast, even with the Q3 and Q4 pipeline-filling caused by ending the wave, Tesla reported only having only 13 days of inventory at the end of Q4. This is still about half as much inventory (measured by days of sales) as Tesla had a few years ago prior to Giga Shanghai beginning to meaningfully contribute to overall deliveries, thus reducing the average number of days required to ship cars to customers.

Data source: Tesla quarterly updates

Also, it’s important to realize that Tesla’s 5x advantage is actually a severely biased comparison in favor of the competitors, because cars in transit account for nearly all Tesla's inventory, with relatively few cars sitting in parking lots at any given time. The norm for the rest of the industry is to have cars sitting for an average of a couple of months at dealerships waiting for the right customer, whereas Tesla still doesn't even have standard same-day purchasing like other car companies or just about all consumer retail businesses in general. I have not been able to find data on the industry norm for days worth of sales of vehicles in transit to dealerships, so this apples-to-oranges comparison is the best I can do, but even this pessimistic analysis shows Tesla having a 5x advantage. Tesla’s actual fundamental business model is a true just-in-time, inventory-light design because they don’t park cars for months accumulating dirt, bird droppings, and costs from capital sunk into the inventory and less-obvious costs like insurance, security and property tax. The big picture for Tesla’s inventory is not the modest rise in the second half of 2022, but rather the online ordering and lack of traditional dealerships.

Yeah he's really lost his mojo. Especially weird that he sat on TSLA for ages before it jagged up in 2019 but can't wait around for the next wave - which seems just as inevitable as the last one.I think he's traumatised by the whole BoD thing, he might go Full Greg at this rate...

Nfa, but TSLA typically:Given the reaction we have seen today, what can we expect the week of earnings? (I'm new to TSLA, but very experienced otherwise.)

Most companies trade earnings week because until the report is released nobody knows... but here we have half the information. Great news, but Wall Street hates it.

So can we expect the same thing earnings week? Like the margin drops just a little, so profits are up a lot but the stock tanks because "margins dropping"?

Or are earnings weeks non-events for TSLA? Appreciate links or references to things I should read. (Searching for "earnings" is tough.)

Signs of too many gamblers playing Tesla options vs actual investors that is affecting the sp movement.Nfa, but TSLA typically:

Trades down on bad news.

Trades down on good news.

Trades up on no news.