Nice looking wife. Any other photos you can send us?I’m not going to read all this but I’m going to tell you while you were writing that I was out touching grass [and snow] with my stunning wife enjoying the fact I sold most of my TSLA much much higher than we are at today. Have a great day my friend.

ps don’t look at my profile photo.

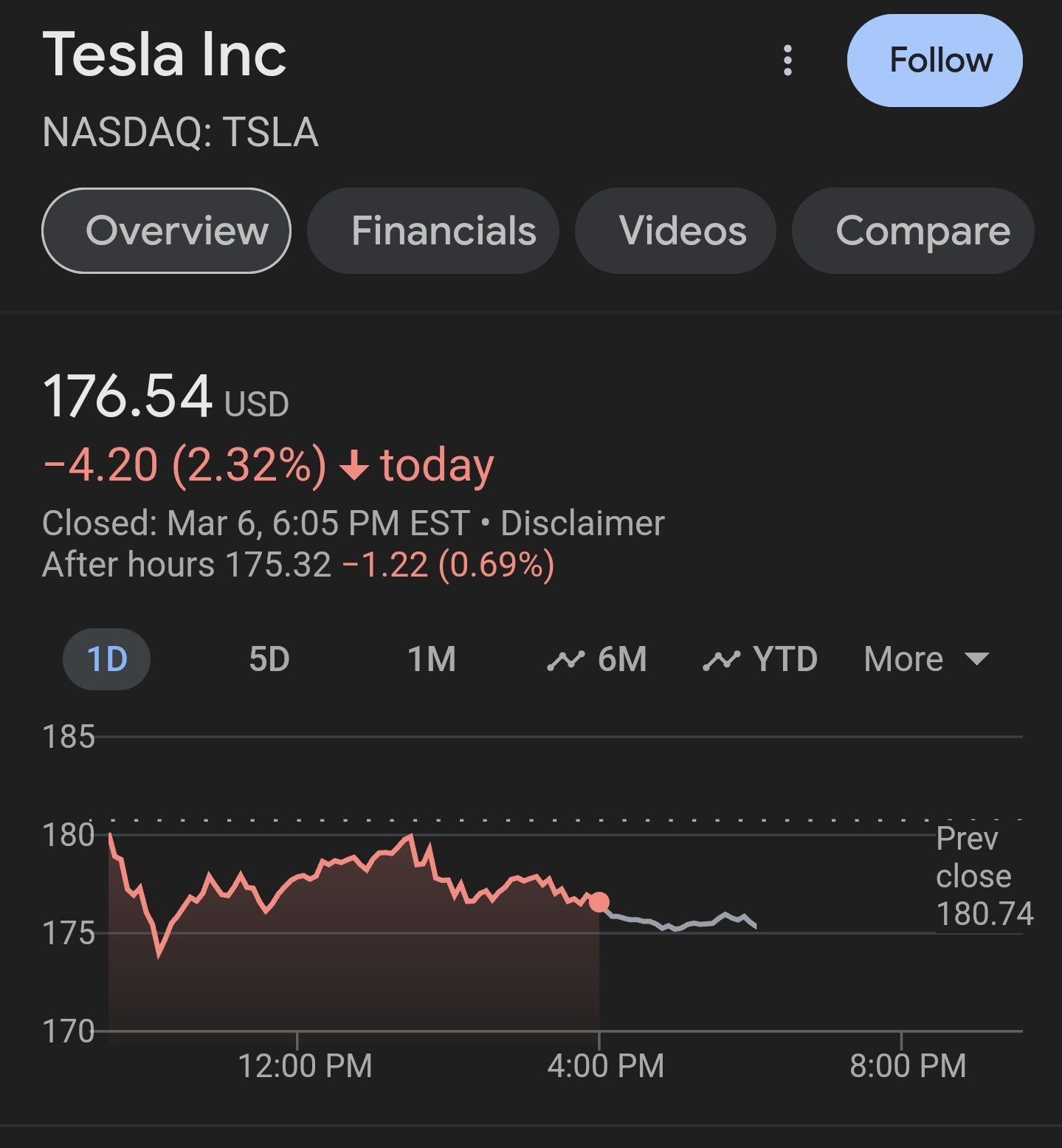

View attachment 1025321

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

Artful Dodger

"Neko no me"

I’m not going to read all this but I’m going to tell you while you were writing that I was out touching grass [and snow] with my stunning wife enjoying the fact I sold most of my TSLA much much higher than we are at today. Have a great day my friend.

So you sold, but are hanging around to gloat? Or tell us about a trophy wife? Please continue, elsewhere.

Knightshade

Well-Known Member

I think opinions change more when the SP changes, not facts.

Weird read since their post was all about specific facts regarding factory and financial items over the coming 18 months.

Though I suppose one could generously read your thoughts as a significantly different SP outcome than one expected might cause a person to reexamine the current facts versus what they'd previously presumed them to be to try and be less wrong in the future.... A thing Elon himself finds a desirable outcome.

0.00%

OpenAI is incorporated in the state of Delaware, USA. The company was founded in 2015 by a group of entrepreneurs and researchers, including Elon Musk, Sam Altman, Ilya Sutskever, Greg Brockman, Wojciech Zaremba, and John Schulman.

Who owns OpenAI? OpenAI LP, the profitable arm of OpenAI is closely tied to Microsoft who invested $1B to gain all of ChatGPT tech for 40% ownership of OpenAI LP. How is this possible and why does Andre Karpathy think that Tesla could resolve the issue by funding OpenAI?

This ties in questions I have about X.ai, Grok and X.com and Tesla which all seem to be connected by sharing technology, assets and employees afaik based on X posts by Elon.

If founded and funded by EM, how does he own 0% after a ? $40-$100 M investment at the start? Does Microsoft now own 40% of the profitable arm of OpenAI? How does OpenAi gets to pay fewer taxes because they are claiming to be non-profit... sell 40% of its LP profitable arm to Microsoft all while 'no one owns' OpenAI. This is so broken.

Last edited:

cliff harris

Member

I think arguing about whether we are currently in a growth 'pause' or not is missing the point. I don't think many people actually think Tesla are sandbagging or lying about their guesses for short term growth.

The argument is what happens when the pause is over, and how radical a change that might be? This is what really matters, and contrary to what some are suggesting, that debate is relevant RIGHT NOW, not in a year or two years time.

Stock prices are always forward looking. You buy shares to own a chunk of the company. If you buy 10% of Tesla today, you own it, and in theory 10% of all future profit, whether that profit comes today or in 2034.

Because the stock is forward looking, you can absolutely make a case to buy NOW, and not wait for the pause to end.

Trader A thinks that EV sales will quintuple in 2027 so plans to buy in 2027.

Trader B wants to buy before trader A, so he benefits from a rise before A bids the price up, he buys in 2026

Trader C wants to ensure he is positioned well in 2027 too, so buys in 2025 to get in before B

and so on, and so on...

If you could guarantee that Teslas profit would 5x in 2027, would that make you buy now? It would me. You never know when the stock goes all 'nvidia' on you, while you were not ready for it. Even if I'm knocked out and in a coma until teslabot & robotaxi, I'm cool, because I already have my 10k chairs ready .

.

The argument is what happens when the pause is over, and how radical a change that might be? This is what really matters, and contrary to what some are suggesting, that debate is relevant RIGHT NOW, not in a year or two years time.

Stock prices are always forward looking. You buy shares to own a chunk of the company. If you buy 10% of Tesla today, you own it, and in theory 10% of all future profit, whether that profit comes today or in 2034.

Because the stock is forward looking, you can absolutely make a case to buy NOW, and not wait for the pause to end.

Trader A thinks that EV sales will quintuple in 2027 so plans to buy in 2027.

Trader B wants to buy before trader A, so he benefits from a rise before A bids the price up, he buys in 2026

Trader C wants to ensure he is positioned well in 2027 too, so buys in 2025 to get in before B

and so on, and so on...

If you could guarantee that Teslas profit would 5x in 2027, would that make you buy now? It would me. You never know when the stock goes all 'nvidia' on you, while you were not ready for it. Even if I'm knocked out and in a coma until teslabot & robotaxi, I'm cool, because I already have my 10k chairs ready

Eh, not buying it. I am not happy with the current SP and I would probably be pissed if I bought recently, but the facts have not changed. Sentiment for the stock has changed. Not only for Tsla, but all EV stocks. Tesla, the company, continues to thrive. The current SP, not so much.Weird read since their post was all about specific facts regarding factory and financial items over the coming 18 months.

Though I suppose one could generously read your thoughts as a significantly different SP outcome than one expected might cause a person to reexamine the current facts versus what they'd previously presumed them to be to try and be less wrong in the future.... A thing Elon himself finds a desirable outcome.

People’s attitude is definitely driven by stock price far more than Tesla fundamentals. People were celebrating about possibly buying islands when the PE was over a thousand.Weird read since their post was all about specific facts regarding factory and financial items over the coming 18 months.

Though I suppose one could generously read your thoughts as a significantly different SP outcome than one expected might cause a person to reexamine the current facts versus what they'd previously presumed them to be to try and be less wrong in the future.... A thing Elon himself finds a desirable outcome.

Knightshade

Well-Known Member

If founded and funded by EM, how does he own 0% after a ? $40-$100 M investment at the start?

It wasn't investment, it was donation to a non-profit.

Tax deductible no less.

As I said, he has 0 ownership of open AI.

Knightshade

Well-Known Member

Eh, not buying it. I am not happy with the current SP and I would probably be pissed if I bought recently, but the facts have not changed.

50% CAGR through 2030 (go back and read all the posts in recent years showing that CAGR rate, annually, getting us to 20 million cars by 2030)-- has changed to 1-2 years of at/near single-digit % growth for one. Growth will be massive after, but that's not now and it's not anytime this year or next.

Or go back 2-3 years and find what people in this very thread claimed the 'facts' for projected margins and EPS in 2024 and 2025 would be.... They're gonna be off by like a factor of 2-4x for margins and perhaps as much as 5-10x on EPS based on todays facts.

That's WHY the stock is where it is today. It was priced for continued massive growth annually through at least 2030--- but the facts changed and we're in a lull right now, unlikely to resume massive growth before 2026.

Last edited:

Got your point. How are the other EV stocks doing comparatively? Tesla is the clear cut leader. Also, Tesla is not limited to selling cars as other companies are. Cars are also particularly sensitive to interest rate hikes. Perhaps astute analysis could have predicted the rapid increase in rates - probably not.50% CAGR has changed to 1-2 years of at/near single-digit % growth for one.

Or go back 2-3 years and find what people in this very thread claimed the 'facts' for projected margins and EPS in 2024 and 2025 would be.... They're gonna be off by like a factor of 2-4x for margins and perhaps as much as 5-10x on EPS based on todays facts.

That's WHY the stock is where it is today. It was priced for continued massive growth annually through at least 2030--- but the facts changed and we're in a lull right now, unlikely to resume massive growth before 2026.

powertoold

Active Member

420 69 baby! Except it's the wrong color

Knightshade

Well-Known Member

Got your point. How are the other EV stocks doing comparatively? Tesla is the clear cut leader.

Sure. But those companies have their own threads to discuss their performance.

This thread is specifically about tesla investment and investors.

Also, Tesla is not limited to selling cars as other companies are.

Sure. Energy via Lathrop may be the one "surprise" bright spot for 2024 and 2025 earnings, but cars will remain the vast majority of sales for the couple years we're talking about. Megapacks from Shanghai won't be a thing on the books until 2025 at this point either and only then starting their ramp... We just discussed that Tesla is actually losing money on insurance right now--- one hopes that'll turn around but it's unlikely to do that so fast it posts material profits this year or next... Robots will be a $0 contributor in that time frame (as Gigapress also pointed out) and FSD income is unlikely to be materially different from current in that period either.

From 2026 on, especially if the next gen/unboxed vehicle is on time and scales well, is a totally different story. But in the 18 month time frame being discussed that's a non-factor.

Cars are also particularly sensitive to interest rate hikes. Perhaps astute analysis could have predicted the rapid increase in rates - probably not.

People keep throwing this out there--You can certainly argue interest rates account for SOME of the difference, but the math simply does not support it being THAT big a part of it.

Tesla has cut prices massively more than interest rates have increased car payments.

A new tesla today, at a 7-8% loan, is still much cheaper to a new buyer than a Tesla at 2% interest was a couple years ago. This exact discussion, with specific numbers, has been posted repeatedly in this thread already.

Krugerrand

Meow

There have been several people over the last decade+ who have attempted to secure their financial future via very risky decisions. The endings have sometimes been ugly and in a few cases, deadly.That’s hitting a little too close to home.

Early investors were very aware of the risk level and were prepared to lose every dime they invested. As time passed and later investors came on board, the risks to the company’s demise decreased but new risks surfaced. Unfortunately, the type of investor shifted.

While I firmly believe people need to be responsible for their own actions, I have no respect for the individuals who have played a role in knowingly influencing people down the wrong road.

Someone passive aggressively mocking an investor here, never mind the cherry picking data aspect, for only making X% of gains in their investment rather than doing something else and making more is abhorrent behavior.

Most of us here are trying to support a company doing good around the world. Just read that tweet by Rohan about how Tesla in Germany is positively affecting the environment, economy, and individuals working and living there. If we can increase our savings, support our families, or bring forth an earlier retirement and enjoy life more fully through an investment in the company and by buying their products then that’s an additional positive.

Those people here trolling, fearmongering, bragging about how good they are at short term trading, ragging on the company etc… are adding to the white noise and should be summarily ignored.

I looked but couldn't find the slapping my forhead emoji in the response icons.It wasn't investment, it was donation to a non-profit.

Tax deductible no less.

As I said, he has 0 ownership of open AI.

DarkandStormy

Active Member

Providing facts is now considering "trolling" on this site. Got it.Another troll to be ignored...

A stark reminder that if it's a good enough time for massive selling by the key-man CEO's brother, it's a good enough time for anyonePeople’s attitude is definitely driven by stock price far more than Tesla fundamentals. People were celebrating about possibly buying islands when the PE was over a thousand.

Keeping in mind your need to prove someone wrong on the internet based on your avatar, what is your take on Tsla? Why are you here on this thread? Do you still believe in Tsla as an investment?Sure. But those companies have their own threads to discuss their performance.

This thread is specifically about tesla investment and investors.

Sure. Energy via Lathrop may be the one "surprise" bright spot for 2024 and 2025 earnings, but cars will remain the vast majority of sales for the couple years we're talking about. Megapacks from Shanghai won't be a thing on the books until 2025 at this point either and only then starting their ramp... We just discussed that Tesla is actually losing money on insurance right now--- one hopes that'll turn around but it's unlikely to do that so fast it posts material profits this year or next... Robots will be a $0 contributor in that time frame (as Gigapress also pointed out) and FSD income is unlikely to be materially different from current in that period either.

From 2026 on, especially if the next gen/unboxed vehicle is on time and scales well, is a totally different story. But in the 18 month time frame being discussed that's a non-factor.

People keep throwing this out there--You can certainly argue interest rates account for SOME of the difference, but the math simply does not support it being THAT big a part of it.

Tesla has cut prices massively more than interest rates have increased car payments.

A new tesla today, at a 7-8% loan, is still much cheaper to a new buyer than a Tesla at 2% interest was a couple years ago. This exact discussion, with specific numbers, has been posted repeatedly in this thread already.

Krugerrand

Meow

And? When it was being shorted to Hell it also was underperforming for years. Then it suddenly wasn’t. Then it was suddenly over performing. Now it’s being attacked again. This is a WS pattern that happens to other stocks as well.Tesla is well below the returns of SPY and QQQ since the 5-for-1 stock split of August 2020.

3.5 years is a not a short amount of time for a lot of people.

3.5 years is more of a medium investment time frame. It’s not long term.

Krugerrand

Meow

And you own that mountain, huh?I’m not going to read all this but I’m going to tell you while you were writing that I was out touching grass [and snow] with my stunning wife enjoying the fact I sold most of my TSLA much much higher than we are at today. Have a great day my friend.

ps don’t look at my profile photo.

View attachment 1025321

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K