I’m guessing Next month if the earnings call goes bad and numbers are low.Your timeframe?

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

nativewolf

Active Member

@Krugerrand as someone that does lots of modeling, or did before I actually went back into the field, the problem I have about Ark is that the model is crap. She got lucky in that the point event turned out to have happened but not for the reasons she predicted. The model is bunka junka. Given enough time can nearly everything happen? Sure. It's not why we create models and getting lucky doesn't mean anything about the model is well founded. EVs got hot, everyone wanted to be Tesla, stock shot up. It was not rational and that is a big part of why TSLA has moved sideways.

All of her models are junk IMO. She literally makes stuff up, there is no rigor. I hope you're not actually Cathy. If so my apologies for calling you a whacko.

All of her models are junk IMO. She literally makes stuff up, there is no rigor. I hope you're not actually Cathy. If so my apologies for calling you a whacko.

nativewolf

Active Member

Damnit you Ninja'd my entire post. My sheep had maybe wandered into my neighbors and they are city folks easily scared by man eating sheep. Not sure why they are bothersome but there you go, I called them home and came in to finish my post. You had already written it.Keep in mind even a 10% car loan at current prices is a lower monthly payment than when loans were 2% but Teslas prices were much higher.

So the "OMG car loan rates" thing continues to be a red herring. Price cuts have far outrun rate hikes.

She also anticipates them selling 5-10 million cars, which is outside the realm of possibility.

She also antipicates 50% gross margin, which is outside the realm of possibility.

She's got market cap at 1.5 to 4 trillion too. How likely do you think that is in 2025?

Even her model of the original target price years ago Tesla DID hit, the actual model was insanely wrong, she just got lucky, once, picking a target # that hit.

Her financial results of her funds ever since, and how far off any detailed items in her models turn out each year, continually prove this was a single lucky guess, not any actual competence at financial modeling.

The fact people still view her as a guru is insane.... For all the mocking Michael Burry gets here at least the one time HE was right also had accurate financial modeling to get there instead of a lucky guess.

That's her in 2017-- telling us how her 2020 price is based on Tesla having a significant share of the robotaxi market.

philw1776

Member

It's a selfish position but my target is buy 1,000 shares if price approaches $100/share. High interest rates killing car loans. Small inexpensive Tesla 3 years away in volume.

As a recent (2019) but long term investor I'm looking for major appreciation towards decade's end. Why so long? Because I'm a FSD pessimist. Optimistic on Optimus $$$ revenue but that's not starting any year soon; huge by decade's end. First Optibots will be factory non-union employees.

As a recent (2019) but long term investor I'm looking for major appreciation towards decade's end. Why so long? Because I'm a FSD pessimist. Optimistic on Optimus $$$ revenue but that's not starting any year soon; huge by decade's end. First Optibots will be factory non-union employees.

nativewolf

Active Member

Burry has been right multiple times and across many industries and for the reasons he modeled.Keep in mind even a 10% car loan at current prices is a lower monthly payment than when loans were 2% but Teslas prices were much higher.

So the "OMG car loan rates" thing continues to be a red herring. Price cuts have far outrun rate hikes.

She also anticipates them selling 5-10 million cars, which is outside the realm of possibility.

She also antipicates 50% gross margin, which is outside the realm of possibility.

She's got market cap at 1.5 to 4 trillion too. How likely do you think that is in 2025?

Even her model of the original target price years ago Tesla DID hit, the actual model was insanely wrong, she just got lucky, once, picking a target # that hit.

Her financial results of her funds ever since, and how far off any detailed items in her models turn out each year, continually prove this was a single lucky guess, not any actual competence at financial modeling.

The fact people still view her as a guru is insane.... For all the mocking Michael Burry gets here at least the one time HE was right also had accurate financial modeling to get there instead of a lucky guess.

That's her in 2017-- telling us how her 2020 price is based on Tesla having a significant share of the robotaxi market.

DarkandStormy

Active Member

Again. You and others said the same thing the first time around when she had a ‘ridiculous’ valuation. And yet - it happened. As it happened when everyone was laughing and pointing fingers at Andrea James, calling for bankruptcy. It’s not relevant how close ‘they’ got to being right. They were serially dead wrong in the end.

I’ve no idea if Cathy is correct again or not. But she’s already been more correct than the dozens of vocal analysts who shouted her down before TSLA got to $6,000 (pre splits). Believe Jonas, Black, Gerber, et al at your own risk. Explain it all away as logically as you want and to your heart’s content. I’ll just continue to stand on the other side of the fence and wait patiently another decade.

You're focused on the share price / market cap, and I'm talking about the underlying assumptions. Just because she was right on the share price once does not mean she has been correct on the underlying assumptions about what got it there. Far from it.

Their published bear case price target (split adjusted) for 2025 is $500/share. Their published bull case price target is $1,333/share. Their average is $1,000/share. I guess you never say never, but...

And again, their *bear case* has Tesla doing 5m units next year for $234bn in auto revenue, $23bn in insurance revenue, $42bn in human ride share network (as a precursor to robotaxis, something Tesla has never publicly mentioned), with 43% total gross margins, for something like $100bn in net income.

Feel free to refer back to this post in January 2026 to see how close they were.

⚡️ELECTROMAN⚡️

Village Idiot

People are still probably waiting for rates to go down, since it's predicted they will fairly soon. They are probably also waiting for the economy to look better too. Are overall new vehicle sales down for ICE and EV?Keep in mind even a 10% car loan at current prices is a lower monthly payment than when loans were 2% but Teslas prices were much higher.

So the "OMG car loan rates" thing continues to be a red herring. Price cuts have far outrun rate hikes.

She also anticipates them selling 5-10 million cars, which is outside the realm of possibility.

She also antipicates 50% gross margin, which is outside the realm of possibility.

She's got market cap at 1.5 to 4 trillion too. How likely do you think that is in 2025?

Even her model of the original target price years ago Tesla DID hit, the actual model was insanely wrong, she just got lucky, once, picking a target # that hit.

Her financial results of her funds ever since, and how far off any detailed items in her models turn out each year, continually prove this was a single lucky guess, not any actual competence at financial modeling.

The fact people still view her as a guru is insane.... For all the mocking Michael Burry gets here at least the one time HE was right also had accurate financial modeling to get there instead of a lucky guess.

That's her in 2017-- telling us how her 2020 price is based on Tesla having a significant share of the robotaxi market.

It's a selfish position but my target is buy 1,000 shares if price approaches $100/share. High interest rates killing car loans. Small inexpensive Tesla 3 years away in volume.

As a recent (2019) but long term investor I'm looking for major appreciation towards decade's end. Why so long? Because I'm a FSD pessimist. Optimistic on Optimus $$$ revenue but that's not starting any year soon; huge by decade's end. First Optibots will be factory non-union employees.

I am of similar view, but I have 2035 as the my long long term target where Tesla gets to the promised land, until then I will be just accumulating. If it happens sooner then great. Obviously they will be well on their way by 2030 though so the SP might reflect that.

On the Loyal Shareholder CT incentive:

One general and one specific question/comment.

First, what does “receive it early” mean? I am in a time crunch at present and if I don’t receive it before the end of April it doesn’t make sense - or logistical reason - to want it before summer’s end….and the Founder version’s premium had d*mned well better have disappeared by then or Tesla is in real trouble.

Second, I already bought two more Teslas in December, and right now I really need a replacement F-350 dually. Like - right away. Which a Cybertruck is NOT, the more is the shameful pity. Not even close. Hauling my excavator the 200 miles over the Alaska Range into Fairbanks should not have to take me 2+ days.

So although I am really aching to have a CT, it’s either *now*, or wait yet ~one more year.

One general and one specific question/comment.

First, what does “receive it early” mean? I am in a time crunch at present and if I don’t receive it before the end of April it doesn’t make sense - or logistical reason - to want it before summer’s end….and the Founder version’s premium had d*mned well better have disappeared by then or Tesla is in real trouble.

Second, I already bought two more Teslas in December, and right now I really need a replacement F-350 dually. Like - right away. Which a Cybertruck is NOT, the more is the shameful pity. Not even close. Hauling my excavator the 200 miles over the Alaska Range into Fairbanks should not have to take me 2+ days.

So although I am really aching to have a CT, it’s either *now*, or wait yet ~one more year.

That's like eternity from now!!! It could hit both 160 and 180 twice by earnings. Still... it's a fun bet see who wins.I’m guessing Next month if the earnings call goes bad and numbers are low.

I'll be buying the dip there as well, plus trading about 5 more times until then. I already sold the 25 from this AM. This forum is my biggest indicator of downess.

The only reason I don't do larger quantities is I'm also HODLing. In fact, I would likely qualify for the early CT delivery even if Tesla set the entry price 5 yrs ago with the lowest point >50% at anytime in between then and today.

Damn. How many shares does Robyn Denholm have? She sold 94k shares last month and this month again. About $25MM in total.

A good thing the uberbulls here know more about the direction of the company than her and her paper hands. /s

A good thing the uberbulls here know more about the direction of the company than her and her paper hands. /s

Keep in mind even a 10% car loan at current prices is a lower monthly payment than when loans were 2% but Teslas prices were much higher.

So the "OMG car loan rates" thing continues to be a red herring. Price cuts have far outrun rate hikes.

You like bringing this up, but the C19 pricings were higher than the cars used to be.

10% interest instead of 2% cuts buying power by 18% for the same payment on a 60 month loan.

Rather than a $40k loan, a person would only get $33k.

$30k becomes $25k.

Prices haven't dropped that much since 2019 (yes, ignoring inflation)

From https://docs.google.com/spreadsheets/u/0/d/1F5IQOynIawoXiJPVarLDgPQDJAdzY8b5Vamw-Vf3eSY/htmlview

Webeevdrivers

Active Member

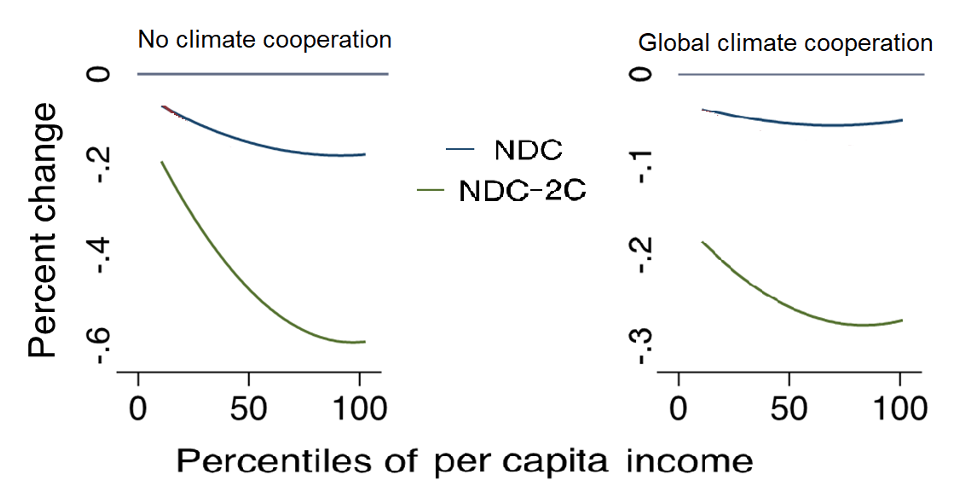

Q - how does the "free" market re-align after the Paris Climate Accord ends in 2024?...after signed into fruition around 11/2015?

Could driving towards sustainable solutions become a country-by-country thing? Maybe some more aggressive than the others?

e.g. Here's a Purdue study on macroeconomics impacts, citing inflation, back in 2021 due to the Paris Climate Accord.

U.S. Climate Policy Revisited: Macroeconomic and Distributional Impacts of the Paris Agreement

With the U.S. re-entering the Paris Agreement on Climate, Purdue researchers consider the economic consequences for the US economy.ag.purdue.edu

Probably all for not though. I suspect the US will abandon any Paris agreement goals by January 2025 after the next election. There is no way that Tesla and other manufacturers are not going to be affected. I think Tesla may be affected less but I think there will still be a significant share price hit.

Jmho.

Knightshade

Well-Known Member

People are still probably waiting for rates to go down, since it's predicted they will fairly soon. They are probably also waiting for the economy to look better too. Are overall new vehicle sales down for ICE and EV?

Jan-Feb in the US at least new vehicle sales are up 6.1% from same period in 2023.

Worldwide, and EV specifically, EV sales set a new record in January 2024-up 69% YoY.

So.... no, that's not it.

nativewolf

Active Member

Many young people live in urban areas with multi family housing and no good way to charge can't help. I agree with Knightshade that the price cuts have easily offset finance costs. I think that there is just only so much market for luxury cars and a tesla is still a luxury car. Also it is surprising that Tesla Insurance is not making profit. Repair costs have soared and as the pool of drivers expanded the numbers are not looking better. How long will they continue to subsidize the insurance division?People are still probably waiting for rates to go down, since it's predicted they will fairly soon. They are probably also waiting for the economy to look better too. Are overall new vehicle sales down for ICE and EV?

2daMoon

Mostly Harmless

While reading the concerns of many who repeatedly view Tesla's future with a bias leaning toward the negative, a quote came to mind from the movie, 2010: The Year We Make Contact.

When all things are considered (which many people don't do), the inevitable growth from the convergence of these several disruptive technologies will be astounding, and they will be adopted, regardless of those attempting to thwart it.

Things like the Paris Accord ending may give some nations the opportunity to move quicker and set an example that the transition to renewable energy is a slam dunk because it costs less on all levels, and dismantles the shackles the current energy regime has placed upon the world's population who have become dependent upon their products.

Once these examples of success and prosperity become more evident the tide will carry the transition faster and to greater heights. That is the very nature of why an S-curve repeats for every such disruption through history. A clever oil company could as easily invest their insane profits into battery, solar, and wind technologies at a faster pace, instead of spending it on FUD.

The more the powers try to hold on to their positions based in the old technology, the longer it may take for their influence to falter. Those nations where that leverage is greatest will lag in the race, until enough of their population demand that they catch up with the boons other nations are enjoying. I'm pretty sure the US could be one of those lagging, as we have the most experienced spin-doctors and concentration of fossil energy leverage over government and media. Though there is nothing that says it has to be that way. Maybe by educating folks Tesla will further hasten the transition, both in the US and elsewhere.

Eventually, something wonderful is going to happen as the trajectory of the curve turns upward. Those riding the TSLA train will have front row seats in the first-class car.

HODL

HAL-9000: What is going to happen, Dave?

Dave Bowman: Something wonderful.

HAL-9000: I'm afraid.

Dave Bowman: Don't be. We'll be together.

HAL-9000: Where will we be?

Dave Bowman: Where I am now.

When all things are considered (which many people don't do), the inevitable growth from the convergence of these several disruptive technologies will be astounding, and they will be adopted, regardless of those attempting to thwart it.

Things like the Paris Accord ending may give some nations the opportunity to move quicker and set an example that the transition to renewable energy is a slam dunk because it costs less on all levels, and dismantles the shackles the current energy regime has placed upon the world's population who have become dependent upon their products.

Once these examples of success and prosperity become more evident the tide will carry the transition faster and to greater heights. That is the very nature of why an S-curve repeats for every such disruption through history. A clever oil company could as easily invest their insane profits into battery, solar, and wind technologies at a faster pace, instead of spending it on FUD.

The more the powers try to hold on to their positions based in the old technology, the longer it may take for their influence to falter. Those nations where that leverage is greatest will lag in the race, until enough of their population demand that they catch up with the boons other nations are enjoying. I'm pretty sure the US could be one of those lagging, as we have the most experienced spin-doctors and concentration of fossil energy leverage over government and media. Though there is nothing that says it has to be that way. Maybe by educating folks Tesla will further hasten the transition, both in the US and elsewhere.

Eventually, something wonderful is going to happen as the trajectory of the curve turns upward. Those riding the TSLA train will have front row seats in the first-class car.

HODL

Last edited:

nativewolf

Active Member

I feel your need. I love my Lightning but a F350 dually replacement it is not. Buy a good used one? Wait 2 years and the pricing and capabilities will increase.On the Loyal Shareholder CT incentive:

One general and one specific question/comment.

First, what does “receive it early” mean? I am in a time crunch at present and if I don’t receive it before the end of April it doesn’t make sense - or logistical reason - to want it before summer’s end….and the Founder version’s premium had d*mned well better have disappeared by then or Tesla is in real trouble.

Second, I already bought two more Teslas in December, and right now I really need a replacement F-350 dually. Like - right away. Which a Cybertruck is NOT, the more is the shameful pity. Not even close. Hauling my excavator the 200 miles over the Alaska Range into Fairbanks should not have to take me 2+ days.

So although I am really aching to have a CT, it’s either *now*, or wait yet ~one more year.

Knightshade

Well-Known Member

You like bringing this up, but the C19 pricings were higher than the cars used to be.

10% interest instead of 2% cuts buying power by 18% for the same payment on a 60 month loan.

Rather than a $40k loan, a person would only get $33k.

$30k becomes $25k.

Prices haven't dropped that much since 2019 (yes, ignoring inflation)

You seem to be cherry picking pre-covid, pre-supply-chain crunch pricing there?(and ignoring the $7500 tax credit too which wasn't available then, but is today).

The fed didn't start increasing rates until March 17, 2022.

Just before the FIRST rate hike a LR AWD Y was $58,990, with no tax credit.

Today it's $48,990. AND you get a $7500 point of sale credit, so effectively $41,490.

So yes, prices have dropped more than that much such that the car is cheaper with todays interest rates than it was 2 years ago with lowest rates.

FWIW using actual car loan rates today vs then the tax credit alone outweighs the interest rate difference, though it's close.

The additional $10,000 price cut is all gravy on TOP of that making the monthly payment and total vehicle cost significantly less today then when rates were bottomed out.

They had to, because the market for near 60k Model Ys was approaching saturation-- the only way we even got to 1.8M last year was price cuts to expand that market to lower-priced buyers with price cuts that made total cost significantly lower than when interest rates were low.

There's no longer massive room to decrease price further to expand the addressable market another 35-50%- hence we're seeing very low growth this year on existing models.... and CT as the only new one won't ramp this year fast enough to be financially material (according to Elons own words).

The next-gen model will "fix" Tesla being at market saturation for products, but not materially so before 2026.

Energy is hopefully going to be a bright spot this year, but it's still a small enough % of the business it's not going to stand fully in for near plateauing of car sales with only a single megapack factory this year.

Last edited:

While reading the concerns of many who repeatedly view Tesla's future with a bias leaning toward the negative, a quote came to mind from the movie, 2010: The Year We Make Contact.

HAL-9000: What is going to happen, Dave?Dave Bowman: Something wonderful.HAL-9000: I'm afraid.Dave Bowman: Don't be. We'll be together.HAL-9000: Where will we be?Dave Bowman: Where I am now.

When all things are considered (which many people don't do), the inevitable growth from the convergence of these several disruptive technologies will be astounding, and they will be adopted, regardless of those attempting to thwart it.

Things like the Paris Accord ending may give some nations the opportunity to move quicker and set an example that the transition to renewable energy is a slam dunk because it costs less on all levels, and dismantles the shackles the current energy regime has placed upon the world's population who have become dependent upon their products.

Once these examples of success and prosperity become more evident the tide will carry the transition faster and to greater heights. That is the very nature of why an S-curve repeats for every such disruption through history. A clever oil company could as easily invest their insane profits into battery, solar, and wind technologies at a faster pace, instead of spending it on FUD.

The more the powers try to hold on to their positions based in the old technology, the longer it may take for their influence to falter. Those nations where that leverage is greatest will lag in the race, until enough of their population demand that they catch up with the boons other nations are enjoying. I'm pretty sure the US could be one of those lagging, as we have the most experienced spin-doctors and concentration of fossil energy leverage over government and media. Though there is nothing that says it has to be that way. Maybe by educating folks Tesla will further hasten the transition, both in the US and elsewhere.

Eventually, something wonderful is going to happen as the trajectory of the curve turns upward. Those riding the TSLA train will have front row seats in the first-class car.

HODL

I agree, BUT, I also feel this "something wonderful" is going to happen quite a bit later now than most of us expected it would. Meaning robotaxis of course.

I honestly do expect Optimus to start contributing substantially to revenues before robotaxi's do, but still not for a few years.

2daMoon

Mostly Harmless

I agree, BUT, I also feel this "something wonderful" is going to happen quite a bit later now than most of us expected it would. Meaning robotaxis of course.

I honestly do expect Optimus to start contributing substantially to revenues before robotaxi's do, but still not for a few years.

I'm looking more at Tesla Energy growing as fast as the battery supply increases, and it being the most significant contributor to the mission. Megapack purchases aren't tossed about on the wind by popular opinion the way retail sales can be.

Optimus is second on my list for the potential for being able to ramp up quickly and provide staggering margins. Likewise, targeting industrial/commercial customers rather than retail.

Next Gen is third most significant on my list, because we know production is hard, and cars are more complex manufacturing processes than are Megapacks and Humanoids.

If the battery supply weren't a bottleneck new Megapacktories could be built much faster than new car lines. Solving the battery problem is paramount to all of the above. Fortunately, Tesla isn't acting alone in making that happen.

The gains from FSD and autonomy/robotaxis will be significant, but may pale in comparison to Energy and Bots. I'm okay with autonomy taking its time to get it right. (though the same resource will be used to provide the AI for the Bots, so we have that parallel development path going for us)

Last edited:

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K