FWIW, Tesla did not originate risk use-based underwriting. That has been ubiquitous with large fleets, marine and trucking. All of those have had monitoring devices that show when, where, how and in some who. In retail car insurance Progressive began using their Snapshot policy rating tool, in 2008 the year Tesla released the original Roadster. The Tesla innovation was built in to the existing vehicle comminication with the Tesla 'mothership'. That is a 'big deal' because the actual user is technically irrelevant, only the vehicle use is directly monitored. Tesla underwriting apart from that is also quite different, since historical use prior to insurance can usually be incorporated. Those differences are one key reason for slow rollout of Tesla Insurance, while the other is the long lead time for actuarial data to be representative in nearly all situations. Thus, it likely will be several years before they'll be generating book profits.No, actually I can reduce my vehicle rates via a number of ways. Indeed, as much as 60%+. So I can undo all the rate increases and future one if I want. I am likely to make a good stab at it without significant sacrifice at my end.

There’s primarily governmentgoing on, changes in actuary methodology, and repair availability/costs - these are nationwide AND locally. There are other factors at play explained by @unk45 (ie., natural disasters, more claims because people no longer have the money to pay out of pocket for less severe damages to their vehicles etc…)

Increase for all vehicle types, except of course those vehicles they outright refuse to insure - several Kia and I believe it was Hyundai models at the top of the getthefudgeoutofmyoffice list.

There was admission that they are way behind Tesla. As in, their methods of determining insurance rates for Tesla vehicles has been behind the technology from the get go and remains behind. Tesla moving way faster than their bureaucracy. That was both disappointing and encouraging to hear. Disappointing because they’re paperweights, but encouraging because of the self-awareness Tesla is changing the landscape.

Other interesting tidbits not directly related. For a podunk place, with a self-admitted country bumpkin broker, he was decently informed on Tesla, interested in knowing more about the vehicles, and didn’t say or hint at a single disparaging thing. He’s even been in one and was blown away. He’s also considered owning one but doesn’t quite yet have the confidence based on his current knowledge of charging infrastructure and how charging typically works for owners. I allayed some of his concerns in that area. His proposed vehicle use definitely would require a bit of forethought on occasion.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

Zaddy Daddy

Member

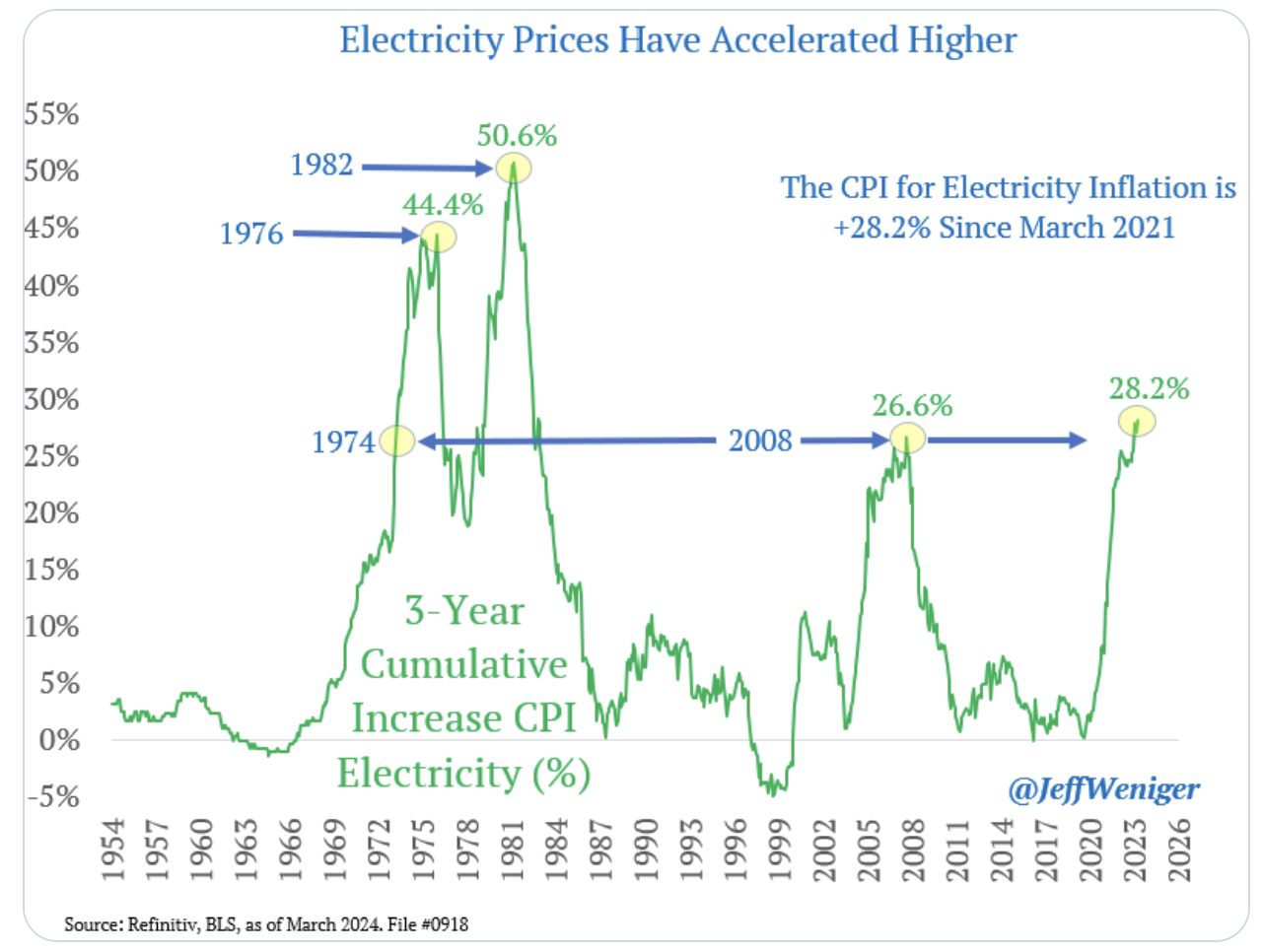

One main reason demand (price adjusted) for EVs is down across the board in the U.S.

The problem is that the current rapid inflation in electricity prices isn't going to correct itself anytime soon. At best, the inflation will slow to zero, and allow wages to catch up but that would take a decade.

While there is some arbitrage opportunity for solar + cheap batteries, the majority of potential EV buyers won't be considering this and so demand is now somewhat chronically impaired relative to a few years ago.

I imagine the main possible event that could rapidly change this phenomena is spiking oil prices.

The problem is that the current rapid inflation in electricity prices isn't going to correct itself anytime soon. At best, the inflation will slow to zero, and allow wages to catch up but that would take a decade.

While there is some arbitrage opportunity for solar + cheap batteries, the majority of potential EV buyers won't be considering this and so demand is now somewhat chronically impaired relative to a few years ago.

I imagine the main possible event that could rapidly change this phenomena is spiking oil prices.

Attachments

Actually it's 'might be'. All policies do not fit all applicants. Tesla has serious standards so some applicants have higher quotes than do others, while others have much lower quotes. That difference is not necessarily only driving record.Thanks for the details.

Did you remind him/her how much cheaper Tesla insurance would be?Ouch!

Generalizing on this subject is fraught with error. 'on average' might be appropriate.

Zaddy Daddy

Member

At this rate by 8/8 everyone already using the S/X/3/Y as an autonomous vehicle is going to be saying 'why did we have to wait so long to see the first robotaxis?'

I wonder if Ford/GM will panic before then and try and tie up a licensing deal to announce?

LOL. At this rate, by 8/8 everyone will say, "this is pretty cool tech demo that gets 1000 miles / critical disengagement, which is neat and all, but looks like years before it will get to 100,000 miles per critical disengagement. So won't buy the stock on some soon to happen robotaxi hype"

"But I guess as an L2 system I'd probably pay $50 / month for it, as that's all I can afford given all the inflation that's sucked out my excess cash."

The new Model 3 is included in the v12.3.4 FSD rollout.

2M Tesla owners about to see the release notes... "Bug Fixes"The new Model 3 is included in the v12.3.4 FSD rollout.

Musskiah

DisGruntled

This is going to get worse before it gets better. After the chip bottleneck we are currently experiencing, the next bottleneck is transformers, and finally electricity.One main reason demand (price adjusted) for EVs is down across the board in the U.S.

View attachment 1037448

The problem is that the current rapid inflation in electricity prices isn't going to correct itself anytime soon. At best, the inflation will slow to zero, and allow wages to catch up but that would take a decade.

While there is some arbitrage opportunity for solar + cheap batteries, the majority of potential EV buyers won't be considering this and so demand is now somewhat chronically impaired relative to a few years ago.

I imagine the main possible event that could rapidly change this phenomena is spiking oil prices.

However, that being said, your thesis that demand for EVs is down because of high electricity costs is pretty weak. Most states are under 0.20 cents per KWh. In Ohio, where my cost is just under 0.16 cents per KWh, it costs me less than $10 to fill up my MYP (300 miles) and less than $12 to fill up my MXLR (340 miles). Between the two cars I drive 30k miles per annum, and save over $3000. So wha'chew talkin' 'bout Willis?

Last edited:

Musskiah

DisGruntled

Who is in your back pocket? WSJ? BI? CNBS?LOL. At this rate, by 8/8 everyone will say, "this is pretty cool tech demo that gets 1000 miles / critical disengagement, which is neat and all, but looks like years before it will get to 100,000 miles per critical disengagement. So won't buy the stock on some soon to happen robotaxi hype"

"But I guess as an L2 system I'd probably pay $50 / month for it, as that's all I can afford given all the inflation that's sucked out my excess cash."

dhrivnak

Active Member

My Erie insurance went up $20/year or 3%. So I am not stressing.As a counter point, after State Farm raised my rate 40% over a period of under 2 years (with clear claims history), I found Progressive would provide equal coverage for nearly half the cost of the most recent State Farm renewal bill. Comparison based on total annual cost. State Farm max period offered was six month coverage, Progressive offered annual coverage and payment.

Any competitive business will eventually be forced to bring their prices down to meet the other player's rates. This seems to be happening. I'm not sure what their actuaries were basing the rate increases on, but it seems there may be lower rates looming on the horizon if my recent experience represents any sort of trend.

cusetownusa

2022 LR5 MSM/Bl | 19"

This is going to get worse before it gets better. After the chip bottleneck we are currently experiencing, the next bottleneck is transformers, and finally electricity.

However, that being said, your thesis that demand for EVs is down because of high electricity costs is pretty weak. Most states are under 0.20 cents per KWh. In Ohio, where my cost is just under 0.16 cents per KWh, it costs me less than $10 to fill up my MYP (300 miles) and less than $12 to fill up my MX (340 miles). Between the two cars I drive 30k miles per annum, and save over $3000. So wha'chew talkin' 'bout Willis?

Just one data point, but my current electricity cost is less than 0.06 cents per kWh when charging off peak. Most of my electricity comes from NG and some hydro. I think people around here are bad at math or simply don’t understand how to even compare TCO between an ev and ice vehicle.

dhrivnak

Active Member

Fortunately thanks to solar my electricity prices were locked in 10 years ago and should remain locked in 20 years from now. A very reasonable $.06/kWhOne main reason demand (price adjusted) for EVs is down across the board in the U.S.

View attachment 1037448

The problem is that the current rapid inflation in electricity prices isn't going to correct itself anytime soon. At best, the inflation will slow to zero, and allow wages to catch up but that would take a decade.

While there is some arbitrage opportunity for solar + cheap batteries, the majority of potential EV buyers won't be considering this and so demand is now somewhat chronically impaired relative to a few years ago.

I imagine the main possible event that could rapidly change this phenomena is spiking oil prices.

Musskiah

DisGruntled

Just one data point, but my current electricity cost is less than 0.06 cents per kWh when charging off peak. Most of my electricity comes from NG and some hydro. I think people around here are bad at math or simply don’t understand how to even compare TCO between an ev and ice vehicle.

That's like practically free! I have driven over 200k miles on Teslas since 2015. I have easily paid for one of them (or more) is gas and maintenance savings, not to mention all the tax credits. Anyone who chooses not to buy a Tesla M3 or MY at this point is just being financially irresponsible.Fortunately thanks to solar my electricity prices were locked in 10 years ago and should remain locked in 20 years from now. A very reasonable $.06/kWh

Skryll

Active Member

The bizarre thing is that renewable energy can fix this to the point of there being negative prices for electricity at times in europe. So what are we in the US doing wrong ? By the way California PUC and PG&E keep raising prices and removing incentives for solar adoption at the same time, it sure looks like political will preventing rapid decarbonication effectively propping up legacy auto and fossil fuel profits.One main reason demand (price adjusted) for EVs is down across the board in the U.S.

View attachment 1037448

The problem is that the current rapid inflation in electricity prices isn't going to correct itself anytime soon. At best, the infys iforplation will slow to zero, and allow wages to catch up but that would take a decade. He

Would be amazing to get some investigative journalism to look at why and who profits and what they do for it.

For context: PG&E raised off peak (!) EV2-A price from $0.17 to $0.36 over maybe 5 years and have already declared they are not done raising yet.

Also net metering where what you feed into the grid over the year offsetting what you consume over the year has been crippled recently for new customers

Last edited:

MC3OZ

Active Member

Numbers from the EIA.The bizarre thing is that there are negative prices for electricity at times in europe. So what are we in the US doing wrong ? By the way California PUC and PG&E keep raising prices and removing incentives for solar adoption at the same time, it sure looks like political will preventing rapid decarbonication effectively propping up legacy auto and fossil fuel profits.

Would be amazing to get some investigative journalism to look at why and who profits and what they do for it.

U.S. utility-scale electricity generation by source, amount, and share of total in 2023

Energy source Billion kWh Share of total Total - all sources 4,178 Fossil fuels (total) 2,505 60.0% Natural gas 1,802 43.1% Coal 675 16.2%

Solar panels cost more in the US than they do in Australia, utility solar in the US grid is a low number.

Renewables (total) 894 21.4% Wind 425 10.2% Hydropower 240 5.7% Solar (total) 165 3.9% Photovoltaic 162 3.9%

What has probably happened is that the cost of gas has increased,,,,

The ideal way to fix the problem is, replace gas with solar and batteries.

Network costs can be a surprisingly high portion of bills, My impression is US utilities can recover network costs via "regulated rate of return". Any time that system exists there are problems with oversight. What investments are approved? And what is billable?

Last edited:

Just one data point, but my current electricity cost is less than 0.06 cents per kWh when charging off peak. Most of my electricity comes from NG and some hydro. I think people around here are bad at math or simply don’t understand how to even compare TCO between an ev and ice vehicle.

Mine too, my electricity costs have been going down over the past year here in PA. Currently locked at $0.058/kWh for the next half year or so. Makes driving the Model Y super affordable!

So long as their antiquated equipment continues causing epic and fatal fire storms I think our rates will continue in the same direction.The bizarre thing is that renewable energy can fix this to the point of there being negative prices for electricity at times in europe. So what are we in the US doing wrong ? By the way California PUC and PG&E keep raising prices and removing incentives for solar adoption at the same time, it sure looks like political will preventing rapid decarbonication effectively propping up legacy auto and fossil fuel profits.

Would be amazing to get some investigative journalism to look at why and who profits and what they do for it.

For context: PG&E raised off peak (!) EV2-A price from $0.17 to $0.36 over maybe 5 years and have already declared they are not done raising yet.

Also net metering where what you feed into the grid over the year offsetting what you consume over the year has been crippled recently for new customers

Sadly it’s the rate payers who are on the hook now for increased rates not the PGE shareholders as they’ve been paying dividends instead of upgrading their infrastructure.

CPUC imposes largest ever penalty of $1.9B on PG&E for Northern California wildfires

However, the agency permanently suspended PG&E's obligation to pay an additional $200 million fine that the utility said could derail its bankruptcy exit.

FWIW, the India giga announcement is the largest SP catalyst I can see other than a large interest rate cut.

I'm hoping this happen prior to earnings or at earnings and I'm watching this closely as it will signal a massive shift for Tesla to autonomy

I'm hoping this happen prior to earnings or at earnings and I'm watching this closely as it will signal a massive shift for Tesla to autonomy

Southpasfan

Member

The somewhat short answer is that the actual "grid" defined as lines that have to reach everywhere, the people to fix them, the need to repair them, and the cost of fires caused by them, is higher in California due to large distances and coverage needs.The bizarre thing is that renewable energy can fix this to the point of there being negative prices for electricity at times in europe. So what are we in the US doing wrong ? By the way California PUC and PG&E keep raising prices and removing incentives for solar adoption at the same time, it sure looks like political will preventing rapid decarbonication effectively propping up legacy auto and fossil fuel profits.

Would be amazing to get some investigative journalism to look at why and who profits and what they do for it.

For context: PG&E raised off peak (!) EV2-A price from $0.17 to $0.36 over maybe 5 years and have already declared they are not done raising yet.

Also net metering where what you feed into the grid over the year offsetting what you consume over the year has been crippled recently for new customers

Its also a situation where one might think that non profit government utilities might do better, but as to the main point note Los Angeles Dept of Water and Power and, I believe its counter part in San Francisco, and compare to PG&E and San Diego Gas & Electric.

The reason the PUC is disincentivizing rooftop solar is that rooftop solar is a form of extreme conservations of energy. All of "the grid" noted above is paid for by users using Kwh. Rooftop solar (and everything else, like better light bulbs) results in fewer kwh sold by utilities.

That's great if you are an environmentalist, a disaster if you are a utility. As the proliferation of rooftop solar does nothing to lower the cost of the grid.

Skryll

Active Member

Interesting.Numbers from the EIA.

For comparison look at real time data and graphs for California at California ISO - Supply, Today's Outlook

5:30pm PST renewable at 67 %? Gas at 17%.

Renewables

67.8% (16,140 MW)

Natural Gas

17.6% (4,188 MW)

Large Hydro

9.8% (2,328 MW)

Imports

0.0% (-1,240 MW)

Batteries (charging)

0.0% (-467 MW)

Solar panels cost more in the US than they do in Australia, utility solar in the US grid is a low number.

What has probably happened is that the cost of gas has increased,,,,

The ideal way to fix the problem is, replace gas with solar and batteries.

Network costs can be a surprisingly high portion of bills, My impression is US utilities can recover network costs via "regulated rate of return". Any time that system exists there are problems with oversight. What investments are approved? And what is billable?

Musskiah

DisGruntled

@Discoduck Can you explain why India giga announcement signals a massive shift to autonomy?FWIW, the India giga announcement is the largest SP catalyst I can see other than a large interest rate cut.

I'm hoping this happen prior to earnings or at earnings and I'm watching this closely as it will signal a massive shift for Tesla to autonomy

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K