Did you even read the post you quoted? Cutting the price down while scaling up which reduces costs so margins can remain higher long term is the plan. Once economics improve, interest rates fall then prices will go back up and new record profits will follow.So, does he have a solution to the demand problem? Can he illustrate that to the investors?

Or before the ER call tomorrow, anyone here can guess or provide some solutions?

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

EDIT: BTW, will you tell us which other user names you have used here, or, do we have to figure this out on our own?

Check out my username on reddit. Go back 2019-2020. You'll see me fighting the RealTesla crowd. But the expectations on a company worth 50B are totally different to a company worth 450B, highest in its industry by a long margin. Look, I get it. Investments are emotional and tbf, I really like Tesla, the company. I don't mind Elon either, I think he's an interesting character and what he has achieved leading companies at the forefront of so many fields is nothing short of extraordinary. But investing is not Patreon, you're not paying money to support someone's efforts. I don't mind the 'ad hominem' attacks, as long as the messages have some strong and realistic arguments attached to them about how Tesla is going to increase their revenue and profits in the next 5-10 years.

My mother just asked if she should sell half her Tesla shares (intention being to buy them back at a lower price).

The bottom is in - confirmed.

I wonder how many people will sell pre earnings and try to buy back in expecting bad numbers. I tried this years ago with Covid and missed out on the big move after. I would never try and predict where SP is going short term now I just buy and hold.

In which case you are not vaguely paying attention.

This is not just another EV company. Do you have any idea what a unique selling point true FSD is? Do you realize that they own the fueling network as well as the car? That they are the only western EV company selling ANY real volume in China? That they are regualrly the #1 desired employer for top engineering graduates all over the world?

If you want to value them like you would value volvo, feel free. Don't be surprised that we don't agree though. Meanwhile GM stock is cheap. Sell your TSLA (its not the right stock for you), and go give mary a pat on the back. She led. And it matters.

No offense, but I know what's being said. Not just a car company etc etc. I was an investor back in 2019-2021, now I'm shorting the stock. I'm looking at actions, not words.

Cars - no serious volume increase in sight due to no new models being launched. Competition (especially in China) seriously ramping up. But without a serious software component, there's no 450B business in 2024.

Charging network - valuable, but a commodity. Slowing EV adoption slows down revenue growth from supercharging, even without any competition. Essentially you can model their supercharging revenue growth rate by taking new EV sales and applying a correction factor. Someone can probably work it out quite reliably, but it's very low margins since the barier of entry is so low.

Western EV company selling in China - how is that not factored into the price through their sales? Arguably the biggest benefit Tesla is getting out of China is the ability to compete on manufacturing costs with the local manufacturers.

But yes, agree to disagree!

Thekiwi

Active Member

The S&P500 inclusion is working its reverse magic on TSLA right now. As the market cap has plummeted through the floor, funds will likely be front running the inevitable large re-weighting smaller of TSLA, which lends even more fuel to the sell off.

Wild that we are down $30 since Elon announced the 8/8 Robotaxi unveil, and the reports about the $25k car being deprioritized. He has lost all credibility with so many investors it seems.

Wild that we are down $30 since Elon announced the 8/8 Robotaxi unveil, and the reports about the $25k car being deprioritized. He has lost all credibility with so many investors it seems.

No offense, but I know what's being said. Not just a car company etc etc. I was an investor back in 2019-2021, now I'm shorting the stock. I'm looking at actions, not words.

Cars - no serious volume increase in sight due to no new models being launched. Competition (especially in China) seriously ramping up. But without a serious software component, there's no 450B business in 2024.

Charging network - valuable, but a commodity. Slowing EV adoption slows down revenue growth from supercharging, even without any competition. Essentially you can model their supercharging revenue growth rate by taking new EV sales and applying a correction factor. Someone can probably work it out quite reliably, but it's very low margins since the barier of entry is so low.

Western EV company selling in China - how is that not factored into the price through their sales? Arguably the biggest benefit Tesla is getting out of China is the ability to compete on manufacturing costs with the local manufacturers.

But yes, agree to disagree!

There we go, at least this one is honest to some extent

Started at 240$ actually. You do know what type of people are so sure of themselves before gathering all the info, right?There we go, at least this one is honest to some extentNo doubt saw the SP falling and read some FUD then "Duh...Im gunna short now ".

I agree with you that this is a meaningless report blamed on CR's part then. EVs simply have lower maintenance. It's a well known fact and a given. I don't find it (the chart posted) of much value for any EV shopper personally as every EV has nearly no maintenance.

I think the source of the misunderstanding is that you overestimate what the average car buyer knows about EVs. What seems obvious for us here on TMC is news for many others that will buy EVs sooner or later.

Started at 240$ actually. You do know what type of people are so sure of themselves before gathering all the info, right?

Why are you posting in a Tesla investors thread if you are short the stock? Sounds like you have doubts and are trying to convince yourself/others that your short is the right thing to do. Shorting a stock like Tesla has historically never worked out, ask Jim Chanos, he would be tweeting like he was the victor whenever the share price dropped, but it wiped out his fund in the end, and he never mentioned it

Why are you posting in a Tesla investors thread if you are short the stock? Sounds like you have doubts and are trying to convince yourself/others that your short is the right thing to do. Shorting a stock like Tesla has historically never worked out, ask Jim Chanos, he would be tweeting like he was the victor whenever the share price dropped, but it wiped out his fund in the end, and he never mentioned itbut you never know maybe you are right this time.

That's what people were saying when I was long, there were just different people. I have good investing results in a variety of companies and environments, I don't guide my investing actions on what others say or think about said actions. Which ties into why I'm here. Because, for the same reason I was reading RealTesla in 2019-2020, I want to get the counter-arguments to my thesis. It would be foolish to lock myself in an echo-chamber where everyone is patting themselves on the back. No matter which side of the discussion that chamber sits on.

CitizenKane

Member

Thank you, this is the right attitude and one that I believe is shared by any serious investor. If anyone should leave the forum, it's the ones that harass people just for having different views on the company and the stock.That's what people were saying when I was long, there were just different people. I have good investing results in a variety of companies and environments, I don't guide my investing actions on what others say or think about said actions. Which ties into why I'm here. Because, for the same reason I was reading RealTesla in 2019-2020, I want to get the counter-arguments to my thesis. It would be foolish to lock myself in an echo-chamber where everyone is patting themselves on the back. No matter which side of the discussion that chamber sits on.

Artful Dodger

"Neko no me"

Lol, let's get this straight? You're predicting the share price could go below $63 per share? I've got a couple of hundred G's sitting on the sidelines. If that happened I'd move some in, that's a hell of a buying opportunity. Still, with my dollar cost average being $18, I wouldn't move it all in. Happy just to HODL for the long term.I’m now thinking TSLA could drop to -75% YTD. I sure hope I’m wrong. I’m tired of these “buying opportunities”.b

Opinions vary. Larry Goldberg is estimating $0.48 non-GAAP EPS for Q1:YouTube video - James Stevenson

Here are my estimates for Q1 2024 Earnings. Later than my usual late as I am operating on a tiny laptop in my erie overlooking the Luberon in Provence, France, far from my cozy and well equipped office. Ideal for the spirit, but not so much for detailed analysis.

In any event my analysis is never done bottom up - like a good, professional analyst - but top down like an out-of-touch manager! (@alojoh is gonna roast me!)

Take it for what it is! I am at $0.48c non-Gaap. I did say earlier in the Q that $0.50 was unlikely, and here we are, sadly.

BTW, I am feeling a little queasy about Auto margins, but this is what my calculations yield, so I am going with it. I do feel that Energy margins may be, if anything, a little conservative. Of course they are far smaller than Auto, so not likely to compensate a miss on Auto. We shall see.

That's what people were saying when I was long, there were just different people. I have good investing results in a variety of companies and environments, I don't guide my investing actions on what others say or think about said actions. Which ties into why I'm here. Because, for the same reason I was reading RealTesla in 2019-2020, I want to get the counter-arguments to my thesis. It would be foolish to lock myself in an echo-chamber where everyone is patting themselves on the back. No matter which side of the discussion that chamber sits on.

Fair enough, but I find every few people (including myself at times) who have money table for short term results are able to separate themselves from their positions and be totaly objective, if you can do that then hats off.

Lol, let's get this straight? You're predicting the share price could go below $63 per share? I've got a couple of hundred G's sitting on the sidelines. If that happened I'd move some in, that's a hell of a buying opportunity. Still, with my dollar cost average being $18, I wouldn't move it all in. Happy just to HODL for the long term.

Opinions vary. Larry Goldberg is estimating $0.48 non-GAAP EPS for Q1:

The bad quarter seems to be priced in now (probably over sold imo), so unless the results are worst than expectations (which they could be) it will be sell the rumour buy the news scenario. All will be revealed soon!

I welcome valid criticism, but if someone is short the stock for shorter term gains they will tend to have a bias, also some are obvious trolls and FUDsters.Thank you, this is the right attitude and one that I believe is shared by any serious investor. If anyone should leave the forum, it's the ones that harass people just for having different views on the company and the stock.

S&P 500 weighting is float adjusted market cap. Tesla SP going down does most of the work of reballancing. S&P 500 reballancing occurred in March, next event is June. Straight 1:1 tracking funds also can't front run (see also closing cross).The S&P500 inclusion is working its reverse magic on TSLA right now. As the market cap has plummeted through the floor, funds will likely be front running the inevitable large re-weighting smaller of TSLA, which lends even more fuel to the sell off.

Wild that we are down $30 since Elon announced the 8/8 Robotaxi unveil, and the reports about the $25k car being deprioritized. He has lost all credibility with so many investors it seems.

Independent or other-weighted funds can, of course, do whatever their rules say.

Fair enough, but I find every few people (including myself at times) who have money table for short term results are able to separate themselves from their positions and be totaly objective, if you can do that then hats off.

Yes, I have some bias internally, but I like to think that I am able to offer decent arguments for my position, not just the conventional "Tesla shorts" ones like "Elon is a junkie, Tesla has quality issues, there's accounting fraud etc" and stupid stuff like that.

jschwefel

Tesla fan/TSLA, Model Y and Cybertruck owner.

Wow…tensions are high. The reality is times are tough here, and human nature is to blame something or someone. The reality is no ONE thing or ONE person is to blame, and nobody here or elsewhere knows where the stock is headed. Focus on what Tesla is doing and the markets they’re serving. Then decide whether or not you want to own the stock.

For those wanting to blame Elon and now vote against his compensation package, I’d ask you to reconsider. Elon is not perfect, his aim is to be less wrong, but what Tesla has accomplished under his leadership is nothing short of amazing. They are an established, profitable EV automaker with a worldwide charging network, and incredible UI and autonomy software that can scale to nearly its entire fleet. No other company is even close to matching this. Tesla would not be here if it weren’t for Elon and it’s only right to follow through and award him the compensation package shareholders approved.

For those wanting to blame Elon and now vote against his compensation package, I’d ask you to reconsider. Elon is not perfect, his aim is to be less wrong, but what Tesla has accomplished under his leadership is nothing short of amazing. They are an established, profitable EV automaker with a worldwide charging network, and incredible UI and autonomy software that can scale to nearly its entire fleet. No other company is even close to matching this. Tesla would not be here if it weren’t for Elon and it’s only right to follow through and award him the compensation package shareholders approved.

Dikkie Dik

If gets hard, use hammer

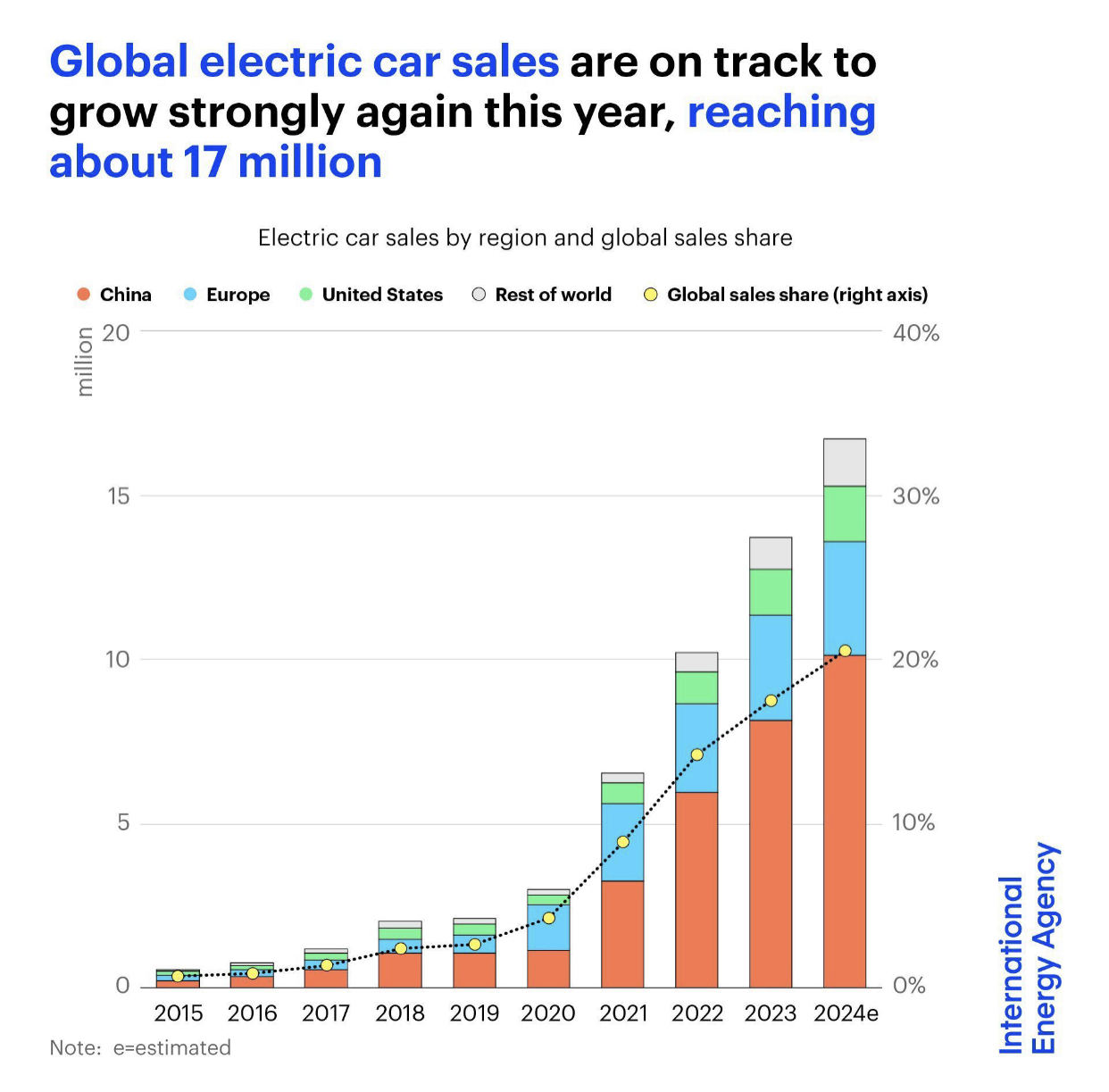

IEA has a positive outlook on EV demand and reiterates that prices must come down further.

Long thread:

Long thread:

yes, some of them, but I don‘t know either how to voteAnyone here having TSLA with Swissquote?

I want to vote with my shares!

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Replies

- 6

- Views

- 5K

- Replies

- 6

- Views

- 11K

- Locked

- Replies

- 27K

- Views

- 3M