Alright guys, help me out with my thinking here.

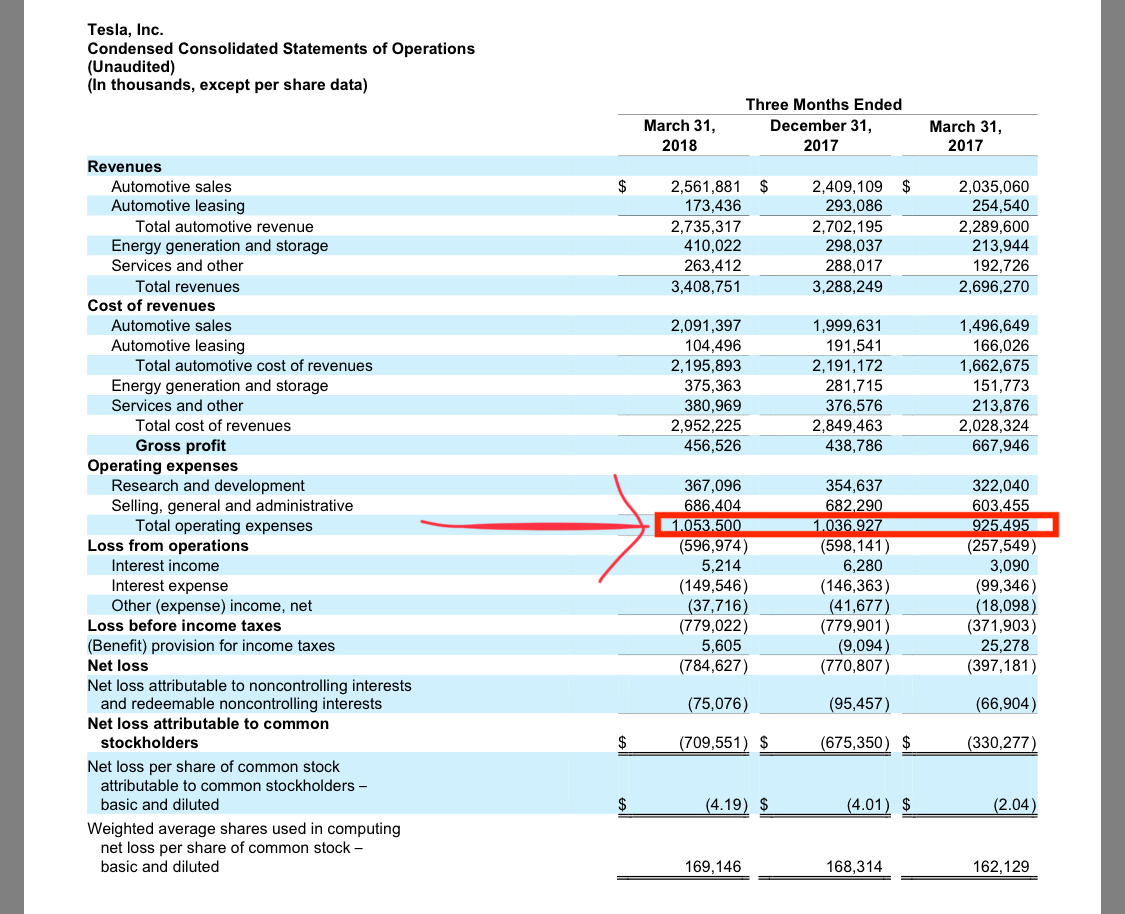

The key figure in Q1 earnings that was overlooked is how operating expenses are barely increasing.

Q1 2018 operating expenses = $1.05B

Compared to a year ago Q1 2017 = $925M

So in the course of a year, Tesla’s quarterly operating expenses grew just $125M. And this is while going from zero model 3s per week last year to 2000 model 3s per week at end of Q1.

So it looks like scaling Model 3 production ramp has little do to with operating expenses. The ramp consists of capital expenditures, which affects cash flow and affects cost of revenue as depreciation over x years. The ramp also costs of hiring labor to assemble/oversee production. However, this cost is also included in the cost of revenue and not operating expenses.

So, to make this simple we can divide Tesla into two parts… but this is just for a thought exercise. Tesla CORE is the part of Tesla that goes into the operating expenses, namely R&D and SG&A. According to Tesla, this is as follows:

Research and development (“R&D”) expenses consist primarily of personnel costs for our teams in engineering and research, manufacturing engineering and manufacturing test organizations, prototyping expense, contract and professional services and amortized equipment expense.

Selling, general and administrative (“SG&A”) expenses consist primarily of personnel and facilities costs related to our stores, marketing, sales, executive, finance, human resources, information technology and legal organizations, as well as fees for professional and contract services and litigation settlements.

Ok, so let’s call this Tesla CORE and this makes up 100% of operating expenses.

Let’s call the second part of Tesla, Tesla MANUFACTURING. Now Tesla manufacturing consists of all the folks working at the factory assembling cars and overseeing the production.

(Note: there are other parts of Tesla like Tesla SERVICE and Tesla ENERGY) which would include service center folks, but we won’t talk about that at the moment.)

So, here’s what’s going on. Model 3 ramps from zero/week to 2000/week in the course of a year (Q1 2017 to Q1 2018), and operating expenses stay relatively flat (increase just 13.5%). What this shows is that in order to ramp Model 3 production, Tesla CORE doesn’t need to increase in size (or just a tiny bit). All the people Tesla is hiring to ramp production of the Model 3 go into Tesla MANUFACTURING and their associated costs are factored in to cost of revenue for auto sales.

So why is this important?

As Model 3 revenue scales and gross margins incase, the gross profit will soon offset operating costs. Once that happens, it’s difficult for me to see how Tesla CANNOT become increasingly profitable in quarters to come because gross profit will grow substantially as revenue grows, but operating expenses will increase only a little.

Even with Model Y ramp in 2010, most all the spending will go into capital expenditures and not operating expenses. The capex gets depreciated over x years under cost of revenue. So, Tesla will remain very profitability even during Model Y ramp.

The key to Tesla is basically this…

Tesla has got to reach a point where their gross profit (margin from revenue) can cover their Tesla CORE expenses (which are operating expenses). Currently they are about $1.05B per quarter. In addition to this Tesla needs about $75M per quarter (Tesla has about $150M in interest expense, but about $75M in net loss attributable to non-controlling interests that are added to their profit).

So Tesla needs about $1.125B per quarter to cover their costs. If they can get there, then they can eek out a profit. But once they get there, as Model 3 revenue and gross profit ramps, the profit will only grow.

So how and when does Tesla get to a point where they can cover the $1.125B in Tesla CORE expenses (plus interest expense)?

If Tesla can sell ~25,000 Model S/X cars for roughly $2.5B and with a gross margin of 27%, they can have $625M gross profit.

And if Tesla can sell 65,000 Model 3 (13 weeks of 5,000 cars production, average selling price of $50k), that would be $3.25B and with a gross margin of 18%, that would be $585M is gross profit.

So $625M + $585M = $1.21B in gross profit, which will cover the $1.125B in operating expenses and interest expense. Net profit of $85M.

Now this is just the beginning.

As production ramps from 5000 to 10000 Model 3s/week, the numbers only get better… and this is all because operating expenses aren’t increasing much while gross profit is rapidly increasing due to rapidly increasing revenue.

At an average of 7000 Model 3/week (for 13 weeks, average selling price of $47k), here’s what it looks like:

Revenue = $4.78B

If gross margin increases to 22%, then gross profit would be $941M.

Add on the $625M in gross profit from Model S/X.

That equals $1.566B in gross profit.

Let’s say operating expenses have increased $100M from Q1 2018 (assuming this quarter is Q1 2019), then operating expenses and interest expense would be $1.225M.

Net profit is 341M.

So let’s say Q3 2018 squeeks out a profit, and Q4 2018 Tesla reaching $85M in profit, and Q1 2019 Tesla reaching 341M in profit.

Now it really gets better.

Let’s say Tesla reaching 10,000 Model 3s/week by end of 2019 (average selling price $45k, over 12 weeks).

Revenue would be $5.4B

If gross margin reaches 25%, then gross profit about be $1.35B.

Add on the $625M in gross profit from Model S/X.

That equals $1.975B in gross profit.

Let’s say operating expenses have increased $100M from Q1 2019, then operating expenses and interest expense would be $1.325M.

Net profit is 650M.

650M profit in Q4 2019. That’s not for the year, that’s just for a quarter. So, annual profit run rate would be $2.6B a year.

Can you imagine if Tesla reported Q4 2018 with $650M profit, and then guided for over $3B in profit in 2020?

Anyway, case in point.

We are at a historic turning point in Tesla’s history.

Most everyone is missing what’s going on.

Once Tesla is able to cover their operating expenses, it’s welcome to Tesla the cash cow.

And this turning point is going to happen in Q3 of this year, according to Elon.

Thus the reason for Elon’s tweet this morning, “short burn of the century coming soon”. Now, I don’t think we can predict exactly when and how the stock will react to things. All I know is that if Tesla continues to execute as they have been doing, Tesla become increasingly profitable every quarter… until they’re making billions of dollars in profit in 2020.

It’s going to be fun ride.

The key figure in Q1 earnings that was overlooked is how operating expenses are barely increasing.

Q1 2018 operating expenses = $1.05B

Compared to a year ago Q1 2017 = $925M

So in the course of a year, Tesla’s quarterly operating expenses grew just $125M. And this is while going from zero model 3s per week last year to 2000 model 3s per week at end of Q1.

So it looks like scaling Model 3 production ramp has little do to with operating expenses. The ramp consists of capital expenditures, which affects cash flow and affects cost of revenue as depreciation over x years. The ramp also costs of hiring labor to assemble/oversee production. However, this cost is also included in the cost of revenue and not operating expenses.

So, to make this simple we can divide Tesla into two parts… but this is just for a thought exercise. Tesla CORE is the part of Tesla that goes into the operating expenses, namely R&D and SG&A. According to Tesla, this is as follows:

Research and development (“R&D”) expenses consist primarily of personnel costs for our teams in engineering and research, manufacturing engineering and manufacturing test organizations, prototyping expense, contract and professional services and amortized equipment expense.

Selling, general and administrative (“SG&A”) expenses consist primarily of personnel and facilities costs related to our stores, marketing, sales, executive, finance, human resources, information technology and legal organizations, as well as fees for professional and contract services and litigation settlements.

Ok, so let’s call this Tesla CORE and this makes up 100% of operating expenses.

Let’s call the second part of Tesla, Tesla MANUFACTURING. Now Tesla manufacturing consists of all the folks working at the factory assembling cars and overseeing the production.

(Note: there are other parts of Tesla like Tesla SERVICE and Tesla ENERGY) which would include service center folks, but we won’t talk about that at the moment.)

So, here’s what’s going on. Model 3 ramps from zero/week to 2000/week in the course of a year (Q1 2017 to Q1 2018), and operating expenses stay relatively flat (increase just 13.5%). What this shows is that in order to ramp Model 3 production, Tesla CORE doesn’t need to increase in size (or just a tiny bit). All the people Tesla is hiring to ramp production of the Model 3 go into Tesla MANUFACTURING and their associated costs are factored in to cost of revenue for auto sales.

So why is this important?

As Model 3 revenue scales and gross margins incase, the gross profit will soon offset operating costs. Once that happens, it’s difficult for me to see how Tesla CANNOT become increasingly profitable in quarters to come because gross profit will grow substantially as revenue grows, but operating expenses will increase only a little.

Even with Model Y ramp in 2010, most all the spending will go into capital expenditures and not operating expenses. The capex gets depreciated over x years under cost of revenue. So, Tesla will remain very profitability even during Model Y ramp.

The key to Tesla is basically this…

Tesla has got to reach a point where their gross profit (margin from revenue) can cover their Tesla CORE expenses (which are operating expenses). Currently they are about $1.05B per quarter. In addition to this Tesla needs about $75M per quarter (Tesla has about $150M in interest expense, but about $75M in net loss attributable to non-controlling interests that are added to their profit).

So Tesla needs about $1.125B per quarter to cover their costs. If they can get there, then they can eek out a profit. But once they get there, as Model 3 revenue and gross profit ramps, the profit will only grow.

So how and when does Tesla get to a point where they can cover the $1.125B in Tesla CORE expenses (plus interest expense)?

If Tesla can sell ~25,000 Model S/X cars for roughly $2.5B and with a gross margin of 27%, they can have $625M gross profit.

And if Tesla can sell 65,000 Model 3 (13 weeks of 5,000 cars production, average selling price of $50k), that would be $3.25B and with a gross margin of 18%, that would be $585M is gross profit.

So $625M + $585M = $1.21B in gross profit, which will cover the $1.125B in operating expenses and interest expense. Net profit of $85M.

Now this is just the beginning.

As production ramps from 5000 to 10000 Model 3s/week, the numbers only get better… and this is all because operating expenses aren’t increasing much while gross profit is rapidly increasing due to rapidly increasing revenue.

At an average of 7000 Model 3/week (for 13 weeks, average selling price of $47k), here’s what it looks like:

Revenue = $4.78B

If gross margin increases to 22%, then gross profit would be $941M.

Add on the $625M in gross profit from Model S/X.

That equals $1.566B in gross profit.

Let’s say operating expenses have increased $100M from Q1 2018 (assuming this quarter is Q1 2019), then operating expenses and interest expense would be $1.225M.

Net profit is 341M.

So let’s say Q3 2018 squeeks out a profit, and Q4 2018 Tesla reaching $85M in profit, and Q1 2019 Tesla reaching 341M in profit.

Now it really gets better.

Let’s say Tesla reaching 10,000 Model 3s/week by end of 2019 (average selling price $45k, over 12 weeks).

Revenue would be $5.4B

If gross margin reaches 25%, then gross profit about be $1.35B.

Add on the $625M in gross profit from Model S/X.

That equals $1.975B in gross profit.

Let’s say operating expenses have increased $100M from Q1 2019, then operating expenses and interest expense would be $1.325M.

Net profit is 650M.

650M profit in Q4 2019. That’s not for the year, that’s just for a quarter. So, annual profit run rate would be $2.6B a year.

Can you imagine if Tesla reported Q4 2018 with $650M profit, and then guided for over $3B in profit in 2020?

Anyway, case in point.

We are at a historic turning point in Tesla’s history.

Most everyone is missing what’s going on.

Once Tesla is able to cover their operating expenses, it’s welcome to Tesla the cash cow.

And this turning point is going to happen in Q3 of this year, according to Elon.

Thus the reason for Elon’s tweet this morning, “short burn of the century coming soon”. Now, I don’t think we can predict exactly when and how the stock will react to things. All I know is that if Tesla continues to execute as they have been doing, Tesla become increasingly profitable every quarter… until they’re making billions of dollars in profit in 2020.

It’s going to be fun ride.