Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

The demise of the OEMs

- Thread starter Buckminster

- Start date

cwerdna

Well-Known Member

Thanks! https://archive.is/ybm3q has a copy if you get hit by a paywall.

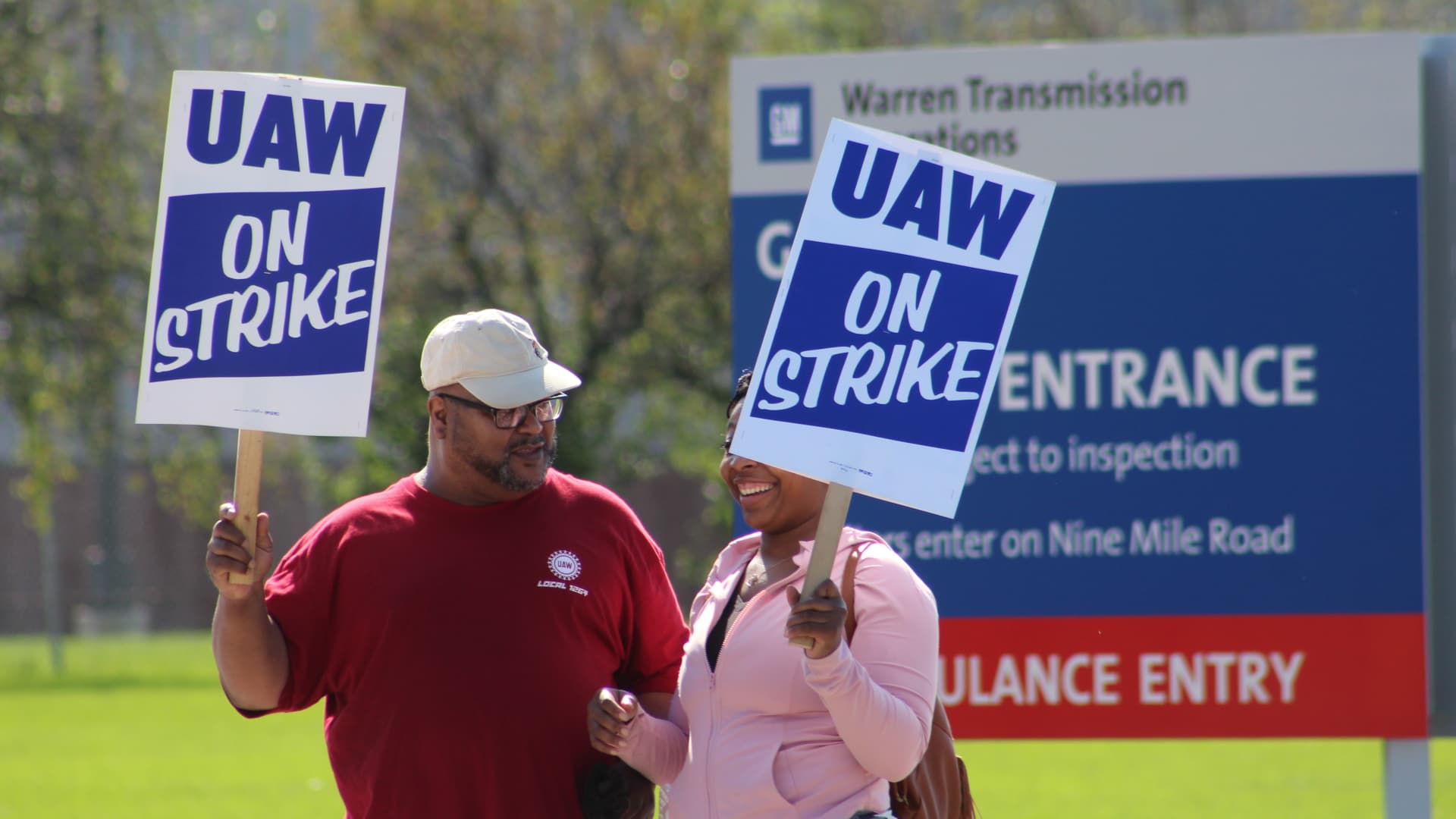

GM says union labor deals will increase costs by $9.3 billion

The UAW's targeted strikes, which ended in late October, cost GM $1.1 billion in adjusted earnings before interest and tax, or EBIT, in 2023.

Last edited:

cwerdna

Well-Known Member

GM initiates $10 billion buyback, boosts dividend and reinstates 2023 guidance after UAW strikes

GM pulled its guidance when it reported its third-quarter earnings on Oct. 24, citing volatility caused by the UAW negotiations and labor strikes.

adiggs

Well-Known Member

A couple of ways that I see this.

GM initiates $10 billion buyback, boosts dividend and reinstates 2023 guidance after UAW strikes

GM pulled its guidance when it reported its third-quarter earnings on Oct. 24, citing volatility caused by the UAW negotiations and labor strikes.www.cnbc.com

1) One of the findings from the Innovator's Dilemma is that near the end of an incumbent's dominant position in a market the company goes through a phase of record profit, though probably not record revenue. The dynamic identified has to do with the innovator taking the market from the bottom up, leaving the incumbent with less and less low revenue / low profit stuff being sold, increasing company profitability by having a higher proportion of higher margin sales.

The alternative I can think of that might be playing out here is that investment in the business starts dropping as the existing business has a pretty short shelf life remaining, so investing as heavily in the future of the ICE business as the historical investment level gets harder and harder to make the business / financial case for. I haven't looked to see whether this is true or not - just a hypothesis of mine.

2) The other way I have of thinking about this is that if you're GM share holder, then this sort of buyback and dividend is an effort by the company to get capital back to share holders. Events like this will stop when GM heads back to bankruptcy, effectively transferring wealth to shareholders that will otherwise be left holding the bag sooner than later.

And yes - fundamental to all of this is my assumption that GM is back in bankruptcy court, wiping out current shareholders, well before 2030. The buyback and dividend money they are spending now is a direct subtraction from investment the company needs to be making to make the transition to EVs.

But that is a long term view of the company surviving and thriving, and typically not consistent with the financial incentives of senior executives. Senior executives are more likely to have their personal financial incentives tied to much shorter term success metrics, and this distribution of capital to shareholders are more in alignment with those executives personal financial incentives.

This is a huge and not-talked-about headwind to success for Tesla's competition.

View attachment 998482

The competition has come and scaled back its 'ambitious production goals'. How long until the EV leader Mary Barra and her crew retract, oh wait....they are releasing 70 new models by 2025

It's funny because it is true

I'm hoping Tesla will retire the MY immediately. SP should rocket.