Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

- Status

- Not open for further replies.

Remus

Active Member

So the short answer is no, you don't have a rebuttal. OkFactChecker is on my ignore list, but I hit that "Show Ignored Content" button just for you.

For starters, I'm talking about cash metrics. Gross Margin is not a cash metric because it includes depreciation. Gross contribution is the cash metric, and it's generally much weaker when it comes to "economies of scale."

Stopped reading after that.

As a side note, I think FactChecker is just a ValueAnalyst clone account because he can't post original content under that pen name while charging for his SeekingAlpha pro subscription.

He's going to remain on my ignore list. His analyses are frequently grossly incompetent.

Yggdrasill

Active Member

No, it's 19% of all passenger cars (including light trucks) in September, and 5.7% of all passenger cars YTD.

Commercial vans however are separate, but they are only around 20% of light vehicles. (Buses, semis, motorcycles, etc are also separate.)

We all know how they got Al Capone, right? No relation to this his story, just sayin'...Beginning of the end?

Will be interesting to see if TSLA can decouple from macros during the rest of this week, should the market as a whole get dragged down. It's interesting that Q3 could turn out to be Tesla's show-me-the-money moment and that it could coincide with the beginning of the end for Trump and the whole Republican party. Interesting times we live in indeed.

I read most of the Times article. Great journalistic work, nothing that would surprise anyone who has watched the man over the last few years...

FirebirdAlpha

Member

So the short answer is no, you don't have a rebuttal. Ok

No, I just chose not to rebuff the worst / most stupid here. I respect posters like luvb2b and RobStark and others. I don't respect people masquerading as if they're an analyst.

Another example of errors: he double-dips on the additional S+X sales. These errors are why I don't entertain him anymore.

jhm

Well-Known Member

I like how you're thinking. For the purpose of ramping up, it could make sense to start with nearly a complete kit and start final assembly asap. Then progressively ramp up lines that produce all the components of the kit. I also suspect that finally assembly is the most labor intensive, so getting a good crew up and running in China could be a huge boost to what can be done with efficient automation in the US plants. Cutting the labor cost per vehicle should be in important advantage of manufacturing in China, and it is not necessary to have all components produced in Shanghai before that advantage is realized.If they are trying to accelerate the timing I don’t think they need to wait for the entire raw material to finished product capability to be ready.

Anyways from a transport standpoint it makes more sense to make both the 3 and the Y in both China and US

dqd88

Member

FactChecker is on my ignore list, but I hit that "Show Ignored Content" button just for you.

For starters, I'm talking about cash metrics. Gross Margin is not a cash metric because it includes depreciation. Gross contribution is the cash metric, and it's generally much weaker when it comes to "economies of scale."

Stopped reading after that.

As a side note, I think FactChecker is just a ValueAnalyst clone account because he can't post original content under that pen name while charging for his SeekingAlpha pro subscription.

He's going to remain on my ignore list. His analyses are frequently grossly incompetent.

hmm... expected response from a short troll. even based on your extremely fuzzy numbers, i see no chance of insolvency. you do realize that this BK trope makes you guys sound really dumb right? blantant fear mongering. why are you here?

Yggdrasill

Active Member

Capex hits cash flow, not profitability.I have a feeling the shorts believe the statement that the China GF is being push up is going to be Tesla’s excuse for not profiting this quarter....

For who? I think it's great and about fracking time!Big NYT articke on Trump, not good.

Ulmo

Active Member

Plenty of people can afford mid-level luxury cars. Your absurd extreme rewording of what I said carries zero logic.Ah, there we go. So apparently any car ever made that isn’t AWD is a death trap, and the car is worthless without a preorder for fully self driving, or without autonomy features not present on any other cars <$100k. On that note, I guess a Tesla is the only viable vehicle of any kind on the planet!

CuriousSunbird

Member

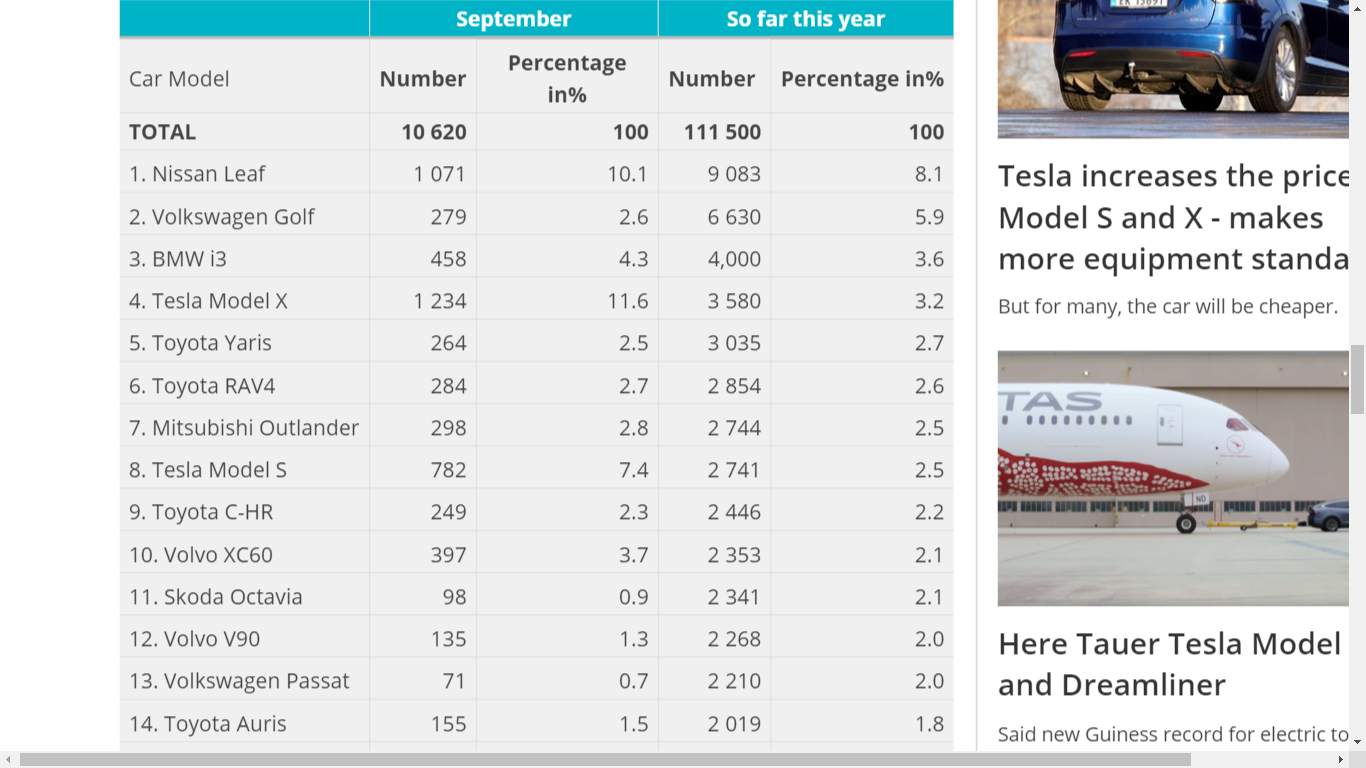

I think you need to take another look at the data, as it was all cars, not just EVs:

That is unless a lot of manufacturers suddenly started making EV versions of their cars specially for Norway.

You're right - my error. Apologies.

Remus

Active Member

Thanks for replying. What about according to luvb2b, one of the people you respect, that the end of quarter Cash increased to 3 billion.?No, I just chose not to rebuff the worst / most stupid here. I respect posters like luvb2b and RobStark and others. I don't respect people masquerading as if they're an analyst.

Another example of errors: he double-dips on the additional S+X sales. These errors are why I don't entertain him anymore.

And the -900m in customer deposit, a sizeable portion of that would disappear after they deliver 160k cars don't you think?

CuriousSunbird

Member

- 900M in restricted cash (deposits can't be used for bond payments)

.

I am not convinced that deposits can't be used for bond payments - where are you getting that from?

Ulmo

Active Member

What’s the market cap of two car companies plus two electric utilities plus one software company divided by about (170 million shares times three)? (I’m thinking roughly equivalent of in 3-4 years Tesla does a copy-paste-deselect-paste.)

luvb2b's estimates are assuming an absolute minimum contribution from ZEV credits ($100m), and include committed capex cash outflows as well, of course.

With all that included and today's Q3 delivery report plugged in, the results become:

[TD2] luv q4-18e [/TD2][TD2] luv q3-18e [/TD2][TD2] Jun-18 [/TD2][TD2] Mar-18 [/TD2] [TD2]15,000[/TD2][TD2]14,470[/TD2][TD2]10,939[/TD2][TD2]11,738[/TD2] [TD2]13,000[/TD2][TD2]13,190[/TD2][TD2]11,380[/TD2][TD2]10,077[/TD2] [TD2] 28,000 [/TD2][TD2] 27,660 [/TD2][TD2] 22,319 [/TD2][TD2] 21,815 [/TD2] [TD2] 62,000 [/TD2][TD2] 55,840 [/TD2][TD2] 18,449 [/TD2][TD2] 8,182 [/TD2] [TD2] 60,000 [/TD2][TD2] 53,239 [/TD2][TD2] 28,578 [/TD2][TD2] 9,766 [/TD2] [TD2]100,000[/TD2][TD2]100,000[/TD2][TD2]0[/TD2][TD2]50,314[/TD2] [TD2] 6,575,927 [/TD2][TD2] 6,271,233 [/TD2][TD2] 3,357,681 [/TD2][TD2] 2,735,317 [/TD2] [TD2]300,000[/TD2][TD2]300,000[/TD2][TD2]270,142[/TD2][TD2]263,412[/TD2] [TD2] 7,299,027 [/TD2][TD2] 6,942,683 [/TD2][TD2] 4,002,231 [/TD2][TD2] 3,408,751 [/TD2] [TD2] 1,653,981 [/TD2][TD2] 1,371,110 [/TD2][TD2] 618,930 [/TD2][TD2] 456,526 [/TD2] [TD2]-700,000[/TD2][TD2]-600,000[/TD2][TD2]-609,813[/TD2][TD2]-655,662[/TD2] [TD2] 573,978 [/TD2][TD2] 721,161 [/TD2][TD2] -436,470 [/TD2][TD2] -745,251 [/TD2] [TD2] 3,531,562 [/TD2][TD2] 2,957,585 [/TD2][TD2] 2,236,424 [/TD2][TD2] 2,665,673 [/TD2]

… s deliveries x deliveries s+x deliveries 3 deliveries 3 production revenue zev credits total auto services/other total revenue gross profit [capex outflow] net change in cash cash & eq end

See the massive improvement in cash equivalents in Q3, which continues in Q4 and onward? Tesla's free cash flow pays for the March 2019 convertibles and for much more. And ZEV is just a minuscule part of this estimate.

Also note that the Model 3 related capex outflows were massive in 2018: in Q3 committed capex outflow was around -$600m, which masks the true extent of the cash generation ability of Tesla, which is well over 1 billion dollars per quarter even at the current ~5k/week Model 3 production rate.

Tesla just had its 'Amazon moment' - and it was Q3 of 2018.

Does this take into account the 60 day (or was is 90, I don’t remeber?) payment period for suppliers, while custumers pay on delivery? Tesla may have received 40k (back of the envelope estimate of the last 60 days of deliveries) * 55K (M3 Asp) that wasn’t payed to the suppliers yet. I.e. 2 billion dollar extra on the ‘cash and equivalents’, with like 80% (average margin), or 1.6 billion extra on the ‘accounts payable‘ line. Actual amounts may be lower because I didn’t take the situation into account at the end of Q2, but given the fast ramp in Q3, these amounts must be significant.

Fact Checking

Well-Known Member

For starters, I'm talking about cash metrics. Gross Margin is not a cash metric because it includes depreciation. Gross contribution is the cash metric, and it's generally much weaker when it comes to "economies of scale."

What makes your non-rebuttal so hilarious is that you used the exact same calculation method, using gross margins to estimate Model 3 related cash flows, just two posts ago:

Selling an additional 35,000 Model 3s in Q3 at a 15% gross contribution and an ASP of 60k only gives 315M cash generated - not even half of the gap. (35k* 60k * 15% = 315 million)

See that 35k*60k*15% calculation? Yeah, that's unit count times ASP times Model 3 gross margin.

Now suddenly, the same basic estimation technique becomes incomprehensible and invalid to you, when the correct unit counts are applied!

(And yes, by the way, because opex is guided to be flat between Q2 and Q3, see the model run for the details, which makes contributory margins scale up similarly to gross margins, so they can be used to estimate cash flows and as well - but you probably don't even know what I'm talking about, I suspect you are just bullshitting about these numbers?)

Stopped reading after that.

Yeah, so you stopped reading after I applied a similar gross margin based calculation to cash flows as ... you did.

Right ...

CuriousSunbird

Member

Thanks for replying. What about according to luvb2b, one of the people you respect, that the end of quarter Cash increased to 3 billion.?

Based on luvb2b's numbers, cash increased by about $750 million and accounts payable increased by about $1.9 billion. So basically they've received payment for the cars but they haven't paid for the components yet.

I have to say I am a little surprised at the size of the AP increase - will take a closer look at that later.

Wait, so @Fact Checking reiterated @luvb2b 's numbers from their model in order to demonstrate where you are getting it wrong, and yet you dismiss them?No, I just chose not to rebuff the worst / most stupid here. I respect posters like luvb2b and RobStark and others. I don't respect people masquerading as if they're an analyst.

Another example of errors: he double-dips on the additional S+X sales. These errors are why I don't entertain him anymore.

Beginning of the end?

Will be interesting to see if TSLA can decouple from macros during the rest of this week, should the market as a whole get dragged down. It's interesting that Q3 could turn out to be Tesla's show-me-the-money moment and that it could coincide with the beginning of the end for Trump and the whole Republican party. Interesting times we live in indeed.

I read most of the Times article. Great journalistic work, nothing that would surprise anyone who has watched the man over the last few years...

Not surprising to anyone that’s lived in NY either. NY real estate is a Petri dish of the most corrupt people making deals with each other and paying off politicians. Almost everyone that’s made money in NY real estate is corrupt. As to Trump all of us that have lived in NY know he is corrupt.

Last edited:

What’s the market cap of two car companies plus two electric utilities plus one software company divided by about (170 million shares times three)? (I’m thinking roughly equivalent of in 3-4 years Tesla does a copy-paste-deselect-paste.)

- Status

- Not open for further replies.

Similar threads

- Replies

- 0

- Views

- 238

- Locked

- Replies

- 0

- Views

- 4K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Poll

- Replies

- 1

- Views

- 12K