Great data, thanks! Would add # cars produced for each quarter in there too thoughIf that is so, then it is even more compelling to give it a go :biggrin:Looking at google docs is quite informative. Although many pieces of the puzzle are missing, numbers that are there are telling. In this case, info is evaluated based on whether it is visible or not. If we see VINs in 118k that is telling.Tesla is getting orders that push into 118k for model S. I was curious where did VIN 100,000 end up, and google has the answer, as usual. Surprise surprise:View attachment 102332 Maybe VIN 100k is sitting in Fremont as a historic piece, never to be sold or someone at Tesla got a hold of that carHere is the spread of VINs in the past quarters, shown in the same table as actual past q cumulative delivery numbers:View attachment 102339q4 numbers are my reasonable guesstimates, based on visible VINs so far and based on past performanceSome observable patterns in the table (I see patterns everywhere so take it with a grain of salt):Actual cumulative delivery falls somewhere mid range point in the q VIN band range, it is not on the low side or high side of that range. Q1 in 2015 is an exception to such pattern, with actual cumulative delivery falling close to lower end of VIN range for that quarter, most likely due to starting the year with an empty pipeline.Feel free to see your own patterns.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Great data, thanks! Would add # cars produced for each quarter in there too though

Great idea, here it is

google doc does not have pre 2014 data, hence my table only shows 2 years as well.

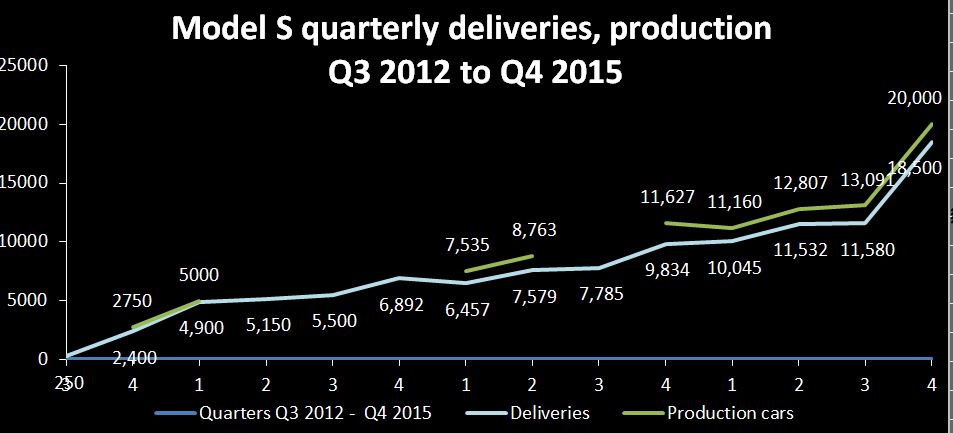

Graph of the production and delivery q data shows how nicely deliveries track production, suggesting production constraints - Tesla delivers most cars that they can make

Note: data from q reports, missing data not reported

2015 q4 numbers are my imagination

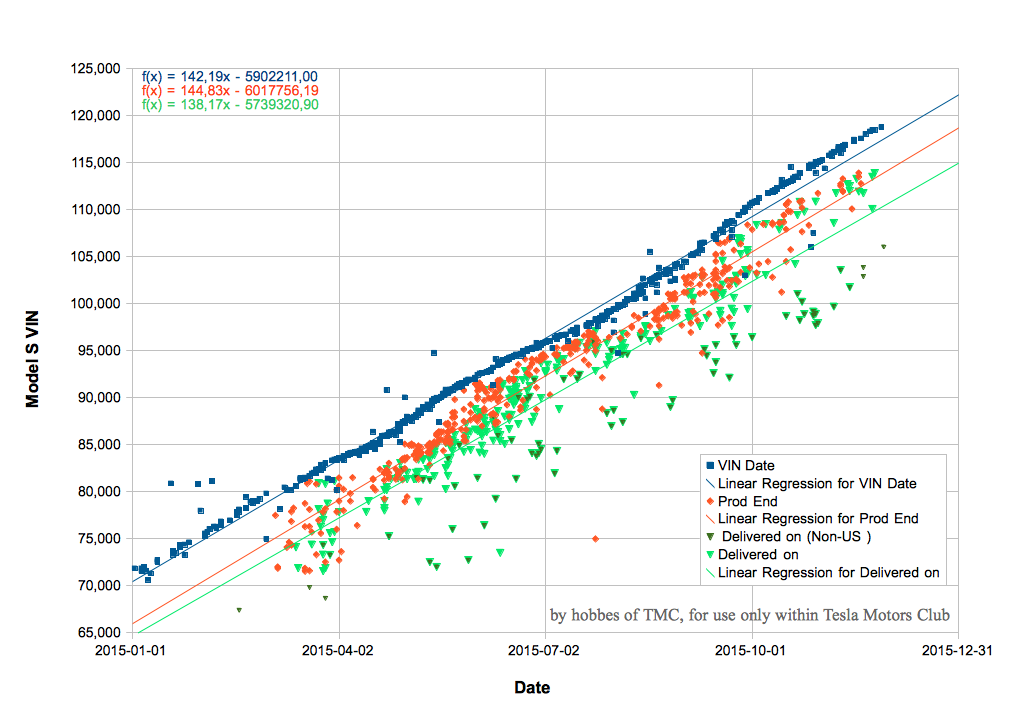

Motivated by Auzie´s work, I updated my VIN plot, too. Trend continues pretty much. Added extra marks for non-US deliveries (dark green triangles). Shows the latest deliveries are in fact almost exclusively outside US.

Playing with the slopes of the linear fits (multiplying by 365 days), they point to 51,899 VINs/52,863 cars produced/50,432 cars delivered in 2015 (Jan 1 through Dec 31). Obviously they won´t produce more cars than assing VINs, that's the statistical error. To reduce that, averaging the three numbers gives 51,731. That would be my best educated guess at Model S deliveries in 2015. Add a few hundred Model X and they *might* hit the upper end of guidance.

DISCLAIMERS: This analysis obviously assumes that the cars produced in 2014 and delivered in 2015 make up for any cars produced this year and only delivered in 2016. (The plot has only VINs which were assigned this year, so it might seem there were no cars delivered in early 2015.) VIN analysis has led to too high forecasts of deliveries earlier on TMC, so take this with a spoon of salt and don´t base your investment decisions on this.

Data source: Model S Order Delivery - Google Sheets

Playing with the slopes of the linear fits (multiplying by 365 days), they point to 51,899 VINs/52,863 cars produced/50,432 cars delivered in 2015 (Jan 1 through Dec 31). Obviously they won´t produce more cars than assing VINs, that's the statistical error. To reduce that, averaging the three numbers gives 51,731. That would be my best educated guess at Model S deliveries in 2015. Add a few hundred Model X and they *might* hit the upper end of guidance.

DISCLAIMERS: This analysis obviously assumes that the cars produced in 2014 and delivered in 2015 make up for any cars produced this year and only delivered in 2016. (The plot has only VINs which were assigned this year, so it might seem there were no cars delivered in early 2015.) VIN analysis has led to too high forecasts of deliveries earlier on TMC, so take this with a spoon of salt and don´t base your investment decisions on this.

Data source: Model S Order Delivery - Google Sheets

Last edited:

Thanks hobbes, I enjoy watching colorful graphs.

I was contemplating developing more complex VIN - date graph that would show overlays of order, production and delivery dates for each VIN. Still contemplating when I get a spare moment, hoping that someone might beat me to it.

I am curious if anyone remembers if previous VIN discussions here on TMC coincided with excessive inventory being built for China?

I was contemplating developing more complex VIN - date graph that would show overlays of order, production and delivery dates for each VIN. Still contemplating when I get a spare moment, hoping that someone might beat me to it.

I am curious if anyone remembers if previous VIN discussions here on TMC coincided with excessive inventory being built for China?

Thanks hobbes, I enjoy watching colorful graphs.

I was contemplating developing more complex VIN - date graph that would show overlays of order, production and delivery dates for each VIN. Still contemplating when I get a spare moment, hoping that someone might beat me to it.

I am curious if anyone remembers if previous VIN discussions here on TMC coincided with excessive inventory being built for China?

Not sure what you mean exactly - what is missing in the plot I posted? I was thinking about investigating what went wrong back when the VIN analysis went wrong, too... Would be interesting so we don´t possibly make the same mistakes again.

I am curious if anyone remembers if previous VIN discussions here on TMC coincided with excessive inventory being built for China?

It was after Q3 2013, which was a miss and came during the infamous fire period. Here is a bullish SeekingAlpha article from the time that unfortunately was very wrong: VIN Data Shows A Tesla Q3 Blowout Coming - Tesla Motors (NASDAQ:TSLA) | Seeking Alpha

A connection to China may be possible because I believe homologation to China was completed around that time, although the first wasn't delivered until April 2014.

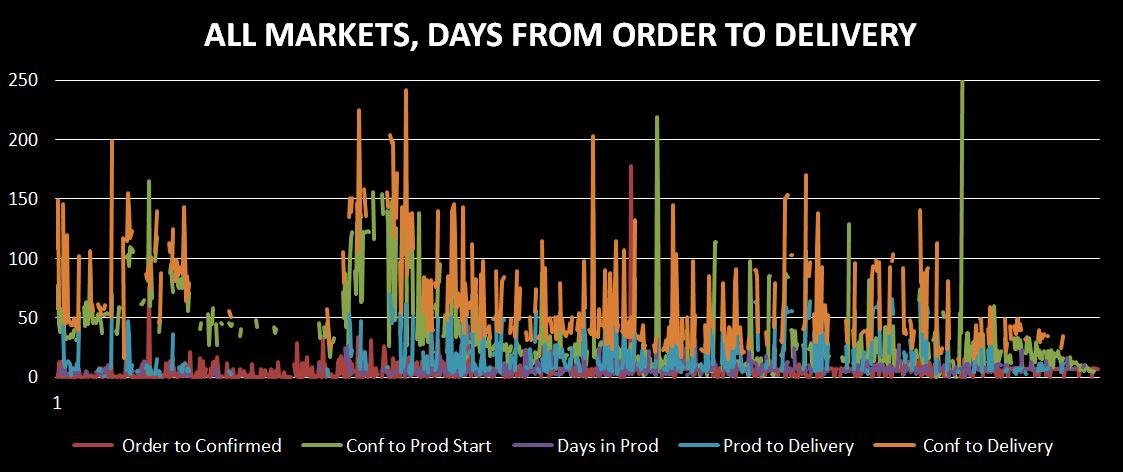

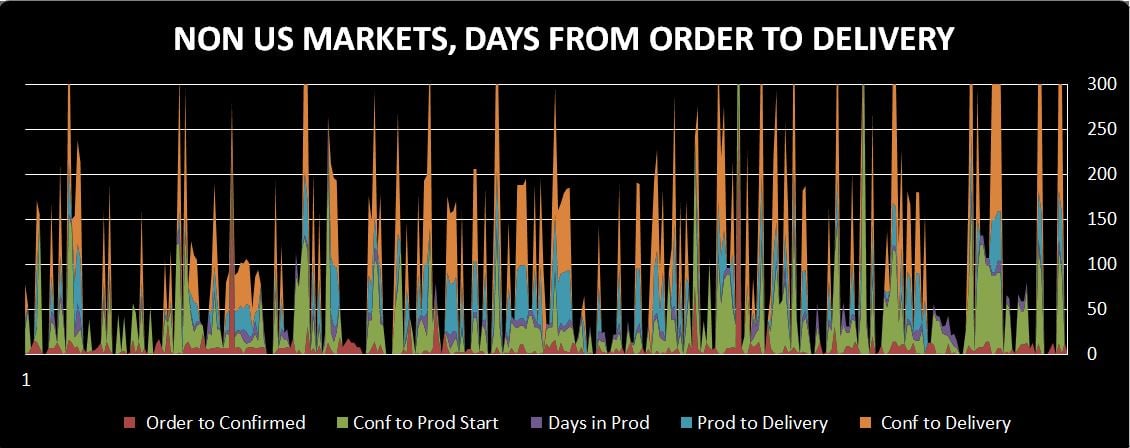

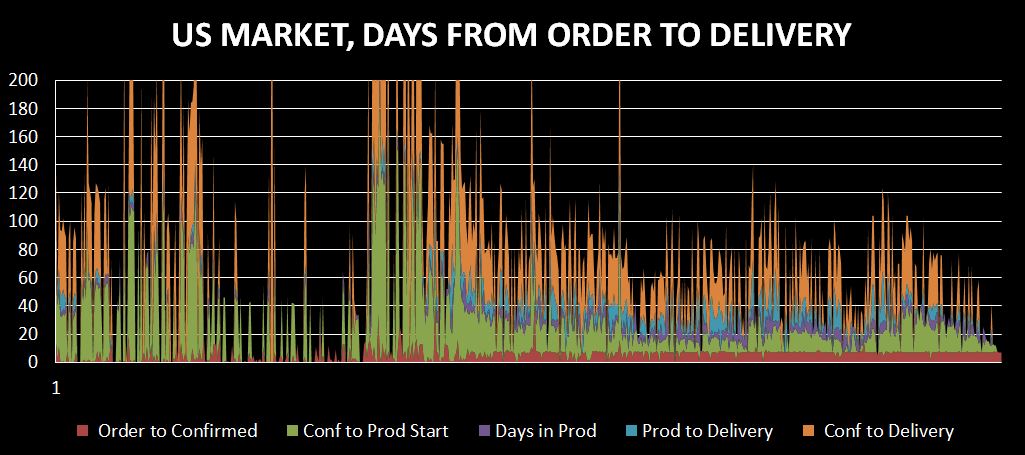

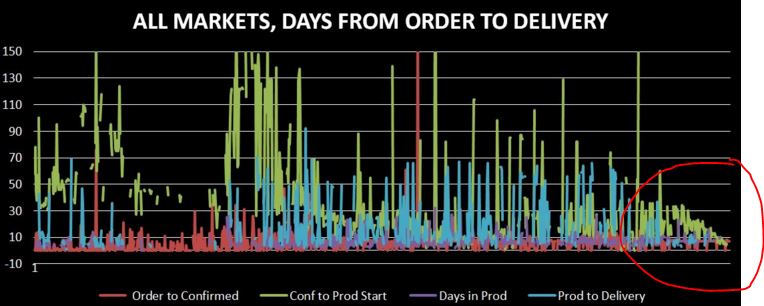

Few more graphs from VIN data google docs

The graphs show delays in days, from order taking to delivery, in US and non-US markets.

Unfortunately, I lumped Canada into non-US markets as it became too tedious to clean data, people were filling in towns rather than countries and filtering is tedious. Graphs could be much better with more granular markets separation.

The horizontal axis on the graphs is VIN numbers in ascending order, not displayed. Displaying VIN numbers is not informative on these graphs, it would only clutter the picture.

The graphs show delays in days, from order taking to delivery, in US and non-US markets.

Unfortunately, I lumped Canada into non-US markets as it became too tedious to clean data, people were filling in towns rather than countries and filtering is tedious. Graphs could be much better with more granular markets separation.

The horizontal axis on the graphs is VIN numbers in ascending order, not displayed. Displaying VIN numbers is not informative on these graphs, it would only clutter the picture.

Not sure what you mean exactly - what is missing in the plot I posted? I was thinking about investigating what went wrong back when the VIN analysis went wrong, too... Would be interesting so we don´t possibly make the same mistakes again.

No mistakes in your work, it is great, I was just curious about the different delays from order to delivery in different markets.

- - - Updated - - -

Here are the same graphs with some redundant data removed, to improve clarity

Confirmed to delivery delays can be deduced from the other delays, so I removed it.

All three graphs show short consistent delays between order to confirmation and days in production.

Longer delays are in between confirmation to production start and production to delivery. No surprises there.

I really like the evident mastering of the US market scheduling and shortened delays between confirmation and production start in that market.

It was after Q3 2013, which was a miss and came during the infamous fire period. Here is a bullish SeekingAlpha article from the time that unfortunately was very wrong: VIN Data Shows A Tesla Q3 Blowout Coming - Tesla Motors (NASDAQ:TSLA) | Seeking Alpha

A connection to China may be possible because I believe homologation to China was completed around that time, although the first wasn't delivered until April 2014.

That is interesting, such timing

Checking this graph again

Note how there is missing production data on 2013 q3 production numbers. It is possible the number was selectively not reported as reporting it could show a high inventory of undelivered cars. Finished goods inventory was unreported few times as well.

Deepak is quite creative with words (reports). He stated

in q3 report but missed to provide full production number for the quarter, as was done in all other quarterly reports.We are now producing 550 cars per week with improved process controls which consistently result in high quality cars

Just my speculation, it is irrelevant now. However, if hidden (at the time) China inventory affected wrong VIN assumptions at the time, then VIN data is informative. I find it informative.

No mistakes in your work, it is great, I was just curious about the different delays from order to delivery in different markets.

Ah, you wanted the time differences between the different steps VIN...delivery. Now I get it.

Here are the same graphs with some redundant data removed, to improve clarity

Confirmed to delivery delays can be deduced from the other delays, so I removed it.

(Plots)

All three graphs show short consistent delays between order to confirmation and days in production.

Longer delays are in between confirmation to production start and production to delivery. No surprises there.

I really like the evident mastering of the US market scheduling and shortened delays between confirmation and production start in that market.

Interesting how much the delays have changed over time though. Actually, what time span do your plots cover? I think the data would become even more clear if you could plot it just with dots, as I think the lines cover up some of the data points.

Ah, you wanted the time differences between the different steps VIN...delivery. Now I get it.

Interesting how much the delays have changed over time though. Actually, what time span do your plots cover? I think the data would become even more clear if you could plot it just with dots, as I think the lines cover up some of the data points.

The graphs were plotted with VIN numbers sorted in ascending order on Horizontal axis. I chose not to display VINs as the numbers are 5-6 digit numbers, there are over thousands of VINs and they would greatly clutter the graph if displayed. Time (dates) and VIN numbers are correlated, hence we could say horizontal axis is representing both time period (2014 - 2015) and VINs.

Interesting how much the delays have changed over time though.

2 delays seem to be constant - order to confirmation is flatlining at 7 days, and days in production seems to be consistent at just a couple of days.

Delivery days obviously vary depending on the region.

Inverse correlation of Confirmation to production start in US and non-US market is evident, not surprising at all.

The last time period on the graphs (circled areas) shows long conf to production in non-US markets (approx. <90 days) and quite short conf to production in US market (approx.< 7 days), due to prioritising US production for the year end.

Note: All delay days for the same VIN number are stacked on top of each other.

Last edited:

It was after Q3 2013, which was a miss and came during the infamous fire period. Here is a bullish SeekingAlpha article from the time that unfortunately was very wrong: VIN Data Shows A Tesla Q3 Blowout Coming - Tesla Motors (NASDAQ:TSLA) | Seeking Alpha

A connection to China may be possible because I believe homologation to China was completed around that time, although the first wasn't delivered until April 2014.

Interesting read, thanks. I followed the links in that article and found the original thread and charts on the Tesla Motors Forum by Craig Froehle (actually he took the charts offline but you can still find them on google image search). Back then he had only the VIN data available. I think by analyzing production end and deliveries now in addition we are a bit less prone to error - but still, the analysis I made with my plot works only if there is not a sudden problem (think strike stopping deliveries or bad weather). Actually I have a good idea how to validate the method, I´ll see when I have time.

Last edited:

Benz

Active Member

The graphs were plotted with VIN numbers sorted in ascending order on Horizontal axis. I chose not to display VINs as the numbers are 5-6 digit numbers, there are over thousands of VINs and they would greatly clutter the graph if displayed. Time (dates) and VIN numbers are correlated, hence we could say horizontal axis is representing both time period (2014 - 2015) and VINs.

2 delays seem to be constant - order to confirmation is flatlining at 7? days, and days in production seems to be consistent at just a couple of days.

Delivery days obviously vary depending on the region.

Inverse correlation of Confirmation to production start in US and non-US market is evident, not surprising at all.

The last time period on the graphs (circled areas) shows long conf to production in non-US markets (approx. 90 days) and quite short conf to production in US market (approx. 20 days), due to prioritising US production for the year end.

View attachment 102474

View attachment 102475

Nice graphs, thanks for posting them.

I understand that you used VINs from 2014 and 2015.

Looking at the second graph (US Market), it's very clear that VINs in 2014 had a much longer delay regarding "confirmation to production start" (green lines), and VINs in 2015 had a much shorter delay regarding "confirmation to production start" (green lines).

There must also be a relation with the increase in production capacity, I think.

My previous Model S quarterly deliveries chart was compressed, 2013 q data is missing. I got 2013 q columns hidden in excel when working on last 2 years data and forgot to unhide when plotting the graph. Here is the full plot, with 2013 quarters included.

There is an article in Seeking Alpha that looks at the google doc Model S delivery data and interprets shortened end of year delivery delays as declining demand.

The author looks at US market only and does not consider the possibility of rising production rates. The rising demand in non-US markets will be reflected as longer delivery delays in the next quarter.

My expectation is that Model X demand, possible new catalysts for Model S (improvements) and raising demand in non-US markets will keep Tesla fully occupied until Model 3 kicks in.

There is an article in Seeking Alpha that looks at the google doc Model S delivery data and interprets shortened end of year delivery delays as declining demand.

The author looks at US market only and does not consider the possibility of rising production rates. The rising demand in non-US markets will be reflected as longer delivery delays in the next quarter.

My expectation is that Model X demand, possible new catalysts for Model S (improvements) and raising demand in non-US markets will keep Tesla fully occupied until Model 3 kicks in.

chickensevil

Active Member

My previous Model S quarterly deliveries chart was compressed, 2013 q data is missing. I got 2013 q columns hidden in excel when working on last 2 years data and forgot to unhide when plotting the graph. Here is the full plot, with 2013 quarters included.

View attachment 103098

There is an article in Seeking Alpha that looks at the google doc Model S delivery data and interprets shortened end of year delivery delays as declining demand.

The author looks at US market only and does not consider the possibility of rising production rates. The rising demand in non-US markets will be reflected as longer delivery delays in the next quarter.

My expectation is that Model X demand, possible new catalysts for Model S (improvements) and raising demand in non-US markets will keep Tesla fully occupied until Model 3 kicks in.

I don't really feel inclined to comment *in* the linked article, but just to clear up something. He states:

In 2015 order lead time has dropped from a high of 52.6 days in January to a low of 11.0 days in August.

I think what is being missed here is that he is *only* considering the US market. Didn't they say recently that the EU overall has risen to the point where it is at least on even level with the NA market? Or am I missing something?

And VG had an interesting hypothesis on allocation as it relates to the estimated delivery dates as being that they are lumping a predicted amount of cars into a region/country. If they get more orders than expected it increases the wait time for that country, and if they get less, it drops the wait time. This of course was thrown out for NA this quarter as they are heavily pushing deliveries to NA to meet year end goals. But otherwise it was seeming to hold steady where the whole world was roughly the same estimated wait time.

I also point toward the fact that Elon has stated before that their goal for wait times is for it to be measured "in weeks not months". This to me indicates that while wait times have dropped off, that this is just them letting things fall back some such that they are able to hit a more sweet spot in the wait times. As they up production, they will pull demand levers as necessary to keep the wait times at a happy spot.

But again, look at what they have done with this quarter and NA. They hit a point where they knew they couldn't get in anymore non-NA deliveries, so we are now full bore pushing NA deliveries like it is going out of style.

Also regarding the lack of CA registrations, it may be that Tesla has been pushing out Non-CA NA deliveries and queuing since they will likely leave their closest areas for December so they can dump as many cars on the market as possible. Just speculation, but I wouldn't read too much into low CA numbers for Nov, and I am willing to bet that the InsideEVs number is a pretty good estimate (keeping in mind that their number always includes Canada in it).

CE, I agree with your thinking along the lines of steady world wide demand for S. The pattern is visible on my chart up thread that shows all markets delays (days) plotted. Here is the chart again

If we disregard the graph tail (circled) as that tail is clearly US market only and most VINs on that part of the chart have not reported all delays (dates), it is evident that the confirmation to production start days are fairly constant in 2015. I will have another go at VIN data on weekend, clean it up a bit (remove incomplete data) and see what is visible on plots regarding world wide demand moves.

I also agree with the SA author that we can discern the demand movements (to a limited degree) from the charts. The insight on demand is greatly clouded with unknown production rate movements. Once production rate is known, we would be able to discern demand levels with more clarity from the VIN data doc.

Demand is not a fixed number, it can change any day in response to numerous developments. Tesla has control over some of these developments, like pricing, car improvements and similar, these are Tesla's demand levers.

There are some events outside of Tesla's control that affect demand, like forex moves, which is predictable for 2016 (unfavourable), regulatory developments related to ev in various countries (likely favourable but varies from country to country), general economic developments in various regions (favourable in some countries, neutral to unfavourable in most), etc.

If one gets a good estimation on the above and other not mentioned but relevant factors that affect demand, such estimation points to a path for shaping Tesla sales in various markets in 2016.

If we disregard the graph tail (circled) as that tail is clearly US market only and most VINs on that part of the chart have not reported all delays (dates), it is evident that the confirmation to production start days are fairly constant in 2015. I will have another go at VIN data on weekend, clean it up a bit (remove incomplete data) and see what is visible on plots regarding world wide demand moves.

I also agree with the SA author that we can discern the demand movements (to a limited degree) from the charts. The insight on demand is greatly clouded with unknown production rate movements. Once production rate is known, we would be able to discern demand levels with more clarity from the VIN data doc.

Demand is not a fixed number, it can change any day in response to numerous developments. Tesla has control over some of these developments, like pricing, car improvements and similar, these are Tesla's demand levers.

There are some events outside of Tesla's control that affect demand, like forex moves, which is predictable for 2016 (unfavourable), regulatory developments related to ev in various countries (likely favourable but varies from country to country), general economic developments in various regions (favourable in some countries, neutral to unfavourable in most), etc.

If one gets a good estimation on the above and other not mentioned but relevant factors that affect demand, such estimation points to a path for shaping Tesla sales in various markets in 2016.

chickensevil

Active Member

Demand is not a fixed number, it can change any day in response to numerous developments. Tesla has control over some of these developments, like pricing, car improvements and similar, these are Tesla's demand levers.

There are some events outside of Tesla's control that affect demand, like forex moves, which is predictable for 2016 (unfavourable), regulatory developments related to ev in various countries (likely favourable but varies from country to country), general economic developments in various regions (favourable in some countries, neutral to unfavourable in most), etc.

If one gets a good estimation on the above and other not mentioned but relevant factors that affect demand, such estimation points to a path for shaping Tesla sales in various markets in 2016.

I would point out as far as Demand levers that they are still not fully pushed into the US yet (vast swaths of the US have little to no Tesla presence), and haven't pushed into other semi-key markets that at least influence their competitor's world wide sales numbers. We are seeing them push into Mexico and Korea here finally, but that still leaves countries like Dubai, India, and Russia largely left untouched (yes, I think some people have forcibly imported the car there, but that hardly counts.)

My guess is that they are trying to push out WW where it makes sense financially as they don't want to over extend themselves as far as OpEx but getting presence in a country sooner rather than later will also help them down the road with the Model 3 as the brand will be better known to the population.

Anyway, my point is that combined with the demand levers you mentioned it should not go unnoticed that they still don't have the global presence of even the likes of their competition and that is an important demand lever. On top of that, word of mouth is helpful to be sure, but advertising in a more traditional sense will help to get the word out to previously untouched individuals so we can add to the discovery factor of Tesla and lead the way to additional word of mouth spreading. Even in our area which is pretty Tesla friendly all around, I still get people who have never seen the car in person or are just not remotely aware of its existence. This is likely the reason for continued acceptance levels in places like CA, since there are likely plenty of people who might know vaguely of there being this EV made by a company called Tesla, they don't know much else and advertising would help penetrate that further should it be required. (The pop-up store is an example of trying to get the word out better, unsure how successful those were)

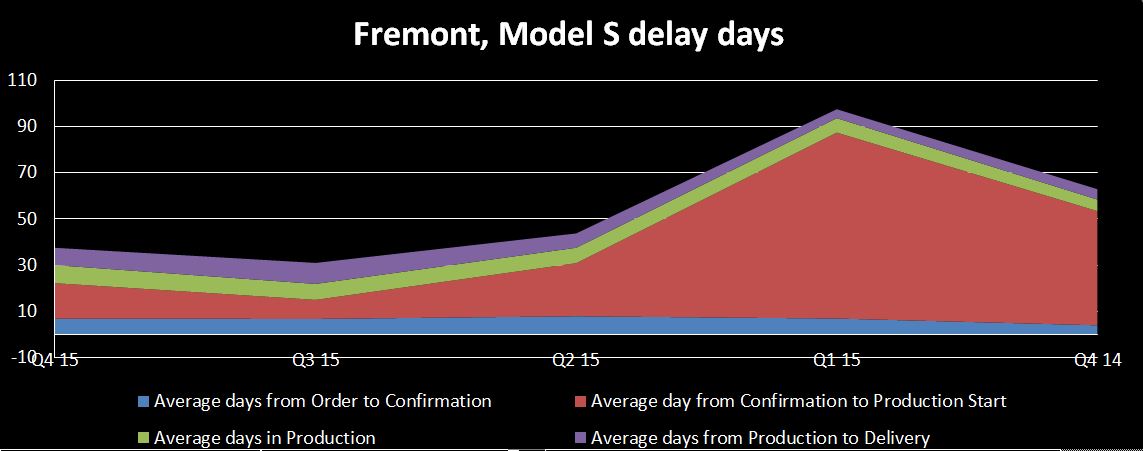

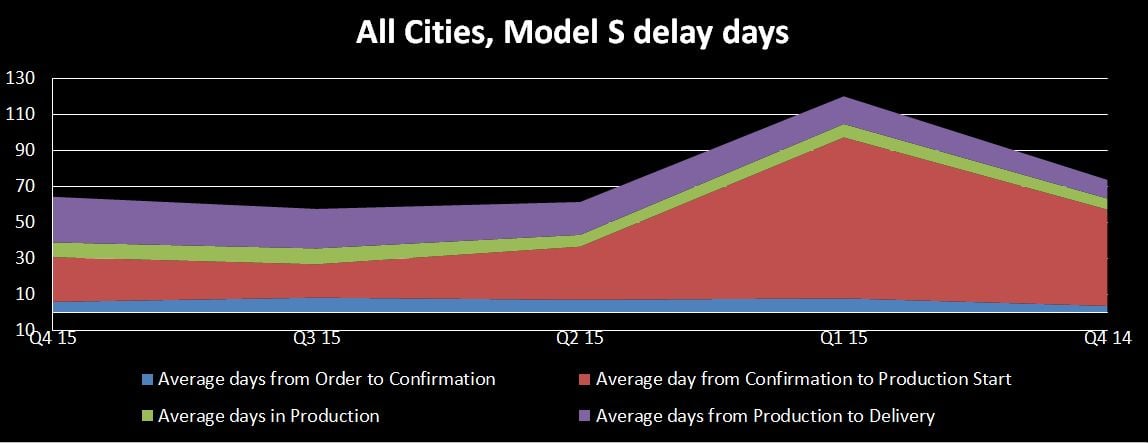

Couple of more graphs, based on google doc, Model S deliveries

Fremont deliveries, 5 last quarters

All cities deliveries, 5 last quarters

All cities Q4 15 delays are slightly shorter than Q4 14 delays. That slight shortening of delays is likely due to increased production rates in Q4 15 vs Q4 14.

Fremont deliveries, 5 last quarters

All cities deliveries, 5 last quarters

All cities Q4 15 delays are slightly shorter than Q4 14 delays. That slight shortening of delays is likely due to increased production rates in Q4 15 vs Q4 14.

chickensevil

Active Member

Wow, you can tell when they switched from truck to rail that is really interesting. I also find it interesting that if anything there was a dip in Q3 and a slight rise in Q4 (at least based on the current Q4 data maybe it will come out as a wash by the end). This is a great sign of steady demand keeping up with obvious production increase. Although I'm sure that the referral program is a strong boost to those numbers. I would also strongly attribute them finally releasing autopilot as a demand boost. Those two factors have likely been two very strong levers in Tesla's sleeve to ensure a healthy demand level to keep up with production in Q4.

Wow, you can tell when they switched from truck to rail that is really interesting. I also find it interesting that if anything there was a dip in Q3 and a slight rise in Q4 (at least based on the current Q4 data maybe it will come out as a wash by the end). This is a great sign of steady demand keeping up with obvious production increase. Although I'm sure that the referral program is a strong boost to those numbers. I would also strongly attribute them finally releasing autopilot as a demand boost. Those two factors have likely been two very strong levers in Tesla's sleeve to ensure a healthy demand level to keep up with production in Q4.

Note the graphs use averaged numbers. I personally do not trust averages too much, they can be misleading sometimes.

Raw data is always the best information. Graphs of averages look neater than raw data graphs, that is the only advantage.

It will be interesting how the pattern unfolds in the coming quarters.

Similar threads

- Replies

- 33

- Views

- 8K

- Replies

- 10

- Views

- 1K

- Replies

- 10

- Views

- 4K

- Replies

- 1

- Views

- 711

- Replies

- 761

- Views

- 51K