Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

- Status

- Not open for further replies.

So, when Kallo said the share price could surge over $500 with a successful Model 3 launch, it was based on the $300 or so we had been at. What happens if we are sitting at $400 or even higher going into July and a flawless launch happen?

We also have to look in relative numbers.

500 dollars gives us about 80 billion dollars market cap.

IMO, I think the stock has the potential to reach 90 B this year. Which is about 550 dollars SP.

Further, might be a bit of a stretch for this year if the M3 deliveries numbers aren't beating expectations beyond wildest dreams.

I agree on the last centensWenche, if you really think TT007 used a 100 multiplier, you probably should stick with indexes. No offense, a good investor should be able to tell which part is obviously not true.

TrendTrader007

Active Member

thank you for appreciating my frankness. i admit i do end up stoking my ego by using a 100 multiplier. For example this afternoon just before the market closed i actually bought 10.01shares of TSLA worth exactly $3419.41 but i could not help myself and posted 1001 shares using the 100 multiplier. and infact now that my TSLA common position is exactly 310.01 shares I'm tempted to again use the 100 multiplier and make them appear 31001 shares! i really need to work on not using the 100 multiplier.Thanks for posting your real possision. I rememeber you posted your possisiion when you had 280 shares as well, some time ago, but ithe post dround in the massive postings here. I think the better way on TMC is to be frank, and not use 100 multipliser. Your choice on what to do on Twitter, is up to you, but I prefer your posts here on TMC to not beeing to strike your ego, but to contribute to common knowledge. I have found at lot of your postings interesting, even when I know you use the 100 multipliser.

Thanks again and sorry for the confusion

TrendTrader007

Active Member

i think i made a short term tactical mistake by buying TSLA before the close today. i did not realize it at the time but looking back on several old time frames TSLA rarely if ever goes up more than 5 days in a row except on very rare occasions. so i'm afraid statistically speaking my probability of a loss tomorrow is very high. However, if TSLA does continue to rise beyond today (Day 5) then that would be an extremely bullish sign and a definite change in character for this stock.

i will post several comparison charts tonight as to what happens in similar technical situations that TSLA is currently in

i must say that it is getting increasingly dangerous to chase the stock here

longer term TSLA will do just great but in the very short term things are likely to get intense

i will post several comparison charts tonight as to what happens in similar technical situations that TSLA is currently in

i must say that it is getting increasingly dangerous to chase the stock here

longer term TSLA will do just great but in the very short term things are likely to get intense

Last edited:

geneclean55

Active Member

InsideEVs report their estimates tomorrow. They expect MX sales to be much improved compared to April.

Zhelko Dimic

Careful bull

Error? Maybe yes, maybe no.i think i made a short term tactical mistake by buying TSLA before the close today. i did not realize it at the time but looking back on several old time frames TSLA rarely if ever goes up more than 5 days in a row except on very rare occasions. so i'm afraid statistically speaking my probability of a loss tomorrow is very high. However, if TSLA does continue to rise beyond today (Day 5) then that would be an extremely bullish sign and a definite change in character for this stock.

i will post several comparison charts tonight as to what happens in similar technical situations that TSLA is currently in

i must say that it is getting increasingly dangerous to chase the stock here

longer term TSLA will do just great but in the very short term things are likely to get intense

In a breakout of 2013, it ended up going 10% day after day.

RSI would accommodate quite a bit of a rise from here... Chaikin Oscillator screams new money is coming in...

TrendTrader007

Active Member

i would love that scenario. chart looks extremely strong and that is the single reason why i have kept on buying despite increasing odds of a pullback. i don't think that $500+ is out of question here . see your points about RSI only at 67 and Chaikin and agree. also MACD just crossed over strongly just 2 days ago. so all in all bullish. also, i consider myself a contrarian indicator so the fact that i am turning squeamish today is good for SP. good thing i buy despite my own fearsError? Maybe yes, maybe no.

In a breakout of 2013, it ended up going 10% day after day.

RSI would accommodate quite a bit of a rise from here... Chaikin Oscillator screams new money is coming in...

probably a shot at high $500s closer to $600 within the next 2 to 3 months if goes parabolic with a short squeeze otherwise more steady rise for several more months

either scenario is highly profitable albeit former likely to result in several longs left holding the bag in case it goes parabolic because in case of a parabolic rise timing is everything and even a few days of mistiming can result in huge difference in returns

in case we get a parabolic rise, i fully expect is coming, and the SP runs to $600 or so in less than 2 to 3 months then i will strongly consider selling all my holdings and buy it again on a major correction.

this is a fluid situation where my opinion will change as the situation evolves

Last edited:

Personally, I prefer the slower steady rise vs parabolic. I admit the latter is more exciting but is also prone to big dips after the fast/parabolic rise with gap filling.

Give me the tortoise vs the hare rise in the SP. I honestly did not see $300 before the M3 production start so I will be happy with $350-400 if we see significant M3 delivers (IMO that means >25K) this year.

Give me the tortoise vs the hare rise in the SP. I honestly did not see $300 before the M3 production start so I will be happy with $350-400 if we see significant M3 delivers (IMO that means >25K) this year.

I was wondering if I could please get some assistance on buying JAN 2019 LEAPS.

I am unsure of what strike to aim for would appreciate suggestions and rationale.

I have seen references to buying DITM leaps. Is this because of the right to exercise in case of SP getting crushed and you can get shares so the LEAP doesn't become worthless in 597 days?

Thanks in advance for the help.

I am unsure of what strike to aim for would appreciate suggestions and rationale.

I have seen references to buying DITM leaps. Is this because of the right to exercise in case of SP getting crushed and you can get shares so the LEAP doesn't become worthless in 597 days?

Thanks in advance for the help.

TrendTrader007

Active Member

It will most likely be a combination of both. The only way I can reconcile the current long term chart with short term is that a powerful rally is in the cards and a new month of June should herald a strong breakout on monthly chart leading to a minimum of 5 to 6 months of frantic upside which could easily double (less likely triple) the SP from current levels before a major correction. So a realistic scenario is $600 to 700 in next 5 to 6 monthsPersonally, I prefer the slower steady rise vs parabolic. I admit the latter is more exciting but is also prone to big dips after the fast/parabolic rise with gap filling.

Give me the tortoise vs the hare rise in the SP. I honestly did not see $300 before the M3 production start so I will be happy with $350-400 if we see significant M3 delivers (IMO that means >25K) this year.

A less realistic but possible and more fantastic scenario is a triple from here to $900 to $1000 which would require a parabolic rise in SP fueled by desperate short covering

Now the real big money in TSLA is over the next 5 to 10 years but if the SP shoots up like crazy month after month then it does not make sense to sit through and suffer major corrections when it's possible to time this thing and make recurrent fortunes

All this is wild fantasy on my part and not to be taken seriously

Zhelko Dimic

Careful bull

I feel this consolidation has shaken weak hands,mine included. I sold everything I could have sold. I have 0 reason to be selling for a long while, as I am in my core position,100% TSLA, but through DITM leaps and bunch of cash on the side.So I don't expect significant pullbacks, though occasional one day down is probably a must for stock as volatile as this, just so MM can take candy away from retail traders.i would love that scenario. chart looks extremely strong and that is the single reason why i have kept on buying despite increasing odds of a pullback. i don't think that $500+ is out of question here . see your points about RSI only at 67 and Chaikin and agree. also MACD just crossed over strongly just 2 days ago. so all in all bullish. also, i consider myself a contrarian indicator so the fact that i am turning squeamish today is good for SP. good thing i buy despite my own fears

probably a shot at high $500s closer to $600 within the next 2 to 3 months if goes parabolic with a short squeeze otherwise more steady rise for several more months

either scenario is highly profitable albeit former likely to result in several longs left holding the bag in case it goes parabolic because in case of a parabolic rise timing is everything and even a few days of mistiming can result in huge difference in returns

in case we get a parabolic rise, i fully expect is coming, and the SP runs to $600 or so in less than 2 to 3 months then i will strongly consider selling all my holdings and buy it again on a major correction.

this is a fluid situation where my opinion will change as the situation evolves

One thing to note, there is a monster number of 350 calls open for Friday. This will act as a wall, however, if 350 is crossed early enough, imperfect delta hedging of MM will mean that they must buy more stock to bring position into balance, and this will exaggerate move.

Said another way, if there is enough momentum to cross 350 convincingly, that will help gather more momentum, like rolling the ball to top of the mountain, and to the other side, but if momentum is not strong enough, 350 will be a top impossible to cross.

Zhelko Dimic

Careful bull

You can buy Jan 19 calls at $100 strike for around $241, maybe a dime or two more. There is no money-value in this call. That lets you keep $100 per share for other purposes, and worst comes to worst, if TSLA fails you can't lose those $100. Potential for leverage is typically why people use DITM calls. It's more efficient use of capital, i.e. you can win or lose more/quicker. I like element of having money on the side, it's as if I bought $100 put for free. But really, that money can be used temporarily for other purposes.I was wondering if I could please get some assistance on buying JAN 2019 LEAPS.

I am unsure of what strike to aim for would appreciate suggestions and rationale.

I have seen references to buying DITM leaps. Is this because of the right to exercise in case of SP getting crushed and you can get shares so the LEAP doesn't become worthless in 597 days?

Thanks in advance for the help.

Eventually, I will convert DITM into shares, but alternative strategy is to roll out leaps and continue carrying leveraged position for year. Potentially effective, for sure more risky than unleveraged strategy. The truly horrendous dip at the wrong time can make it impossible to roll out calls and would make loses exaggerated - assuming you're not deep enough in the money. But any large dip will make rolling out more expensive as part of this strategy.

TrendTrader007

Active Member

Okay I will not give you any advice because I don't want you blaming me if you lose all your money and realize that you could potentially lose ALL your money playing optionsI was wondering if I could please get some assistance on buying JAN 2019 LEAPS.

I am unsure of what strike to aim for would appreciate suggestions and rationale.

I have seen references to buying DITM leaps. Is this because of the right to exercise in case of SP getting crushed and you can get shares so the LEAP doesn't become worthless in 597 days?

Thanks in advance for the help.

I never give anyone any advice

Having made these disclaimers I can tell you my positions and whatever you decide is entirely your decision

I'm sorry I don't have time or patience to explain anything

January 2018 with strikes of $250 $260 $290 $300 $410 $500

January 2019 $300 $500 $600 I might have a few other strikes I don't remember

Realize that if the stock goes south you'll lose money so fast that it's not even funny

On the other hand if stock goes up then it won't be too bad

And timing is critical

TrendTrader007

Active Member

You're right on the mark. I came close to selling everything a few times especially since I'm so heavily leveraged but managed to talk myself out of it. Sometimes I think it's not intelligence or foresight but just sheer stupidity and death wish that keeps me in my position. When it's all said and done I think I'll owe my profits to sheer luck more than anything elseI feel this consolidation has shaken weak hands,mine included. I sold everything I could have sold. I have 0 reason to be selling for a long while, as I am in my core position,100% TSLA, but through DITM leaps and bunch of cash on the side.So I don't expect significant pullbacks, though occasional one day down is probably a must for stock as volatile as this, just so MM can take candy away from retail traders.

One thing to note, there is a monster number of 350 calls open for Friday. This will act as a wall, however, if 350 is crossed early enough, imperfect delta hedging of MM will mean that they must buy more stock to bring position into balance, and this will exaggerate move.

Said another way, if there is enough momentum to cross 350 convincingly, that will help gather more momentum, like rolling the ball to top of the mountain, and to the other side, but if momentum is not strong enough, 350 will be a top impossible to cross.

You really are on top of your game though. I learn a lot from your posts

i think i made a short term tactical mistake by buying TSLA before the close today. i did not realize it at the time but looking back on several old time frames TSLA rarely if ever goes up more than 5 days in a row except on very rare occasions. so i'm afraid statistically speaking my probability of a loss tomorrow is very high. However, if TSLA does continue to rise beyond today (Day 5) then that would be an extremely bullish sign and a definite change in character for this stock.

i will post several comparison charts tonight as to what happens in similar technical situations that TSLA is currently in

i must say that it is getting increasingly dangerous to chase the stock here

longer term TSLA will do just great but in the very short term things are likely to get intense

From casual observation, I suspect it's quite probable you can sell those shares in the pre-market for what you've paid or slightly higher. It just seems that outside of days with substantial news, typically over the several hours of pre-market trading, trades are made above and below the prior day's close. Just a possible easy way to erase that trade TT007 that might go unseen right in plain sight in front of you if you still think that purchase was likely a mistake.

One thing to note, there is a monster number of 350 calls open for Friday. This will act as a wall, however, if 350 is crossed early enough, imperfect delta hedging of MM will mean that they must buy more stock to bring position into balance, and this will exaggerate move.

Said another way, if there is enough momentum to cross 350 convincingly, that will help gather more momentum, like rolling the ball to top of the mountain, and to the other side, but if momentum is not strong enough, 350 will be a top impossible to cross.

Bingo. That's exactly what happened last Friday. The trick seems to be momentum needs to form and push for the high OI strike early in the day, say before 10:30-11am, at which point said momentum doesn't even need to push it over the high strike, just get it close enough that gamma will rise at such a rate that delta hedging effectively turns the high strike into a magnet. It's not even imperfect delta hedging - it's not like there's really any other alternative, and it's all automatic now - buying/selling done by algos, so all that has to happen is a certain set of conditions be met to "get the ball rolling".

GEX (gamma exposure) is also quite high as of close today ~420k shares per 1% move - similar to this time last week, maybe 5% higher. This will have the effect of muting price movements - sqzme | Documentation

Given we need roughly a similar magnitude move as last Friday to make this happen, and we've already rallied for 5 days straight, temper your hopes/expectations. Not saying it won't happen, just that with such a substantially different (wider range of) open interest this week, it'll be challenging. Best pin right now looks like $335, but $340 is probably more likely unless the bulls take the day off.

On a positive note however, based on squeezemetric's data, dark pool volume last Thursday was 46% buy side, whereas today is was a very healthy 63%, with 3x higher buying volume than last Thursday. Fair disclaimer though, dark pools were net sellers for the last ~month until last Friday, and it tends to be choppy (lot of trading is done this way too, not just large funds buying/selling), so no way of knowing if it will continue.

Last edited:

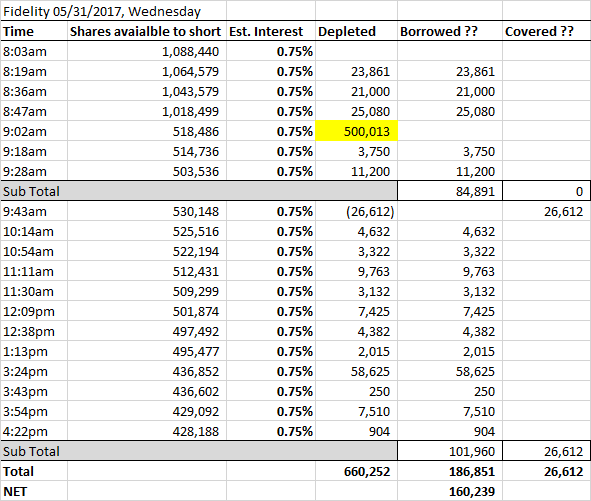

Still no signs of any sizable covering activity at Fidelity. Today was very similar to yesterday - Fidelity made a lot of shares available for shorting (1M+), but faced with week demand likely pulled 500K in pre-market. Based on the trading screen snap shots there was another net shorting day (insert your favorite disclaimer here).

- Status

- Not open for further replies.

Similar threads

- Locked

- Replies

- 0

- Views

- 4K

- Locked

- Replies

- 0

- Views

- 6K

- Replies

- 6

- Views

- 5K

- Article

- Replies

- 29

- Views

- 6K

- Replies

- 1

- Views

- 891