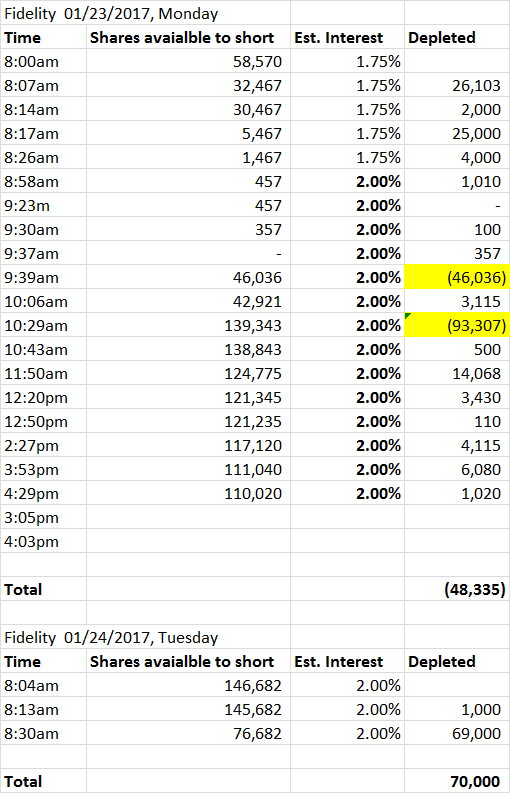

There were 146k shares available for shorting at Fidelity at 8:04am, with 69k shares borrowed for shorting so far. Yesterday was a net covering day at Fidelity, with total net of 48k shares. Looking at the granular data, it appears that we are witnessing fairly orderly (for now) rotation: some short positions are being exited, while new ones are being added. If we assume that a more reasonable short interest would be about 5M shares less than what we have now, and that about half of short trading in TSLA is reflected in Fidelity data, it will take 50 days to get us there at this pace. Admittedly, these are pants of the seat assumptions, but I think they demonstrate in general terms how untenable this situation is. I think this could come to a violent resolution and Q4 ER, if financials are OK and 2017 guidance is positive, could be a trigger.

Last edited: