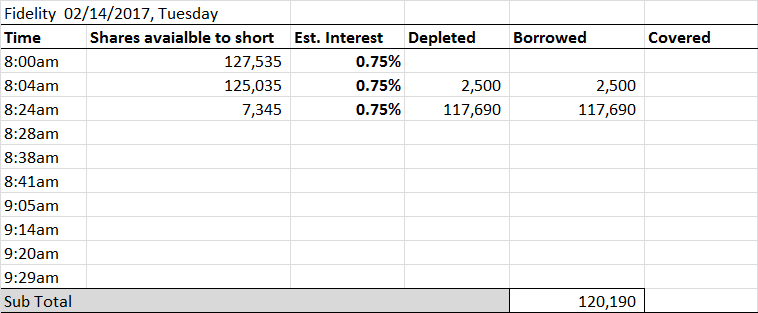

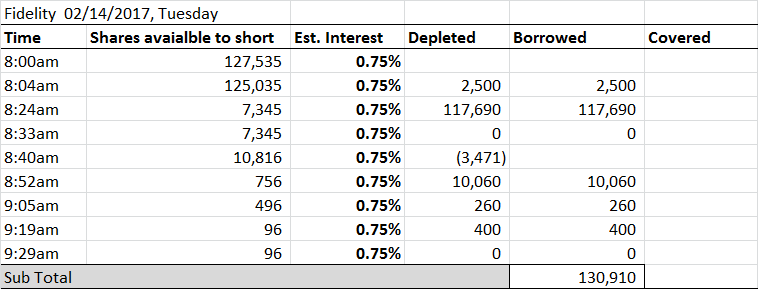

Fidelity is down from 127k shares available for borrowing to 7k. The interest rate went down from 2% to 0.75%.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

- Status

- Not open for further replies.

MMASSASSIN

Member

It would make more sense to cover at the begging of the market day.

The rally we see at open on Mondays is due to weekly options expired the week before. I can tell you first hand that if that move happened on Friday , options that that day expired would of gone up immensely , so market makers killed the options by not allowing the run that should of occurred on Friday to instead take place o the Monday when the % returns to weekly options traders is minuscule in comparison .

Foe me and a few others in here, if the run would of happened on Friday , we would of had an enormous payday for our weekly options strategy, still sore about that.

Oppenheimer making comments today,

Tesla could decide to tap capital markets as its shares rally, analyst says

They "would not be surprised to see (Tesla) opportunistically raise capital to support medium- and long-term growth," the analysts said. "We would view a capital raise as a catalyst to the upside given that it would remove part of the near-term bear argument."

Tesla could decide to tap capital markets as its shares rally, analyst says

They "would not be surprised to see (Tesla) opportunistically raise capital to support medium- and long-term growth," the analysts said. "We would view a capital raise as a catalyst to the upside given that it would remove part of the near-term bear argument."

Oppenheimer making comments today, don't have the full report or link...

Tesla could decide to tap capital markets as its shares rally, analyst says

They "would not be surprised to see (Tesla) opportunistically raise capital to support medium- and long-term growth," the analysts said. "We would view a capital raise as a catalyst to the upside given that it would remove part of the near-term bear argument."

Here is the link:

Tesla could decide to tap capital markets as its shares rally, analyst says

neroden

Model S Owner and Frustrated Tesla Fan

Flat (down a little) in premarket. Probably going to be a boring day for the stock.

Flat (down a little) in premarket. Probably going to be a boring day for the stock.

Agreed. I expect some consolidation. TSLA has had a nice run up.

Oppenheimer making comments today,

Tesla could decide to tap capital markets as its shares rally, analyst says

They "would not be surprised to see (Tesla) opportunistically raise capital to support medium- and long-term growth," the analysts said. "We would view a capital raise as a catalyst to the upside given that it would remove part of the near-term bear argument."

To be honest, if there were capital needs going into next few quarters I don't see why Elon wouldn't decide to cash in on this amazing run and tap the capital markets soon. Despite the market's complacency, I don't think macro risk has disappeared.

Odd shorting activity at Fidelity today. There were only 127k shares available, with only 3k shares added. There were no signs of Fidelity replenishing the supply, although originally available shares were all borrowed quite quickly. On top of this the interest rate went down significantly, to 0.75%, so one would think that Fidelity would make more shares available. I have a gut feeling that these oddities is a manifestation of something unusual brewing on and we will se another explosive day.

geneclean55

Active Member

Oh TSLA, you never fail to amaze me

DurandalAI

Member

neroden

Model S Owner and Frustrated Tesla Fan

And f........! OK, still was not expecting this.

I guess maybe this is a buy-the-rumor sell-the-news type of event and we'll see a pullback *after* earnings. Or maybe we'll just see the endless runup which TrendTrader predicts.

My most speculative position, SCTY Jan 2019 $30Cs (equivalent to 272.73 on TSLA), bought for $1.21/share (equivalent to $11 on TSLA) is about to have more inherent value than the amount I paid for it, 23 months before expiration. What? This was just a toy position, I didn't put significant money into it...

I guess maybe this is a buy-the-rumor sell-the-news type of event and we'll see a pullback *after* earnings. Or maybe we'll just see the endless runup which TrendTrader predicts.

My most speculative position, SCTY Jan 2019 $30Cs (equivalent to 272.73 on TSLA), bought for $1.21/share (equivalent to $11 on TSLA) is about to have more inherent value than the amount I paid for it, 23 months before expiration. What? This was just a toy position, I didn't put significant money into it...

Last edited:

T3slaTulips

Member

racer26

Active Member

Things definitely seem to be firing on all... well I guess that's a crappy metaphor. But wow.

5 out of the last 7 trading days now are shaping up to be big up days. The other 2 were fairly flat.

5 out of the last 7 trading days now are shaping up to be big up days. The other 2 were fairly flat.

So upper BB acting as support on the daily so far? Is that a thing??

Or we should start using 3 standard deviations setting instead of 2.

racer26

Active Member

Really, I think its just that there is a point at which using technicals to predict where the stock will go just breaks completely when the fundamentals are too strong.Or we should start using 3 standard deviations setting instead of 2.

Krugerrand

Meow

Flat (down a little) in premarket. Probably going to be a boring day for the stock.

Would you like to retract that statement?

- Status

- Not open for further replies.

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Replies

- 6

- Views

- 5K

- Article

- Replies

- 29

- Views

- 6K

- Replies

- 1

- Views

- 869