as i am studying the non-gaap/gaap eps issue: although gross margins get non-gaap'd with stock-based comp and zev revenue taken out, the bottom line eps is non-gaap'd a different way.

for bottom line eps the methodology has shifted over the last 5-6 quarters, but the recent approach is start with net income take out stock based comp. and one-time gains/expenses (like those related to solarcity acquisition). i would lean towards taking out the solarcity fine in non-gaap numbers this time around.

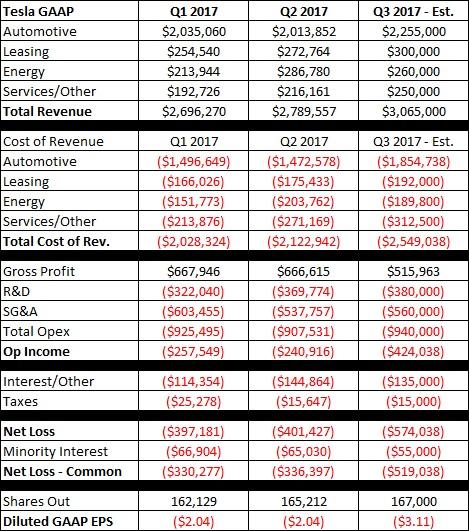

1. added non-gaap reconciliation section, see below -2.19 for non-gaap eps and -3.09 for gaap eps. that will be the worst in the last 7 quarters, at least.

2. i was mistakenly assuming some model 3's were leased, i believe they are all sales with no leases for now. this has the effect of bringing up model 3 revenue and gross margin. model 3 asp i adjusted slightly higher realizing i forgot to include options like autopilot and paint etc. model 3 gross margin i set to maintain total auto gross margin at 20% while assuming s/x gross margin of 25%.

3. speaking of s/x gross margin, that was guided lower in the last letter. but i think with higher production comes greater efficiency and so am favoring a slight uptick there taking midpoint of q3 2016 and q1 2017 gross margin (when production was around 25k units s/x).

4. i had the wrong share count, they had 167m shares going into the quarter and this reduces the loss per share.

5. i thought about r&d a bit after some comments and decided it was prudent to adjust it higher - for example they had to pay grohmann employees more. note that i try to estimate a split of tesla/scty r&d so those looking for full company r&d / sg&a should add those respective line items.

6. there's some downside risk from higher opex. they guided "essentially flat", but that could mean up 3%, which makes a meaningful difference to the bottom line number.

| … |

| ls veh % total |

| avg price s+x |

| avg price model 3 |

| revenue |

| auto sales ex 3 |

| auto sales mod 3 |

| auto leasing |

| 1 time autopilot |

| zev credits |

| total auto |

|

| energy storage |

| solarcity |

| grohmann |

| services/other |

| total revenue |

|

| cost of revenue |

| auto sales ex 3 |

| auto sales mod 3 |

| auto leasing |

| total auto |

|

| energy storage |

| solarcity |

| grohmann |

| services & other |

| total cost of rev |

|

| gross profit |

|

| auto gaap ex 3 gm |

| auto-zev ex 3 gm |

| model 3 gm |

| auto-zev incl 3 gm |

| storage gm |

| scty gm |

| grohmann gm |

| services gm |

|

| opex |

| tesla r&d |

| tesla sg&a |

| 1time acq cost |

| solarcity r&d |

| solarcity sg&a |

| total opex |

|

| op income |

|

| interest inc |

| interest exp |

| scty interest |

| other income exp |

| 1time scty gain |

| pretax income |

| income tax |

| net income |

| non-cont int. |

| net inc to common |

|

| basic shares |

| diluted shares |

|

| diluted gaap eps |

| gaap net income |

| - stock based comp |

| - one time scty |

| non-gaap net income |

| non-gaap diluted eps |

[TD2]

luv q3-17

[/TD2][TD2]

Jun-17

[/TD2][TD2]

Mar-17

[/TD2][TD2]

Sep-16

[/TD2]

[TD2]

0.21

[/TD2][TD2]

0.19

[/TD2][TD2]

0.26

[/TD2][TD2]

0.32

[/TD2]

[TD2]

108.00

[/TD2][TD2]

107.27

[/TD2][TD2]

108.06

[/TD2][TD2]

105.40

[/TD2]

[TD2]

53.00

[/TD2][TD2]

0.00

[/TD2][TD2]

0.00

[/TD2][TD2]

0.00

[/TD2]

[TD2]2,212,348[/TD2][TD2]1,913,852[/TD2][TD2]2,000,060[/TD2][TD2]1,778,901[/TD2]

[TD2]11,660[/TD2][TD2]0[/TD2][TD2]0[/TD2][TD2]0[/TD2]

[TD2]253,395[/TD2][TD2]272,764[/TD2][TD2]254,540[/TD2][TD2]231,285[/TD2]

[TD2]0[/TD2][TD2]0[/TD2][TD2]35,000[/TD2][TD2]0[/TD2]

[TD2]0[/TD2][TD2]100,000[/TD2][TD2]0[/TD2][TD2]138,541[/TD2]

[TD2]

2,477,403

[/TD2][TD2]

2,286,616

[/TD2][TD2]

2,289,600

[/TD2][TD2]

2,148,727

[/TD2]

[TD2]35,000[/TD2][TD2]15,680[/TD2][TD2]5,244[/TD2][TD2]23,334[/TD2]

[TD2]285,000[/TD2][TD2]271,100[/TD2][TD2]208,700[/TD2][TD2]0[/TD2]

[TD2]5,100[/TD2][TD2]10,200[/TD2][TD2]22,400[/TD2][TD2]0[/TD2]

[TD2]230,000[/TD2][TD2]205,961[/TD2][TD2]170,326[/TD2][TD2]126,375[/TD2]

[TD2]

3,032,503

[/TD2][TD2]

2,789,557

[/TD2][TD2]

2,696,270

[/TD2][TD2]

2,298,436

[/TD2]

[TD2]1,686,317[/TD2][TD2]1,472,578[/TD2][TD2]1,496,649[/TD2][TD2]1,355,102[/TD2]

[TD2]132,924[/TD2][TD2]0[/TD2][TD2]0[/TD2][TD2]0[/TD2]

[TD2]162,990[/TD2][TD2]175,433[/TD2][TD2]166,026[/TD2][TD2]161,959[/TD2]

[TD2]

1,982,231

[/TD2][TD2]

1,648,011

[/TD2][TD2]

1,662,675

[/TD2][TD2]

1,517,061

[/TD2]

[TD2]36,750[/TD2][TD2]19,414[/TD2][TD2]6,473[/TD2][TD2]24,281[/TD2]

[TD2]199,500[/TD2][TD2]184,348[/TD2][TD2]145,300[/TD2][TD2]0[/TD2]

[TD2]3,825[/TD2][TD2]7,600[/TD2][TD2]14,900[/TD2][TD2]0[/TD2]

[TD2]287,500[/TD2][TD2]263,569[/TD2][TD2]198,976[/TD2][TD2]120,359[/TD2]

[TD2]

2,509,806

[/TD2][TD2]

2,122,942

[/TD2][TD2]

2,028,324

[/TD2][TD2]

1,661,701

[/TD2]

[TD2]

522,697

[/TD2][TD2]

666,615

[/TD2][TD2]

667,946

[/TD2][TD2]

636,735

[/TD2]

[TD2]25.0%[/TD2][TD2]27.9%[/TD2][TD2]27.4%[/TD2][TD2]29.4%[/TD2]

[TD2]25.0%[/TD2][TD2]24.6%[/TD2][TD2]26.3%[/TD2][TD2]24.5%[/TD2]

[TD2]-1040.0%[/TD2][TD2]0.0%[/TD2][TD2]0.0%[/TD2][TD2]0.0%[/TD2]

[TD2]20.0%[/TD2][TD2]0.0%[/TD2][TD2]0.0%[/TD2][TD2]0.0%[/TD2]

[TD2]-5.0%[/TD2][TD2]-23.8%[/TD2][TD2]-23.4%[/TD2][TD2]-4.1%[/TD2]

[TD2]30.0%[/TD2][TD2]32.0%[/TD2][TD2]30.4%[/TD2][TD2]0.0%[/TD2]

[TD2]25.0%[/TD2][TD2]25.5%[/TD2][TD2]33.5%[/TD2][TD2]0.0%[/TD2]

[TD2]-25.0%[/TD2][TD2]-28.0%[/TD2][TD2]-16.8%[/TD2][TD2]4.8%[/TD2]

[TD2]270,000[/TD2][TD2]324,774[/TD2][TD2]239,070[/TD2][TD2]214,302[/TD2]

[TD2]470,000[/TD2][TD2]407,757[/TD2][TD2]446,637[/TD2][TD2]336,811[/TD2]

[TD2]0[/TD2][TD2]0[/TD2][TD2]67,000[/TD2][TD2]0[/TD2]

[TD2]30,000[/TD2][TD2]45,000[/TD2][TD2]44,800[/TD2][TD2]0[/TD2]

[TD2]145,000[/TD2][TD2]130,000[/TD2][TD2]127,988[/TD2][TD2]0[/TD2]

[TD2]

915,000

[/TD2][TD2]

907,531

[/TD2][TD2]

925,495

[/TD2][TD2]

551,113

[/TD2]

[TD2]

-392,303

[/TD2][TD2]

-240,916

[/TD2][TD2]

-257,549

[/TD2][TD2]

85,622

[/TD2]

[TD2]6,000[/TD2][TD2]4,785[/TD2][TD2]3,090[/TD2][TD2]2,858[/TD2]

[TD2]-65,000[/TD2][TD2]-54,441[/TD2][TD2]-46,146[/TD2][TD2]-46,713[/TD2]

[TD2]-54,000[/TD2][TD2]-54,000[/TD2][TD2]-53,200[/TD2][TD2]0[/TD2]

[TD2]-12,000[/TD2][TD2]-41,208[/TD2][TD2]-18,098[/TD2][TD2]-11,756[/TD2]

[TD2]-29,500[/TD2][TD2]0[/TD2][TD2]0[/TD2][TD2]0[/TD2]

[TD2]

-546,803

[/TD2][TD2]

-385,780

[/TD2][TD2]

-371,903

[/TD2][TD2]

30,011

[/TD2]

[TD2]20,000[/TD2][TD2]15,647[/TD2][TD2]25,278[/TD2][TD2]8,133[/TD2]

[TD2]

-566,803

[/TD2][TD2]

-401,427

[/TD2][TD2]

-397,181

[/TD2][TD2]

21,878

[/TD2]

[TD2]-50,000[/TD2][TD2]-65,030[/TD2][TD2]-66,904[/TD2][TD2]0[/TD2]

[TD2]

-516,803

[/TD2][TD2]

-336,397

[/TD2][TD2]

-330,277

[/TD2][TD2]

21,878

[/TD2]

[TD2]167,500[/TD2][TD2]165,212[/TD2][TD2]162,129[/TD2][TD2]148,991[/TD2]

[TD2]167,500[/TD2][TD2]165,212[/TD2][TD2]162,129[/TD2][TD2]156,935[/TD2]

[TD2]

-3.09

[/TD2][TD2]

-2.04

[/TD2][TD2]

-2.04

[/TD2][TD2]

0.14

[/TD2]

[TD2]-516,803[/TD2][TD2]-336,397[/TD2][TD2]-330,277[/TD2][TD2]21,878[/TD2]

[TD2]120,000[/TD2][TD2]116,042[/TD2][TD2]103,717[/TD2][TD2]89,543[/TD2]

[TD2]29,500[/TD2][TD2]0[/TD2][TD2]11,571[/TD2][TD2]0[/TD2]

[TD2]-367,303[/TD2][TD2]-220,355[/TD2][TD2]-214,989[/TD2][TD2]111,421[/TD2]

[TD2]

-2.19

[/TD2][TD2]

-1.33

[/TD2][TD2]

-1.33

[/TD2][TD2]

0.71

[/TD2]