Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

All discussion of Lucid Motors

- Thread starter Right_Said_Fred

- Start date

Another Lucid Air recall: https://static.nhtsa.gov/odi/rcl/2024/RCLRPT-24V011-9593.PDF

HV coolant heater fails and doesn't provide cabin, or defrost, heat with no warning/notification to the driver. The recall will be to update the software to identify when the heater has failed and notify the driver and then replace it. (Apparently the same failure prone part was used in the Jaguar I-Pace and was recalled in July, but they replaced all of them rather than try to identify just the failed ones..)

HV coolant heater fails and doesn't provide cabin, or defrost, heat with no warning/notification to the driver. The recall will be to update the software to identify when the heater has failed and notify the driver and then replace it. (Apparently the same failure prone part was used in the Jaguar I-Pace and was recalled in July, but they replaced all of them rather than try to identify just the failed ones..)

Lucid has analyzed failures in early versions of High Voltage Coolant Heaters (HVCH) supplied by Webasto AG (the “Supplier). The HVCH supplies warm air for both cabin heat and defrost capability in Lucid Air vehicles. Lack of defrost capability poses a safety risk due to a possibility of obstructed driver vision. Lucid has identified 25 HVCH delamination failures out of 5,283 HVCH manufactured prior to July 2022. HVCH manufactured from July 2022 to February 2023 incorporated Supplier process improvements and additional screening by Supplier, and only 2 of 8,030 HVCH suffered a delamination failure. HVCH manufactured since February 2023 are of a new Supplier design that is not subject to delamination. Lucid is conducting a recall of 2,042 model year 2022–23 Lucid Airs that may have HVCH manufactured prior to July 2022 (the “Suspect HVCH”). Lucid anticipates that approximately 1% of Suspect HVCH will experience a delamination failure. The recall remedy includes a software update to identify any HVCH failure when it occurs, and in the event of a failure, to provide a warning on the glass cockpit panel about the lack of defrost capability, and advise the owner to contact Lucid for an HVCH replacement, at no cost. In addition to the required recall notifications by first-class mail, Lucid will also notify affected customers via email and the Lucid mobile app to update their vehicle software. Additionally, Lucid is monitoring vehicle telemetry for HVCH failure and Lucid will proactively contact customers who experience a failure.

Doggydogworld

Active Member

It's even less. They can't realistically operate with less than 2b of cash. Their target market is too financially savvy to buy that close to BK. That's probably hurting sales already.The end isn’t “near” but if you divide the money left by the amount consumed on average over the last 4 quarters, you can calculate it, and it’s not decades off. It’s more like 4-6 quarters off.

The Saudis have no real ability to fix this. As I've said before, Toyota should buy them and make Lucid a Lexus sub-brand. Their sales and supply chain muscle could lift them to break-even in a reasonable time frame. Honda needs their technology even more, and might be able to pull it off.

I still think Mercedes should have bought Lucid 6-7 years ago during their original funding crunch. But it was still early days and Mercedes had plenty of time for in-house development. Japan today is much further behind.

SwedishAdvocate

Active Member

Rawlinson has been the problem since day one....he is the literal embodiment of the perfect being the enemy of the good

If that was the case – then why is the Lucid Air (and the Gravity) not better looking?... Also: I fail to see what it is that is "perfect" with their current ownership structure...

Samurai51

Member

Ehhh, I don't know if either Japanese company looks at Lucid as a way forward. The return-on-investment argument is hard to support.It's even less. They can't realistically operate with less than 2b of cash. Their target market is too financially savvy to buy that close to BK. That's probably hurting sales already.

The Saudis have no real ability to fix this. As I've said before, Toyota should buy them and make Lucid a Lexus sub-brand. Their sales and supply chain muscle could lift them to break-even in a reasonable time frame. Honda needs their technology even more, and might be able to pull it off.

I still think Mercedes should have bought Lucid 6-7 years ago during their original funding crunch. But it was still early days and Mercedes had plenty of time for in-house development. Japan today is much further behind.

Outside of us EV-interested folks here, I don't think the Lucid brand has much recognition at all with the general public. Lucid have also been unable to ramp production -- so the degree to which savings could be realized from economies-of-scale are murky at best. Technology? Lucid has some pretty interesting aspects, but is it worth taking on all their debt?

If Lucid falls apart, I could comprehend a small bidding war for some of their patents and maybe for hiring some of their engineers & designers. But probably not much beyond that.

I don't know if that is true. If they had ramped production then they would have even more inventory on hand, as there appears to be inadequate demand. (They are already producing more than they sell.)Lucid have also been unable to ramp production

Can you imagine what would be going through Rawlinson’s mind when his company gets bought up and his technology gets put in a cheap car with a Lucid badge slapped onEhhh, I don't know if either Japanese company looks at Lucid as a way forward. The return-on-investment argument is hard to support.

Outside of us EV-interested folks here, I don't think the Lucid brand has much recognition at all with the general public. Lucid have also been unable to ramp production -- so the degree to which savings could be realized from economies-of-scale are murky at best. Technology? Lucid has some pretty interesting aspects, but is it worth taking on all their debt?

If Lucid falls apart, I could comprehend a small bidding war for some of their patents and maybe for hiring some of their engineers & designers. But probably not much beyond that.

Samurai51

Member

Yes, but whether it's due to limited demand or technical hurdles, the non-ramp up of production means they have not demonstrated what kind of economies-of-scale would result. I can see where any potential buyer would be concerned by this.I don't know if that is true. If they had ramped production then they would have even more inventory on hand, as there appears to be inadequate demand. (They are already producing more than they sell.)

Doggydogworld

Active Member

Lexus has the brand recognition. And the distribution channel. And they eliminate warranty/service fears.Outside of us EV-interested folks here, I don't think the Lucid brand has much recognition at all with the general public.

They can't sell them. Heck, Rawlinson couldn't sell hand warmers to Eskimos. The tear downs don't show anything uniquely expensive, they just lack volume and supply chain clout. Both of which Toyota can provide.Lucid have also been unable to ramp production

Debt is 2b vs. 3.5b+ cash. Market cap is down to 6.5b, but the public only owns about 2b. I figure the Saudis just want out and would cut a deal for CVRs or something.Technology? Lucid has some pretty interesting aspects, but is it worth taking on all their debt?

I'm afraid no one is going to buy Lucid until they are in chapter 11, 7 or whatever liquidates. Why buy their debt when the fire sale is coming without it? Why assume debt when you can buy the assets and knowledge for pennies on the dollar.

Now, I don't want this to happen. I don't hope it will happen. I just don't see how it is not going to happen. Many say the Saudis will back them no matter what. I give that a 50% chance and it's impossible for me to wrong.

My math said they would not survive past the end of 2024 (leaving a couple hundred million to pay lawyers to shut down). Let's see what happens.

Now, I don't want this to happen. I don't hope it will happen. I just don't see how it is not going to happen. Many say the Saudis will back them no matter what. I give that a 50% chance and it's impossible for me to wrong.

My math said they would not survive past the end of 2024 (leaving a couple hundred million to pay lawyers to shut down). Let's see what happens.

Samurai51

Member

I agree. I'd love to see Lucid succeed and thrive, because I want the market to have plenty of competition and for consumers to have a lot of choices. But I don't think it's likely for reasons hit upon multiple times in this thread. Setting aside the debate over if/when Saudi patience will finally collapse, I don't see the enticement for any other buyer to swoop in prior to bankruptcy.I'm afraid no one is going to buy Lucid until they are in chapter 11, 7 or whatever liquidates. Why buy their debt when the fire sale is coming without it? Why assume debt when you can buy the assets and knowledge for pennies on the dollar.

Now, I don't want this to happen. I don't hope it will happen. I just don't see how it is not going to happen. Many say the Saudis will back them no matter what. I give that a 50% chance and it's impossible for me to wrong.

My math said they would not survive past the end of 2024 (leaving a couple hundred million to pay lawyers to shut down). Let's see what happens.

No offense to the fans of Lucid -- I know they exist. But for the target market -- luxury sedan and soon-to-be luxury SUV owners, I don't see any evidence the Lucid "brand" has significant consumer appeal or strength. And, again, Lucid have never reached the rate of production that could potentially provide real economies of scale that might lead to an all-important positive profit margin. This also likely means their one existing factory and the other one in the works probably has much less value than the average person might expect.

RobStark

Well-Known Member

Sapphire came back to the drag strip. Got 9.072. Still not 8.9. Reaction time of Lucid driver is about a tenth slower than Plaid driver. Sapphire bone stock. Plaid minus rear seats and trim for 172 lbs weight reduction.

Sapphire beat Plaid in 1/4 mile by about a car length. Tesla Plaid Channel points it is $89k vs $249k. At $89k you don't get the good brakes, wheels capable of 200 mph, or FSD. Sapphire has forged wheels, carbon ceramic brakes, and Dream Drive Pro as standard. Plaid is a better value but Sapphire best showing is at a road course not a drag strip.

Another Lucid Air recall for loss of power while driving: https://static.nhtsa.gov/odi/rcl/2024/RCLRPT-24V076-6758.PDF

Fixed via an OTA software update.

It sort of sounds like it is caused by phantom braking and the user overriding the braking.

Fixed via an OTA software update.

It sort of sounds like it is caused by phantom braking and the user overriding the braking.

For the fault to occur, the Lucid vehicle must be operating on an Affected Version of software and have Adaptive Cruise Control (ACC) on; the Lucid vehicle must then detect an unexpected obstacle or other vehicle that causes ACC to decelerate, the driver must accelerate to override ACC, and then, within a narrow time window, the driver must cancel ACC via either the steering wheel button or by braking.

RobStark

Well-Known Member

And yet the cons of the Lucid are FAR worse than the Tesla, IMO. And the yoke is a moot point now since it’s an option. Should have compared the 2024 Tesla.

DBV1

Member

Sure hope it would win first place, when it is almost 3 times the cost of a Plaid. Who would pay that?

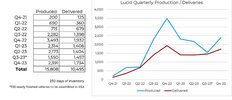

Lucid earnings were not good. Only projecting to sell 9000 cars this year. Feel bad for them, as they are just not catching on. Will be challenging for them.

Selling 9000 cars or building 9000 cars? This is a disaster for Lucid. This is a disaster for their cash pile which is dwindling.

Sure hope it would win first place, when it is almost 3 times the cost of a Plaid. Who would pay that?

What’s worse is that if all things were equal, if the Air was exactly the same as the Model S, they’d have even less sales because what reason would there to be to have risk buying an Air when Lucid may not be around in 12 mo the to service it?

Lucid is going broke. Forget the car. Just look at the sales and the losses. It’s a train wreck in slow motion. They’re stuck on The tracks and the train of bankruptcy is barreling at them.

I agree...when Tesla first sold the S, they were also in a precarious position...but they had an inbuilt market of early adopters....that market is now mature and the niche for vastly expensive 1500 hp limousines is probably negligible...and if you did buy one, you aren’t the sort of guy to take out a multimeter when it goes wrong...and a defunct company is of no use to youSelling 9000 cars or building 9000 cars? This is a disaster for Lucid. This is a disaster for their cash pile which is dwindling.

What’s worse is that if all things were equal, if the Air was exactly the same as the Model S, they’d have even less sales because what reason would there to be to have risk buying an Air when Lucid may not be around in 12 mo the to service it?

Lucid is going broke. Forget the car. Just look at the sales and the losses. It’s a train wreck in slow motion. They’re stuck on The tracks and the train of bankruptcy is barreling at them.

Similar threads

- Replies

- 2

- Views

- 138

- Replies

- 3

- Views

- 339

- Replies

- 2

- Views

- 415

- Locked

- Marketplace listing

- Replies

- 1

- Views

- 408

- Replies

- 0

- Views

- 196