bdy0627

Active Member

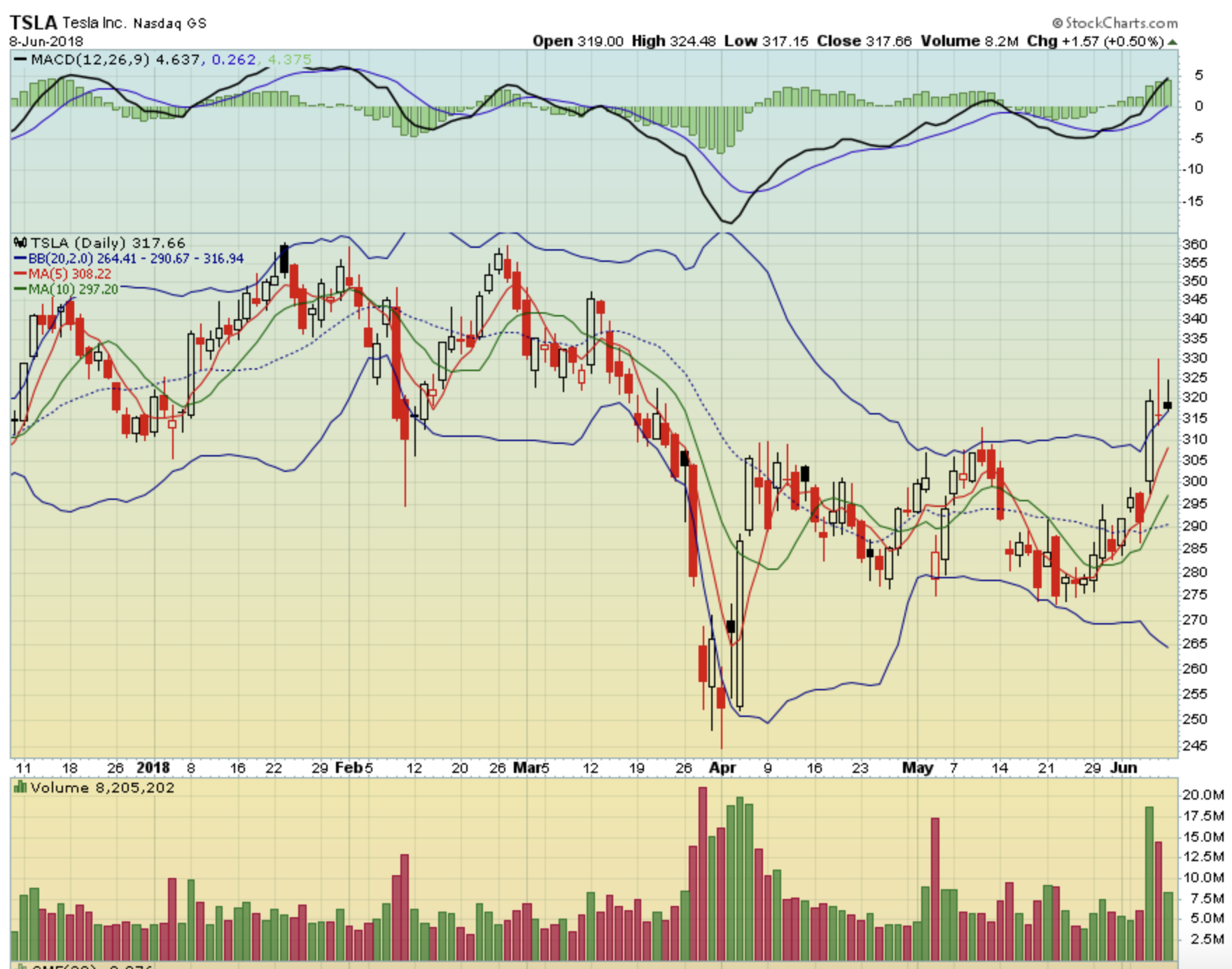

Now let's zoom in to the dip in February to see how these indicators played out. That reversal was quick with no indecision at the bottom.

Here's the daily chart. Notice just how far the stock dove below the lower bb on Feb 9th.

Now here's the zoomed in hourly chart:

Notice the high volume candles, red and green. The buying support is strong as demonstrated by the green candles with growing volume. The reversal is clear.

The take home point I think is to carefully look at the buying support even when the stock dips below the lower bb. If the response seems indecisive, beware. It's safest just to wait until it becomes clear. Much better to have missed adding at the bottom than to have added leverage before an additional big drop. I have mistakenly guessed at the bottom several times, adding leverage. I hate seeing paper losses accumulate as the dip worsens, but each time I have added more leverage near the eventual bottom anyway and have ended up coming out of the dip with profits.

Here's the daily chart. Notice just how far the stock dove below the lower bb on Feb 9th.

Now here's the zoomed in hourly chart:

Notice the high volume candles, red and green. The buying support is strong as demonstrated by the green candles with growing volume. The reversal is clear.

The take home point I think is to carefully look at the buying support even when the stock dips below the lower bb. If the response seems indecisive, beware. It's safest just to wait until it becomes clear. Much better to have missed adding at the bottom than to have added leverage before an additional big drop. I have mistakenly guessed at the bottom several times, adding leverage. I hate seeing paper losses accumulate as the dip worsens, but each time I have added more leverage near the eventual bottom anyway and have ended up coming out of the dip with profits.