I have a theory. Those automakers that dominate the EV market will eventually dominate dominate the whole auto market.

What's more, I think the top 5 or 6 EV makers will capture 80% share of the EV market and ultimately 80% of the whole auto industry. This implies substantial consolidation in the auto industry. Right now VW and Toyota compete for top automaker by market share. Each hold about 10%. But my outlook is that Tesla can capture more than 20% of the EV market and hold onto this as EVs squeeze ICE out to the market. Thus, Tesla arrives at 20% share of the whole auto market. But Tesla might not be the only EV maker to follow this path to 20% market share. The critical issue is the pace at which these EV market leaders bring product to market. Those that grow above 50% per year will gain the lion's share of the market.

So who will this top 5 EV market leaders be? That is the topic of this thread.

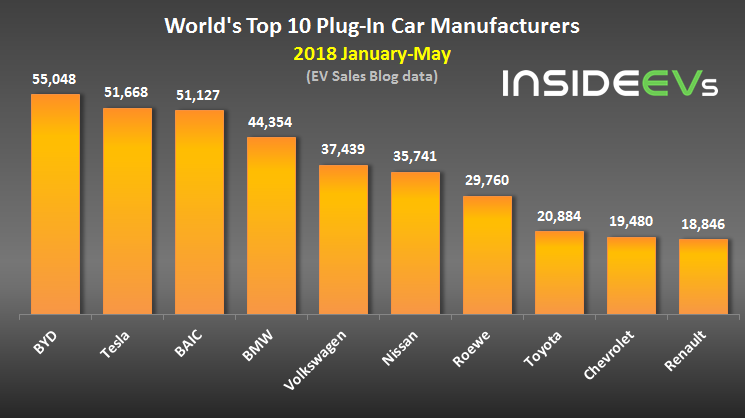

But first let's see where things stand as of May 2018.

Global Plug-In Electric Car Sales Booming - Market Expands 75%

Can Tesla beat out BYD and when? Will Toyota or Chevrolet ever be able to catch up with the top 3 or even the top 6? Will the gap widen between the top 3 and and the eighth thru tenth? So many questions! This is truly the great EV race.

What's more, I think the top 5 or 6 EV makers will capture 80% share of the EV market and ultimately 80% of the whole auto industry. This implies substantial consolidation in the auto industry. Right now VW and Toyota compete for top automaker by market share. Each hold about 10%. But my outlook is that Tesla can capture more than 20% of the EV market and hold onto this as EVs squeeze ICE out to the market. Thus, Tesla arrives at 20% share of the whole auto market. But Tesla might not be the only EV maker to follow this path to 20% market share. The critical issue is the pace at which these EV market leaders bring product to market. Those that grow above 50% per year will gain the lion's share of the market.

So who will this top 5 EV market leaders be? That is the topic of this thread.

But first let's see where things stand as of May 2018.

Global Plug-In Electric Car Sales Booming - Market Expands 75%

Can Tesla beat out BYD and when? Will Toyota or Chevrolet ever be able to catch up with the top 3 or even the top 6? Will the gap widen between the top 3 and and the eighth thru tenth? So many questions! This is truly the great EV race.