Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

camalaio

Active Member

My ICBC basic is 1200 with 43% discount...

Ouch. Is basic coverage different depending on location? I think we also have the stipulation of all drivers needing to be licensed for 10 years or more to drive the car. Not sure if that impacts the basic price, or just the optionals.

Ouch. Is basic coverage different depending on location? I think we also have the stipulation of all drivers needing to be licensed for 10 years or more to drive the car. Not sure if that impacts the basic price, or just the optionals.

I have that 10 years all drivers thing too. My wife doesn't have 10 years but she's not driving my car.

Nepassnakes

Member

I don’t know how is been covered yet but I just ordered my car and Tesla is asking me for proof of registration, my insurance rep said it’s impossible to get registration without a vin. The Tesla sales rep said registration is needed to get a vin (Im thinking this is not true). Is it possible to get your car registered without a vin?

hiener

Member

Ouch. Is basic coverage different depending on location? I think we also have the stipulation of all drivers needing to be licensed for 10 years or more to drive the car. Not sure if that impacts the basic price, or just the optionals.

$1200-1300 is about right for gvrd. Anything outside of the mainland gets really cheap.

hiener

Member

I don’t know how is been covered yet but I just ordered my car and Tesla is asking me for proof of registration, my insurance rep said it’s impossible to get registration without a vin. The Tesla sales rep said registration is needed to get a vin (Im thinking this is not true). Is it possible to get your car registered without a vin?

Do you mean in your Tesla account? It does ask for proof of insurance but that doesn’t apply in BC.

You can upload a ICBC logo file like many have in that section.

Nepassnakes

Member

MexiCanuck

Member

I went into BCAA this morning to talk about optional. They gave me a price of about $1100 for $5M third-party, $1000 deductible on collision & comprehensive, and Plus replacement (50% in each of the first three years, then 90% in 4 & 5).

Later I looked at the BCAA website and saw that there is a 10% discount for BCAA members.

I figured that was a no-brainer, so I got BCAA for $115, then a discount of $91 (apparently the 10% discount doesn’t apply to everything optional). Then they looked over the estimate and found another $30-$40 in discounts, so the BCAA membership paid for itself.

(I was going to try to get a discount because I will never use the “free $10 L of gas”, but I thought that was pushing it.)

Later I looked at the BCAA website and saw that there is a 10% discount for BCAA members.

I figured that was a no-brainer, so I got BCAA for $115, then a discount of $91 (apparently the 10% discount doesn’t apply to everything optional). Then they looked over the estimate and found another $30-$40 in discounts, so the BCAA membership paid for itself.

(I was going to try to get a discount because I will never use the “free $10 L of gas”, but I thought that was pushing it.)

I went into BCAA this morning to talk about optional. They gave me a price of about $1100 for $5M third-party, $1000 deductible on collision & comprehensive, and Plus replacement (50% in each of the first three years, then 90% in 4 & 5).

Later I looked at the BCAA website and saw that there is a 10% discount for BCAA members.

I figured that was a no-brainer, so I got BCAA for $115, then a discount of $91 (apparently the 10% discount doesn’t apply to everything optional). Then they looked over the estimate and found another $30-$40 in discounts, so the BCAA membership paid for itself.

(I was going to try to get a discount because I will never use the “free $10 L of gas”, but I thought that was pushing it.)

I was about to do the same but Tesla guy told me either do insurance on site or bring your insurance guy to do it there. I can’t get the paper done before hand and bring it over. BTW, BCAA quote me $860 with 2m $500 deductibles with no insurance, leisure only.

I was about to do the same but Tesla guy told me either do insurance on site or bring your insurance guy to do it there. I can’t get the paper done before hand and bring it over. BTW, BCAA quote me $860 with 2m $500 deductibles with no insurance, leisure only.

In Vancouver? My last accident was in 2010 and I was quoted $1400 >15km for work, $300 deductible.

MexiCanuck

Member

I was about to do the same but Tesla guy told me either do insurance on site or bring your insurance guy to do it there. I can’t get the paper done before hand and bring it over. BTW, BCAA quote me $860 with 2m $500 deductibles with no insurance, leisure only.

The on-site person can do the ICBC basic insurance but not the BCAA optional portion.

I had BCAA make up a full quote and print it out with a reference number.

When I take delivery I will buy the ICBC policy at Tesla, then phone BCAA with the plate number, the registration number and the BCAA policy reference number.

I will pay BCAA by credit card and have both my basic and optional insurance before I get onto a public street.

The on-site person can do the ICBC basic insurance but not the BCAA optional portion.

I had BCAA make up a full quote and print it out with a reference number.

When I take delivery I will buy the ICBC policy at Tesla, then phone BCAA with the plate number, the registration number and the BCAA policy reference number.

I will pay BCAA by credit card and have both my basic and optional insurance before I get onto a public street.

Do you have an estimate of how much of the savings will be compares to if go with ICBC in full? I’m evaluate if it worth the hassle. or maybe just buy one day from ICBC then go for BCAA.

MexiCanuck

Member

For me, the difference between BCAA and ICBC for the optional was in excess of 100%. I live on Vancouver Island and have decades of no at-fault accidents and no tickets.

Remember, if you buy coverage from anyone, including ICBC, there is a very significant administrative overhead cost. I recently bought three months of insurance on a car as I was selling it to a friend. I had the insurance for a week, then transferred the car. The refund was something like 75-80% of the three month policy. So 20-25% charge for one week of insurance over 13 weeks worth.

My commute is about 70 km each way and I drive about 40,000 km/year.

Remember, if you buy coverage from anyone, including ICBC, there is a very significant administrative overhead cost. I recently bought three months of insurance on a car as I was selling it to a friend. I had the insurance for a week, then transferred the car. The refund was something like 75-80% of the three month policy. So 20-25% charge for one week of insurance over 13 weeks worth.

My commute is about 70 km each way and I drive about 40,000 km/year.

Last edited:

For me, the difference between BCAA and ICBC for the optional was in excess of 100%. I live on Vancouver Island and have decades of no at-fault accidents and no tickets.

Remember, if you buy coverage from anyone, including ICBC, there is a very significant administrative overhead cost. I recently bought three months of insurance on a car as I was selling it to a friend. I had the insurance for a week, then transferred the car. The refund was something like 75-80% of the three month policy. So 20-25% charge for one week of insurance over 13 weeks worth.

I don’t have decades of good record but life time clean record instead

In Vancouver? My last accident was in 2010 and I was quoted $1400 >15km for work, $300 deductible.

Yes. I’m in Vancouver. I have clean record since 2002. They quote me $930 for $300 deductible. I’m not driving this to work so use it for pleasure only (for work is about $200 more annually)

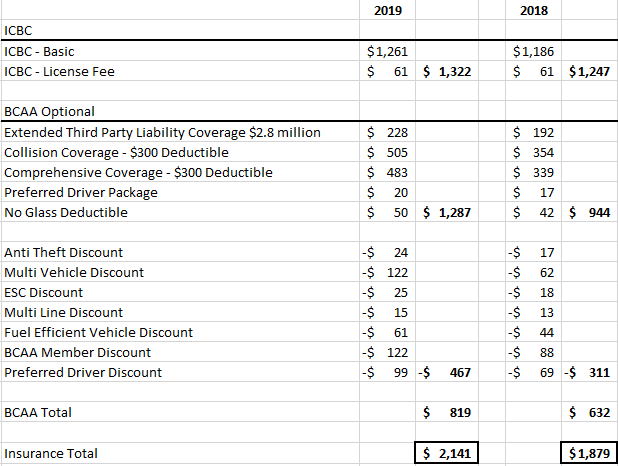

Tesla Model 3 LR RWD, all drivers 10 years or more Safe Driving, over 15km to/from work, based out of Maple Ridge, BCAA member, House Insurance with BCAA, 2 Cars with BCAA, renewed March:

Fuel Efficient Vehicle Discount needed to be manually entered for LR RWD. No replacement cost with BCAA as I have that with Aviva instead ($447 per year for 8 years up front). Can't say for sure, but I recall BCAA replacement cost plus was quoted at $180 per year for 5 years maximum and subject to change each year).

Hope this helps.

Fuel Efficient Vehicle Discount needed to be manually entered for LR RWD. No replacement cost with BCAA as I have that with Aviva instead ($447 per year for 8 years up front). Can't say for sure, but I recall BCAA replacement cost plus was quoted at $180 per year for 5 years maximum and subject to change each year).

Hope this helps.

MexiCanuck

Member

My ICBC/BCAA worked seamlessly today.

I did my paperwork with Tesla.

The ICBC person came over. He saw the BCAA quote sheet that I already had out. He observed that I would be using BCAA for optional.

I did the ICBC basic with him. He printed it.

I used a PDF scanner app on my iPad to get a copy of the ICBC paperwork.

I phoned my person at BCAA and emailed the ICBC document to her.

Twenty minutes later she emailed to me and the ICBC guy my BCAA optional insurance document.

My insurance was all in place before the car was at Tesla.

I did my paperwork with Tesla.

The ICBC person came over. He saw the BCAA quote sheet that I already had out. He observed that I would be using BCAA for optional.

I did the ICBC basic with him. He printed it.

I used a PDF scanner app on my iPad to get a copy of the ICBC paperwork.

I phoned my person at BCAA and emailed the ICBC document to her.

Twenty minutes later she emailed to me and the ICBC guy my BCAA optional insurance document.

My insurance was all in place before the car was at Tesla.

I have the SR+ RWD and I'm at BCAA right now and they're saying BCAA system isn't allowing the car to have the fuel efficient vehicle discount...

She said she's gonna call the underwriter on Monday to check.

Also is replacement cost plus actually worth it? Am I gonna jinx myself if I don't get it? It's like$483 more a year

She said she's gonna call the underwriter on Monday to check.

Also is replacement cost plus actually worth it? Am I gonna jinx myself if I don't get it? It's like$483 more a year

MexiCanuck

Member

I have the SR+ RWD and I'm at BCAA right now and they're saying BCAA system isn't allowing the car to have the fuel efficient vehicle discount...

She said she's gonna call the underwriter on Monday to check.

Also is replacement cost plus actually worth it? Am I gonna jinx myself if I don't get it? It's like$483 more a year

On a purchase this expensive, I want someone else to be on the hook if it gets destroyed in the first few years. This is a very large purchase for me. I can’t afford to do it again.

That’s what BCAA told me yesterday about the fuel efficiency discount. They said it works when they are doing the estimate, but not when activating the policy.

The explanation they gave me was that BCAA uses the Natural Resources fuel efficiency numbers that are published each year. The Model 3 SR+ (Model 3 - 50) didn’t have numbers when BCAA set the fuel efficiency models this year. The Model 3 - 60 (Model 3 MR?) is on there, but not the SR+.

https://www.nrcan.gc.ca/sites/www.nrcan.gc.ca/files/oee/files/csv/MY2012-2019 Battery Electric Vehicles.csv

2019 standard range plus is on there.On a purchase this expensive, I want someone else to be on the hook if it gets destroyed in the first few years. This is a very large purchase for me. I can’t afford to do it again.

That’s what BCAA told me yesterday about the fuel efficiency discount. They said it works when they are doing the estimate, but not when activating the policy.

The explanation they gave me was that BCAA uses the Natural Resources fuel efficiency numbers that are published each year. The Model 3 SR+ (Model 3 - 50) didn’t have numbers when BCAA set the fuel efficiency models this year. The Model 3 - 60 (Model 3 MR?) is on there, but not the SR+.

https://www.nrcan.gc.ca/sites/www.nrcan.gc.ca/files/oee/files/csv/MY2012-2019 Battery Electric Vehicles.csv

Similar threads

- Replies

- 15

- Views

- 3K

- Replies

- 21

- Views

- 3K

- Article

- Replies

- 39

- Views

- 2K

- Replies

- 9

- Views

- 1K