Oh, that's *very* interesting. That actually changes my analysis a lot. Thanks.

When Texas had to change to secondary recovery, it vastly raised the floor production price of US oil, from pennies per barrel to, IIRC, something in the $10/bbl range. (That second number could be totally wrong since it's from memory and I don't have a source readily available.) Saudi Arabia took over control of the oil market, *and* the oil price multiplied by 10, permanently (though part of that was monetary effects).

If Saudi Arabia has to change to secondary recovery, it should raises the floor production price of Saudi oil -- to $10 or $20 per barrel, I would guess? I wish I had a better reference for that. If they have to switch to tertiary recovery (not yet!) then upwards of $25/bbl, I believe...

California has had staggering oil reserves too. They started secondary recovery before Texas did. My sister was a Geologist at Getty in California when they merged with Texaco. The Texaco people were bragging about how they were cutting edge in secondary recovery in Texas but ended up embarrassed when they found out they were 15 years behind Getty.

So my general model involves:

-- the floor production price of oil (cheapest oil) going up

-- the marginal production price of oil (most expensive oil) going up

-- the price of substitution -- the price of oil at which people switch to alternatives -- going down

Interesting things happen at all stages along this, but perhaps the most fascinating happens when the price of substitution drops below the floor production price, because that is the actual end for oil. Raising the floor production price has a big impact on when that happens.

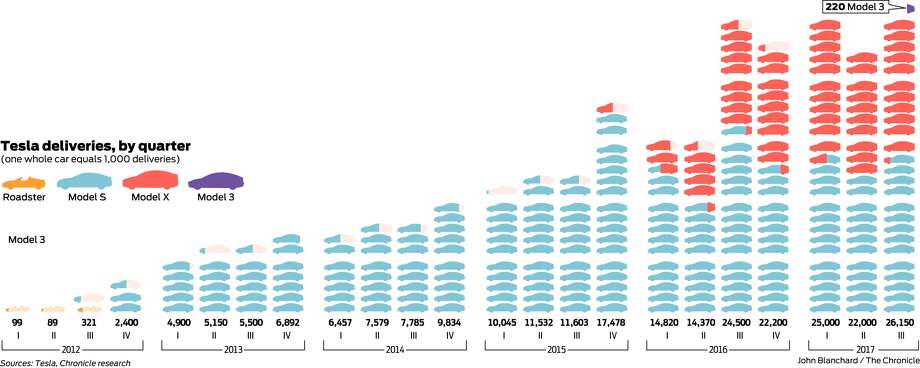

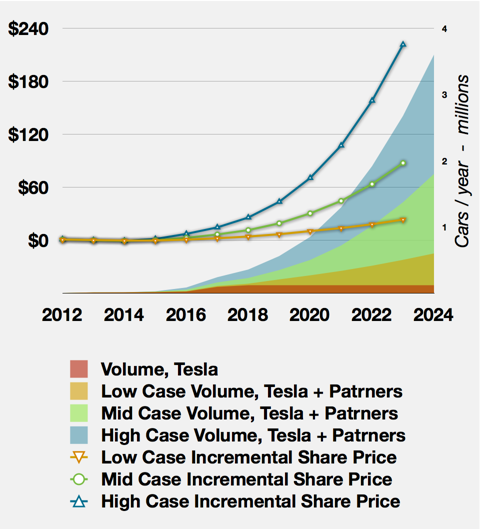

Unfortunately right now substitution isn't constrained by price but by production capacity of substitutes (!!!). This does mean that the faster Tesla can ramp up, the better -- for years to come they'll be selling into a market where people are falling over themselves to get off of oil. Tesla can make a lot of mistakes and still do well as long as the market remains *unbalanced*: at almost any price point, demand exceeds supply and manufacturers can't keep up with demand. The market will remain unbalanced until production capacity can catch up.

I suspect the price of oil is also a major political football. There was an interview I heard about 15 years ago with an investigative journalist who looked at the price of oil since the 1980s and how the US and its allies have manipulated it for geopolitical purposes. It was kept artificially low until the USSR collapsed. The journalist had interviewed the last Soviet foreign minister and he thought the low price of oil had contributed to the fall of the Soviet Union.

After the USSR fell, the price of oil went up and stayed up until Putin invaded Crimea and then it crashed again. High oil prices hurt China who is dependent on foreign oil. The US also spiked some oil deals China made along the way.

When the glut of oil from the Bakkan started coming online, there was a lot of head scratching about why the price of oil remained high. The supply went way up, but the price remained the same. I predicted it would drop when Russia did something the US didn't like and that is what happened.

Fascinatingly, you're wrong about this when it comes to the Integrated Oil Companies. Although oil exploration is very expensive, it's now very unproductive, and they would be much better off if they didn't do any of it, *they insist on doing it anyway*.

Specifically, most of the oil "majors" insist on burning money on oil exploration. It's some kind of psychological problem -- I attribute it to their identity as "oilmen". I've been wondering when they'll get over this psychological hangup, and there seem to be some inroads, but they aren't over it yet.

The National Oil Companies may have less psychological investment in being "oilmen" so they may be willing to abandon exploration much sooner.

I have a good friend who is a retired exploration Geophysicist and my sister is a production Geologist in California. My father also did work for Union Oil. I've heard a lot about what's going on in the oil biz since around 1980 and a bit before that. Around 1990 the bean counters took over the major oil companies and they closed down a lot of their exploration departments. Exploration and production geoscientists as well as petroleum engineers were getting laid off right and left.

A significant number left the business entirely. My sister got laid off from Mobil and took a job as #2 at a small Geology firm in Bakersfield. The company was started by a friend of hers who had been laid off as a manager at Occidental after they closed his entire department.

Their first projects were working to rehab the Russian oil fields which suffered from decades of mismanagement. It was the only work there was then. They suffered for a few years until the price of oil went back up and then she started raking in the cash.

My friend managed to hang on at Marathon Oil and took early retirement at 55 to take a job at a small Geology firm in Houston.

Both said that the oil companies were farming out a lot of the work developing new oil and rehabbing old ones because they didn't have the staff anymore. They also both said there was such a massive shortage of professionals still in the business they were overwhelmed with work. My friend got burned out because he had to do the work of an entire department of 6 people. The other 5 jobs in his department remained open because there was nobody to fill them.

My sister worked 80 hour weeks for several years and she made a huge wad of money. She tried retiring once, but the phone kept ringing. She quoted astronomical hourly rates and they kept biting.

Since the price of oil dropped, the development work has dried up. My friend retired just ahead of being laid off and my sister said her business had one paying project all last year. She had to lay off all her staff. She had investment income to fall back on, but she's the sort of person who frets about spending her retirement living under a bridge no matter how much money she has.

The oil companies today are most interested in refining and marketing. They farm out most of the exploration and development when the price of oil is high. When the price is low, the support companies starve and the oil companies rake in huge profits.

Battery-operated ocean-going ships is solved technology, actually. It's just not yet cheap enough to compete with ultra-cheap high-polluting bunker fuel. (It reduces cargo capacity on the ships.)

Airplanes actually have a technology problem due to the very tight weight issues with airplanes.

It's a trade off of cargo space vs propulsion space. Back in the 50s there were some ideas about nuclear powered freighters, but the problem was the power plant required more space than a conventional power plant and fuel tanks. The reduced cargo space made it unprofitable.

Current batteries take up about 33X more space per KWH than liquid fuel. Even if you triple the energy efficiency, you still need 11X more space for fuel than with a conventional ship.

Solar, obviously. Sun is everywhere. Eliminating the fuel supply lines is a humungous benefit. US Army management is often deeply incompetent so I don't know when they'll actually convert wholesale, but it's totally obvious.

That's quite possible on permanent bases, but you would need hundreds of acres of solar cells to keep a unit of any size in the field. That is not workable for many reasons: sometimes the sun doesn't shine, that much space taken up with panels would let the enemy know where you are and would make your fuel supply very vulnerable to attack, and you can't ship in more sunlight when you need more energy than you have locally.