Thanks for everyone's posts - it's a little refreshing to come back to the long-term thread after spending maybe a little too much time on the short-term and debt ceiling threads.

I could have included a bunch of the preceding posts, but the 3d chess comment resonated. What happens to projections and cash flow if everything is moved up 6 months?

When Model X was postponed:

1) Cars were coming off the line at about 200/wk,

2) There was a reservation list, but not a good idea of demand in the US, much less the rest of the world,

3) There were significant challenges with the supply chain to produce more cars,

4) TESLA not only had a negative balance sheet with $225 million in cash and $460 million in debt, they had negative gross margins on the cars they were producing....etc, etc. etc. They would have been fools to stay with their proposed 2013 rollout of X.

Contrast that to now:

1) Cars coming off the line at 7-800/week or 38-42k/year (as per Craig cfOH) - in the Q2 conference call Elon said they were going to solve the supply chain problems by Q1 or Q2 of 2014...I think he was sandbagging and they are, for the most part, solved - including the good information in previous posts about battery production coming online for 50-80k per year.)

2) Very good feel for demand in US and better feel for demand in Europe and Asia - I believe Elon is supply, not demand constrained. 42k of Model S in 2014 seems doable (with some reports of a goal of 51k).

3) A positive balance sheet, with over $750 million in cash, profitable quarters, approaching 25% margins and the potential to reduce some of the outstanding $460 million of debt if some of the convertible bondholders convert to stock - (note: the bond trading activity for the convertible bonds looks to be between 20-50% less than before the conversion date (

http://finra-markets.morningstar.co...93595&startdate=09/02/2012&enddate=09/02/2013). Increased Brand recognition, new stores, free marketing, supercharger rollout, experience with global deliveries, etc. etc.

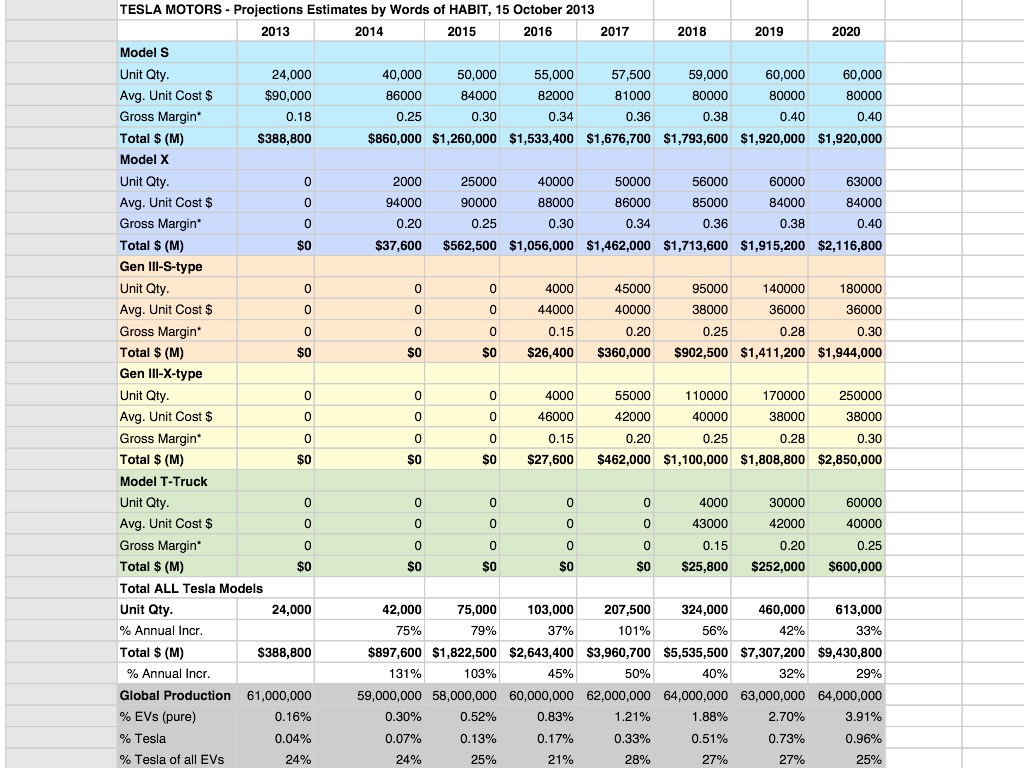

Which gets me back to the 3d chess. I think Elon et al were prudent to delay Model X rollout until "late" 2014 in March of this year. Barring some engineering challenge, I think they would be fools not to accelerate the rollout to "early" or "mid" 2014 as part of their guidance for 2014. I think when Elon is talking about production rates, margin and supply chain, he is solving for S + X, while the analysts believe he is solving for S. If it is solving for S + X then that = $ for shareholders as a "mid" 2014 rollout would potentially mean 42,000 S + 10 - 15,000 X =52-57k production for 2014 and a bigger lever to move the logistics, plants, supply chain, etc for gen3.

Fun to think about....