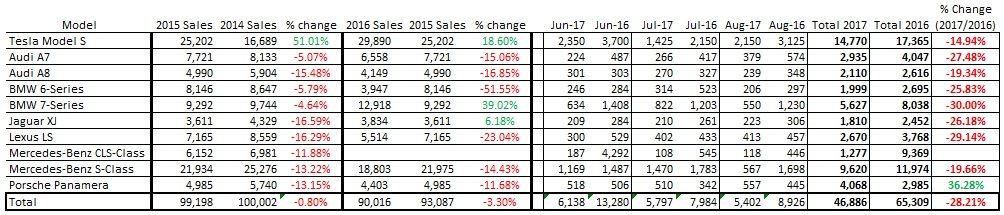

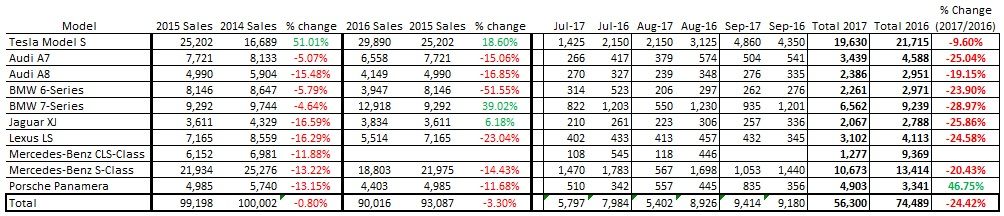

Even though the Model S's sales are down in the US, its market share is up. At this point in 2016 it had a little over 26% of the market and now it has 31.5%.

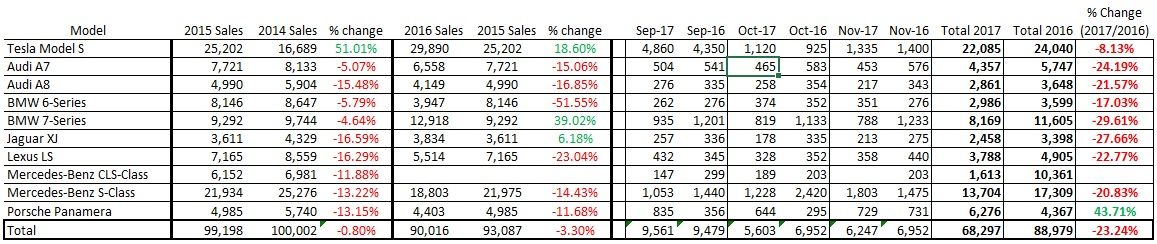

Sedans are a shrinking market though. I read Toyota is considering dropping some of its sedans in coming years, the Lexus LS and Avalon among them. I believe Ford is dropping the Taurus in the US after the 2017 model year. Their new sedan platform is only available as the Continental outside of China.

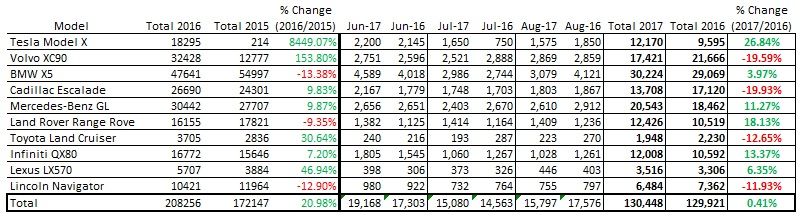

Various types of vehicles with hatches have become more popular. Even companies like Porsche are making them. The Model S holds its own in large part because it and the X are the best EVs in the world (currently available), but also it has a hatch. Tesla will see strong sales for the Model 3 when it's introduced, but I suspect it will suffer when the Model Y hits the market.

Sedans are a shrinking market though. I read Toyota is considering dropping some of its sedans in coming years, the Lexus LS and Avalon among them. I believe Ford is dropping the Taurus in the US after the 2017 model year. Their new sedan platform is only available as the Continental outside of China.

Various types of vehicles with hatches have become more popular. Even companies like Porsche are making them. The Model S holds its own in large part because it and the X are the best EVs in the world (currently available), but also it has a hatch. Tesla will see strong sales for the Model 3 when it's introduced, but I suspect it will suffer when the Model Y hits the market.