We need chemicals. All kinds of them. Lots of them.

Too much of our chemical supply comes from

oil and gas, but if there's one thing I know in my limited understanding of chemical engineering, it's that almost everything is negotiable if you’re willing to pay the price of fighting entropy by expending enough energy. Many chemical synthesis processes are known and fairly well researched but have been rightfully shelved because of their wasteful energy consumption. When energy suddenly explodes in abundance and affordability, that changes everything. We are about to enter a new era of brute force chemical synthesis driven by cheap SWB power.

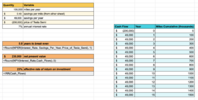

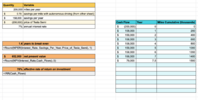

Energy-intensive processes exist to synthesize all of the following primary chemicals using solar power and abundant material inputs including primarily air, water, salt (NaCl) and limestone (calcium carbonate CaCO3):

- Methane

- Ammonia

- Hydrogen

- H2

- Water electrolysis or Chloralkali Process

- Hydroxide

- Carbon monoxide

- CO

- Steam reforming of CH4 or High-temperature electrolysis of CO2

- Lye / Sodium hydroxide

- Chlorine

- Ethanol

- CH3CH2OH

- Fermentation of sugar with yeast or new electrochemical process published in 2017

- Sodium carbonate

- Na2CO3

- Obtainable by mining, but also can be synthesized with the Solvay Process

- Quicklime

- CaO

- High-temperature calcination of limestone (CaCO3)

- Ozone

- O3

- Coronal Discharge Method or Electrolysis of H2O

Out of all the chemicals on this list, only sodium hydroxide and ozone are currently mass-produced with electric power, with the rest directly relying on coal and natural gas as either feedstocks or heat sources.

With these basic building blocks and ultra-low cost of energy, almost any imaginable chemical can be synthesized. As a matter of fact, today’s chemical industry already makes extensive use of the chemicals in this list to knit together bigger molecules. I would encourage you to go explore Wikipedia for any of these chemicals to see the possibilities. These primary chemicals can also be used to synthesize a wide variety of derivative chemicals currently produced by cracking petroleum, because syngas of CO + H2 + steam can go through the Fischer-Tropsch process to form liquid hydrocarbons we typically get from oil. Other pathways exist too, and I'm not enough of an expert in this area to know which is best. However, I am fairly confident that cheap SWB energy and cheap H2 and CH4 will make it economically competitive to produce key chemicals like olefins, higher alkanes, carbon monoxide, formaldehyde, and aromatics.

I do not have the requisite expertise in chemical engineering to estimate how much of the cost is affected by energy compared to other factors, but the outlook is good especially as the hydrocarbon mining industry dwindles and loses economies of scale. Also, there may be ways to exploit cheap energy with tradeoffs that reduce these other costs.

It could get even crazier. If we get to a point where we can use machine learning models like AlphaFold to reliably

design proteins in a reasonable timeframe and then use genetic engineering techniques like CRISPR to insert the corresponding gene sequences into microorganisms for precision fermentation, in principle we could theoretically make a practically unlimited supply of our own customized organic catalysts to unlock even more potential for a sustainable abundant chemicals industry. Among the benefits of customized enzymes would be lower cost, higher yield, improved energy efficiency, reduced undesirable byproducts, and higher throughput. This is a long shot because protein folding and enzyme behavior are extremely complicated to model computationally and even advanced AI may not be able to solve protein design in a practical computational budget. However, the known laws of physics don’t preclude the possibility and if it works it will literally catalyze the growth of the chemical synthesis industry even more than cheap SWB energy alone.

Methane and hydrogen synthesis from CO2 and H20 could by themselves drive a 10x or more bump in energy consumption because it requires splitting H20 and CO2 molecules which has very low thermodynamic efficiency since those molecules are extremely stable. As Terraform Industries founder Casey Handmer wrote in a

whitepaper explaining the purpose of the startup and doing the physics calculations:

"Indeed, the quantity of electricity required to synthesize 100% of California’s natural gas demand exceeds grid consumption by more than 10:1. This means that synthetic fuel price parity will drive enormous increases in demand for solar power deployment, providing the demand necessary to keep the learning curve bending downwards."

Plus, this 10x estimate is probably understating the impact of increased consumption of methane and hydrogen driven by lower cost, again in line with the Law of Demand that predicts higher quantity demanded when price is lower.

Methane is just one of the many chemicals we need, and a huge variety of other chemicals can be derived from H2 and CH4. As far as I'm aware, we can in theory replace the main outputs of the entire petrochemical stack with air, sunshine, water, and common minerals at potentially lower cost. This matters.

Terraform Industries is a very early stage startup, and they have a competitor who also is surely aware of where solar prices are headed: SpaceX.

We already knew this though, because this method is the only possible means of in situ methane production for fuel of habitat and rockets on Mars. Elon said on the recent Everyday Astronaut interview with Tim Dodd that when Starship/Super Heavy is fully and rapidly reusable, the propellant expenses become most of the cost structure. Elon also said that the sole figure of merit for the rocket, booster, launch and manufacturing teams is to work together to reduce cost per ton to orbit. Obviously this means they will soon devote HEAVY, RELENTLESS attention and engineering prowess towards developing high throughput, low cost, environmentally friendly CO2 + H20 --> CH4 + O2 factories. What people are missing is that this also implies that SpaceX might expand to adjacent markets, which happens to include...all uses of oil and gas that can't be directly replaced with SWB power. Methane is methane. CH4 is a global commodity. There's nothing special about "rocket fuel" methane except perhaps higher purity. Ironically, the Musk Foundation may technically need to award the $100M

X-Prize for carbon capture technology to SpaceX!

No one is likely to outcompete SpaceX in any market segment where they devote the majority of their engineering resources, and once full and rapid reusability is working, methane production will be the next target. I think only Terraform has a shot at beating SpaceX by getting a head start while SpaceX focuses on Starship/Super Heavy, but then again maybe they'll be acquired by SpaceX like Hibar, Grohmann and Maxwell were acquired by Tesla.

Yes, you read that right. SpaceX looks to be in the early stages of becoming the world's largest and most profitable hydrocarbon producer. Potentially in the long run SpaceX Hydrocarbons could make today's Saudi Aramco look tiny, because SpaceX will have even lower production and distribution costs than Saudi oil & gas, and there's vastly more available carbon in the atmosphere than in Saudi crustal oil & gas reserves. SpaceX will likely get even more bonus pricing power vs. mined hydrocarbons to the extent that governments provide carbon sequestration subsidies. This is probably 20 or 30 years away but it seems almost inevitable if you look at the historical track record of SpaceX and other Musk companies and the overarching goal to "maximize the probability that the future is good".

SpaceX will need to make green hydrogen in the process, so they'll also probably be the leader in that area too. Note that Elon has always said that H2 is a poor choice for energy storage, but he has never commented on its many critical applications in chemical production...

Just as Tesla used their experience and expertise with batteries to pivot into development of a whole new business unit (Tesla Energy), SpaceX will probably make a whole new business unit to leverage their hardcore engineering and manufacturing expertise in carbon sequestration / synthetic hydrocarbon production. SpaceX Energy would effectively become a synthetic oil and gas company that mines carbon from the atmosphere and hydrogen from the hydrosphere instead of getting both from the crust.

Note that SpaceX is conveniently headquartered in Texas, the undisputed leader of the hydrocarbon industry outside OPEC nations. Texas has a huge local supply of hydrocarbon processing engineers, organic chemists, technicians, and hydrocarbon finance and consulting specialists who are all going to be looking for new work pretty soon. Texas also has relatively minimal bureaucratic hurdles for permitting for chemical factory construction, many existing organic chemical factories, gas pipelines, gobs of wind and sunshine, and cheap land. Southeast Florida was another decent option for Starbase but they chose Texas and I believe a future plan for hydrocarbon synthesis was probably one of the undisclosed reasons in favor of Texas. Mordor gentrification is proceeding at a speed that will catch almost everyone off guard.