The Accountant

Active Member

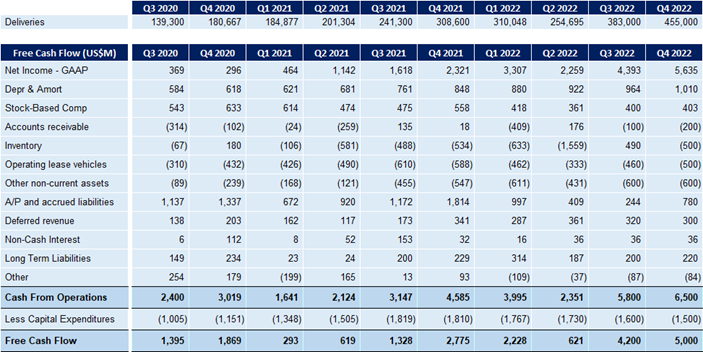

$9.2B Free Cash Flow in Back Half of the Year?

I am expecting incredibly high Free Cash Flows in Q3 & Q4 mainly driven by huge deliveries in the back half of the year.

These numbers are preliminary but I am pretty comfortable sharing them now.

The highest Free Cash Flow Tesla had generated to date was $2.8b in Q4 2021. This record will likely be smashed by $4.2b in Q3 ad $5.0b in Q4.

See details below.

I am expecting incredibly high Free Cash Flows in Q3 & Q4 mainly driven by huge deliveries in the back half of the year.

These numbers are preliminary but I am pretty comfortable sharing them now.

The highest Free Cash Flow Tesla had generated to date was $2.8b in Q4 2021. This record will likely be smashed by $4.2b in Q3 ad $5.0b in Q4.

See details below.