The Accountant

Active Member

My Earnings estimate for Q3 2020

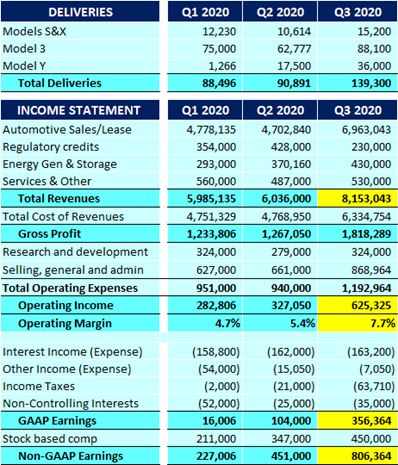

Record Revenues of $8.2B

Record Operating Income of $625m

Record Operating Margin of 7.7%

Record GAAP Earnings of $356m

Record non-GAAP Earnings of $806m

GAAP Profit of $356m higher than Reg Credits of $230m

Some key points:

- SG&A includes $190m for Elon's Performance Award; this may be understated by about $60-$80m. It depends on how Tesla determines probability of additional milestone achievements. I believe I have the most likely scenario in my estimates.

- There is a potential GAAP upside from a tax benefit of $1.4B to $1.6B if Tesla unwinds some of their Deferred Tax Valuation Allowance. I am assuming this will happen in Q4 but may come in Q3.

Record Revenues of $8.2B

Record Operating Income of $625m

Record Operating Margin of 7.7%

Record GAAP Earnings of $356m

Record non-GAAP Earnings of $806m

GAAP Profit of $356m higher than Reg Credits of $230m

Some key points:

- SG&A includes $190m for Elon's Performance Award; this may be understated by about $60-$80m. It depends on how Tesla determines probability of additional milestone achievements. I believe I have the most likely scenario in my estimates.

- There is a potential GAAP upside from a tax benefit of $1.4B to $1.6B if Tesla unwinds some of their Deferred Tax Valuation Allowance. I am assuming this will happen in Q4 but may come in Q3.

Last edited: