Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Near-future quarterly financial projections

- Thread starter luvb2b

- Start date

The Accountant

Active Member

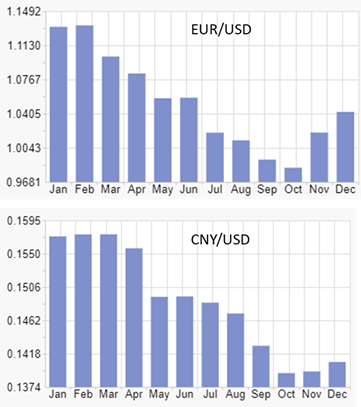

FX hit in Q4 should not be as large as in Q3.

Currency rate headwinds may be subsiding for Tesla in Q4 with the recent Euro strength. The Yuan remains weak but this is beneficial to Tesla as they have more Yuan denominated costs than Yuan denominated sales as they export half of their production with sales in Euros, Australian $, etc.

I estimate that foreign currency translation in Q3 2022 negatively impacted Tesla's earnings by about $400m vs Q3 2021. Perhaps the impact in Q4 may be half this amount. I will compute an estimate for Q4 in mid December.

Currency rate headwinds may be subsiding for Tesla in Q4 with the recent Euro strength. The Yuan remains weak but this is beneficial to Tesla as they have more Yuan denominated costs than Yuan denominated sales as they export half of their production with sales in Euros, Australian $, etc.

I estimate that foreign currency translation in Q3 2022 negatively impacted Tesla's earnings by about $400m vs Q3 2021. Perhaps the impact in Q4 may be half this amount. I will compute an estimate for Q4 in mid December.

zach_

Member

I assume Tesla converts to EUR to USD (for earnings calculation purposes) at the time of sale? If so, even though they are trying to unwind the wave, EU sales were still pretty backloaded in the quarter, at the euros weakest, but the bulk of sales may happen at the euro's strongest point this quarter. Something that might matter (as opposed to just looking at the quarterly average exchange rate).FX hit in Q4 should not be as large as in Q3.

Currency rate headwinds may be subsiding for Tesla in Q4 with the recent Euro strength. The Yuan remains weak but this is beneficial to Tesla as they have more Yuan denominated costs than Yuan denominated sales as they export half of their production with sales in Euros, Australian $, etc.

I estimate that foreign currency translation in Q3 2022 negatively impacted Tesla's earnings by about $400m vs Q3 2021. Perhaps the impact in Q4 may be half this amount. I will compute an estimate for Q4 in mid December.

View attachment 880515

Maybe getting needlessly complex here, but how about COGS then? Does COGS go through the RMB to USD conversion at the time of production? Or at the time of sale as well?

Last edited:

StarFoxisDown!

Well-Known Member

I think we all assumed that effects from currency in COGS were real-time with the timing of sales. Q3 showed that they aren't to some extent. So it could have been a situation last quarter where the currency effects on COGS happened earlier in the quarter for the production of the sales that were deliveried in the latter part of the quarter. Which was a double whammy on Tesla's earnings.I assume Tesla converts to EUR to USD (for earnings calculation purposes) at the time of sale? If so, even though they are trying to unwind the wave, EU sales were still pretty backloaded in the quarter, at the euros weakest, but the bulk of sales may happen at the euro's strongest point this quarter. Something that might matter (as opposed to just looking at the quarterly average exchange rate).

Maybe getting needlessly complex here, but how about COGS then? Does COGS go through the RMB to USD conversion at the time of production? Or at the time of sale as well?

However, if this dynamic is in fact how thing happened, the reverse would happen in Q4 where the currency was weakest at the beginning of the quarter when the production happened for the vehicles that will be delivered in the latter part of the Q4 where the currency is now stronger. So could be a potential tailwind for Q4's earnings.

zach_

Member

It seems in Q3 EUR/CNY was relatively stable, it was just the profit conversion to USD that varied throughout the quarter. In Q4 EUR/CNY itself is moving (favorably) as well. The pedant in me would love to figure out how this all should affect EPS estimates, but it feels too convoluted to be able to confidently conclude anything other than "Q4 FX is probably more favorable than Q3." Which I suppose should be enough to make me happy.I think we all assumed that effects from currency in COGS were real-time with the timing of sales. Q3 showed that they aren't to some extent. So it could have been a situation last quarter where the currency effects on COGS happened earlier in the quarter for the production of the sales that were deliveried in the latter part of the quarter. Which was a double whammy on Tesla's earnings.

However, if this dynamic is in fact how thing happened, the reverse would happen in Q4 where the currency was weakest at the beginning of the quarter when the production happened for the vehicles that will be delivered in the latter part of the Q4 where the currency is now stronger. So could be a potential tailwind for Q4's earnings.

The Accountant

Active Member

This can be a tricky topic to explain. I hope I can explain it well enough with a brief reply.I assume Tesla converts to EUR to USD (for earnings calculation purposes) at the time of sale? If so, even though they are trying to unwind the wave, EU sales were still pretty backloaded in the quarter, at the euros weakest, but the bulk of sales may happen at the euro's strongest point this quarter. Something that might matter (as opposed to just looking at the quarterly average exchange rate).

Maybe getting needlessly complex here, but how about COGS then? Does COGS go through the RMB to USD conversion at the time of production? Or at the time of sale as well?

Currency translation does not occur at the time of sale.

Tesla's European entity records transaction in Euros and maintains its financial statements in Euros. Their Chinese legal entity records and maintains its financials in CNY (RMB). When the financials are reported each month to Tesla HQ in the US, they get converted to US$ using the average exchange rate for the month. This is for the P&L, the Balance Sheet uses a different method.

Last year in October, for the European financials, €1.00 was translated to $1.16. This October €1.00 was translated to $0.93. You can see the exchange rate negative impact.

However, your point is correct in that sales in Europe occurring at the backend of the quarter is beneficial to Tesla as December's exchange rate should be better than Oct & Nov.

Oct 2022 Avg: €1.00 = $0.98

Nov 2022 Avg: €1.00 = $1.02

Dec 2022 Avg: €1.00 = $1.04 (thus far)

The Accountant

Active Member

Yes - Although there will be a negative impact to the financials from FX in Q4, it will be less of an impact than what we saw in Q3.It seems in Q3 EUR/CNY was relatively stable, it was just the profit conversion to USD that varied throughout the quarter. In Q4 EUR/CNY itself is moving (favorably) as well. The pedant in me would love to figure out how this all should affect EPS estimates, but it feels too convoluted to be able to confidently conclude anything other than "Q4 FX is probably more favorable than Q3." Which I suppose should be enough to make me happy.

This should all flip at some point in the future . . .when we will actually see a positive impact to the financials results from FX. Maybe this happens late next year.

zach_

Member

This can be a tricky topic to explain. I hope I can explain it well enough with a brief reply.

Currency translation does not occur at the time of sale.

Tesla's European entity records transaction in Euros and maintains its financial statements in Euros. Their Chinese legal entity records and maintains its financials in CNY (RMB). When the financials are reported each month to Tesla HQ in the US, they get converted to US$ using the average exchange rate for the month. This is for the P&L, the Balance Sheet uses a different method.

Last year in October, for the European financials, €1.00 was translated to $1.16. This October €1.00 was translated to $0.93. You can see the exchange rate negative impact.

However, your point is correct in that sales in Europe occurring at the backend of the quarter is beneficial to Tesla as December's exchange rate should be better than Oct & Nov.

Oct 2022 Avg: €1.00 = $0.98

Nov 2022 Avg: €1.00 = $1.02

Dec 2022 Avg: €1.00 = $1.04 (thus far)

First off, thank you for all the info you provide here. My understanding of many topics is much more nuanced and complete (or, probably more correctly, *less incomplete*Yes - Although there will be a negative impact to the financials from FX in Q4, it will be less of an impact than what we saw in Q3.

This should all flip at some point in the future . . .when we will actually see a positive impact to the financials results from FX. Maybe this happens late next year.

The first post was completely clear, and at first blush, the fact that the average exchange rate *is* how its handled was quite surprising to me. But does make more sense if I think of them as primarily separate entities that need to tally up every so often. Also I suppose tracking each individual vehicles COGS and sale price quickly becomes unrealistic.

Lastly the YoY comparison of Octobers exchange rates is massive. Tesla did themselves call out in the latest Earnings Report that FX was ~250M profit hit I believe. If (emphasis on *if*) the dollar has topped, this is a big tailwind for EPS and the market's earnings as a whole!

petit_bateau

Active Member

The Accountant

Active Member

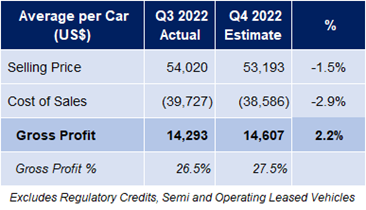

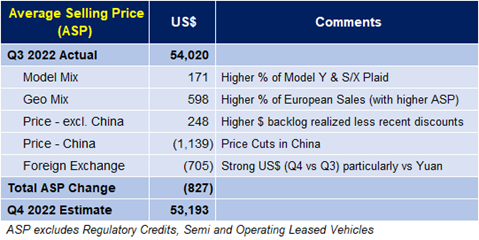

I am expecting gross profit per car (S3XY) to increase to $14.6k in Q4.

This is based on @Troy 's 428k deliveries (with slight mix adjustment to increase China)

I will update this periodically with new delivery estimates and as exchange rates change.

Higher mix of Model Y and S&X Plaids along with higher sales in Europe (where ASP is higher) help to partially offset the ASP decline due to China price cuts and foreign exchange.

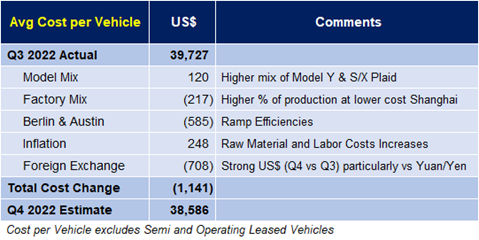

Cost per vehicle should decline due to a higher % of production at Shanghai, Berlin and Austin ramp efficiencies and the strong USD vs Yuan & Yen.

This is based on @Troy 's 428k deliveries (with slight mix adjustment to increase China)

I will update this periodically with new delivery estimates and as exchange rates change.

Higher mix of Model Y and S&X Plaids along with higher sales in Europe (where ASP is higher) help to partially offset the ASP decline due to China price cuts and foreign exchange.

Cost per vehicle should decline due to a higher % of production at Shanghai, Berlin and Austin ramp efficiencies and the strong USD vs Yuan & Yen.

JohnnyEnglish

Member

Thanks for the analysis - really helpful.I am expecting gross profit per car (S3XY) to increase to $14.6k in Q4.

This is based on @Troy 's 428k deliveries (with slight mix adjustment to increase China)

I will update this periodically with new delivery estimates and as exchange rates change.

View attachment 884906

Higher mix of Model Y and S&X Plaids along with higher sales in Europe (where ASP is higher) help to partially offset the ASP decline due to China price cuts and foreign exchange.

View attachment 884907

Cost per vehicle should decline due to a higher % of production at Shanghai, Berlin and Austin ramp efficiencies and the strong USD vs Yuan & Yen.

View attachment 884908

One question: Are COGS/vehicle calculated based on the number of vehicles sold or the number produced (I thought it was the latter)? If production then the cost per vehicle decline may be even higher than shown.

Stretch2727

Engineer and Car Nut

Did you consider the $3750 discount being offered in the US in December on Model Y and 3?I am expecting gross profit per car (S3XY) to increase to $14.6k in Q4.

This is based on @Troy 's 428k deliveries (with slight mix adjustment to increase China)

I will update this periodically with new delivery estimates and as exchange rates change.

View attachment 884906

Higher mix of Model Y and S&X Plaids along with higher sales in Europe (where ASP is higher) help to partially offset the ASP decline due to China price cuts and foreign exchange.

View attachment 884907

Cost per vehicle should decline due to a higher % of production at Shanghai, Berlin and Austin ramp efficiencies and the strong USD vs Yuan & Yen.

View attachment 884908

Produced, it is tied to the specific car.Thanks for the analysis - really helpful.

One question: Are COGS/vehicle calculated based on the number of vehicles sold or the number produced (I thought it was the latter)? If production then the cost per vehicle decline may be even higher than shown.

The Accountant

Active Member

yes I did.Did you consider the $3750 discount being offered in the US in December on Model Y and 3?

The Accountant

Active Member

I did include a tiny decline in costs for higher production (fixed costs spread over more units decreases cost per car).Thanks for the analysis - really helpful.

One question: Are COGS/vehicle calculated based on the number of vehicles sold or the number produced (I thought it was the latter)? If production then the cost per vehicle decline may be even higher than shown.

I have it buried in the -$217 factory mix number. But I was very conservative so you are correct that cost decline can be more.

EVNow

Well-Known Member

One thing unknowable is how various material costs are impacted by inflation vs long term contracts. But, in case the costs get affected adversely, is there a sense of by how much ?Cost per vehicle should decline due to a higher % of production at Shanghai, Berlin and Austin ramp efficiencies and the strong USD vs Yuan & Yen.

bkp_duke

Well-Known Member

One thing unknowable is how various material costs are impacted by inflation vs long term contracts. But, in case the costs get affected adversely, is there a sense of by how much ?

Aluminum - Price - Chart - Historical Data - News

Aluminum increased 72 USD/Tonne or 3.02% since the beginning of 2024, according to trading on a contract for difference (CFD) that tracks the benchmark market for this commodity. Aluminum - values, historical data, forecasts and news - updated on April of 2024.

Cobalt - Price - Chart - Historical Data - News

Cobalt decreased 585 USD/T or 2.01% since the beginning of 2024, according to trading on a contract for difference (CFD) that tracks the benchmark market for this commodity. Cobalt - values, historical data, forecasts and news - updated on April of 2024.

Nickel - Price - Chart - Historical Data - News

Nickel increased 2,894.50 USD/MT or 17.68% since the beginning of 2024, according to trading on a contract for difference (CFD) that tracks the benchmark market for this commodity. Nickel - values, historical data, forecasts and news - updated on April of 2024.

There are also some pretty good forecasts available.

The Accountant

Active Member

It's a good point you bring up. I don't do enough of a deep dive in this area. I have a 1% inflation factor Q4 vs Q3 for COGS material components.One thing unknowable is how various material costs are impacted by inflation vs long term contracts. But, in case the costs get affected adversely, is there a sense of by how much ?

The Producer Price Index (PPI) has increased about 0.8% in the last 3 months but I know that the overall PPI is not the basket of goods that Tesla is purchasing. But I also don't have cost improvements such as removing ultrasonic sensors. So hopefully some missing cost savings offset any missing cost increases. Some areas are more art than science in my model.

petit_bateau

Active Member

Good points.It's a good point you bring up. I don't do enough of a deep dive in this area. I have a 1% inflation factor Q4 vs Q3 for COGS material components.

The Producer Price Index (PPI) has increased about 0.8% in the last 3 months but I know that the overall PPI is not the basket of goods that Tesla is purchasing. But I also don't have cost improvements such as removing ultrasonic sensors. So hopefully some missing cost savings offset any missing cost increases. Some areas are more art than science in my model.

To an extent it doesn't matter. It is the old "I don't have to run faster than the lion, I have to run faster than you" joke.

All that really matters in GM% terms is:

- change in pricing power +/-

- change in raw materials costs +/-

- change in designed product +/-

- change in manufacturing operation +/-

So if design & manufacturing are constant, and raw materials increase, then the real issue becomes whether Tesla can raise prices or not; and to what extent are there lead/lag terms in play. All vs the relevant opposition.

Similar threads

- Replies

- 192

- Views

- 20K

- Replies

- 41

- Views

- 7K