Right, but is there an FCF difference if the parts are asssembled into a car or not?If a car is sold, Tesla would get the money, which would pay for all the parts/labor (and margin). If not, Tesla may have to pay for all those things, but not get any revenue in return, which reduces cash on hand.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Near-future quarterly financial projections

- Thread starter luvb2b

- Start date

EVNow

Well-Known Member

Yes - in the sense, Tesla would have spent more on the car than just parts (labor, may be shipment etc).Right, but is there an FCF difference if the parts are asssembled into a car or not?

Sure, but assuming the factory wouldn't be shutdown, then (I think) the cars pick up the BOM variable cost and apportioned fixed cost of factory and labor as a portion of CoGS. So the quarterly expense is nearly the same in each case and the payables on parts is also?Yes - in the sense, Tesla would have spent more on the car than just parts (labor, may be shipment etc).

If so, the increased build volume reduces the cost of each car, so it would ultimately be advantageous to have cars vs parts.

Doggydogworld

Active Member

UK and Germany did blow the doors off, so Europe is within a few thousand of Troy's estimate. This is good news because Shanghai cars sold in Europe have the best margins. Tesla China sales dropped even more than expected in the final week of 2022 and the wholesale numbers don't support the large fleet sale hypothesis, so Troy's estimate looks a couple thousand high there. That leaves a 10-12k gap in North America + ROW. I figure that's almost all US.Troy's number for Europe may also be a bit high, unless UK and Germany really blow the doors off. His China number should be close. I think most/all of Q3's ~20k inventory increase was Shanghai cars. I don't think they added too much more to that in Q4.

Q1 should be great in the US, limited only by production. Europe should be up a little from Q4 as strong momentum overcomes seasonal softness. China Q1 looks like trouble. It's much more seasonal than EU/US, incentives declined a bit and Tesla was limping badly at the Q4 finish line.

Lower priced competition is hurting in China, and Tesla has less room to cut prices there. Switching to CATL's next-gen pack vs. the current kludge should help a bit, but I don't know the timeline.

Best case: Tesla China is about to unveil a Model 2 that's been secretly developed over the past two years.

Worst case: Musk said "screw that, fembots are the future".

UkNorthampton

TSLA - 12+ startups in 1

Analysis I've seen said that China had best margins. No major transport costs, no import tax (5% China>EU, base + transport costs?), no cumulative VAT on base + transport + import tax.UK and Germany did blow the doors off, so Europe is within a few thousand of Troy's estimate. This is good news because Shanghai cars sold in Europe have the best margins. Tesla China sales dropped even more than expected in the final week of 2022 and the wholesale numbers don't support the large fleet sale hypothesis, so Troy's estimate looks a couple thousand high there. That leaves a 10-12k gap in North America + ROW. I figure that's almost all US.

Q1 should be great in the US, limited only by production. Europe should be up a little from Q4 as strong momentum overcomes seasonal softness. China Q1 looks like trouble. It's much more seasonal than EU/US, incentives declined a bit and Tesla was limping badly at the Q4 finish line.

Lower priced competition is hurting in China, and Tesla has less room to cut prices there. Switching to CATL's next-gen pack vs. the current kludge should help a bit, but I don't know the timeline.

Best case: Tesla China is about to unveil a Model 2 that's been secretly developed over the past two years.

Worst case: Musk said "screw that, fembots are the future".

so if base is 36,000 + transport at 4,000, VAT at 20%, we get to (40,000 * 1.05)*1.2 = 50,400

Transport includes ships/port capacity plus 2 sets of handling car transporters usually. All of this is/was in short supply - premium cost, inefficiencies, unnecessary intermediate storage & delays probably.

Doggydogworld

Active Member

China has VAT, too, I think 13% or 15% for cars. (There's also a separate 10% Vehicle Purchase Tax, but that doesn't apply to EVs.) And 20% VAT seems a bit high for Europe, where some countries discount it for EVs. Import tariff is based on manufacturing + transport cost. If Model 3 RWD mfg cost is really 36k then margins are now negative in China.Analysis I've seen said that China had best margins. No major transport costs, no import tax (5% China>EU, base + transport costs?), no cumulative VAT on base + transport + import tax.

so if base is 36,000 + transport at 4,000, VAT at 20%, we get to (40,000 * 1.05)*1.2 = 50,400

Transport includes ships/port capacity plus 2 sets of handling car transporters usually. All of this is/was in short supply - premium cost, inefficiencies, unnecessary intermediate storage & delays probably.

Also, 4000 for transport is recent spot pricing. A consistent shipper like Tesla should have long term contracts in place for much of their volume.

I'm not saying Europe overall has the best margins, Berlin is not efficient yet. But I can't see transport + tariff + delta VAT adding $20k.

EVNow

Well-Known Member

Well, they either have great margins in China, so they cut 10% or they cut 10% because they want to sell all they can make.Lower priced competition is hurting in China, and Tesla has less room to cut prices there. Switching to CATL's next-gen pack vs. the current kludge should help a bit, but I don't know the timeline.

Best case: Tesla China is about to unveil a Model 2 that's been secretly developed over the past two years.

Worst case: Musk said "screw that, fembots are the future".

UkNorthampton

TSLA - 12+ startups in 1

No currency specified, sample numbers for illustrative purposes, not too far from USD or EUR to give a sense. Pretty hard to know accurate figures unless an insider. "Base" cost was illustrative of what a China income to Tesla might be - as a comparison whether profit would be higher in Europe or China.China has VAT, too, I think 13% or 15% for cars. (There's also a separate 10% Vehicle Purchase Tax, but that doesn't apply to EVs.) And 20% VAT seems a bit high for Europe, where some countries discount it for EVs. Import tariff is based on manufacturing + transport cost. If Model 3 RWD mfg cost is really 36k then margins are now negative in China.

Also, 4000 for transport is recent spot pricing. A consistent shipper like Tesla should have long term contracts in place for much of their volume.

I'm not saying Europe overall has the best margins, Berlin is not efficient yet. But I can't see transport + tariff + delta VAT adding $20k.

Tesla have a wave, so shipping costs aren't as good as they could be, that should improve. Is VAT in China shown in comparative figures? In Europe (certainly UK) prices must be shown with VAT included, For USA, it seems like taxes are on top of prices on Tesla website, but I could well be wrong. China VAT would be on a lower cost as transport would be lower.

Share of VAT in the net price of cars, by EU country

The automobile sector provides a vital source of government revenue to EU member states. This interactive map shows the share of value-added tax (VAT) in the net price of new passenger cars, by EU country.

VAT between 17 and 27%, majority OVER 20%. UK 20% (plus luxury car tax after 2025, some other countries may apply similar, Denmark seems nuttily complex). No subsidies in UK for Tesla, other countries vary,

Edit: The 10% (reduced to 5% on small ICE cars earlier this year, probably gone now) tax seems to be VAT - so Tesla was probably at 0% until recently (if NEV not extended)

VAT rates China Chinese VAT Rates - Avalara

13% default VAT rate (but not for vehicles)

1-56% for luxuries including cars (presumably 10% is the rate minus concessions for small cars/NEV which have probably ended).

My head hurts.

Last edited:

petit_bateau

Active Member

The Accountant

Active Member

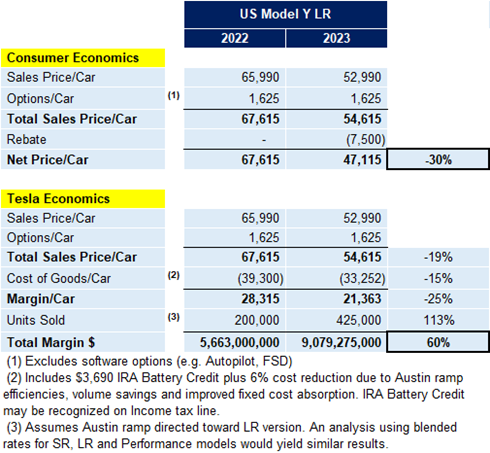

I use Model Y LR (US sales) in this scenario. Even with huge price decrease I have margin dollars increasing 60%.

Feedback Please

Feedback Please

zach_

Member

So going from ~42% GM to ~39% GM. How will we survive?I use Model Y LR (US sales) in this scenario. Even with huge price decrease I have margin dollars increasing 60%.

Feedback Please

View attachment 895296

But more seriously, my only (minor) feedback is it kind of confusing how the margin $ is presented. It could be read as suggesting that's how much the Model Y made in gross profit in 2022, and we'll be up 60% from that. But we know prices were lower than that for most delivered in 2022, so really we'll be up much more (% of $ wise) from 2022 actuals if this analysis is correct.

I know you know this, just thought I'd point it out for those who potentially might misread it, as I did initially.

EVNow

Well-Known Member

I use Model Y LR (US sales) in this scenario. Even with huge price decrease I have margin dollars increasing 60%.

Feedback Please

View attachment 895296

So,

ASP : -20%

Cogs : -19%

Units : +113%

Tot Margin : +60%

What happens with lower cogs decrease ? Even if the COGS remains the same, they can reduce the price by ~2k and get the same total margin, if the unit count goes up to 425k.

The Accountant

Active Member

Yes - but we don't want flat margin dollars year over year. At least I don't. I know they can give up a year in profit growth to take market share but I don't think that would be good for the stock.So,

ASP : -20%

Cogs : -19%

Units : +113%

Tot Margin : +60%

What happens with lower cogs decrease ? Even if the COGS remains the same, they can reduce the price by ~2k and get the same total margin, if the unit count goes up to 425k.

The Accountant

Active Member

That's a good point. Model Y sales price was lower in 2022 due to older orders being processed.So going from ~42% GM to ~39% GM. How will we survive?

But more seriously, my only (minor) feedback is it kind of confusing how the margin $ is presented. It could be read as suggesting that's how much the Model Y made in gross profit in 2022, and we'll be up 60% from that. But we know prices were lower than that for most delivered in 2022, so really we'll be up much more (% of $ wise) from 2022 actuals if this analysis is correct.

I know you know this, just thought I'd point it out for those who potentially might misread it, as I did initially.

I wanted to keep the list price that people recognize so as not to complicate matters.

I intent is to show people that a decline in list price does not mean a decline in profits.

Gigapress

Trying to be less wrong

I use Model Y LR (US sales) in this scenario. Even with huge price decrease I have margin dollars increasing 60%.

Feedback Please

View attachment 895296

In future revisions do you intend to estimate any increases in Options per Car? This is almost certain to be nonzero but the question is how much.

Edit: Just saw your footnotes. So, to highlight for others, the $21.3k margin per car estimate excludes software revenue, which will likely increase above 2022 levels.

Noob assumptions:

Factories are built using CapEx, so cash impact versus income

When building cars, the depreciation on the factory is assigned to the vehicles as part of the cost

Noob Questions:

Is this just an accounting thing as the factory was already paid for (delayed write off)? If so, does that mean the cash flow (bank account balance) from production is better than the gross margin alone would indicate?

i.e. if built from cash, the factory is "free" afterward so zero cost to vehicles built there.

Factories are built using CapEx, so cash impact versus income

When building cars, the depreciation on the factory is assigned to the vehicles as part of the cost

Noob Questions:

Is this just an accounting thing as the factory was already paid for (delayed write off)? If so, does that mean the cash flow (bank account balance) from production is better than the gross margin alone would indicate?

i.e. if built from cash, the factory is "free" afterward so zero cost to vehicles built there.

Short answer is yes. If factory CapEx was based on cash accounting, COGS would be lower once the factory was built but there would be giant expenses during the buildout phase.Noob assumptions:

Factories are built using CapEx, so cash impact versus income

When building cars, the depreciation on the factory is assigned to the vehicles as part of the cost

Noob Questions:

Is this just an accounting thing as the factory was already paid for (delayed write off)? If so, does that mean the cash flow (bank account balance) from production is better than the gross margin alone would indicate?

i.e. if built from cash, the factory is "free" afterward so zero cost to vehicles built there.

Do a CTRL + F for depreciation in the 10-Q and you can see what it contributes to COGS (more or less)

I always try to fall back to the basics. Cash is what actually happens, P&L is the smoothed ideal world of accountants, the BS is the memory storage device to reconcile the two.

petit_bateau

Active Member

Nice.I use Model Y LR (US sales) in this scenario. Even with huge price decrease I have margin dollars increasing 60%.

Feedback Please

View attachment 895296

If I was setting out that table in that way I'd include a GM% line as well as a GM line.

Your volume assumption is 113%, i.e. more than doubling. I expect you are doing that calc for USA. However two things:

1) A lot of sales are non-USA and prices have reduced all over the world; but IRA is US-specific. Maybe two customer-view tables are required.

2) The 2023 volume is likely to be of the order of 2.2m vs the 2022 volume of 1.3m, i.e. 72% volume growth, a long way below the 113% you are selecting.

Clearly this is pricing to run Tesla at max capacity during what we expect to be a high-volume increase 2023 year of ?? 72%. The 2022 was a low point at only (!) 40%. The amazing thing is that 2024 is also likely to be high and 81% is my model for that, so 4.1m.

I wonder which will be the first legacy manufacturer to go under.

Thanks!Short answer is yes. If factory CapEx was based on cash accounting, COGS would be lower once the factory was built but there would be giant expenses during the buildout phase.

Do a CTRL + F for depreciation in the 10-Q and you can see what it contributes to COGS (more or less)

I always try to fall back to the basics. Cash is what actually happens, P&L is the smoothed ideal world of accountants, the BS is the memory storage device to reconcile the two.

Cost of automotive sales revenue includes direct and indirect materials, labor costs, manufacturing overhead, including depreciation costs of tooling and machinery, shipping and logistic costs, vehicle connectivity costs, allocations of electricity and infrastructure costs related to our Supercharger network and reserves for estimated warranty expenses. Cost of automotive sales revenues also includes adjustments to warranty expense and charges to write down the carrying value of our inventory when it exceeds its estimated net realizable value and to provide for obsolete and on-hand inventory in excess of forecasted demand.

So, theoretically, even if Tesla went to 0% automotive gross margin, they would still be making money ($620 million a quarter at that level) because depreciation is an accounting thing?Construction in progress is primarily comprised of construction of Gigafactory Berlin-Brandenburg and Gigafactory Texas, expansion of Gigafactory Shanghai and equipment and tooling related to the manufacturing of our products. Completed assets are transferred to their respective asset classes and depreciation begins when an asset is ready for its intended use. Interest on outstanding debt is capitalized during periods of significant capital asset construction and amortized over the useful lives of the related assets. During the three and nine months ended September 30, 2022, we capitalized interest of an immaterial amount. During the three and nine months ended September 30, 2021, we capitalized $14 million and $52 million, respectively, of interest.

Depreciation expense during the three and nine months ended September 30, 2022 was $620 million and $1.75 billion, respectively. Depreciation expense during the three and nine months ended September 30, 2021 was $495 million and $1.38 billion, respectively. Gross property, plant and equipment under finance leases as of September 30, 2022 and December 31, 2021 was $2.76 billion and $2.75 billion, respectively, with accumulated depreciation of $1.56 billion and $1.21 billion, respectively.

Gigapress

Trying to be less wrong

Yes, the calc was for USA Y Long RangeNice.

If I was setting out that table in that way I'd include a GM% line as well as a GM line.

Your volume assumption is 113%, i.e. more than doubling. I expect you are doing that calc for USA. However two things:

1) A lot of sales are non-USA and prices have reduced all over the world; but IRA is US-specific. Maybe two customer-view tables are required.

2) The 2023 volume is likely to be of the order of 2.2m vs the 2022 volume of 1.3m, i.e. 72% volume growth, a long way below the 113% you are selecting.

Clearly this is pricing to run Tesla at max capacity during what we expect to be a high-volume increase 2023 year of ?? 72%. The 2022 was a low point at only (!) 40%. The amazing thing is that 2024 is also likely to be high and 81% is my model for that, so 4.1m.

I wonder which will be the first legacy manufacturer to go under.

Similar threads

- Replies

- 192

- Views

- 21K

- Replies

- 41

- Views

- 8K