I'd like to start a discussion of the term "Net new orders".

I was doing some math and research into this and the only way I can come up with the math behind the term used in the letter:

Taking the fact that no confirmations for Model X occurred in Q2 2015.

And that Tesla does not define the internals making up what a "Net new order" is.

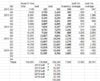

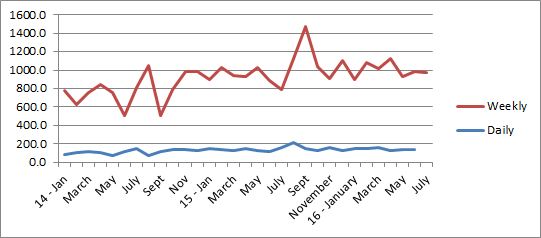

And that the Model S Vin # issues in Q2 of 2016 are just about 7% higher than Q2 of 2015. See graph below of Model S Vin # issues per month.

12315 MS Vins in Q2 2015 - 13184 MS Vins in Q2 2016 = 7%

The fascia refresh cars inclusive as a small subset of Q2 2016.

I then add in about 7100 Model X Confirmations done to customer reservations during Q2 2016. Zero for 2015.

The total becomes (13184 + 7100) / 12315 = 65% increase.

So, is it agreed that a "Net new order" is a reservation that has become a CONFIRMED order which locks in the refundable deposit into a true order?

Terms do change often - and so is an order just a reservation until it is confirmed. Then it is an order "for sure"? And does that make it a "Net order"? And is a Net New Order really just a set of confirmed reservations done per unit time?

Help the analysts know what a Net New order is. I don't think they know even after the Q2 ER call last night.

From that, one must review the vin #s that occur now in Q3 for Model X and Model S production. Presumably that lines up with the Q3 "Net new orders" which is the basis of the H2 sales profile.

I consider a Confirmation done for a Model X on 6/30 to be a "Net new order for Q2" even if Vin # is issued on 7/9/16. And thus, Confirmations for Model X done July 1 onward and Vinned soon after are Q3 Net new orders. These are Vin #s starting in the 145xx range. We are at roughly 169xx as of 8/4/16. Perhaps 2400 "Net new orders" for Model X first 33 days of Q3. Model S confirms of July 1 started with Vin # 1502xx and are now at 1550xx. 4800 there. Total net new orders so far in Q3 are 7200. Annualized ~ 80,000 Or perhaps 40,000 Half-annual. My only glitch in the data is a jump in MX Vin #s on July 3-4 which doesn't make sense. Between 134xxx and 141xx . Could be a clean Vin # used at 14000 for some reason.

I was doing some math and research into this and the only way I can come up with the math behind the term used in the letter:

- Despite not having the refreshed Model S in stores for the full quarter, and not until June for international markets, Model S orders increased year over year. With the addition of Model X orders, total Q2 net new vehicle orders rose 67% from a year ago.

Taking the fact that no confirmations for Model X occurred in Q2 2015.

And that Tesla does not define the internals making up what a "Net new order" is.

And that the Model S Vin # issues in Q2 of 2016 are just about 7% higher than Q2 of 2015. See graph below of Model S Vin # issues per month.

12315 MS Vins in Q2 2015 - 13184 MS Vins in Q2 2016 = 7%

The fascia refresh cars inclusive as a small subset of Q2 2016.

I then add in about 7100 Model X Confirmations done to customer reservations during Q2 2016. Zero for 2015.

The total becomes (13184 + 7100) / 12315 = 65% increase.

So, is it agreed that a "Net new order" is a reservation that has become a CONFIRMED order which locks in the refundable deposit into a true order?

Terms do change often - and so is an order just a reservation until it is confirmed. Then it is an order "for sure"? And does that make it a "Net order"? And is a Net New Order really just a set of confirmed reservations done per unit time?

Help the analysts know what a Net New order is. I don't think they know even after the Q2 ER call last night.

From that, one must review the vin #s that occur now in Q3 for Model X and Model S production. Presumably that lines up with the Q3 "Net new orders" which is the basis of the H2 sales profile.

I consider a Confirmation done for a Model X on 6/30 to be a "Net new order for Q2" even if Vin # is issued on 7/9/16. And thus, Confirmations for Model X done July 1 onward and Vinned soon after are Q3 Net new orders. These are Vin #s starting in the 145xx range. We are at roughly 169xx as of 8/4/16. Perhaps 2400 "Net new orders" for Model X first 33 days of Q3. Model S confirms of July 1 started with Vin # 1502xx and are now at 1550xx. 4800 there. Total net new orders so far in Q3 are 7200. Annualized ~ 80,000 Or perhaps 40,000 Half-annual. My only glitch in the data is a jump in MX Vin #s on July 3-4 which doesn't make sense. Between 134xxx and 141xx . Could be a clean Vin # used at 14000 for some reason.

Last edited: