Words of HABIT

Active Member

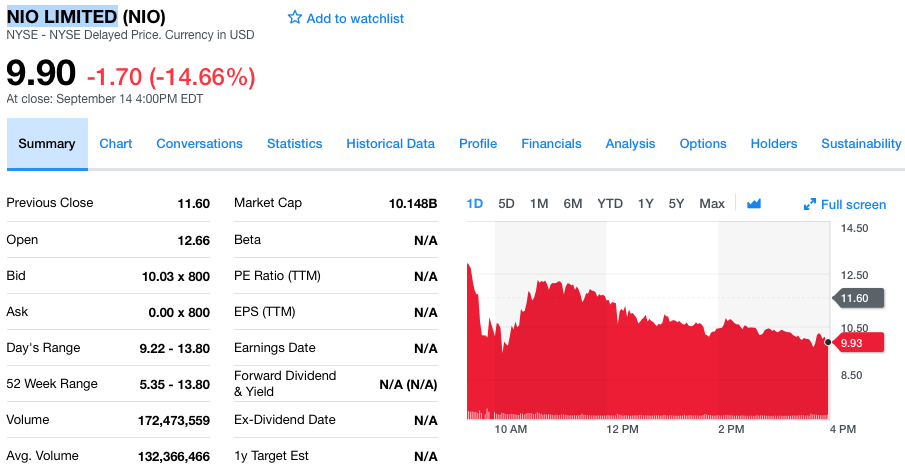

IMHO, NIO, having sold just 460 cars, is immensely overvalued at its current Market Cap of $10.15B.

Valuing NIO at just less than 1/4 of TSLA with 250,000 deliveries of high end luxury EVs in 2018 and expected >400,000 deliveries in 2019.

NIO is riding on the coat tales of Tesla, has no new technology, no battery plant, no charging infrastructure and I could go on and on.

I'm all for new EV players and I wish NIO and their investors all the best, however would not touch this stock over a dollar. I give NIO ten years to grow into its current valuation.

Sorry, my money and heart is with Tesla.

Valuing NIO at just less than 1/4 of TSLA with 250,000 deliveries of high end luxury EVs in 2018 and expected >400,000 deliveries in 2019.

NIO is riding on the coat tales of Tesla, has no new technology, no battery plant, no charging infrastructure and I could go on and on.

I'm all for new EV players and I wish NIO and their investors all the best, however would not touch this stock over a dollar. I give NIO ten years to grow into its current valuation.

Sorry, my money and heart is with Tesla.