Thanks Papafox and Happy New Years to you and others. New here and happy to have just begun following your insightful analysis. I have been day and short term swing trading for a couple years, mostly options due to small account size with TSLA being well over 1/2 my holdings at the moment,,, have ordered a dual engine cybertruck,,, guess you could say I've been bitten.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

SageBrush

REJECT Fascism

Despite the restricted liquidity ?Moving so much of the short-manipulations covering outside of the hours where it affects the stock price makes the shorting more potent because of less springback from covering during market hours, no matter how carefully it is done.

Fortunately for day-shorters, there were enough entities willing to take money off the table at and after 4pm prior to the P&D report to supply the needed shares to cover. Pre-arranged trades would involve big fish: market makers, hedge funds, brokerage houses, etc.

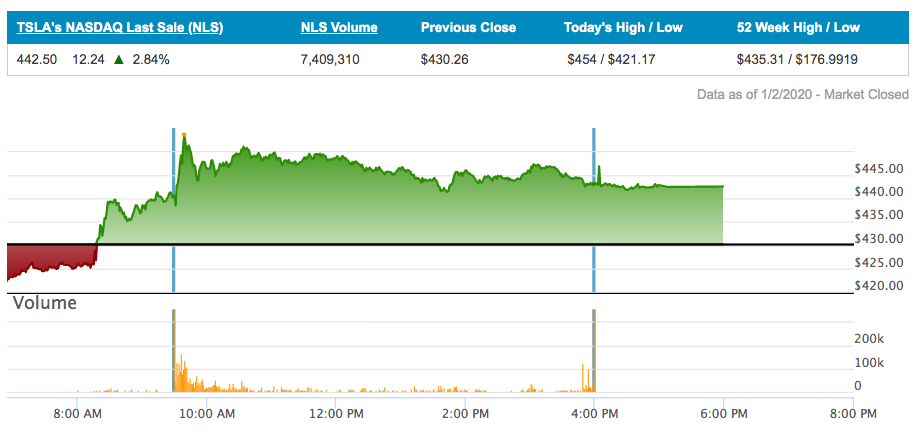

Today was an odd day of trading as no P&D report in pre-market could have spooked some investors, but obviously that didn't happen today. Tagged with 59% of the selling today, the shorts did indeed try to resist this climb, but to no avail.

What then should be used to explain today's strong performance and a climb back above 430? The media of course looked at this upgrade of TSLA to 515 by Cannacord and said that's the reason, but it really isn't. It's just one small piece of the bullishness that evolved today. With the NASDAQ up 1.33%, it's not uncommon for a stock like TSLA to be up 2.66% for that reason alone. Now add this story about Made in China Model 3s beginning wider deliveries at an event on January 7, and the picture sharpens. Don't get me wrong, we need analysts to post price targets above 500 to get smaller buyers inspired to buy in the 400s. Many investors are influenced by such numbers being suggested the same way that the $10 bear case price target of Adam Jonas affected the stock price negatively back in that day.

Macros were much higher today, due to a move by the Chinese central bank to spur that country's economy (and also the world economy as we are indeed affected by the economies of our trading partners). The NASDAQ closed up 1.33%

Shorts were tagged with 59% of TSLA selling today, suggesting an effort to resist the relentless climb today

Looking at the tech chart, the upper bollinger band now stands at 456.32, very comfortable headroom for a good P&D Report. If the report is exceptionally good, however, the bollinger band won't be an issue... the stock price would waltz right through it. Anyway, yesterday's bottom was the first real test of how well TSLA will hold onto its value after this long, quick climb from 330. So far, TSLA looks strong. Now it just comes down to the P&D Report results. Fingers crossed!

Conditions:

* Dow up 330 (1.16%)

* NASDAQ up 120 (1.33%)

* TSLA 430.26, up 11.93 (2.85%)

* TSLA volume 9.3M shares

* Oil 61.18

* Percent of selling tagged to TSLA shorts: 59%

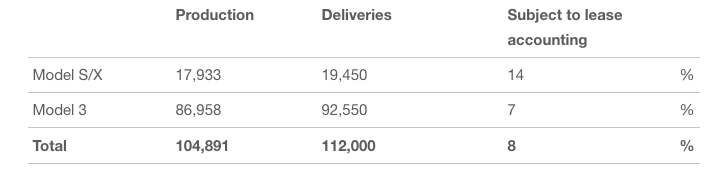

Congratulations longs, the Q4 P&D report was very solid. Not only did Tesla achieve 112,000 deliveries, but the number of S&Xs in the report was over 19,000, which exceeded the expectations of many of our best experts and points to good revenue for the quarter. Further, we received word in the report that "We have also demonstrated production run-rate capability of greater than 3,000 units per week, excluding local battery pack production which began in late December." China sounds like it is moving forward wonderfully.

The Q4 2019 Production and Delivery report summary

Anyone for 440? How about 450? Shortie got his knickers in a knot that we longs were ready to skip the 440s altogether and run directly to the 450s, so he made sure we'll enjoy some time in 440-land. It's not a bad place to be at the moment.

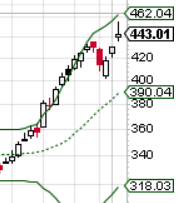

Notice how restrained the stock price increase was in pre-market trading when the excellent P&D report came out. I attribute this restraint to pre-market selling by hedge funds to suggest that the results were "no big deal". Nonetheless, volume was high after open and TSLA touched 454 nine minutes after market open. Alas, we saw a slow degradation of the stock price as the day progressed and we closed at 443.01.

Why the decline? Consider:

* Macros were down about 0.80% on Friday, with declining macros in the afternoon

* There is some concern in cautious longs that a retaliatory strike by Iran would hurt the market some time in the near future. Some short-term profit-taking occurred.

* The situation with Iran made final 30 minute buying on Friday for Monday Morning Buyer Exuberance a sketchy proposition. Nonetheless, it took a TON of selling in the final 21 minutes to dip the stock price further and keep it from possibly running up. At 3:49pm 123K shares traded hands and at 3:54pm 98K shares traded. Big investors don't shed shares like this with no news. It has "manipulation" written all over it.

* Percent of selling by shorts was a mighty 61% on Friday, suggesting serious effort to push the stock down for options close

We saw 354K shares trade in the 4pm minute and an additional 138K at 4:51pm in a pre-arranged trade. I suggest this heavy trading during times when there's no price consequences as likely opportunities for day-shorting manipulators to cover their selling.

Macros were depressed on Friday due to fears related to the Iran issue, with the NASDAQ closing down 0.79%

The developing tug-of-war

A chasm has opened between the expectations of bulls vs. bears. Here's a summary:

Bulls:

* P&D report was good, which means Q4 ER will be good, which puts TSLA in a decent position for qualifying for S&P 500 inclusion after a small Q1 profit. The buying by big institutional buyers would then carry TSLA through until the second half of 2020, at which time Model Y and China Model 3 will be putting Tesla in a position to deliver all time high quarterly profits, delivery numbers, and production numbers.

* Elon may give guidance at the ER that pours cold water on the hopes of bears that Q1 will be weak.

* Announcement of battery day will likely give the stock price a boost even before the event because it suggests that Tesla has lined up its battery strategy and is now willing to make the plan public.

Bears:

* Shorts were likely planning a bear raid after P&D report because they perceive TSLA as greatly overpriced at the moment

* Bear raid would exploit any weakness in the P&D report including disappointing S&X deliveries or not enough deliveries over 104K to meet analyst expectations (none of these conditions came through)

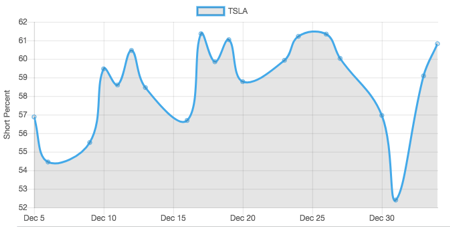

* Shorts have been increasing short interest over the past week as they anticipated a peak and then fall of the stock price

* Shorts believe TSLA has a long way to fall if a downtrend can be established, and Friday would have been the day to establish it.

Thus, we have longs who see a string of positive developments coming in 2020 that should propel the stock price noticeably higher, and shorts who have been expecting the P&D Report to be a turnaround point from which they can see a decline begin and entice new shorts to jump in. Unfortunately for the shorts, the ER is likely just a few weeks away and we're likely to start seeing analyst upgrades plus buying from both longs and shorts who wish to prepare for a positive ER.

TSLA shorts were tagged with 61% of selling on Friday, on the high end of the range and suggesting lots of manipulations

Should the market shake off its jitters about international affairs and TSLA investors start to digest the demand implications from a Q4 where deliveries significantly outstripped record production, there's room to run higher and the upper bollinger band gives nearly $20 of headroom from Friday's closing price.

For the week, TSLA closed at 443.01, up 12.63 from last Friday's 430.38. Add in the previous three weeks and we're up 106.12 in less than a month. Not bad. Enjoy your weekend.

Conditions:

* Dow down 234 (0.81%)

* NASDAQ down 71 (0.79%)

* TSLA 443.01, up 12.75 (2.96%)

* TSLA volume 17.4M shares

* Oil 63.05

* Percent of selling tagged to TSLA shorts: 61%

The Q4 2019 Production and Delivery report summary

Anyone for 440? How about 450? Shortie got his knickers in a knot that we longs were ready to skip the 440s altogether and run directly to the 450s, so he made sure we'll enjoy some time in 440-land. It's not a bad place to be at the moment.

Notice how restrained the stock price increase was in pre-market trading when the excellent P&D report came out. I attribute this restraint to pre-market selling by hedge funds to suggest that the results were "no big deal". Nonetheless, volume was high after open and TSLA touched 454 nine minutes after market open. Alas, we saw a slow degradation of the stock price as the day progressed and we closed at 443.01.

Why the decline? Consider:

* Macros were down about 0.80% on Friday, with declining macros in the afternoon

* There is some concern in cautious longs that a retaliatory strike by Iran would hurt the market some time in the near future. Some short-term profit-taking occurred.

* The situation with Iran made final 30 minute buying on Friday for Monday Morning Buyer Exuberance a sketchy proposition. Nonetheless, it took a TON of selling in the final 21 minutes to dip the stock price further and keep it from possibly running up. At 3:49pm 123K shares traded hands and at 3:54pm 98K shares traded. Big investors don't shed shares like this with no news. It has "manipulation" written all over it.

* Percent of selling by shorts was a mighty 61% on Friday, suggesting serious effort to push the stock down for options close

We saw 354K shares trade in the 4pm minute and an additional 138K at 4:51pm in a pre-arranged trade. I suggest this heavy trading during times when there's no price consequences as likely opportunities for day-shorting manipulators to cover their selling.

Macros were depressed on Friday due to fears related to the Iran issue, with the NASDAQ closing down 0.79%

The developing tug-of-war

A chasm has opened between the expectations of bulls vs. bears. Here's a summary:

Bulls:

* P&D report was good, which means Q4 ER will be good, which puts TSLA in a decent position for qualifying for S&P 500 inclusion after a small Q1 profit. The buying by big institutional buyers would then carry TSLA through until the second half of 2020, at which time Model Y and China Model 3 will be putting Tesla in a position to deliver all time high quarterly profits, delivery numbers, and production numbers.

* Elon may give guidance at the ER that pours cold water on the hopes of bears that Q1 will be weak.

* Announcement of battery day will likely give the stock price a boost even before the event because it suggests that Tesla has lined up its battery strategy and is now willing to make the plan public.

Bears:

* Shorts were likely planning a bear raid after P&D report because they perceive TSLA as greatly overpriced at the moment

* Bear raid would exploit any weakness in the P&D report including disappointing S&X deliveries or not enough deliveries over 104K to meet analyst expectations (none of these conditions came through)

* Shorts have been increasing short interest over the past week as they anticipated a peak and then fall of the stock price

* Shorts believe TSLA has a long way to fall if a downtrend can be established, and Friday would have been the day to establish it.

Thus, we have longs who see a string of positive developments coming in 2020 that should propel the stock price noticeably higher, and shorts who have been expecting the P&D Report to be a turnaround point from which they can see a decline begin and entice new shorts to jump in. Unfortunately for the shorts, the ER is likely just a few weeks away and we're likely to start seeing analyst upgrades plus buying from both longs and shorts who wish to prepare for a positive ER.

TSLA shorts were tagged with 61% of selling on Friday, on the high end of the range and suggesting lots of manipulations

Should the market shake off its jitters about international affairs and TSLA investors start to digest the demand implications from a Q4 where deliveries significantly outstripped record production, there's room to run higher and the upper bollinger band gives nearly $20 of headroom from Friday's closing price.

For the week, TSLA closed at 443.01, up 12.63 from last Friday's 430.38. Add in the previous three weeks and we're up 106.12 in less than a month. Not bad. Enjoy your weekend.

Conditions:

* Dow down 234 (0.81%)

* NASDAQ down 71 (0.79%)

* TSLA 443.01, up 12.75 (2.96%)

* TSLA volume 17.4M shares

* Oil 63.05

* Percent of selling tagged to TSLA shorts: 61%

I swear, can't a guy and his dog sneak out for a few hours of skiing without TSLA running to a new ATH close and a new epidemic of Tesla fever breaking out? My job ain't easy. Anyway, congrats on the ATH close above 451. I believe 454 is still the intra-day high, but it'll likely be eclipsed tomorrow. If TSLA continues up from here, the 440s will have been one of the quickest dispatches of a $10 price range yet.

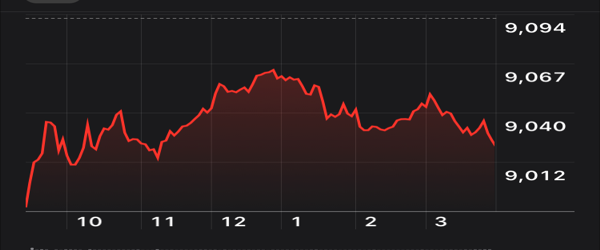

Macros were definitely low on opening today amidst concerns about Iran, but the NASDAQ climbed quickly to reach the green by 11am then drifted higher for the remainder of the day. This macro behavior contributed to this afternoon's rally. The next input was the Monday Morning buyer's exuberance even with the macro weakness. TSLA run into the the green right after market opening, it had to be whacked down into the red by the hedge funds, it ran higher again, and for the remainder of the morning a game of whack-the-mole was underway with the hedge funds befuddled by this strange buying pressure. After noon, TSLA wanted to climb higher and I believe the hedge funds moved their whack-a-mole threshold to about 445 and succeeded holding it there until about 2pm.

Meanwhile, there was news that Elon was over the Pacific, heading to China for a big delivery event of Made-In-China Model 3s, and a photo of a poster mentioning Model Y at GF-3, which has led to considerable speculation.

All of these positive inputs (plus some buying by the relentless buyers that have caused the December rally) simply overwhelmed the ability of the manipulators to hold the stock back, and by 2:30pm it was clear that Monday would be a strong day for TSLA.

What I found most impressive was that in market trading the intra-day high was just a penny above close, and the high of day including after-hours trading took place right as my chart cut off at 6pm. Such rising into the close bodes well for tomorrow's opening.

The NASDAQ opened low and in the red but climbed quickly and ended the day up 0.56%

For the second trading day in a row, TSLA shorts were tagged with 61% of selling, suggesting lots of manipulations.

Looking at the tech chart, the upper bollinger band is at 467.39, and with the stock price this frisky, it's important to have some headroom. Notice, too, how close TSLA came today to undoing the downward manipulative push on Friday once the stock price had topped out early in the day.

Conditions:

* Dow up 69 (0.24%)

* NASDAQ up 51 (0.56%)

* TSLA 451.54, up 8.53 (1.93%)

* TSLA volume 10.2M shares

* Oil 62.59

* Percent of selling tagged to TSLA shorts: 61%

If TSLA continues up from here, the 440s will have been one of the quickest dispatches of a $10 price range yet.

I don't think this is going to age well

2virgule5

Member

Wait a few months and we’ll dispatch $100’s in a single trading dayI don't think this is going to age well

Tuesday was yet another ATH close at 469.06, after we saw trading above 470 today. Yesterday's strong rise into close gave an excellent signal that today would be strong, and so it was. Today's signals about Wednesday are less optimistic. The bears managed a dip in the final 20 minutes of trading today, but when you look at the massive 62.5% of selling tagged to the shorts, it looks like a dip that was bought for a price. Likewise, the slow decline of the SP in after-hours trading is a bit of a warning, but the rise in final 30 minutes of after-hours suggests otherwise.

We'll never know how the tea leaves above would likely turn out on their own because Iran launched missiles Tuesday evening at American positions in Iraq. Initial reports are of no casualties, and that's the good news, but expect the market to be down and jumpy on Wednesday, so some of this macro worry will likely spill over to TSLA trading. Much of Wednesday's volatility will depend upon the U.S. reaction to the Iranian response.

Overall, the incredible strength of this breakout so far is related to Tesla's improved production, proof of strong demand, and an optimistic view towards 2020 financials. It would be fair to say that a good deal of this strength is related to anticipation of S&P 500 inclusion during 2020. As I have said before, I advocated the long-term game with TSLA right now because 2020 and 2021 look so strong. Macro events and a negative surprise in a quarter can gork short-term bets, but the long term continues to look very solid.

Regarding Q4 ER, @luvb2b has posted Q4 financial performance estimates here. Luvb2b's profit calculations look very encouraging. Take a look.

With short term macro worries due to Mid-East tensions and no guarantee of Q1 ushering in S&P 500 inclusion, this is all the more reason to concentrate on a longer-term (to at least 2021 or 2022) investing strategy with TSLA.

Overall, we see the hedge funds pulling out all the stops to slow down the rally of TSLA, but once there are big companies accumulating shares, the manipulations tend to fail as the steamroller moves forward. Expect additional accumulation by the big institutional investors through S&P 500 inclusion and limits to how effective the manipulations can be. The big investors might back off on Fridays and allow the manipulations to give them a discount come Monday, but there's plenty of buying ahead. Today's volume was over 17 million shares. A good portion of the volume is likely buying and selling by high-speed algobots, so it is difficult to really estimate how many shares really changed hands today between old investors taking profits and new investors buying in for S&P 500 inclusion. An unprofitable Q1 remains a possibility due to low inventory and seasonality, but if your time horizon for your investments extends through the end of 2020, any dip would be erased once the 2nd half of 2020 shows its strength. OTOH, there's so much unknown about FCA credits, other credits, and GF3 ramp-up that it'd be unwise to assume Q1 will cause a dip and you'll be able to get back in for less. Anticipating dips during a strong breakout is a dubious strategy.

The NASDAQ was choppy today but percent changes from lows to highs wasn't much. NASDAQ closed down a mere 0.03%

TS

TSLA shorts were tagged with 62.5% of the selling today, suggesting very substantial manipulations

Today's trading reached close to yesterday's upper bollinger band, but fortunately the upper bb rose to 475 today and kept the needed headroom during the excellent rally.

Conditions:

* Dow down 120 (0.42%)

* NASDAQ down 3 (0.03%)

* TSLA 469.06, up 17.52 (3.88%)

* TSLA volume 17.7M shares

* Oil 64.12

* Percent of selling tagged to TSLA shorts: 62.5%

Last edited:

Papafox, Thanks for your daily analysis of TSLA. Given the strong volume yesterday (17M) and then today (30M), it would seem like there might be some pending news. I wonder if the November news of FCA+PSA possibly purchasing battery packs and electric motors might be coming to fruition. Pure speculation, but it sure feels like something is up.

Papafox, Thanks for your daily analysis of TSLA. Given the strong volume yesterday (17M) and then today (30M), it would seem like there might be some pending news. I wonder if the November news of FCA+PSA possibly purchasing battery packs and electric motors might be coming to fruition. Pure speculation, but it sure feels like something is up.

There's definitely something afoot that is accelerating the buying, but nailing it down is extremely difficult. Ihor Dusaniwsky is apparently on vacation and not tweeting this week. Let's hope we get a reading on short covering vs. selling soon. Besides shorts, there's also the possibility that institutions are realizing Tesla's S&P 500 inclusion is almost inevitable this year and the cost of picking up shares is going up so quickly that it's encouraging more and more to jump in and acquire. I remain open for ideas.

Ihor Dusaniwsky is apparently on vacation and not tweeting this week. Let's hope we get a reading on short covering vs. selling soon.

But they are still sending their daily newsletter which is saying that the short interest percent hasn't changed in the last three days:

Date Short-Interest $ SI %

1/3/2020 $11,892,040,901.00 20.65%

1/6/2020 $12,120,680,060.00 20.44%

1/7/2020 $12,349,849,285.00 20.44%

1/8/2020 $12,832,315,986.00 20.44%

Of course I trust his data about as much as I paid for it: nothing.

Note: and starting on 1/17 they are ending the free daily short interest email, so I guess we won't even be getting that on a regular basis.

Last edited:

dmckinstry

Model X 2019

Hopefully weeks and not months.Wait a few months and we’ll dispatch $100’s in a single trading day

Today's $23.08 rise was accompanied by 30 million shares volume and a substantial effort by the shorts with short percentage of selling at 61.5%. Needless to say, with this much price rise and such heavy volume, there was no way the hedge funds could hold TSLA back. Take a look below at the NASDAQ chart. About 11:30am the macros did a nice rise as Trump gave a very reasonable speech regarding a willingness to stop the escalation with Iran. The markets liked it and expressed their like with a quick rally. TSLA lagged behind in its run-up as the downward pressure hedge fund algos churned away, but once TSLA turned upward to join the NASDAQ's rally (on a much greater scale, of course) there was no holding it back.

I think the 2:30pm descent of TSLA was likely energized as a short-selling exercise to get the stock headed downhill, but the appetite for TSLA was significant enough that the SP recovered to 493 and then started heading up towards the close. Only a macro dip towards close (worry about reports of some explosions in Bagdad) kept TSLA from reclaiming most of that lost ground.

My NASDAQ chart shows 498.49 as today's high, just $1.51 under $500. It's entirely possible that $500 will fall Thursday morning, but there will likely be a fight for it.

The NASDAQ closed up 0.67% today

Shorts were tagged with 61.5% of TSLA selling today

Looking at the tech chart, today's climb drove through the upper bollinger band, which stood at 486.61 upon close today.

With TSLA approaching 500, how should you adjust your trading strategy? Quite frankly, it depends upon your level of leverage right now, your exposure to TSLA as a percentage of your portfolio and net worth, your age, your investment goals... so many things. On one hand, a young person in stock only would be reasonable to hold steady and enjoy the excellent appreciation that likely lies ahead in the coming years. On the polar extreme, someone who has been leveraged with options, is not diverse in investments, is close to retirement age, and has just hit his or her retirement goal would reasonably be expected to be in the deleveraging stage now. There's simply no answer that fits all TSLA investors.

Looking at the dynamics of rising and falling share prices, consider the following dynamics currently affecting the stock price:

* The rising price is putting pressure on institutions to buy for fear of S&P 500 inclusion when the stock price is even higher than today

* Rising prices typically cause shorts to cover, mainstream media to reduce the FUD, market-makers to buy in order to delta-hedge, and fear to remain low in investors

------Thus rising begets more rising ---------------

* As long as the big investors continue the furious buying, hedge funds lack the horsepower to turn the stock price around. Their ability to instill fear of falling grows greater when the stock price has risen to extreme heights very quickly. It's nearly impossible to predict when bears can finally get some traction in turning the rally around. Longs want to hold for the likely positive Q4 ER, but if the price of the stock is too high going into the ER, the chance of a sell the event action increase.

-------- Thus there's a limit at some point on how high the SP will go before the Q4 ER ----------------

* Once the stock price starts to decrease, short-selling are likely going to jump in and add steroids to the dip. Big institutional buyers may choose to hold off on the buying and allow the price to dip before they resume.

* The usual FUD increases with a downward motion of the stock price, market-makers delta-hedge by shorting or selling, longs accelerate profit-taking by selling

------- Thus once a downward motion begins there are forces to maintain it ---------------------

* Fortunately, the 4Q ER provides a buffer because once any descent reaches a critical point, longs start buying back in prior to the ER in order to take advantage of the rise that it can generate at a lower price

* Fortunately, once the stock price pulls out of a dip the big institutional buyers resume their buying (if they haven't been doing so to lessen the dip.

----------------- Thus there are forces to get the stock price heading upwards again ---------------------

Many of you already embrace the existence of these forces. What's new is the current role of the heavy accumulators, the likely positive 4Q ER, the rosy outlook for the coming years, profitability, and the likelihood of S&P 500 inclusion. It's good to take some time and consider how each of these forces work in a rally as well as in a dip.

Conditions:

* Dow up 161 (0.56%)

* NASDAQ up 61 (0.67%)

* TSLA 492.14, up 23.08 (4.92%)

* TSLA volume 30.6M shares

* Oil 64.12

* Percent of selling tagged to TSLA shorts: 61.5%

Yesterday I wondered out loud what catalyst could lead to an interruption in this ruthlessly steady rally we've been riding. The answer came today with a note from Tesla bull analyst Ben Kallo of Oppenheimer. Kallo said that he was raising his price target from the high 300s to 525, he was changing his rating from "buy" to "hold", and he said now would be a good time for investors to take some profits. That's all it took. The hedge funds read these notes too, and Kallo had just primed Tesla investors for a test of resolve.

Pre-market trading was positive in the hour leading up to market open, and we even hit a new ATH in pre-market. Volume during the first hour was intense. Around 9:54am over 100K shares traded in 1 minute and TSLA dipped more than $5 into the red. Nonetheless, buyers scooped up shares at this discount and TSLA popped back into the green. A short game of whack-the-mole ensued as hedge funds sought to convince longs that today was the end of the rally and it was time to follow Kallo's advice and do some profit-taking. The whack-the-mole session apparently convinced longs who were hopeful the rally would continue that today was going to be a negative day, and so the profit-taking began. In all, we saw volume of nearly 28 million shares traded today, nearly as many as yesterday. The good news? There was no lack of buyers with this heavy volume. The number of profit-taking sellers was just too high for the buyers to prevail today and so TSLA dipped.

Taking a look at the daily chart, you can see that the icicles were intense today, indicating severe efforts by the shorts to push TSLA lower. Notice how intense the volume was during the various icicles that mostly popped back up to near the prices before the surge in volume. These selling surges were of course used to generate some fear of falling in the longs so that they would be convinced to do some profit-taking here.

As I mentioned in the main investor's thread today, I believe today's dip is actually a good thing. If the SP runs up all the way to the ER, it'll be so high that a sell the news event is strongly likely. OTOH, if the stock can show that it can keep a dip such as today's from running too deep, then long investors become confident that the price is not going to fall out from under them. Today's recovery from the mid-day dip suggests that the heavy buying is moderating the downward forces of profit-taking and manipulations.

Macros were way up today, with the NASDAQ closing up 0.81%. Notice the NASDAQ dip around 12:40pm. This dip coincided with the big TSLA dip of the day. Was the NASDAQ dip the cause? Nope, it may have been the scapegoat used to justify heavy short selling to get longs to join in the selling, but a dip in the NASDAQ from about 0.8% to about 0.4% in the green wasn't enough to justify an $18 dip in TSLA, not even close.

Just what's a stake to motivate the hedge funds to put so much pressure on TSLA today? The Opricot max pain chart above shows options expirations for Friday, Jan. 10. Look at all the 500 calls set to expire. A good number of 480s and 485s exist as well. We typically see the heaviest manipulation pressure on option-expiration Fridays, so don't be surprised to see a second day in a row of negative pressure on the stock price tomorrow.

Dusaniwsky says in text and graphics that short interest is actually up over the past month even though shorts are down over $2 billion in January alone. His data suggests that longs buying are the source of the rapid increase in stock price, not short covering. It's going to get very interesting if there's a major run upwards after the 4Q ER. Those shorts who expect a turnaround after the ER or in Q1 may be in for a surprise. Hope so.

Shorts were tagged with 58.5% of TSLA selling today. Even though the percentage of selling by shorts has dropped in the past two days, the daily trading chart suggests that we saw especially heavy icicle formations today. One explanation is that shorts went outside of FINRA sources for shares to short.

The upper bollinger band has risen to 493.72. Let's hope it can get above 500 by early next week. Also notice that today's losses were only about half of yesterday's gains.

My guess is that we see the hedge funds apply pressure on Friday to try and save those 480 calls. The 4Q ER could come in less than 2 weeks if it is early, so at some point the dip will likely give way to a rise as investors position for the ER. All signs so far point to a good ER. Remember that today's dip was an almost necessary pause in the relentless rise, and such days are to be expected.

Conditions:

* Dow up 212 (0.74%)

* NASDAQ up 74 (0.81%)

* TSLA 481.34, down 10.80 (2.19%)

* TSLA volume 27.9M shares

* Oil 59.40

* Percent of selling tagged to TSLA shorts: 58.5%

Last edited:

View attachment 498466Taking a look at the daily chart, you can see that the icicles were intense today, indicating severe efforts by the shorts to push TSLA lower. Notice how intense the volume was during the various icicles that mostly popped back up to near the prices before the surge in volume. These selling surges were of course used to generate some fear of falling in the longs so that they would be convinced to do some profit-taking here.

I'm wondering, do you still think TSLA is heavily manipulated by shorts, oil interests, etc. on days like this? Not only is the SP double what it was 6 months ago, volumes are absolutely nuts. Isn't it WAY harder and WAY more costly to manipulate TSLA on days like this? I don't know if market makers and hedge funds make more due to higher SP and higher volumes, and therefore can also afford to 'spend' more on manipulations? But shorts didn't just get 10x the funds to manipulate TSLA with compared to six months ago, right?

What is your take on this Papafox? Do you think manipulations are still heavily ongoing, or is it more likely that some of these movements were simply due to day-traders, speculators, and natural buying and selling pressure?

I'm wondering, do you still think TSLA is heavily manipulated by shorts, oil interests, etc. on days like this? Not only is the SP double what it was 6 months ago, volumes are absolutely nuts. Isn't it WAY harder and WAY more costly to manipulate TSLA on days like this? I don't know if market makers and hedge funds make more due to higher SP and higher volumes, and therefore can also afford to 'spend' more on manipulations? But shorts didn't just get 10x the funds to manipulate TSLA with compared to six months ago, right?

What is your take on this Papafox? Do you think manipulations are still heavily ongoing, or is it more likely that some of these movements were simply due to day-traders, speculators, and natural buying and selling pressure?

I am open-minded to the causes of the high (60ish) percent of selling by shorts that we have been seeing. On Thursday, the dips were brought about by super-heavy selling concentrated within a few minutes, which made the icicles you can clearly see on the chart. Those icicle dips then led to profit-taking by long investors and to tag-along selling by algos. Likewise, there was no news of consequence to justify the deep mandatory morning dips we've been seeing. I envision traders as being more reactive than likely to initiate such a dip. Also, why would Friday's typically be such a difficult day for the stock if it wasn't for options expiration? We seldom see dips on Fridays going deep enough to bring the big put strikes into the money. Instead, we see dips that typically keep the biggest call strikes out of the money. Such a situation suggests to me that the seller of the calls, the hedge funds, are behind the dips, rather than it being shorts who bought those puts (granted that some of the puts were hedging by longs, too).

@ReflexFunds put forward a reasonable explanation for much of the volume of buying and selling, which is delta-hedging by market-makers to remain delta-neutral as the stock price changes and as options are bought and sold. It is, of course, possible to mis-interpret this buying or selling as manipulations, and I have undoubtedly done so at times. OTOH, Thursday's selling streaks were so blatant that I really don't think market-makers would be doing their buying and selling in such a lumpy fashion.

In time, we may confirm that the hedge funds have indeed been manipulating this substantially, or we may find another explanation for what I believe is hedge fund manipulations. The important thing, however, is that this model in my mind has been very useful for trading purposes. When I saw what I thought were manipulations failing back when TSLA was trading in the 190s this summer (after the dip had bottomed out), those failed manipulations gave me the confidence to buy a ton of 200-strike Jan2021 call options. In the following months, I used volatility to upgrade these call options at no charge to Jun2021 200 calls. I still own most of them. The free upgrades to Jun21 calls was done by buying two Jun21 calls at a time and waiting for the SP to rise before selling two Jan21s, or (when the stock price was falling) selling 2 Jan21s and waiting for the price to fall enough to buy the Jun21s for the same amount. Note, this trading was done in a IRA where there were no tax consequences to the trading, but it did take a lot of time and concentration. More recently, the heavy buying from the whales has defeated many of the apparent manipulations thrown in the way of TSLA, and I suspect that buying is going to take us to the Q4 ER without any huge dips. I may be delusional, but my delusions have allowed me to understand what comes next and make money, and so I maintain this model while always looking for evidence that something else is the reality.

Last edited:

This weekend has been fly back to Hawaii weekend with some surprises thrown in, so my post lacks last minute news but does reflect considerable thought on Friday’s trading and the prospects for the coming week.

Looking at the daily chart, you can see that the hedge funds succeeded in pushing TSLA below 480 for a big options-close Friday, so no surprises there. Their technique was very similar to Thursday’s attack, which was to start a stock price reduction in pre-market leading up to market opening, sell big shortly after opening to establish a Mandatory Morning Dip, play whack-the-mole any time TSLA ran up into the green, try another push-down around 10:30am, do more whack-the-mole, and then exploit any weakness that could be generated throughout the day. Finally, we see the typical push-down attempt into close that started after 3pm and the equally predictable reversal of that push-down shortly before close as traders sought to buy shares in anticipation of the typical Monday morning buyers exuberance.

Why were the losses on Friday so much less than Thursday’s? Look at Thursday as the perfect opportunity for instilling some “I need to take profits” fears in investors with the Kallo quote about taking profits and the heavy effort by shorts to induce a sizable dip. Friday was pretty much a dissipation of that downward momentum day, with additional efforts thrown in by the hedge funds to keep the close below 480. The substantial decrease in volume on Friday to me suggests fewer sellers. I believe there were fewer sellers because the dip now doesn’t look that deep and the process of “seller’s remorse” is becoming a factor as sellers looking to protect their profits are starting to think they sold too early and some may reinvest on Monday or whenever the market signals this dip is complete.

Consider, too, what the trading during the past five weeks means if you accept Dusaniwsky’s take that shorts were actually increasing short interest slightly, rather than covering. Net buying was done by longs, with the whales likely picking up the better part of that buying. These new buyers have been picking up TSLA in the 400s and high 300s and planning to hold through S&P500 inclusion and then well beyond. These buyers aren’t likely to sell if the stock price jumps $50. Meanwhile, the sellers were the weakest of the longs, willing to pare down or eliminate their TSLA holdings in return for locking in profits. Some of the sellers will likely reenter positions in the high 400s, thus reestablishing their positions at much higher buy-in prices. Thus, the holders of TSLA shares are becoming much more resilient to selling in the short term, a situation that could really bite the shorts should Q4 ER surprise to the high side.

Consider for a moment the position of the shorts. Over 20 million shares have remained resilient to recent stock price increases. I assume that these shorts are depending upon a weak Q1 to see the stock price fall. If Elon provides convincing enough guidance in the coming ER that Q1 will be a positive rather than a negative, then we could see a quick unwinding of short interest and lots of upward pressure on the stock price. A strong guidance regarding Q1 would also cause more longs to simultaneously buy in and a reluctance of current longs to sell. The result could actually be a short squeeze. Don’t bet the farm on this happening, but I certainly am going to leave a good amount of money in the stock for the possibility of it happening. My fallback position would be strong Q3 and Q4 results and S&P500 inclusion sometime this year to offset any Q1 weakness. Fingers crossed.

Consider, too, that this rapid rise in TSLA stock price is a two-edged sword. The rise creates the environment for it to rise further. The rise also creates an environment where a miss relative to expectations can be punished with a substantial dip. For this reason, it’s essential at these prices to keep a sharp eye on what Tesla is delivering so that we may anticipate before the market any weakness that might appear. Thankfully, we have not a single event coming up that's likely to be positive but a string of them. The future positive event would help cushion any decline, provided the relative importance of what is to come in 2020 is more important than what just happened.

The NASDAQ closed down 0.27% on Friday

On Friday, shorts were tagged with 56% of selling, still a number indicating significant manipulations

With the upper Bollinger band now at 498.43 and likely to top 500 on Monday, big buyers will be less reluctant to buy TSLA above 500 than they were last week.

For the week, TSLA closed at 478.15 up 35.14 from last Friday’s 443.01, so despite Thursday and Friday’s dip, the week was still a very good one. Add these gains to the previous 4 weeks of gains and we’re up 141.26 in the past 5 weeks. Not too shabby and a reminder to never underestimate the potential of a breakout with this stock after nearly three years of building a base. Enjoy your weekend. Let's see if Monday morning's exuberant buying can turn this ship around.

Conditions:

* Dow down 133 (0.46%)

* NASDAQ down 25 (0.27%)

* TSLA 478.15, down 3.19 (0.66%)

* TSLA volume 13M shares

* Oil 59.03 on Sunday

* Percent of selling tagged to TSLA shorts: 56%

SageBrush

REJECT Fascism

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Replies

- 21

- Views

- 6K

- Replies

- 2

- Views

- 213

- Replies

- 23

- Views

- 781