June 9 posting

June 9 posting

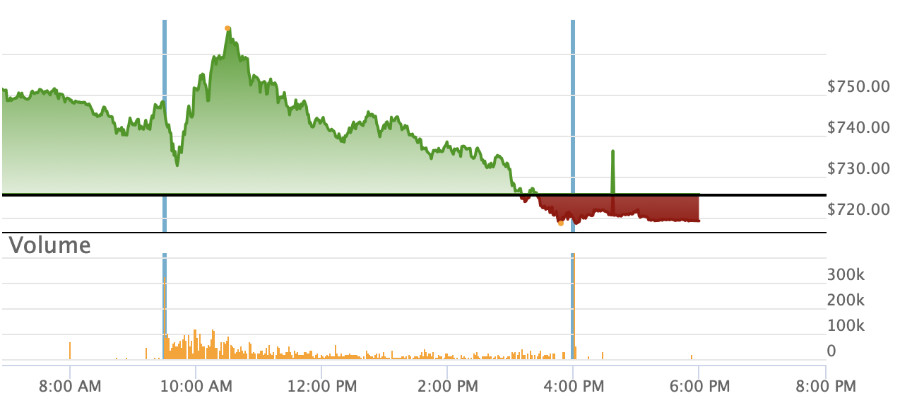

TSLA chart above

For the second day in a row, TSLA rose strongly in the morning and then faded in the afternoon as macros fell and manipulators used the macro falls to pull TSLA down at a rate that gave a desirable closing price. The good news is that TSLA looks like it wants to rally but it needs support from the macros to do so. If CPI numbers are positive Friday morning, the state is set for a strong TSLA day. If the numbers are disappointing, TSLA will fall with everything else. Fingers crossed.

The most likely reason for TSLA's strength was that Shanghai production numbers for May came in slightly above Troy's estimates. Moreover, we saw an upgrade by UBS from hold to buy, with 1100 as the price target. Elon is priming employees for an end of quarter deliveries push. You might say that the May Shanghai numbers was the end of the expected bad news and TSLA's overall trajectory is moving into positive territory. If CPI numbers are positive on Friday morning, the market makers could lose control of TSLA and we could see a rally that doesn't get pushed down in the afternoon.

News:

* CPCA reported China production of 33,544 vehicles by the Shanghai factory in May

* UBS upgraded TSLA to buy and price target of 1100

* Electrek reports that Elon has briefed employees on a "nutty" end of quarter delivery push. Note, Troy commented that the article's reference to an Elon statement about 300,000 deliveries possible was wrong. Troy is correct. Elon's statement was made for additional COVID delays at Shanghai took place.

* Electrek reports that Tesla's secret master plan, part 3 is all about "massive" expansion. When Elon starts quantifying what massive means and the timetables, I suspect Wall Street will respond favorably

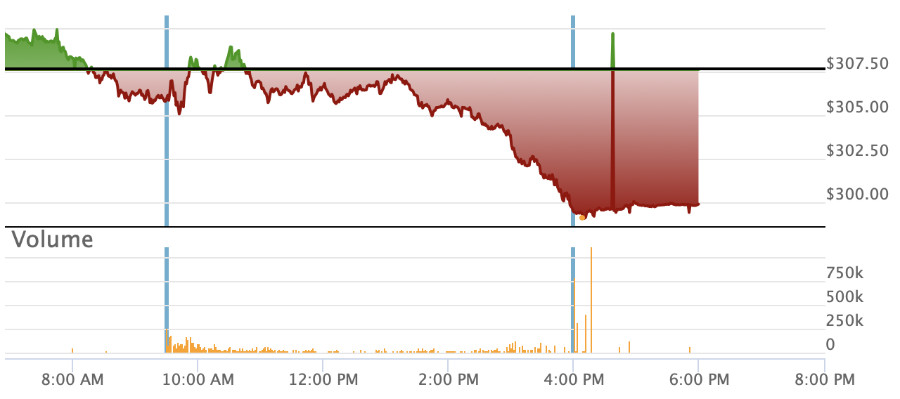

QQQ chart above

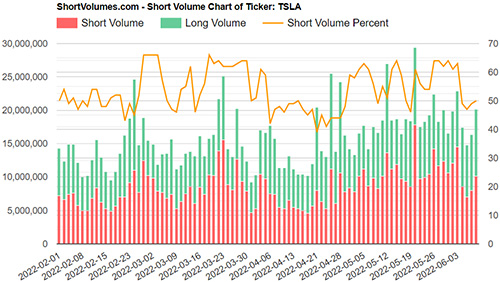

Percent of selling by shorts rose slightly from Wednesday to 50%

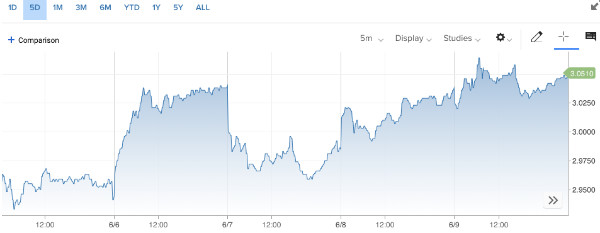

Yields on 10 yr. treasury bonds continue to hover just above 3%

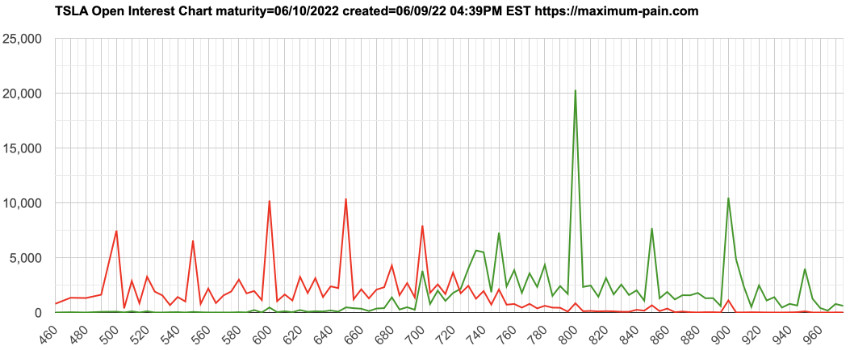

Max pain was 725, up $5 from Wednesday morning's number. There remains lots of puts at 799 strike, and we're seeing a cluster of big call bets between 735 and 750. TSLA closing at 719 keeps it within the big profit zone for the market makers.

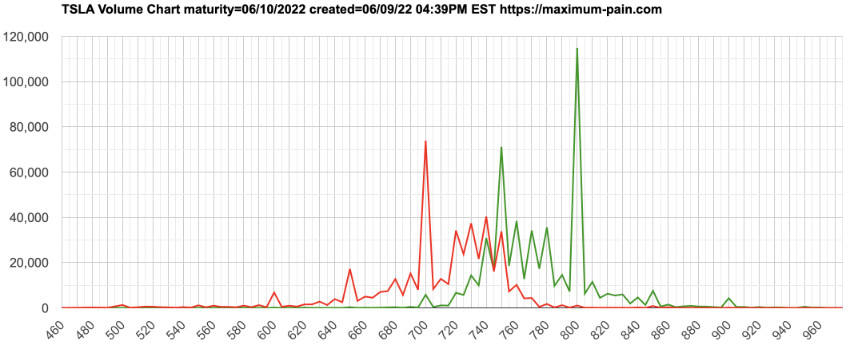

Thursday volume included lots of 700 put and 750 call action, with 800-strike lottery cards trading quickly. Two reasons why there is so much activity in the 800 strike calls are: it's a very volatile strike and can be used for quick day-trades, and even though it's more than $80 out of the money, a mega-rally of the NASDAQ could theoretically put it in play for Friday (likely just wishful thinking, however).

What is similar to the trading of the past two days is big rises in the morning, followed by big dips in the afternoon. In both cases the NASDAQ dipped in the afternoon and gave an opportunity for manipulators to pull TSLA down to a desired closing price on both days, which was very near the mid bollinger band.

Conditions:

* Dow down 638 (1.94%)

* NASDAQ down 332 (2.75%)

* SPY down 10 (2.38%)

* TSLA 719.12, down 6.48 (0.89%)

* TSLA volume 31.8M shares

* Oil 121.5

* IV 71.5, 91%

* Max Pain 725

* Percent of TSLA selling tagged to shorts: 50%

June 9 posting

TSLA chart above

For the second day in a row, TSLA rose strongly in the morning and then faded in the afternoon as macros fell and manipulators used the macro falls to pull TSLA down at a rate that gave a desirable closing price. The good news is that TSLA looks like it wants to rally but it needs support from the macros to do so. If CPI numbers are positive Friday morning, the state is set for a strong TSLA day. If the numbers are disappointing, TSLA will fall with everything else. Fingers crossed.

The most likely reason for TSLA's strength was that Shanghai production numbers for May came in slightly above Troy's estimates. Moreover, we saw an upgrade by UBS from hold to buy, with 1100 as the price target. Elon is priming employees for an end of quarter deliveries push. You might say that the May Shanghai numbers was the end of the expected bad news and TSLA's overall trajectory is moving into positive territory. If CPI numbers are positive on Friday morning, the market makers could lose control of TSLA and we could see a rally that doesn't get pushed down in the afternoon.

News:

* CPCA reported China production of 33,544 vehicles by the Shanghai factory in May

* UBS upgraded TSLA to buy and price target of 1100

* Electrek reports that Elon has briefed employees on a "nutty" end of quarter delivery push. Note, Troy commented that the article's reference to an Elon statement about 300,000 deliveries possible was wrong. Troy is correct. Elon's statement was made for additional COVID delays at Shanghai took place.

* Electrek reports that Tesla's secret master plan, part 3 is all about "massive" expansion. When Elon starts quantifying what massive means and the timetables, I suspect Wall Street will respond favorably

QQQ chart above

Percent of selling by shorts rose slightly from Wednesday to 50%

Yields on 10 yr. treasury bonds continue to hover just above 3%

Max pain was 725, up $5 from Wednesday morning's number. There remains lots of puts at 799 strike, and we're seeing a cluster of big call bets between 735 and 750. TSLA closing at 719 keeps it within the big profit zone for the market makers.

Thursday volume included lots of 700 put and 750 call action, with 800-strike lottery cards trading quickly. Two reasons why there is so much activity in the 800 strike calls are: it's a very volatile strike and can be used for quick day-trades, and even though it's more than $80 out of the money, a mega-rally of the NASDAQ could theoretically put it in play for Friday (likely just wishful thinking, however).

What is similar to the trading of the past two days is big rises in the morning, followed by big dips in the afternoon. In both cases the NASDAQ dipped in the afternoon and gave an opportunity for manipulators to pull TSLA down to a desired closing price on both days, which was very near the mid bollinger band.

Conditions:

* Dow down 638 (1.94%)

* NASDAQ down 332 (2.75%)

* SPY down 10 (2.38%)

* TSLA 719.12, down 6.48 (0.89%)

* TSLA volume 31.8M shares

* Oil 121.5

* IV 71.5, 91%

* Max Pain 725

* Percent of TSLA selling tagged to shorts: 50%