SPY seems to be spiking, so we will see...I am day trading some calls / puts based on the trend for this year -

from Twitter -

ON EVERY SINGLE FOMC RATE HIKE SO FAR THIS YEAR MARKETS HAVE DUMPED AT 2:00 PM EST WHEN THE RATE HIKE CAME OUT AND RALLIED AT 2:30 EST WEHEN POWELL SPOKE

So.... definitely not advice.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Wiki Selling TSLA Options - Be the House

- Thread starter adiggs

- Start date

corduroy

Active Member

I am day trading some calls / puts based on the trend for this year -

from Twitter -

ON EVERY SINGLE FOMC RATE HIKE SO FAR THIS YEAR MARKETS HAVE DUMPED AT 2:00 PM EST WHEN THE RATE HIKE CAME OUT AND RALLIED AT 2:30 EST WEHEN POWELL SPOKE

So.... definitely not advice.

IV seems high and building ahead of the Fed meeting. I suspect we will see a crush shortly after.SPY seems to be spiking, so we will see...

TheTalkingMule

Distributed Energy Enthusiast

I'm guessing since the intra-day relief rally is so universally expected, we see flat to red for the remainder of today. Then a very strong climb tomorrow into the Friday close. Basically the opposite of expectation.

juanmedina

Active Member

I unloaded all my CC's hopping to reload at better prices.

strago13

Member

STO 9/30 290P's for $3.89 on the dip. Hoping that was the dip and now we rally...

EDIT:

GTC for JUN2024 $366.67 filled completing my buydown from yesterday

BTC 290SEP30 for $2.62 for a nice 30%

All in all, not a bad 30 minutes of trading

EDIT:

GTC for JUN2024 $366.67 filled completing my buydown from yesterday

BTC 290SEP30 for $2.62 for a nice 30%

All in all, not a bad 30 minutes of trading

Last edited:

SebastienBonny

Member

I am day trading some calls / puts based on the trend for this year -

from Twitter -

ON EVERY SINGLE FOMC RATE HIKE SO FAR THIS YEAR MARKETS HAVE DUMPED AT 2:00 PM EST WHEN THE RATE HIKE CAME OUT AND RALLIED AT 2:30 EST WEHEN POWELL SPOKE

So.... definitely not advice.

wow. SPOT ON!

And that's how we make whiskey money!wow. SPOT ON!

Trades were -

$295 P's - STO - $2.30 --> BTC $0.85

$310 C's - STO - $4.50 -->BTC $3

Out both now for a round trip of $3 each strangle in all of 35 minutes

Outstanding.And that's how we make whiskey money!

Trades were -

$295 P's - STO - $2.30 --> BTC $0.85

$310 C's - STO - $4.50 -->BTC $3

Out both now for a round trip of $3 each strangle in all of 35 minutes

I made a little beer money (not enough for whiskey) today, following your advice.

Closed out my CC325: sold initially for $1.73, bought at the dip for $0.50. Then put in order to re-sell at $1.10, which executed right as Powell started speaking.

This is the first time I've ever day-traded anything. Not a lot of money, but it was fun! Thanks @UltradoomY!

Very nice, totally the right play. I missed it by a few cents on my limit order for CCs.And that's how we make whiskey money!

Trades were -

$295 P's - STO - $2.30 --> BTC $0.85

$310 C's - STO - $4.50 -->BTC $3

Out both now for a round trip of $3 each strangle in all of 35 minutes

Should have done the straddle.

juanmedina

Active Member

well loaded and unloaded again at 70-60% profit on $320-330's in less than 30 minutes lol. I hope we don't down trend from here on.

Last edited:

TheTalkingMule

Distributed Energy Enthusiast

Did anyone see any wildly optimistic options orders execute right at the 2pm announcement? My portfolio is at a bizarre place in that it's ITM BPS heavy right now, so the "total portfolio value" can swing wildly as SP moves. Anywho.....right at 2pm it tanked like -25% and then rose back up over the next 20-30 seconds. (after I had a mild heart attack)

Did IV just crush or rise that much in the one moment? Woulda been nice to have some orders in that quickly execute and were +30% a minute later.

Did IV just crush or rise that much in the one moment? Woulda been nice to have some orders in that quickly execute and were +30% a minute later.

I can't explain it but this kind of thing is exactly why I open up optimistic limit orders, on both sides, going into events like this.Did anyone see any wildly optimistic options orders execute right at the 2pm announcement? My portfolio is at a bizarre place in that it's ITM BPS heavy right now, so the "total portfolio value" can swing wildly as SP moves. Anywho.....right at 2pm it tanked like -25% and then rose back up over the next 20-30 seconds. (after I had a mild heart attack)

Did IV just crush or rise that much in the one moment? Woulda been nice to have some orders in that quickly execute and were +30% a minute later.

I am day trading some calls / puts based on the trend for this year -

from Twitter -

ON EVERY SINGLE FOMC RATE HIKE SO FAR THIS YEAR MARKETS HAVE DUMPED AT 2:00 PM EST WHEN THE RATE HIKE CAME OUT AND RALLIED AT 2:30 EST WEHEN POWELL SPOKE

So.... definitely not advice.

green day tom? (asking for everyone here

intelligator

Active Member

Nice trades you all had 2pm and later ... I wasn't around to play the sell buy repeat the other direction game, sweet! Another trick to add to the bag.

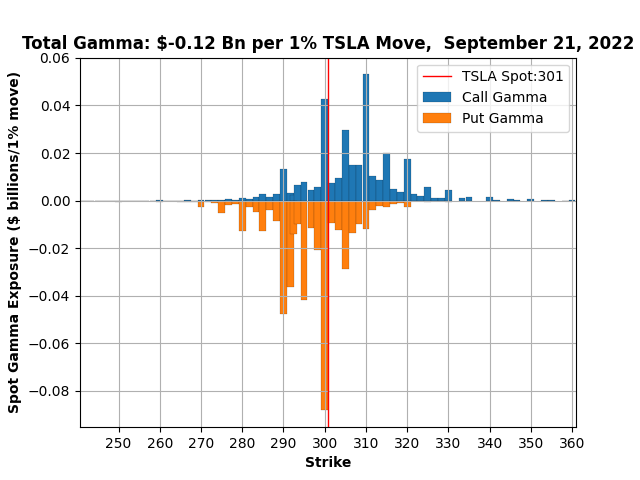

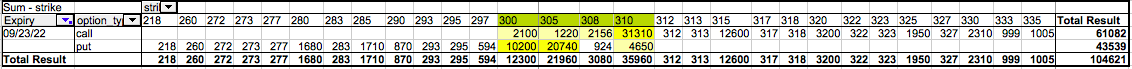

Option interest doubled down on 300p, increased interest at 290p. I have a good feel for 307-308 Friday; there's still a cluster of interest at those strikes. I'll add the graph of the options volume >=. 500 contacts later. When I looked at mid-day, the strikes were between 280 and 320 , nothing below or above , that too showed a strong concentration at 290-300-310. However, the afternoon changed that snapshot; look at 315 and the $5 strikes above... up up up?

Option interest doubled down on 300p, increased interest at 290p. I have a good feel for 307-308 Friday; there's still a cluster of interest at those strikes. I'll add the graph of the options volume >=. 500 contacts later. When I looked at mid-day, the strikes were between 280 and 320 , nothing below or above , that too showed a strong concentration at 290-300-310. However, the afternoon changed that snapshot; look at 315 and the $5 strikes above... up up up?

Last edited:

this gamma chart is AMAZINGNice trades you all had 2pm and later ... I wasn't around to play the sell buy repeat the other direction game, sweet! Another trick to add to the bag.

Option interest doubled down on 300p, increased interest at 290p. I have a good feel for 307-308 Friday; there's still a cluster of interest at those strikes. I'll add the graph of the options volume >=. 500 contacts later. When I looked at mid-day, the strikes were between 280 and 320 , nothing below or above , that too showed a strong concentration at 290-300-310. However, the afternoon changed that snapshot; look at 315 and the $5 strikes above... up up up?

View attachment 855413

View attachment 855416

scubastevo80

Member

Wrote an IC yesterday on ADBE 9/24 270-310 for $0.55, which I'm likely to close this morning. Thesis: ADBE has been crushed post its acquisition of Figma, falling from $370 to $290 in the last week. I put this trade on at $290 yesterday afternoon and believe the stock won't head much lower this week given it's already extremely oversold. I may roll any profits on this one into a 2-4 week bull call spread for a quick bounce play.

I keep looking at TSLA BPS but, for example, next week's 250/230 is only worth $0.21 or $105 for $10k worth of risk. Also, I'm extremely reluctant to do BCS as I view that as a market timing call on the top of this TSLA rally, especially as we head into P&D and earnings.

I keep looking at TSLA BPS but, for example, next week's 250/230 is only worth $0.21 or $105 for $10k worth of risk. Also, I'm extremely reluctant to do BCS as I view that as a market timing call on the top of this TSLA rally, especially as we head into P&D and earnings.

I see lots of folks reluctant on BCS, and rightly so, if the stock pops hard you can get wiped-out...Wrote an IC yesterday on ADBE 9/24 270-310 for $0.55, which I'm likely to close this morning. Thesis: ADBE has been crushed post its acquisition of Figma, falling from $370 to $290 in the last week. I put this trade on at $290 yesterday afternoon and believe the stock won't head much lower this week given it's already extremely oversold. I may roll any profits on this one into a 2-4 week bull call spread for a quick bounce play.

I keep looking at TSLA BPS but, for example, next week's 250/230 is only worth $0.21 or $105 for $10k worth of risk. Also, I'm extremely reluctant to do BCS as I view that as a market timing call on the top of this TSLA rally, especially as we head into P&D and earnings.

However, I've been selling/rolling -c300's for several weeks now, I didn't do the exact maths, but I think I took around $30 in premiums so far - that's the benefit of buy-writes. The only real risk is the SP dropping below your average purchase price, even then you can still keep selling, albeit for lower premiums at that same strike and wait for the recovery. The other downside is if the stock rallies hard and you miss out on potential gains, but "potential gains" are just that, "potential gains" - since when did we ever predict the direction of the stock correctly? And then you have the chance to sell puts

The wheel on steroids...

I just closed my 300ccs. There's a lot of puts at 300. I intend to resell the 300s on the recovery. Worst case scenario still my most profitable week ever.

Similar threads

- Replies

- 50

- Views

- 7K

- Replies

- 10

- Views

- 4K

- Replies

- 106

- Views

- 10K

- Replies

- 5

- Views

- 5K