Is $1.2M the premium amount?

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Wiki Selling TSLA Options - Be the House

- Thread starter adiggs

- Start date

R

ReddyLeaf

Guest

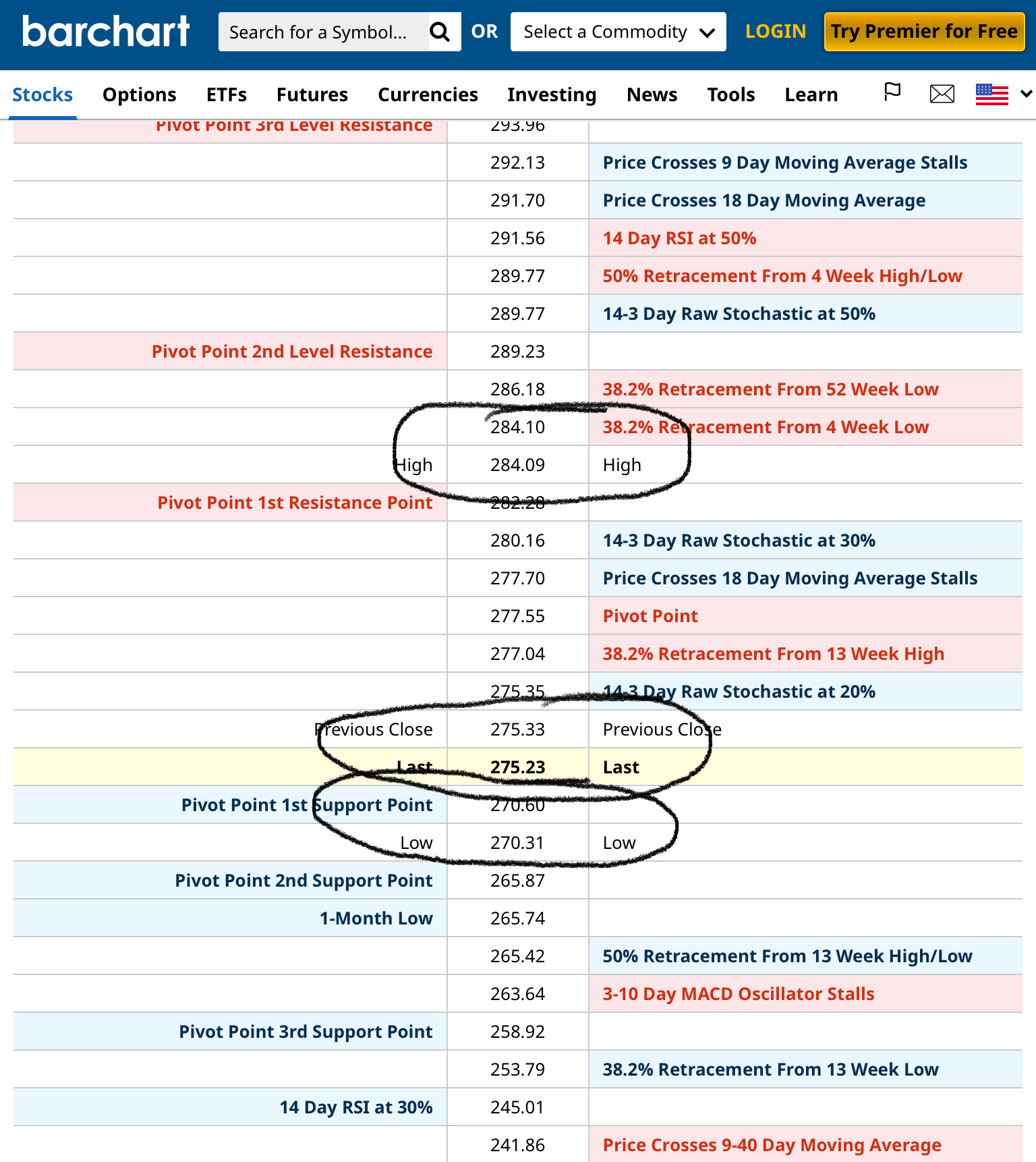

Since I wasn’t planning to trade today, I slept through the AM action, but it looks like it was a good day to sleep all the way through.  SP turned around at $0.01 of 38% fib, low near 1st pivot, and closed $0.10 from previous close. Hmmmmm, all daytraders anyone?

SP turned around at $0.01 of 38% fib, low near 1st pivot, and closed $0.10 from previous close. Hmmmmm, all daytraders anyone?

BTW, really like this site, thanks for posting it awhile back.

TSLA - Tesla Stock Trader's Cheat Sheet - Barchart.com

BTW, really like this site, thanks for posting it awhile back.

TSLA - Tesla Stock Trader's Cheat Sheet - Barchart.com

R

ReddyLeaf

Guest

Ok, how come this hasn’t been copied/noted in this options thread? This certainly hints at insider knowledge and trading if a TWTR settlement is imminent.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

willow_hiller

Well-Known Member

Ok, how come this hasn’t been copied/noted in this options thread? This certainly hints at insider knowledge and trading if a TWTR settlement is imminent.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

Wow, some quick and dirty charts for you all, but 350 really does pop for 2022-10-07 expiry.

This week:

Next week:

today's 10/7 c350 trades... total volume 12,761; sea of greenWow, some quick and dirty charts for you all, but 350 really does pop for 2022-10-07 expiry.

This week:

View attachment 857163

Next week:

View attachment 857164

(green=traded at ask or above, red=traded at bid or below); bullish???

10/7 highest call gamma=283, put=279 (i dunno what that means)

Last edited:

today's 10/7 c350 trades... total volume 12,761; sea of green

(green=traded at ask or above, red=traded at bid or below); bullish???

View attachment 857189

10/7 highest call gamma=283, put=279 (i dunno what that means)

View attachment 857192

12,761 contracts even at the high of the day ($0.31) is less than $4000. Seems insignificant even if it does look suspicious on the chart. Or am I missing something?

Two decimal places.12,761 contracts even at the high of the day ($0.31) is less than $4000. Seems insignificant even if it does look suspicious on the chart. Or am I missing something?

12k contracts covers 1.2M shares at $0.30 is more like $400k. The 100 share per contract is what tripped you up

intelligator

Active Member

today's 10/7 c350 trades... total volume 12,761; sea of green

(green=traded at ask or above, red=traded at bid or below); bullish???

View attachment 857189

10/7 highest call gamma=283, put=279 (i dunno what that means)

View attachment 857192

The way I read these charts, !!! NEVER ADVICE !!! ... is that dealers/brokers are needing to hedge their obligatory act in fulfilling their role as market makers. For instance, the bid ask difference is sometimes wide but magically an order fills; dealer bought at your selling ask, maybe. Gamma is always going to be the highest at the money, forming the bell curve, mostly influenced by open interest. The chart highlights where that hedging *might* need to occur. Perhaps the balancing act of selling has begun that slow walk towards 300? I tend to look at the clusters as the hedging work necessary to balance the overbought / oversold cycle; 270-285 looks like it's going to be a busy day for MM with a (wishful) slow walk towards 290.

I've noticed lately that the after hours closing price (8PM) compared to market close (4PM) difference has been less than a dollar... how do they do it?

Weekly Kickoff - Extreme Fear and Massive Options Volume — Opinicus 🦅

We are seeing extremes everywhere - Highest put option volume in history, explosive put/call ratios, etc. Here is how we are cutting through the noise. A look ahead to the most important macro events, market data, technical setups and more.opinicusholdings.com

"There is attention being paid to the record-breaking “put buying” (by small lot traders, 1-10 contracts) and put volume traded data that was released by the Options Clearing Corp on Friday.

While this is true, the headlines which are grabbing attention fail to address one key aspect here - The sell to open premium that was also done on Friday. This premium is also at a record level, surpassing the size that was sold to open in 2021.

To put it simply, the buying (to open) and selling (to open) offset each other. The massive volume done on Friday was not purely buying, and nor was it heavily biased towards retail either.

While pouring over the data from the OCC, we came across an interesting find that isn’t being talked about - The ETF (QQQ, SPY, etc) flow.

Total premium bought and sold (for both open and close) shows levels not seen since 2020. This is indicative of heavy puts being closed (or sold to open) in this past week. This has been associated with near-term bottoms in the past, so something to keep in mind. This is perhaps the most interesting piece of data from Friday’s close."

This week we will see if we bounce at June lows and probability of the end of the bear market if we double bottom. I can’t see if we breached June lows yesterday with the intraday candles that breached however closing price was above. Not clear.

Friday I bought 2500 TQQQ

Wanted to buy a mix if 500 GOOG, PYPL META and QQQ to diversify a bit. My wife told me to sell 3 ITM puts 15 DTE on GOOG, 3 puts on PYPL, 3 puts on QQQ. She told me this way I would have the premium to buy more TSLA if it goes lower.

This morning we seem to be gapping up. Good news so far.

SebastienBonny

Member

Will need to educate mine a bit more to get some trading ideas from her as wellThis week we will see if we bounce at June lows and probability of the end of the bear market if we double bottom. I can’t see if we breached June lows yesterday with the intraday candles that breached however closing price was above. Not clear.

Friday I bought 2500 TQQQ

Wanted to buy a mix if 500 GOOG, PYPL META and QQQ to diversify a bit. My wife told me to sell 3 ITM puts 15 DTE on GOOG, 3 puts on PYPL, 3 puts on QQQ. She told me this way I would have the premium to buy more TSLA if it goes lower.

This morning we seem to be gapping up. Good news so far.

scubastevo80

Member

If I had three wishes right now, it would be to close above $250 this Friday, $293 on 10/21 and $327 in Jan'23 (#BPSrollsfromearlierthisyear). On a more serious note, I'd love to see a run to $350, but I wonder how much of that is contingent on a macro rebound - whether bear bounce or actual turnaround related to the inflation numbers.

Knightshade

Well-Known Member

Ok, how come this hasn’t been copied/noted in this options thread? This certainly hints at insider knowledge and trading if a TWTR settlement is imminent.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

Because it was nonsense?

scubastevo80

Member

Exited my 9/30 BPS 250/230 for $.25 (up just over 50%) this morning and then got back in at $0.45 after the market turned.

As needed, I normally roll covered calls by simultaneously entering market orders to btc and sto, taking what the market gives me soon after taking the decision to roll. With this peculiar dip Friday/Monday prior to P/D and ER, considering doing a little market timing today/tomorrow by closing all the following, and then selling before or after ER. Anticipating a small spurt. It’s about the same as buying calls, and could be an opportunity to reset at something like Jan23 $325+.

- Mar23 $320

- Apr23 $308.33 and $325

Any comments?

- Mar23 $320

- Apr23 $308.33 and $325

Any comments?

SebastienBonny

Member

Just rolled 295 CC for friday to 300 CC for 10/7 for 3.07.

That strike is a safe one for these 100 shares so won’t have to follow SP that closely.

Weekly 1% on top makes me done for this week.

Will let this run until next week unless we get another big leg down.

Rolling and accumulating premium on green days in the current market situation seems a good strategy.

That strike is a safe one for these 100 shares so won’t have to follow SP that closely.

Weekly 1% on top makes me done for this week.

Will let this run until next week unless we get another big leg down.

Rolling and accumulating premium on green days in the current market situation seems a good strategy.

Still holding -p300, added -p280.

Also have +c290 and +c300 for this week, anticipating at least a little "buy the rumor" in the next few days.

Also have +c290 and +c300 for this week, anticipating at least a little "buy the rumor" in the next few days.

Earlier this morning my Oct 320 cc, a roll from last week, had the net position ahead very slightly (like $1 per contract) and I decided to close them out. With P&D coming very soon I am sitting out on the cc side in anticipation of a really good report. I didn't want those contracts to be in the way of a run.

not-advice (really, really not advice)

I'm liking the possibility of a really strong P&D report enough; surprisingly strong to wall street, that I've decided to follow along with that big 350 call position and bought calls at the 320 and 350 strike for Oct 7. This is strictly a P&D play with an expectation that I'll be closing on Monday or Tuesday after P&D. I don't anticipate riding these to expiration. I'm really, really hoping for an "oh **** moment" from investors when they realize they've got Tesla mis-valued badly, in which case I'll make out like a bandit.

My history with these sorts of trades is that I'll lose 50%+ or about the week of income the 275 strike puts I've got open for this week will earn. This is the actual outcome that I expect.

In at .30 and 1.25.

Really, really not advice.

not-advice (really, really not advice)

I'm liking the possibility of a really strong P&D report enough; surprisingly strong to wall street, that I've decided to follow along with that big 350 call position and bought calls at the 320 and 350 strike for Oct 7. This is strictly a P&D play with an expectation that I'll be closing on Monday or Tuesday after P&D. I don't anticipate riding these to expiration. I'm really, really hoping for an "oh **** moment" from investors when they realize they've got Tesla mis-valued badly, in which case I'll make out like a bandit.

My history with these sorts of trades is that I'll lose 50%+ or about the week of income the 275 strike puts I've got open for this week will earn. This is the actual outcome that I expect.

In at .30 and 1.25.

Really, really not advice.

I'm expecting a small "beat" on the P&D, 360-365, but I think in the current environment this will be a huge message to the markets, and EPS come earnings will be even better, of course...Earlier this morning my Oct 320 cc, a roll from last week, had the net position ahead very slightly (like $1 per contract) and I decided to close them out. With P&D coming very soon I am sitting out on the cc side in anticipation of a really good report. I didn't want those contracts to be in the way of a run.

not-advice (really, really not advice)

I'm liking the possibility of a really strong P&D report enough; surprisingly strong to wall street, that I've decided to follow along with that big 350 call position and bought calls at the 320 and 350 strike for Oct 7. This is strictly a P&D play with an expectation that I'll be closing on Monday or Tuesday after P&D. I don't anticipate riding these to expiration. I'm really, really hoping for an "oh **** moment" from investors when they realize they've got Tesla mis-valued badly, in which case I'll make out like a bandit.

My history with these sorts of trades is that I'll lose 50%+ or about the week of income the 275 strike puts I've got open for this week will earn. This is the actual outcome that I expect.

In at .30 and 1.25.

Really, really not advice.

As of now I'm holding some 280 straddles and a pile oc -c300's -> I expect the -c300's to expire this week and will not write against them on Friday (unless we close ATM, then I might do some to mitigate risk of a "miss"). The 280 straddle I don't know, will really depend how ATM it ends up. I'm very aware that I'm balls-deep in $TSLA shares right now, on which I'm very bullish, but I fear the wider macro. So part of me wouldn't mind to de-risk 1500x $TSLA shares, but my inner bull wants to hold on to them for next week

But how often have we seen good P&D get rewarded with a 10% dip, quite often, no? Will this time be different? I like to think so because the smallest positives in this market will stand out like a shaft of gold, when all around is dark (yes, that was a Monty Python reference)

But if logic was the master and not the Hedgies then the plan would be watch the SP rise into the $300's next Monday and then sell some fat, juicy calls... maybe even -c300's again, why not? Part of me wants to go totally to cash right now, sell dOTM puts instead for a bit, don't know...

Similar threads

- Replies

- 50

- Views

- 8K

- Replies

- 10

- Views

- 4K

- Replies

- 106

- Views

- 10K

- Replies

- 5

- Views

- 5K