Should be even better by end of the week when the extrinsic is washed out from 20th, but IV still rising for the 27th - in theory...The 1/20 to 1/27 rolls are quite favorable right now...

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Wiki Selling TSLA Options - Be the House

- Thread starter adiggs

- Start date

I believe you are correct.Could someone please check my understanding of trailing stops?

View attachment 896786

I think it will operate as such:

1. As soon as the order is sent, it will record the mark price of the option. (Let's say 1.67)

2. The limit is set at 1.67 less 20% (1.336)

3. If the limit is hit, the trailstop turns into a limit order and tries to fill at 1.336

4. If the mark ever increases higher than 1.67, the limit also increases, and the process begins again from step 2.

Is that roughly correct? Thanks in advance.

But I see no indication that the stop will not fill at market if triggered.

willow_hiller

Well-Known Member

I believe you are correct.

But I see no indication that the stop will not fill at market if triggered.

Okay, thanks. That makes sense that it would be replaced with a market order in normal circumstances. Thinkorswim did have a warning message that made me believe it could be a limit order in some circumstances:

"Due to potentially wide markets or liquidity risks at the time of activation, this order may be manually substituted with a limit order upon activation and worked until filled."

My expectation for a dump on earnings day is increasing.

intelligator

Active Member

I got distracted and didn't close the 1/20 -130/+135 BCS. The problem I see, or opportunity is that Fidelity paired the sold call with shares as a CC and I have a Long Call for the 135. The -c130 is worth 4.30, so the buyer of that call can sell the call or exercise, which the latter would be a problem for me. I can also roll the call tomorrow to 1/27 $140 at about even or 1/27 $145 for a $1.29 debit and STC the long call at a profit. Do I have this correct?

Last edited:

My expectation for a dump on earnings day is increasing.

We se having the run up and short covering leading to it

Fidelity upped my margin requirement from 40 to 50% which has put me in a freaking margin call. After working so hard to finally get out of the woods, i've been picked up and dropped off back in them.

Anyone have any experience negotiating this? Worth giving them a call?

Anyone have any experience negotiating this? Worth giving them a call?

See my post about it on Friday. They would not negotiate, even though I said I was going to change brokerage, and they make a TON of money off of my trades in fees. Prior to the change I was good on Margin down to SP of 85. Suddenly I had to take a $50k loss on some April Puts (that will probably finish OTM) to increase my margin. TD Ameritrade is also at 50% now when I called them.Fidelity upped my margin requirement from 40 to 50% which has put me in a freaking margin call. After working so hard to finally get out of the woods, i've been picked up and dropped off back in them.

Anyone have any experience negotiating this? Worth giving them a call?

TSLA is today's #1 in S&P 500 and in Nasdaq 100TSLA is today's #1 in S&P 500 and in Nasdaq 100

View attachment 893995

View attachment 893992

View attachment 893993

intelligator

Active Member

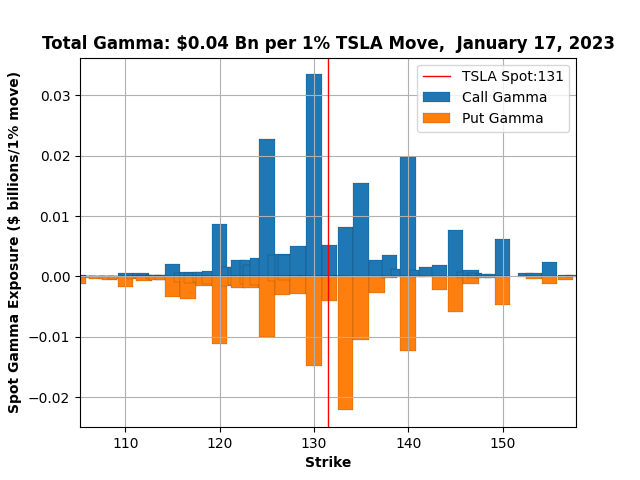

The exposure chart is goofy due to peak gamma at 132 , magnifying the 133 and 135 puts while 120p has more open interest than 133p. Same with the 130c but that does have the highest open interest south of 160c. Will be interesting what happens Wednesday.... open interest for the 100p is 101K !!!

See my post about it on Friday. They would not negotiate, even though I said I was going to change brokerage, and they make a TON of money off of my trades in fees. Prior to the change I was good on Margin down to SP of 85. Suddenly I had to take a $50k loss on some April Puts (that will probably finish OTM) to increase my margin. TD Ameritrade is also at 50% now when I called them.

I’m also with TD Ameritrade and really happy with the service and overall experience. I don’t know why they’re giving you such a hard time. I’m on 40% (vs 50%) with them due to TSLA concentration in my port (5,800 shares w/ little else other than 58x protective TSLA Puts @$80 strike and some of SPY/NVDA/SMH put spreads). If I can help in any way DM me. Perhaps I can conference you in with my rep there. It doesn’t make sense they’re forcing you at 50% unless there’s something else going on maybe with exposure like LEAPS or something? Worth exploring IMO.

GrmMastrDoobie

Member

I STO a 140 on Friday the 13th, mainly for educational purposes. Based on this:I STO CCs ranging from 141 to 145 strikes for Friday. I think I sold too early, and those strikes might not be high enough....

We should be pretty safe right? Friday when I sold, it was 16% above whatever the current price was. Looks like those numbers are based on opening price though. Not sure what it opened at on Friday.

Looks like if I waited until today to sell the 140 CC I could have got almost three times as much for it as I got on Friday.

At what point do you decide to roll to 1/27? Or is it just safer to buy it back at a loss, since next week is earnings week?

R

ReddyLeaf

Guest

@GrmMastrDoobie I would just hold for a bit and see how Wednesday fairs. You still have another $10 before you really need to roll. Unfortunately for your Friday trade, it looks like TSLA has returned to its formerly “normal” trading behavior (the SP would often spike Mondays and then trail off much of the rest of the week). In the past, there could also often be spikes on Wednesdays, as well, and I’ve found waiting until then can help reduce losses or rolling. At least you know there are only two mor trading days at that point. Anyway, it sure feels like the shorts have taken their feet off of TSLA’s neck, near the EOY.

SebastienBonny

Member

135 hit now premarket. Would be crazy if we go to 140 already today, but as we did go to the lows in only a couple of weeks, why wouldn't we go back to 200s in the same time span... Of course this could also be a build up to earnings to sell off after, so I won't be too nervous with CC's unless you get deeply underwater.

That's why I'm not taking risks and roll 10 dollar higher when a strike hits. Should we head back lower, that contract goes down in value as well and even faster than a shorter term contract. Needs some manageing, but doubling your amount of contracts (like stated here before) is a good strategy to get out of that position.

Now SP is rising, you could also use a longer term sold put as well (rolling it up a bit and maybe out) to gain some premium or pay to close calls that tend to go against you.

That's why I'm not taking risks and roll 10 dollar higher when a strike hits. Should we head back lower, that contract goes down in value as well and even faster than a shorter term contract. Needs some manageing, but doubling your amount of contracts (like stated here before) is a good strategy to get out of that position.

Now SP is rising, you could also use a longer term sold put as well (rolling it up a bit and maybe out) to gain some premium or pay to close calls that tend to go against you.

Cory on the stocks channel advocating for a V shaped recovery since we saw capitulation in December.

To avoid getting margin called and liquidated my LEAPS in December I sold 6/1 120CCs that I rolled to 17/2 140CCs once we hit 120. Now my hesitation if we hit 140 is to roll to net resistance at 155 17/3 or roll far out at 400 Jan25 waiting for a reversal to roll back in ATM when we resume a downtrend.

I don’t think we are rallying up straight to all time highs however I don’t know when the bears will start shorting massively after covering their shorts. Once they do I can roll back down ATM or ITM to salvage my CCs. However right now we are clearly entering a upward trend.

To avoid getting margin called and liquidated my LEAPS in December I sold 6/1 120CCs that I rolled to 17/2 140CCs once we hit 120. Now my hesitation if we hit 140 is to roll to net resistance at 155 17/3 or roll far out at 400 Jan25 waiting for a reversal to roll back in ATM when we resume a downtrend.

I don’t think we are rallying up straight to all time highs however I don’t know when the bears will start shorting massively after covering their shorts. Once they do I can roll back down ATM or ITM to salvage my CCs. However right now we are clearly entering a upward trend.

SpeedyEddy

Active Member

Something tells me the bulls are getting trapped. If, like just now, housing (and car loans) get involved, something 's smelling like 2008. Black swans peeking behind every tree added by a lot of war-speech of Putin, Xi to Ukrain Europe US India.

SebastienBonny

Member

Correct. That's why I wouldn't panicroll contracts far away (yet).Something tells me the bulls are getting trapped. If, like just now, housing (and car loans) get involved, something 's smelling like 2008. Black swans peeking behind every tree added by a lot of war-speech of Putin, Xi to Ukrain Europe US India.

Similar threads

- Replies

- 50

- Views

- 7K

- Replies

- 10

- Views

- 4K

- Replies

- 106

- Views

- 10K

- Replies

- 5

- Views

- 5K