Do you think we still have the bull trend or do you think we have seen the highs of this rally at 278 today?normally yes. But I think we often forgets how strong the rally really is and how the bears are feeling the heat, not the bulls. The frequent small pullbacks here and there are telling us bulls have been taking profits here and there, yet it's the bears who still owe a debt to the SP. So before a big reveal that could swing the stock both ways, I think the opposite is going to happen.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Wiki Selling TSLA Options - Be the House

- Thread starter adiggs

- Start date

samn

Member

Can anyone recommend a tax accountant/advisor? I specifically need help filing last year's taxes which includes options losses and wash sales. I'm in California but am mostly concerned about Federal tax filing so accountant in CA is not necessarily a requirement.

I'm a long term TSLA investor and naively got into selling puts. I got hit hard last year when these long dated deep in the money puts started getting exercised against me. I ended up with a string of margin calls and had to sell TSLA multiple times to cover margin. This all lead to large gains on paper from the stock I had to sell, and my large losses that I had hoped to use to offset the gains are being considered wash sales and disallowed. I'm having trouble finding any tax accountants that will take on new clients and I'm concerned that this may be a tricky area of tax law to navigate.

Can anyone help with references? If so please PM me, I would appreciate it!

—

Mod: no responses in this thread, use PM as requested.

I'm a long term TSLA investor and naively got into selling puts. I got hit hard last year when these long dated deep in the money puts started getting exercised against me. I ended up with a string of margin calls and had to sell TSLA multiple times to cover margin. This all lead to large gains on paper from the stock I had to sell, and my large losses that I had hoped to use to offset the gains are being considered wash sales and disallowed. I'm having trouble finding any tax accountants that will take on new clients and I'm concerned that this may be a tricky area of tax law to navigate.

Can anyone help with references? If so please PM me, I would appreciate it!

—

Mod: no responses in this thread, use PM as requested.

Last edited by a moderator:

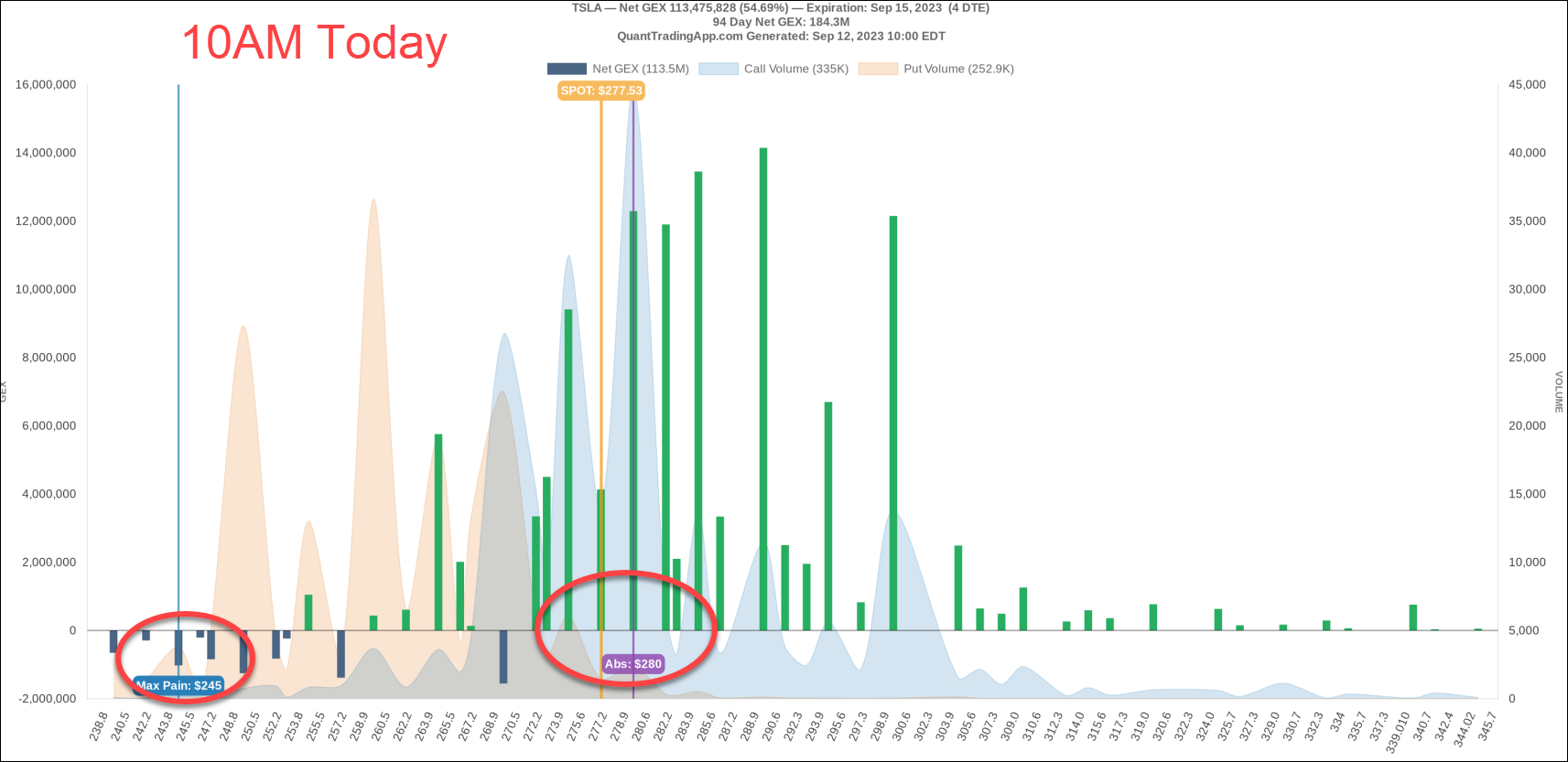

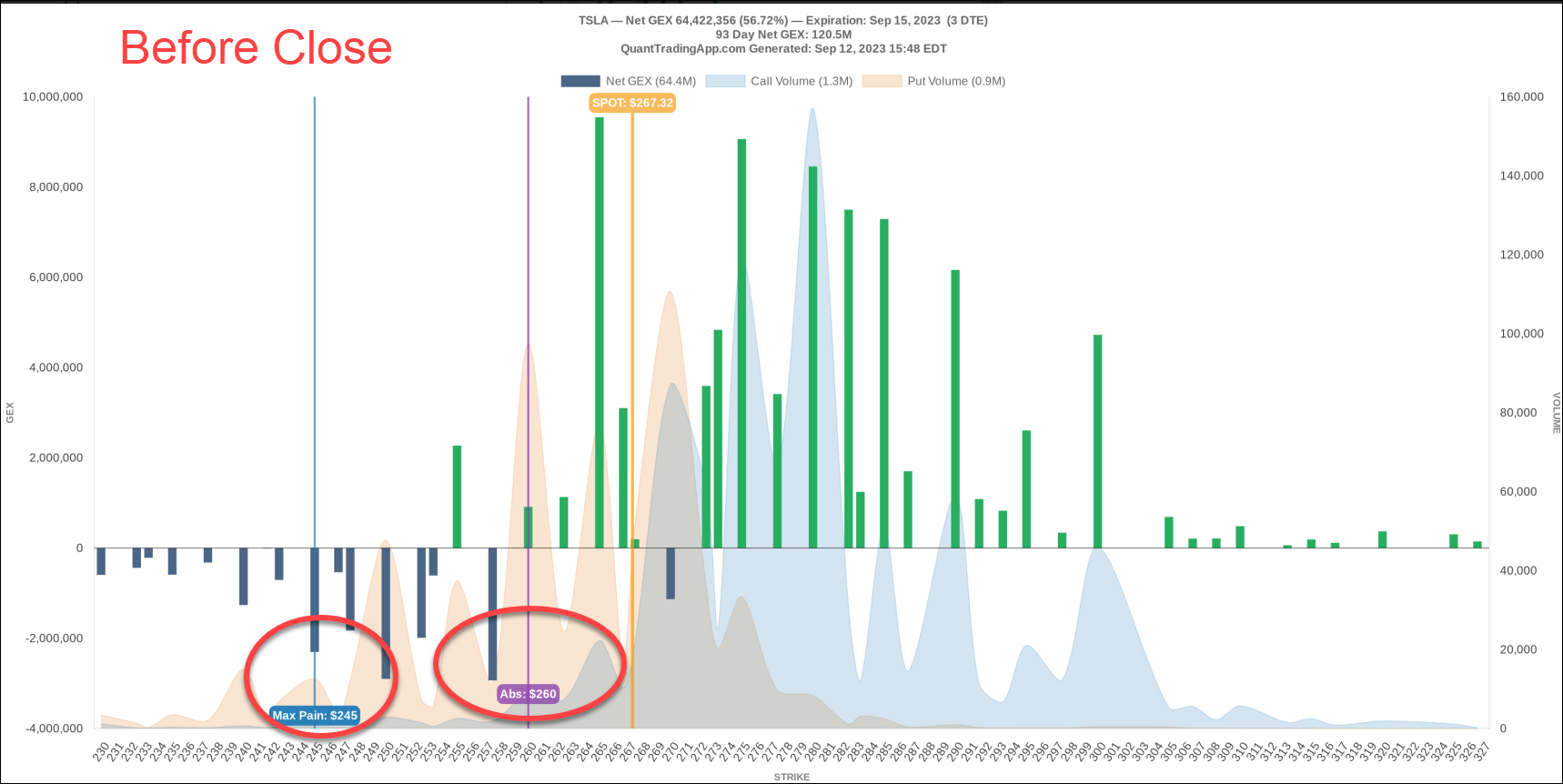

Lousy follow through day BUT based on option data as the day unfolded it should have been clear (and Cary was right to suggest) to sell the $278 area. I've only today found and tried a new tool Quant Trading App which saves lots of time adding GEX and similar to one's charts and has TONS of great backend options flow views of beta stocks, incl. TSLA.

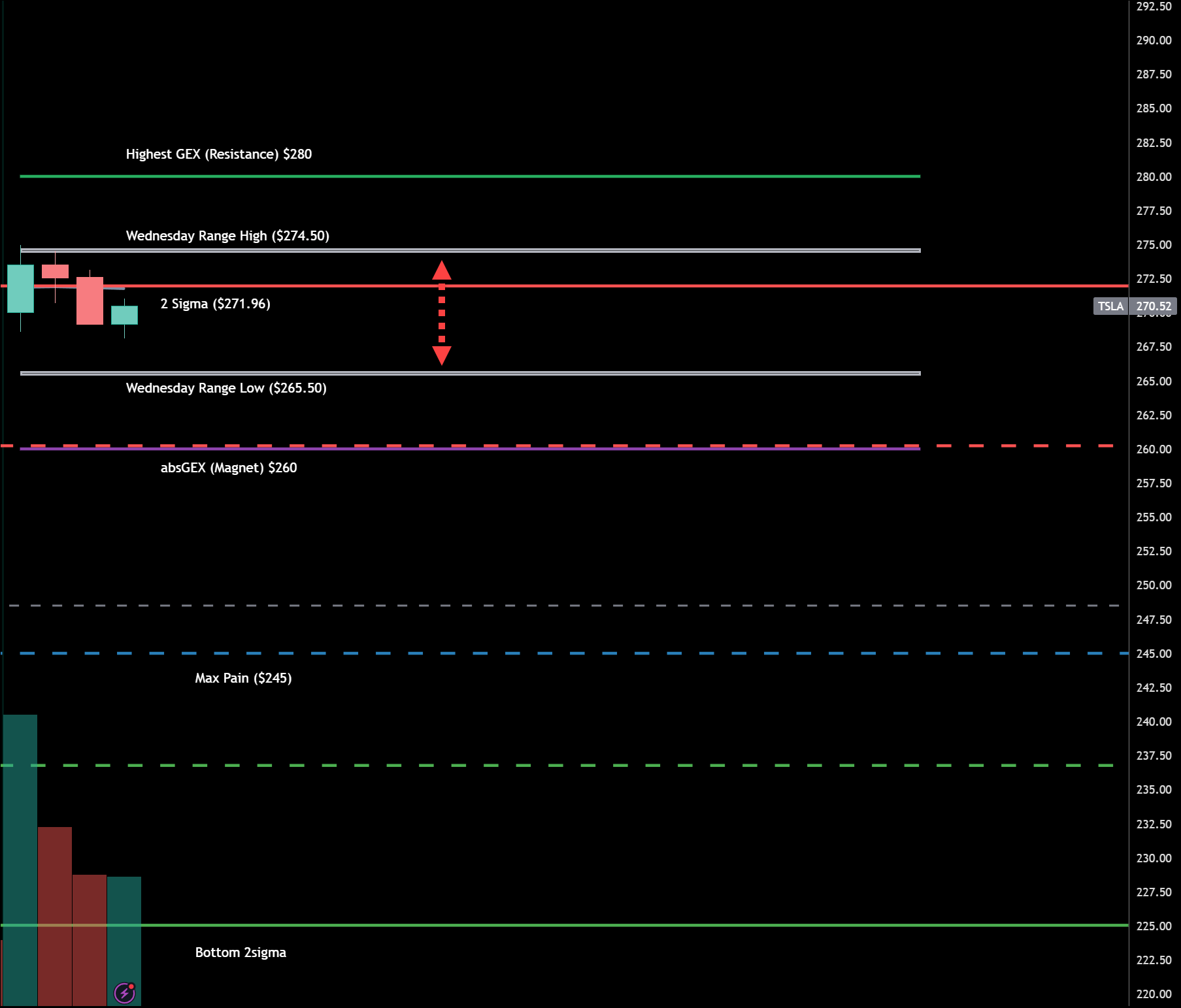

FWIW I learnt from the data that TSLA has developed STRONG pull at $260 from AbsGEX (absolute GEX) and having hit and surpassed 2 sigma breakout on Monday there was no way it'll run more, and R:R favors it will come back to the mean between the two daily expected range (gray boxes below) which it did. Bias is currently to the downside given the backend positioning, especially considering triple witching Friday and CPI tomorrow. Little chance TSLA puts up another 10% ontop of the one it just had without consolidation and downside first.

This means to say based on option flow and positioning it'll likely chop or go lower and that short calls as low as $282.50 will be safe and certainly higher this week is not in the cards right now.

and certainly higher this week is not in the cards right now.

I'm no data scientist and I'm still learning how it all interplays so take it for what it's worth. Let's see if it holds true tomorrow and the rest of the week.

Last time TSLA had a huge gap up to $277-$283 (July) it chopped for several days after and then fell back to $265:

FWIW I learnt from the data that TSLA has developed STRONG pull at $260 from AbsGEX (absolute GEX) and having hit and surpassed 2 sigma breakout on Monday there was no way it'll run more, and R:R favors it will come back to the mean between the two daily expected range (gray boxes below) which it did. Bias is currently to the downside given the backend positioning, especially considering triple witching Friday and CPI tomorrow. Little chance TSLA puts up another 10% ontop of the one it just had without consolidation and downside first.

This means to say based on option flow and positioning it'll likely chop or go lower and that short calls as low as $282.50 will be safe

I'm no data scientist and I'm still learning how it all interplays so take it for what it's worth. Let's see if it holds true tomorrow and the rest of the week.

Last time TSLA had a huge gap up to $277-$283 (July) it chopped for several days after and then fell back to $265:

Cary update:

Holding above $266.08 will keep $281.90 in reach Wednesday, which will likely be the weekly high, dropping off from there toward $259.15 where we can place a daily low, and round back up this week. If we close below $259.15 then expect $250.36 on Thursday.

For swing traders it's selling $281.80 and then going long at $250.36, and selling at $280's again.

A close above $281.80 invalidates the downward draft and keeps $289.25 and $312.45 in reach in 1-2 weeks.

A close below $250.36 sets up for a test of $226.71 by end of next week.

Holding above $266.08 will keep $281.90 in reach Wednesday, which will likely be the weekly high, dropping off from there toward $259.15 where we can place a daily low, and round back up this week. If we close below $259.15 then expect $250.36 on Thursday.

For swing traders it's selling $281.80 and then going long at $250.36, and selling at $280's again.

A close above $281.80 invalidates the downward draft and keeps $289.25 and $312.45 in reach in 1-2 weeks.

A close below $250.36 sets up for a test of $226.71 by end of next week.

tivoboy

Active Member

I think what is interesting is that with ALL THIS HOOPLA, Max pain has move up 10$… from $232… so I doubt we’re going to get down to $242/5, but still I would have expected so much call BUYING (I was a seller yesterday at $275 monthlys, but a month out) that we wouldn’t move short term MP up quite a bit. Especially with all these strikes up at 290/300+. TWT.

Last edited:

The bull trend is still intact. Whether 278 was the high remains to be seen, though.Do you think we still have the bull trend or do you think we have seen the highs of this rally at 278 today?

I think what is interesting is that with ALL THIS HOOPLA, Max pain has move up 10$… from $232… so I doubt we’re going to get down to $242/5, but still I would have expected so much call BUYING (I was a seller yesterday at $275 monthlys, but a month out) that we wouldn’t move short term MP up quite a bit. Especially with all these strikes up at 290/300+. TWT.

??? I'm seeing max-pain at $245, which would be a $15 jump from $230 (where it started from Friday afternoon). I use this site: Stock Option Max Pain

Pre CPI game plan:

If tomorrow TSLA closes above 267, very bullish. Expect at least a full gap fill soon.

If TSLA closes below 267, expect a test of 255 by EOW next week.

If 255 is broken - very low chance - very bearish. The bull trend will be in grave danger.

If tomorrow TSLA closes above 267, very bullish. Expect at least a full gap fill soon.

If TSLA closes below 267, expect a test of 255 by EOW next week.

If 255 is broken - very low chance - very bearish. The bull trend will be in grave danger.

It's a Jan 2024 expiry? You could sell a calendar spread against that for the next 20 weeks...$10 at close, so yes, definitely caught the top. Unfortunately, only 1x, though better than beer money, enough for a nice dinner. Now the tougher decision is to let it ride and sell ATM weekly puts or not. Traveling again today (supercharging now), but I have some time tomorrow, plus CPI coming out so……decisions.

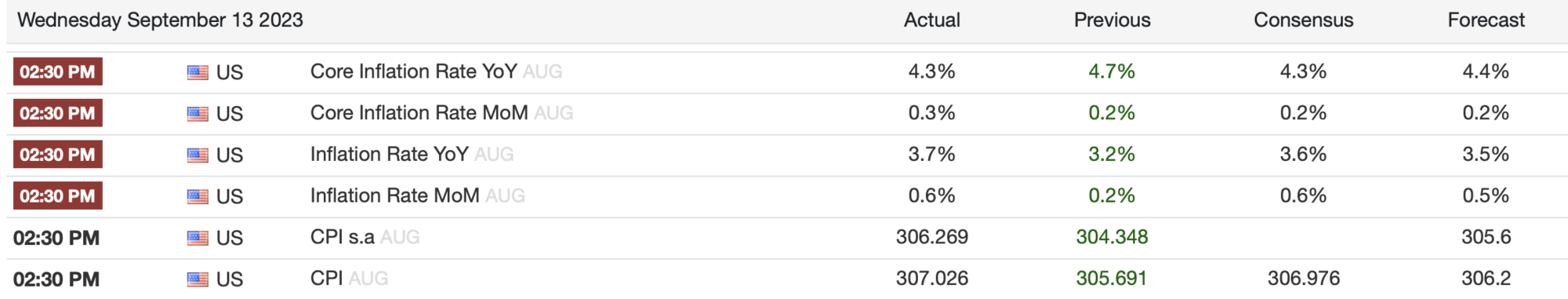

Totally forgot it's CPI day! Came in on the warm side:

tivoboy

Active Member

I think this will be the last teeny tiny slightly warm number we see this year.. summer travel is over..school buying is over (k-12 and post secondary), strikes looming, gov’t shut-down looming, enterprise spend goes into hibernation Q4, consumer balance sheets are now 1/5th of their peaks (which was irrational). I also think we’re at essentially PEAK rates.. so if you want some fixed income for the next 2-5 years in your portfolios, BUY it soon.

winter is coming..

So we can see that TSLA is still running below the 50% fib channel line, represented by a solid white line here. Last week it got rejected by the 0.381 line (yellow) before consolidating at the 0.236 line (red). Then on Sunday, Morgan Stanley came out with a surprise upgrade (250 -> 400) and TSLA broke through the yellow line with ease, only to be rejected at the white line. Right now it is still retesting the yellow line, previously resistance now support.

Today is CPI so there was no surprise it would pull back to the yellow line before numbers came out. That's fine. However, now that those numbers are known, TSLA needs to hold this support into the close (267+). If it can do that, then expect another test of 280 soon.

If it cannot hold 267 into the close, then expect it to test 255-257 next week before bouncing. That will be where the red line is, plus the ascending anchored vwap from the 212 low. Also the 50 DMA. I don't see TSLA breaking down from this level but THERE'S ALWAYS A CHANCE. If it breaks down from this level, it will be very bearish for the stock because it means the blue line will be next. And you see that TSLA only touches the blue line at major lows (102, 153, 212). Once it touched this line, it would go on to make new highs before touching it again. If this time it touches this blue line before making new high, expect it to break down from the uptrend and really CORRECT.

This is not gloom and doom. As long as TSLA holds these supports, it can undo all the damage and then some in just a day or two. So both bulls and bears beware.

Today is CPI so there was no surprise it would pull back to the yellow line before numbers came out. That's fine. However, now that those numbers are known, TSLA needs to hold this support into the close (267+). If it can do that, then expect another test of 280 soon.

If it cannot hold 267 into the close, then expect it to test 255-257 next week before bouncing. That will be where the red line is, plus the ascending anchored vwap from the 212 low. Also the 50 DMA. I don't see TSLA breaking down from this level but THERE'S ALWAYS A CHANCE. If it breaks down from this level, it will be very bearish for the stock because it means the blue line will be next. And you see that TSLA only touches the blue line at major lows (102, 153, 212). Once it touched this line, it would go on to make new highs before touching it again. If this time it touches this blue line before making new high, expect it to break down from the uptrend and really CORRECT.

This is not gloom and doom. As long as TSLA holds these supports, it can undo all the damage and then some in just a day or two. So both bulls and bears beware.

Last edited:

sold these at 274.5.As mentioned yesterday, I only sold naked puts and those are doing wonderfully. Of course I sold them when the SP was at 265 and they were decently OTM at the time so a lot of leeway at the moment for when it starts pulling back. At 274 today, I bought some share to play the scenario I just described. Hopefully can sell them at 279 this afternoon.

Sold 350 naked calls for next week at the opening pop above 274.

The Daily Trader's Youtube channel shows that TSLA is in a bullish channel with bullish indicators for now. Should end the week higher.

The Daily Trader's Youtube channel shows that TSLA is in a bullish channel with bullish indicators for now. Should end the week higher.

How are F and GM up everyday? I guess Wallstreet thinks it is a good thing if the strike happens and those two companies stop making their crappy products....

Dude for real. My GM puts have been slowly bleeding out just as the risks of a strike increase.How are F and GM up everyday? I guess Wallstreet thinks it is a good thing if the strike happens and those two companies stop making their crappy products....

tivoboy

Active Member

You had me at VWAPSo we can see that TSLA is still running below the 50% fib channel line, represented by a solid white line here. Last week it got rejected by the 0.381 line (yellow) before consolidating at the 0.236 line (red). Then on Sunday, Morgan Stanley came out with a surprise upgrade (250 -> 400) and TSLA broke through the yellow line with ease, only to be rejected at the white line. Right now it is still retesting the yellow line, previously resistance now support.

Today is CPI so there was no surprise it would pull back to the yellow line before numbers came out. That's fine. However, now that those numbers are known, TSLA needs to hold this support into the close (267+). If it can do that, then expect another test of 280 soon.

If it cannot hold 267 into the close, then expect it to test 255-257 next week before bouncing. That will be where the red line is, plus the ascending anchored vwap from the 212 low. Also the 50 DMA. I don't see TSLA breaking down from this level but THERE'S ALWAYS A CHANCE. If it breaks down from this level, it will be very bearish for the stock because it means the blue line will be next. And you see that TSLA only touches the blue line at major lows (102, 153, 212). Once it touched this line, it would go on to make new highs before touching it again. If this time it touches this blue line before making new high, expect it to break down from the uptrend and really CORRECT.

This is not gloom and doom. As long as TSLA holds these supports, it can undo all the damage and then some in just a day or two. So both bulls and bears beware.

View attachment 973539

tivoboy

Active Member

What did you get? A penny?Sold 350 naked calls for next week at the opening pop above 274.

The Daily Trader's Youtube channel shows that TSLA is in a bullish channel with bullish indicators for now. Should end the week higher.

got .69 for Oct 6th 350 strikes and sold CC's against Sept 25 350 calls ....Sold 350 naked calls for next week at the opening pop above 274.

The Daily Trader's Youtube channel shows that TSLA is in a bullish channel with bullish indicators for now. Should end the week higher.

Sharing from QTA (quanttradingapp.com)

Will watch for several days to see their accuracy level. It's based on option flow/GEX levels.

So far impressive how price respected the intraday range high.

Will watch for several days to see their accuracy level. It's based on option flow/GEX levels.

So far impressive how price respected the intraday range high.

Similar threads

- Replies

- 50

- Views

- 8K

- Replies

- 10

- Views

- 4K

- Replies

- 106

- Views

- 10K

- Replies

- 5

- Views

- 5K