Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Wiki Selling TSLA Options - Be the House

- Thread starter adiggs

- Start date

tivoboy

Active Member

It’s a pretty concerted effort, and I think the objective is hold price a few more days, into next week. At that point the 50 day should dip below the 200 day moving average and well, that event has a dire name.Pretty impressive job keeping TSLA down with SPY, QQQ ripping this morning.

Can anyone easily project how long at this price till the 50 moves to the intersection of the 200 (~231)? My quess is another week between $227 and $234 and the already falling 50 is going to be very close. Just in time for a max pain of $217.50 for 1/19/24

SpeedyEddy

Active Member

Because of the long time it was available. (for instance: you see a peak at $233.33 as a $700 before-split..)1/19 (messy)

juanmedina

Active Member

It’s a pretty concerted effort, and I think the objective is hold price a few more days, into next week. At that point the 50 day should dip below the 200 day moving average and well, that event has a dire name.

Can anyone easily project how long at this price till the 50 moves to the intersection of the 200 (~231)? My quess is another week between $227 and $234 and the already falling 50 is going to be very close. Just in time for a max pain of $217.50 for 1/19/24

You don't see a run up to ER?

NVDA has stolen all the previous TSLA-type action (look at its chart today...).

Longing for the good ole' days when TSA was like that ;- )

Longing for the good ole' days when TSA was like that ;- )

juanmedina

Active Member

NVDA has stolen all the previous TSLA-type action (look at its chart today...).

Longing for the good ole' days when TSA was like that ;- )

Will we eventually see a crash like TSLA?

Last edited:

Doesn't matter, today alone was a +$23 run in under 45 minutes, that's all we traders need, in-and-out. It's been so long since we had one like that on TSLA.Will eventually see a crash like TSLA?

Yes. The challenge is knowing when...Will eventually see a crash like TSLA?

Nvidia's got most of the AI reality priced in (and then some), but they don't have a sustainable solution for that market for the "potential" people see in AI.

I sold 252.5CC for .65 when the stock was climbing earlier around 238.

I have a stop to buy them back for .64 in case this is a MMD that will reverse later because I wouldn't be surprised to see the SP rise this week and 252.5 is not far away.

I have a stop to buy them back for .64 in case this is a MMD that will reverse later because I wouldn't be surprised to see the SP rise this week and 252.5 is not far away.

SpeedyEddy

Active Member

And Nvidia are/can be copied a bit more easily on most of their business. There is no company that can Cover All of Tesla's MOAT. Remember 2014-2018? We have that now, but I am with @Jim Holder and look at other stocks to make money with options. Waiting to sell Nvidia calls soon. (GM as well I guess, they are heading for a government rescue (otherwise bankruptcy). C3.AI Vinfast (bit too late)Yes. The challenge is knowing when...

Nvidia's got most of the AI reality priced in (and then some), but they don't have a sustainable solution for that market for the "potential" people see in AI.

But this being the Tesla Options thread:

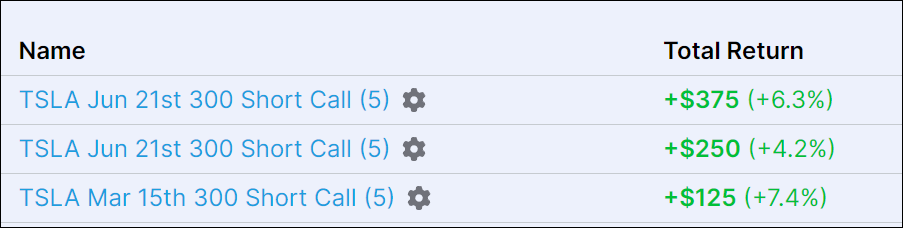

Positions: [EDITED!!!!]

+ $TSLA Stock

- TSLA NASDAQ.NMS Jan12'24 235 CALL

- TSLA NASDAQ.NMS Jan12'24 237.5 CALL

- TSLA NASDAQ.NMS Jan19'24 272.5 CALL

- TSLA NASDAQ.NMS Mar15'24 240 PUT

- TSLA NASDAQ.NMS Mar15'24 300 CALL

- TSLA NASDAQ.NMS Mar15'24 310 CALL

just closed - TSLA NASDAQ.NMS Jan12'24 250 CALL with a almost 50% profit

Last edited:

I'm playing the long side with weekly -p235's, but I just bought myself some medium term insurance with 10 bearish put spreads (+p180 and -p150) for 3/15. I didn't want to spend a huge amount ($1.5k), but it's a good feeling to have something to fall back on in case the bottom falls out for whatever reason (poor guidance, Elon selling shares after the lock-up period, world war Z).

same daytrade, BTC soon; my plan is pocket gains here and thereI sold 252.5CC for .65 when the stock was climbing earlier around 238.

I have a stop to buy them back for .64 in case this is a MMD that will reverse later because I wouldn't be surprised to see the SP rise this week and 252.5 is not far away.

if there is no replacement tomorrow, try other DTEs

Only small scalps so far this morning for me. Feeling TSLA is neither here nor there ATM, so being careful.

If we lose and stay below $235 I'll re-sell a set of CC's, same if we pop over $240, will scale in.

If we lose and stay below $235 I'll re-sell a set of CC's, same if we pop over $240, will scale in.

SpeedyEddy

Active Member

(I expect a volatile week as you can see, not planning on holding on until Friday. Just some (COVERED) theta/delta-catch)

Second day of negative dealer delta (bullish):

email from SpotGamma; long story short - M7 has reversal signals

A Return to Negative Gamma

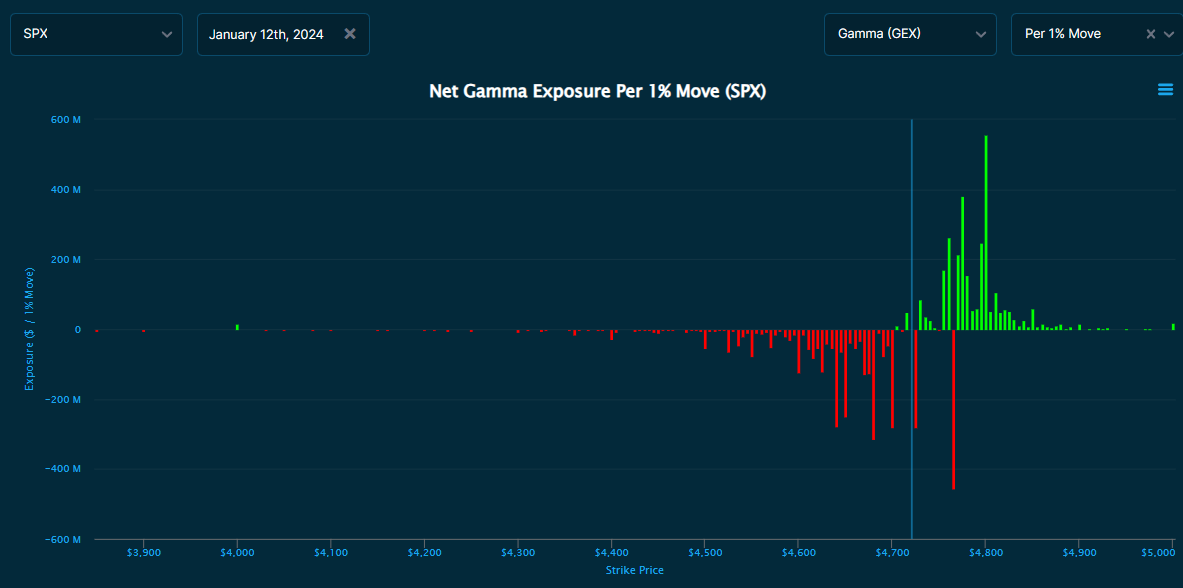

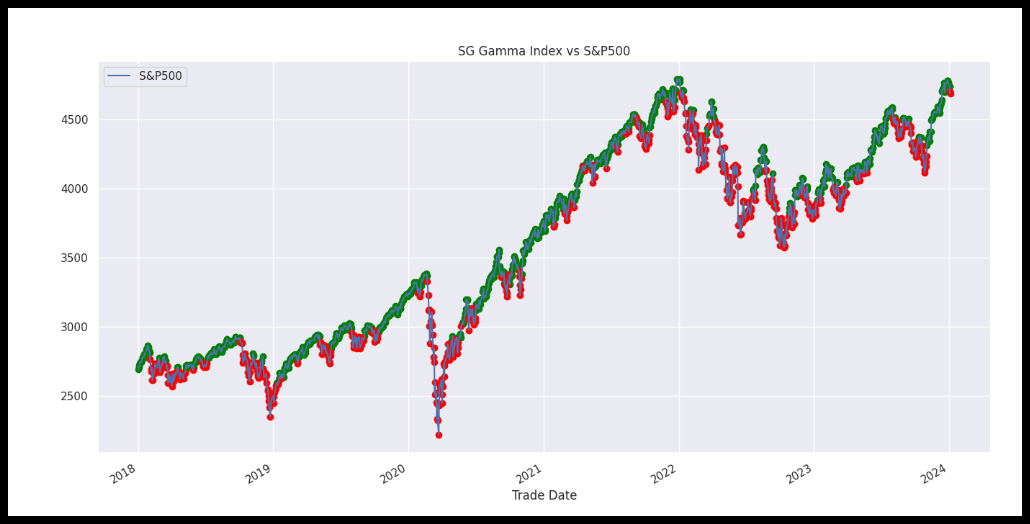

On Thursday, our SG Gamma Index™ went negative for the first time since November 02, 2024. This poses a potential danger for long equities (without stop losses or fixed debits), given the history of what has happened in the past after flips to negative gamma. Last year’s major correction was marked by negative gamma, as was the bear market of 2022, and the Q1 2022 crash:

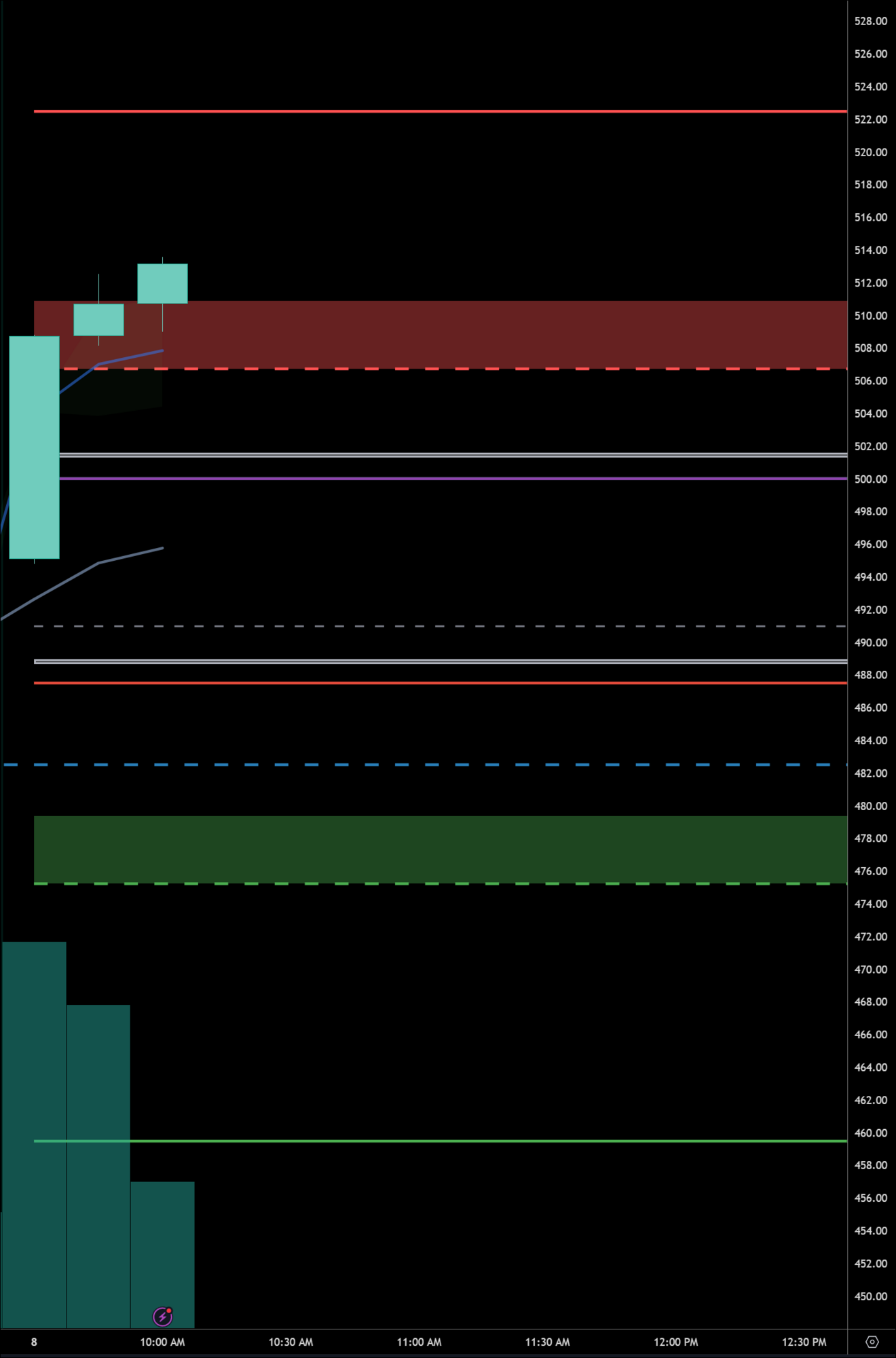

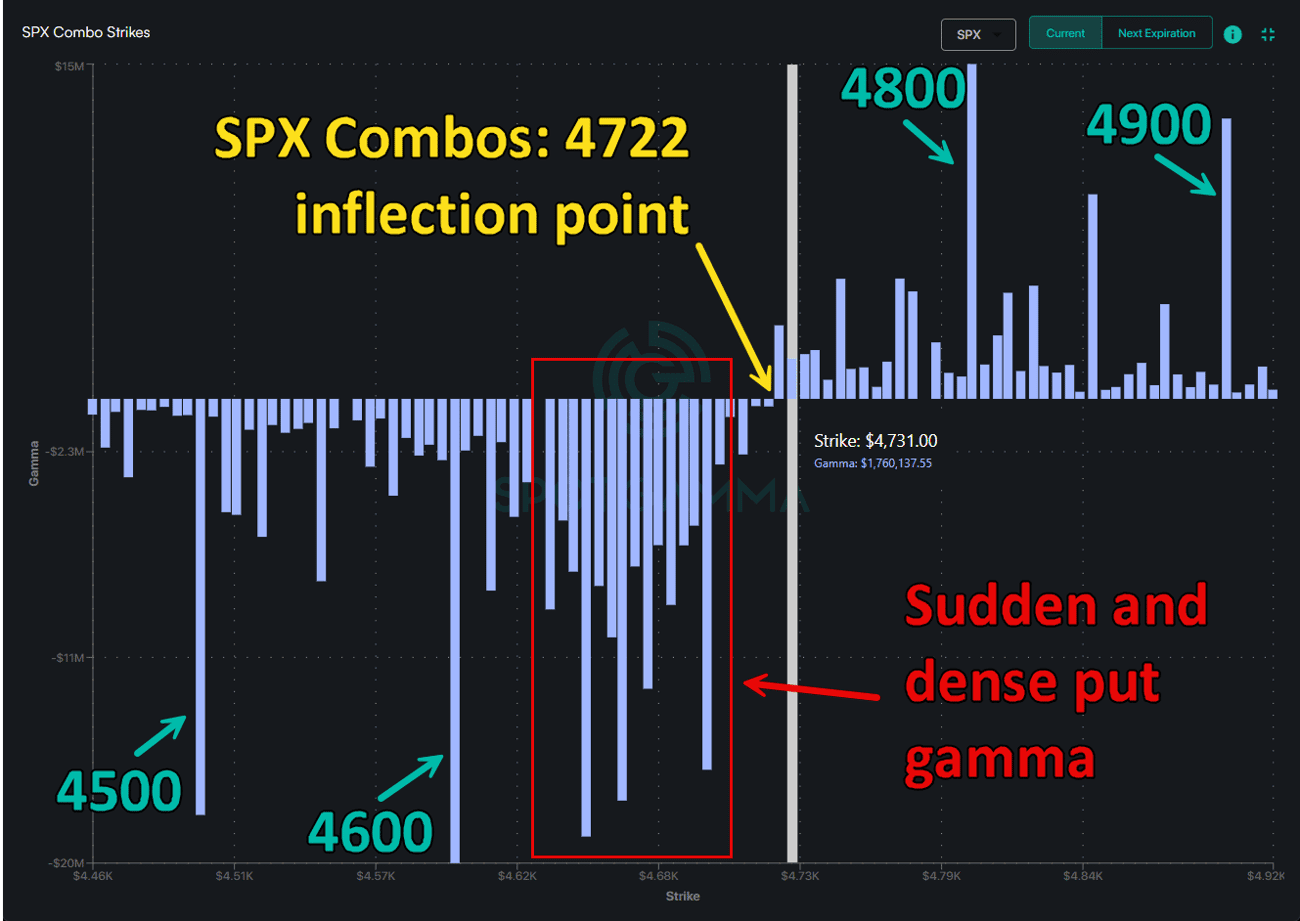

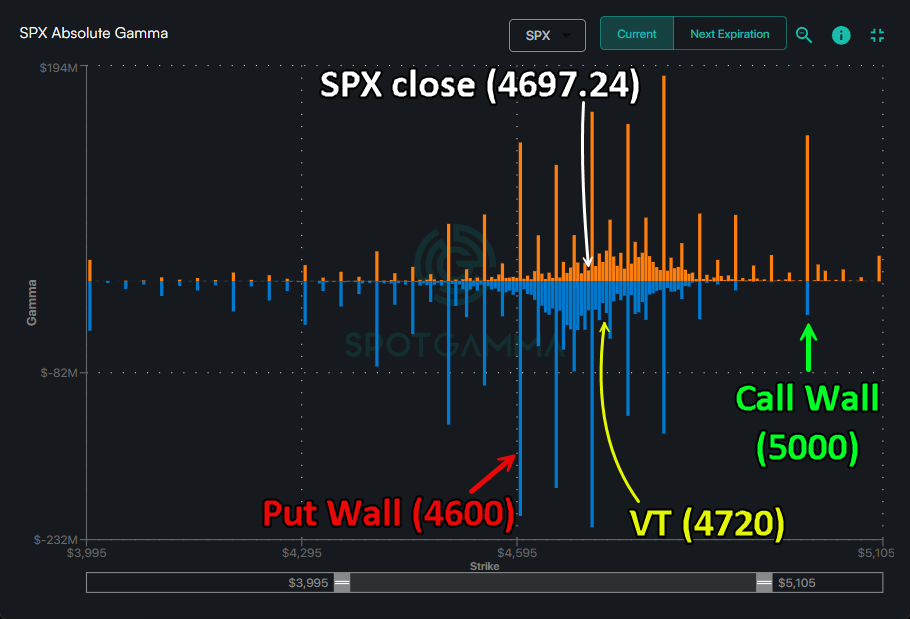

Our daily models break down multiple ways of seeing and understanding what is going on with these gamma regimes and the inflection points which mark them. For example, our combos here show areas of net negative gamma between associating levels of SPY and SPX:

Focusing only on SPX from Friday’s model, the underlying price is shown to have closed just underneath the largest combined gamma level at 4700. There are many reasons why 4700 is such a pivotal point, such as the three largest put gamma strikes residing between 4600 and 4700. These should function as strong support moving forward, but elevated volatility is expected if the price is engaging with these high put strikes (and operating underneath our Volatility Trigger™).

If the futures can inch back up above this key SPX 4700 level, as they have been doing slightly so far since the Sunday futures gap at 6pm EST, then this is a game-changing difference that would switch from secondary forces (of vanna and charm) working for the price in a bullish way—rather than against it in a bearish way.

However, for tactical trading, and besides using our new volatility tools, the flows themselves are the most directly relevant for seeing how the price is being steered. Pictured below from our MAG7 flows on Friday, which combine the net directional options influence from the megacap big tech leaders, we can see how a high of the day was marked by a distinct bearish reversal signal from the call flows (shown here in orange).

That bearish reversal—marked distinctly in the flows—also associated directly with our most tactical structural tool, which is the Volatility Trigger™. This level functions as support/resistance, but it also has the unique property of automatically forecasting increases in volatility if the price becomes trapped underneath it.

It helps to know exactly where this level lies each morning in the premarket (before the action begins) because different types of trades work better underneath this point, and it is our most explicit boundary for risk on and risk off.

A Return to Negative Gamma

On Thursday, our SG Gamma Index™ went negative for the first time since November 02, 2024. This poses a potential danger for long equities (without stop losses or fixed debits), given the history of what has happened in the past after flips to negative gamma. Last year’s major correction was marked by negative gamma, as was the bear market of 2022, and the Q1 2022 crash:

Our daily models break down multiple ways of seeing and understanding what is going on with these gamma regimes and the inflection points which mark them. For example, our combos here show areas of net negative gamma between associating levels of SPY and SPX:

Focusing only on SPX from Friday’s model, the underlying price is shown to have closed just underneath the largest combined gamma level at 4700. There are many reasons why 4700 is such a pivotal point, such as the three largest put gamma strikes residing between 4600 and 4700. These should function as strong support moving forward, but elevated volatility is expected if the price is engaging with these high put strikes (and operating underneath our Volatility Trigger™).

If the futures can inch back up above this key SPX 4700 level, as they have been doing slightly so far since the Sunday futures gap at 6pm EST, then this is a game-changing difference that would switch from secondary forces (of vanna and charm) working for the price in a bullish way—rather than against it in a bearish way.

However, for tactical trading, and besides using our new volatility tools, the flows themselves are the most directly relevant for seeing how the price is being steered. Pictured below from our MAG7 flows on Friday, which combine the net directional options influence from the megacap big tech leaders, we can see how a high of the day was marked by a distinct bearish reversal signal from the call flows (shown here in orange).

That bearish reversal—marked distinctly in the flows—also associated directly with our most tactical structural tool, which is the Volatility Trigger™. This level functions as support/resistance, but it also has the unique property of automatically forecasting increases in volatility if the price becomes trapped underneath it.

It helps to know exactly where this level lies each morning in the premarket (before the action begins) because different types of trades work better underneath this point, and it is our most explicit boundary for risk on and risk off.

vwman111

Member

IV spike on earnings can't come soon enough. Can't recall premiums being so low.

Started rolling my Dec 2025 +p270’s to June 2026, did 10x already for $5 per contract, which seems a good deal for +6 months expiry…

Ah, another 20x 6/2026 BTO @$77 on the “pop” back to to $238.50

So now I will sell STO 20 9/2024 -p270

Also have a STO 9/2024 -c270 order open

Ah, another 20x 6/2026 BTO @$77 on the “pop” back to to $238.50

So now I will sell STO 20 9/2024 -p270

Also have a STO 9/2024 -c270 order open

yah, dead last in M7 and hardly moving; perfect for ICOnly small scalps so far this morning for me. Feeling TSLA is neither here nor there ATM, so being careful.

If we lose and stay below $235 I'll re-sell a set of CC's, same if we pop over $240, will scale in.

View attachment 1007097

View attachment 1007100

Similar threads

- Replies

- 50

- Views

- 8K

- Replies

- 10

- Views

- 4K

- Replies

- 106

- Views

- 10K

- Replies

- 5

- Views

- 5K