And legally binding too…. That’s the best part … adiggs guarantees all of our gains. Fantastic guy seriouslyThis is some of the best not advice on this thread!

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Wiki Selling TSLA Options - Be the House

- Thread starter adiggs

- Start date

juanmedina

Active Member

Thanks, I may call my broker and see if there’s something else I need to set or get approval for. Perhaps I can do this by calling and having the broker trade instead of me trading via the web interface.

Yes, thanks again for the reminder. I very much appreciate your input on this thread and have learned so much from your trading. Everyone is at a different point in life, trading, experience, risk tolerance, account value, financial needs, etc. I’m quite a bit behind you, ADiggs and others, especially on $$$, but value everyone’s input.

Since I only began invested in TSLA after Battery day, I’m really not ready to lose shares below $1000. I’m also very close to my target number of shares needed for retirement and don’t want to risk losing out. I’m actually over my “needs” now, but have decided to give back to the community by buying a new Plaid for myself and a Model Y for a few family members.

I’m mostly learning about selling options to follow ADiggs method of generating income in retirement without having to sell any shares (though it’s very fun and addictive). I’m planning to lease the new cars with my trading profits and probably need $5k-10k/mo in total living expenses. Unlike many TSLA owners, I live in a very low cost area, have modest needs/wants, and have the house paid off, so very low expenses. Back in 2014, when I was tracking expenses in anticipation of early retirement, I managed to live off $36,000 for the year and still took four vacations (including 3 weeks in Italy, 3 weeks in Hawaii). Because I was unable to break away from work, I decided to splurge on a new 2015S70D, stupidly bought with $80k cash. Now, I only dream about what if that money had bought stock instead.Edit ouch: $80k / $40/sh = 2000 shares.

How many shares are you looking to accumulate? I remember @Lycanthrope was shooting for $800 SP to retire which it is similar to my target and the SP got to $900 and I did nothing

Is the concern about a run up because of a possible stock split?

I’m of the opinion that all the reasons it happened last year are present again, other than potentially the amount of naked shorting.

Last year the meeting was July 7th and the split was announced Tuesday August 11th.

Would the split not be after the meeting as I think they need some kind of permission to even do a 2 for 1 at this point?

What’s the thinking and reason for fear this coming week?

Good luck everyone!

I’m of the opinion that all the reasons it happened last year are present again, other than potentially the amount of naked shorting.

Last year the meeting was July 7th and the split was announced Tuesday August 11th.

Would the split not be after the meeting as I think they need some kind of permission to even do a 2 for 1 at this point?

What’s the thinking and reason for fear this coming week?

Good luck everyone!

Knightshade

Well-Known Member

Is the concern about a run up because of a possible stock split?

I’m of the opinion that all the reasons it happened last year are present again, other than potentially the amount of naked shorting.

I'm not sure it's likely Tesla will be added to the S&P 500 for a second time though.

I don't know about the % of profits orders. I haven't wanted to enter them so I haven't gone looking for themDoes fidelity have any good way of taking profits on percentage profit or points ? Like bracket orders? It’s all sorts of awkward for me coming from Schwab. I plan to go back to Schwab because fidelity app is also a bit counterintuitive, can’t really easily close out positions, and gives you selection of “margin” versus “cash” when opening position.…. And seems to keep cash in a sppaxx money market type account which may be good but I find confusing.

The SPAXX fund for your cash is just Fidelity's way of making sure you get that 0.01% interest your cash can be earning in a money market fund. It's cash.

I'm arriving at the same conclusion regarding Fidelity's tools. The desktop app has a Close Strategy choice, but it also arranges everything based on how to minimize margin, and that frequently doesn't match up with how I align the positions.

As much as I'm spending on commissions these days I'm thinking about moving

I feel very much the same. Though holding shares is easy for me, so I hold some shares (fewer today than a year ago when I retired) for upside exposure, and use a big hunk of the portfolio for generating the income.How many shares are you looking to accumulate? I remember @Lycanthrope was shooting for $800 SP to retire which it is similar to my target and the SP got to $900 and I did nothing. I sometimes feel like selling the stock and just living of Put income; it seems easier emotionally than holding shares. I am in a similar situation my expenses are low and I don't have many wants and needs other than the Plaid... I just need to convince the wife.

And since I sell both puts (put spread) and calls (backed by leaps), I can earn income in an up or down tread from Tesla. AND because of all of the leaps, I actually have more exposure to big moves up than just owning the shares.

Since my view is 10x from here sometime over the decade ($6-10k per share), I don't NEED to have anything go up 10x, but I'd sure like it to happen. If nothing else it'll make for a lot more money to give away.

A big reason for the big move last year was the 4-5 years of winding the spring that happened before that. I don't know how closely you've been following the company for a longer time window, but we traded in a 180-280 band for a year or two, and then the 280-380 band for a year or two. The company probably wasn't worth $280 when it first got there (2014 I believe it was), and it definitely wasn't worth $180 on the huge push down in 2019 -- or any of the 280-380 share prices it closed at throughout 2018-2019; maybe earlier.Is the concern about a run up because of a possible stock split?

I’m of the opinion that all the reasons it happened last year are present again, other than potentially the amount of naked shorting.

Last year the meeting was July 7th and the split was announced Tuesday August 11th.

Would the split not be after the meeting as I think they need some kind of permission to even do a 2 for 1 at this point?

What’s the thinking and reason for fear this coming week?

Good luck everyone!

All those shorts and share manipulation / push down finally went pop. And then the share split. And then the S&P inclusion.

The 'concern' about a run up, at least for me, is mostly about understanding risks to the positions I am in. I think I spend more time thinking about how they can go wrong than I do with how they can go right. An important risk if I'm selling covered calls is a big move up that doesn't come back. Just as I also spend time thinking about how I'm going to handle a big move down.

On the downside, I've been adding leverage (via put spreads, selling calls against leaps), and just about all of my positions do badly on a deep and extended move down. The covered calls themselves will be doing great, but they won't offset the put spreads that I either decide to stop selling or even go ITM. And the leaps instead of shares means that I can't just hold through anything and everything (which I've done before).

I don't have an opinion on whether a stock split will happen or not. If I were guessing then I'd bias towards not (Elon giving the shorts more time to pile in

Can’t recommend it highly enough, Webull is phenomenal app and worth the 5 dollars to set up a brokerage account simply have access to the features in the mobile app…As much as I'm spending on commissions these days I'm thinking about moving

Here is my link … quite powerful as a desktop app and iphone app.... dont be thrown by the amway style referral link

As a shortcut to evaluating Webull through your link, does the app just supply analytical information or do you have to put funds/shares on deposit with them?Can’t recommend it highly enough, Webull is phenomenal app and worth the 5 dollars to set up a brokerage account simply have access to the features in the mobile app…

Here is my link … quite powerful as a desktop app and iphone app.... dont be thrown by the amway style referral link

afaik you can just "test" it forverer.. and use it to simulate stuff & then just transfer it over to another platform.As a shortcut to evaluating Webull through your link, does the app just supply analytical information or do you have to put funds/shares on deposit with them?

Some people do this with tastytrade-workstation as well.

Having had the opportunity to read and learn along with everyone since @adiggs started this thread over a year ago - you can really see the learning as a group in near real-time.

Pretty cool!

Also went back this weekend and did a speed read through from the beginning. Definitely much more mature positions, entries, and most importantly exits.

It wasn't too long ago that "we" would have left something open at 80% profit just to let that Theta burn, but now closing that opportunity shows the ability to enter another strategy with a better set up and more credit since things change so fast during the week.

Also one of my big techniques is being applied more liberally across the board and that is "do nothing" sometimes just a day, maybe a morning but all the times I have "done nothing" I have been happy about it.

All that said - will be looking to open a new BPS this morning somewhere around the MMD if we get one!

Cheers!

Pretty cool!

Also went back this weekend and did a speed read through from the beginning. Definitely much more mature positions, entries, and most importantly exits.

It wasn't too long ago that "we" would have left something open at 80% profit just to let that Theta burn, but now closing that opportunity shows the ability to enter another strategy with a better set up and more credit since things change so fast during the week.

Also one of my big techniques is being applied more liberally across the board and that is "do nothing" sometimes just a day, maybe a morning but all the times I have "done nothing" I have been happy about it.

All that said - will be looking to open a new BPS this morning somewhere around the MMD if we get one!

Cheers!

Would anyone mind giving their opinion on which roll they would do in my situation? I’ve been lurking for a long time and making lots of money, and id like to compare my opinion with others.

I’ve sold 8/6 700p and 705c in even amounts. What would you do? Close or roll to what strike and expiration?

I’ve sold 8/6 700p and 705c in even amounts. What would you do? Close or roll to what strike and expiration?

without thinking about tax:Would anyone mind giving their opinion on which roll they would do in my situation? I’ve been lurking for a long time and making lots of money, and id like to compare my opinion with others.

I’ve sold 8/6 700p and 705c in even amounts. What would you do? Close or roll to what strike and expiration?

close at 9:45 (usually morning-dip), open again at 14h or so (usually peak of day), wait for turnaround-tuseday & close then for good.

not advice & i bit more like gambling ..

jeewee3000

Active Member

Here are my plays for the morning/week. I've got another two to go but will hold in case things get nutty. These three already surpassed my weekly goal so probably best not to get greedy, or at least greedy too soon.

i used my 5x 20/8 +730c for a 6/8 -750c. i would like it to expire worthless, but happily take a 3x on my 20/8 calls if that is what is is needed on friday

edit: also turned my 700/750/770 broken-wing butterfly into an 730/750/770 freefly. bestcase: 750 on 20/8 for 20k gains, worst case: 2k gains anywhere around that freefly.

Quite ok for a weekend-trade

edit: also turned my 700/750/770 broken-wing butterfly into an 730/750/770 freefly. bestcase: 750 on 20/8 for 20k gains, worst case: 2k gains anywhere around that freefly.

Quite ok for a weekend-trade

corduroy

Active Member

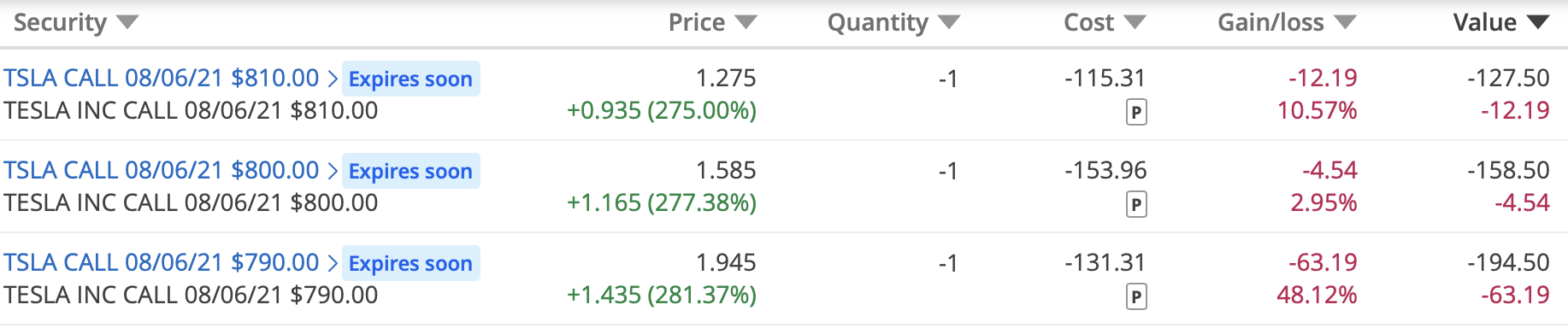

I also sold the $810s. That's as close as I'm willing to get to this freight train.Here are my plays for the morning/week. I've got another two to go but will hold in case things get nutty. These three already surpassed my weekly goal so probably best not to get greedy, or at least greedy too soon.

View attachment 690991

juanmedina

Active Member

Sold everything I can sell for the week 760's on the shares and 770's the calls. I didn't follow my own rule of not selling everything on one day  will see how it goes. I will deploy the the vertical spreads tomorrow.

will see how it goes. I will deploy the the vertical spreads tomorrow.

I tend to think not games - just the market continuing to digest the recent earnings report. I'm giving it at least another week assuming this kind of move / direction. Not every day in the week of course, but more up than down on up days, and more up days than down days, sort of thing. And that earnings report WAS really goodWhat games are afoot with the significant pre-market price bump from Friday’s close?

Similar threads

- Replies

- 50

- Views

- 7K

- Replies

- 10

- Views

- 4K

- Replies

- 106

- Views

- 10K

- Replies

- 5

- Views

- 5K