Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Wiki Selling TSLA Options - Be the House

- Thread starter adiggs

- Start date

Hey, welcome back ;- )I thought market was supposed to crash on a no cut FOMC? What's going on?

Based on today's PA do you think TSLA has legs to $183 or not a bad idea to start selling -C200 5/17 around here ($175-176)?

Biden finalizes crackdown on gas cars, forcing more than half of new car sales to be electric by 2030

Thomas CatenacciWed, March 20, 2024

The Biden administration has finalized a slate of highly-anticipated environmental regulations curbing gas-powered vehicle tailpipe emissions as part of its broader efforts to reduce greenhouse gas emissions and combat global warming.

In a joint announcement Wednesday, the White House and the Environmental Protection Agency (EPA) unveiled the most aggressive multi-pollutant emission standards ever finalized. While the regulations target gas-powered vehicles, they are explicitly designed to push wider nationwide adoption of electric vehicles (EV) and, according to officials, are expected to ensure nearly 70% of all new car sales are zero-emissions within a few years.

"President Biden is investing in America, in our workers, and in the unions that built our middle class and established the U.S. auto sector as a leader in the world," White House national climate adviser Ali Zaidi said in a statement. "The President’s agenda is working."

"With transportation as the largest source of U.S. climate emissions, these strongest-ever pollution standards for cars solidify America’s leadership in building a clean transportation future and creating good-paying American jobs, all while advancing President Biden’s historic climate agenda," added EPA administrator Michael Regan.

https://www.yahoo.com/news/biden-finalizes-crackdown-gas-cars-155147441.html

tivoboy

Active Member

Not when the expectation for a cut was essentially 0%… that said, I’m surprised that with the move out of the dot plot, only ONE governor seeing a cut by June, or 3 instead of 2 cuts this year, having EOY FOMC rates at 4.63 by EOY shouldn’t be considered too great, but it’s basically the 75 bps that I foresee.. June, Sept, Dec. that would get us there.I thought market was supposed to crash on a no cut FOMC? What's going on?

I entered -210C and +160/-150P as a hedge for 4/12.Hey, welcome back ;- )

Based on today's PA do you think TSLA has legs to $183 or not a bad idea to start selling -C200 5/17 around here ($175-176)?

Not when the expectation for a cut was essentially 0%… that said, I’m surprised that with the move out of the dot plot, only ONE governor seeing a cut by June, or 3 instead of 2 cuts this year, having EOY FOMC rates at 4.63 by EOY shouldn’t be considered too great, but it’s basically the 75 bps that I foresee.. June, Sept, Dec. that would get us there.

Not when the expectation for a cut was essentially 0%… that said, I’m surprised that with the move out of the dot plot, only ONE governor seeing a cut by June, or 3 instead of 2 cuts this year, having EOY FOMC rates at 4.63 by EOY shouldn’t be considered too great, but it’s basically the 75 bps that I foresee.. June, Sept, Dec. that would get us there.

I think JPow and the FOMC did a pretty thoughtful job of kicking the can down the road here. They seem sensitive to not giving the market indigestion. At the same time, it seems like markets anticipated this outcome fairly well coming into the presser, so...no need to reposition to the downside.

Re: TSLA, my thesis on expectations of a rough reaction to the Q1 print have not changed at this point. I just think we might have an opportunity to dump from the $190s instead of from the $160s. Wouldn't be surprised if we get a rally into early next week before the profit-taking / hedging begins. Will Tesla's attempts to pull demand forward into Q1 be enough to get us a 430k print? Remains to be seen.

tivoboy

Active Member

What is most interesting for ME at this point, is the war of words and push me pull you that is now going to be going on between ECB and USAFED… ECB is indicating they will move SOONER rather than too late, and so I think we’re going to see shortly higher USD$ demand, for liquidity and fixed income investing IN USD, which well you all know what happens when the USD$ rallies.I think JPow and the FOMC did a pretty thoughtful job of kicking the can down the road here. They seem sensitive to not giving the market indigestion. At the same time, it seems like markets anticipated this outcome fairly well coming into the presser, so...no need to reposition to the downside.

Re: TSLA, my thesis on expectations of a rough reaction to the Q1 print have not changed at this point. I just think we might have an opportunity to dump from the $190s instead of from the $160s. Wouldn't be surprised if we get a rally into early next week before the profit-taking / hedging begins. Will Tesla's attempts to pull demand forward into Q1 be enough to get us a 430k print? Remains to be seen.

276.67 Puts @ 6/21/2024 is the most dominant contract today

The contract has received $61.05M in premiums today(Huh? Anyone understand this play?)

Last edited:

semi-related to TSLA, but the way it looks now, SPY bulls will have a very easy time all the way to end of May, even if this thing starts pulling back from here. Now that FOMC is out of the way and the next one is not due for another 2 months, I'm wondering if another hot CPI/PPI/PCE print can even derail this market, especially when another hot earning season, aside from the obvious suspect (singular, not plural), is coming next month. This is what it's all about. Bears had limited ammo and when that ran out, we squeezed.

missed by a smidgeWicked Stocks says close today over 175.94 = close all short positions and go long.

thenewguy1979

"The" Dog

BTO some Long 1DTE QQQ and SPY Calls riding the euphoria for tomorrow.

Reenter ICs for NVDA at -870P/-965C exp 3/22

Riding the "happiness" band wagon for now.

Reenter ICs for NVDA at -870P/-965C exp 3/22

Riding the "happiness" band wagon for now.

thenewguy1979

"The" Dog

Guess now we can say it can go either way tomorrowmissed by a smidge

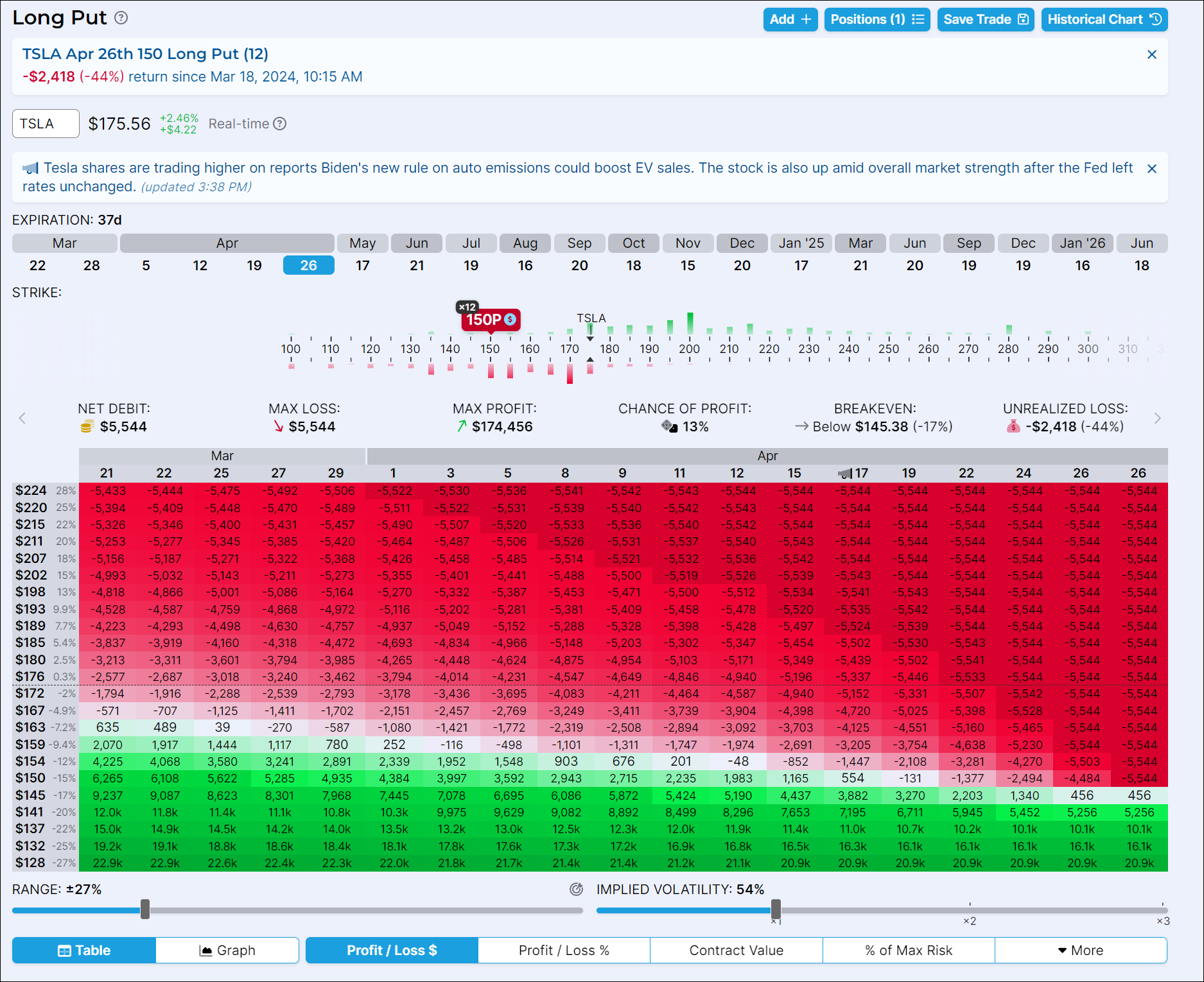

Guys I need some non-advice, earlier this week I bought 12x +P150 4/26 (37 days left) @4.87 with profits from gains. They're trading now around $2.60 (-46%) didn't set a SL (I know, I know).

Do I get out and take what I can get tomorrow at any dip, wait to see if we take out $183 first, or hold out for 4/2 P&D where IV will likely be higher and we may travel down (but we can be trading higher too)?

Yes, I need to manage my positions better so this doesn't happen. Earlier this week I sold dying +C255 9/20 calls at a decent loss, so my batting average is getting hit on both sides

https://optionstrat.com/pFuF3YGkGdmk

Today @54% IV:

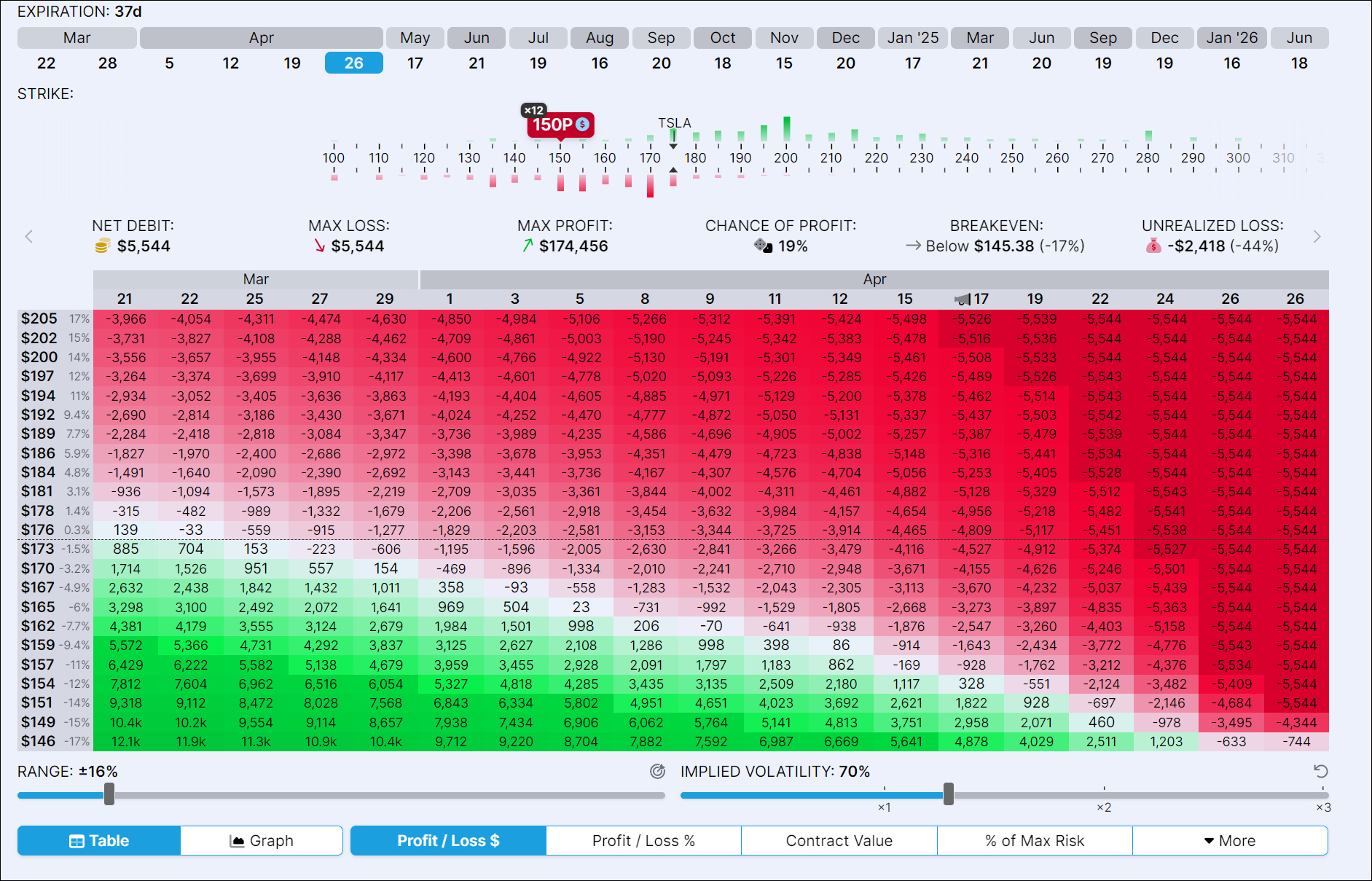

At @70% IV:

Do I get out and take what I can get tomorrow at any dip, wait to see if we take out $183 first, or hold out for 4/2 P&D where IV will likely be higher and we may travel down (but we can be trading higher too)?

Yes, I need to manage my positions better so this doesn't happen. Earlier this week I sold dying +C255 9/20 calls at a decent loss, so my batting average is getting hit on both sides

https://optionstrat.com/pFuF3YGkGdmk

Today @54% IV:

At @70% IV:

Last edited:

I'm holding on to my 100x July +p150's... sure the markets rallied after FOMC today, but based on nothing, and Tesla story remains unchanged. The stock has picked-up thanks to a few price increases, but these seem to be more of a demand lever to me rather than a throttle, and indicative of poor sales in Q1Guys I need some advice, earlier this week I bought 12x +P150 4/26 (37 days left) @4.87 with profits from gains. They're trading now around $2.60 (-46%) didn't set a SL (I know, I know).

Do I get out and take what I can get tomorrow at any dip, wait to see if we take out $183 first, or hold out for 4/2 P&D where IV will likely be higher and we may travel down (but we can be trading higher too)?

Yes, I need to manage my positions better so this doesn't happen. Earlier this week I sold dying +C255 9/20 calls at a decent loss, so my batting average is getting hit on both sides

https://optionstrat.com/pFuF3YGkGdmk

Today @54% IV:

View attachment 1030061

At @70% IV:

View attachment 1030064

Will this be the case, don't know, no idea whatsoever, even if P&D is terrible, is it "priced-in"? Again, zero clue... but I'd sure kick myself if I sold them off, then watched the SP dump, so I prefer to wait and see, then sell shitputs against them to recuperate

What I might do is go for a -p170 YOLO on them for 3/28, given that I have 100x -c170's that I intend to roll if they're ITM, then might be worth doing a big-ass straddle if the SP looks like it will rise pre-P&D

So not advice, just saying what I'm doing with mine, plus they have +3 months more time to run than yours, which makes them more interesting to keep for the moment

Thanks. Since my +P150 4/26/24 has only 37 days left, best to just kill it tomorrow and take what I could get NFA (maybe rebuy at $183, $187 or $197 if we get there)? Just not sure what’s the smart thing to do with a +P that has gone rogue for now.I'm holding on to my 100x July +p150's... sure the markets rallied after FOMC today, but based on nothing, and Tesla story remains unchanged. The stock has picked-up thanks to a few price increases, but these seem to be more of a demand lever to me rather than a throttle, and indicative of poor sales in Q1

Will this be the case, don't know, no idea whatsoever, even if P&D is terrible, is it "priced-in"? Again, zero clue... but I'd sure kick myself if I sold them off, then watched the SP dump, so I prefer to wait and see, then sell shitputs against them to recuperate

What I might do is go for a -p170 YOLO on them for 3/28, given that I have 100x -c170's that I intend to roll if they're ITM, then might be worth doing a big-ass straddle if the SP looks like it will rise pre-P&D

So not advice, just saying what I'm doing with mine, plus they have +3 months more time to run than yours, which makes them more interesting to keep for the moment

Last edited:

Tough to time these puts. I have some P155 for 04/05 that are obviously under water. I’m going to see how TSLA performs tomorrow in the first hour and close them if it continues to be strong.Thanks. Since my +P150 4/26 has only 37 days left, best to just kill it tomorrow and take what I could get NFA (maybe rebuy at $183, $187 or $197 if we get there)? Just not sure what’s the smart thing to do with a +P that has gone rogue for now.

A lot of the option flow today seemed to suggest we are going higher. I guess the market liked what it heard from JPow. He almost seemed to suggest that he cares more about unemployment than inflation.

TSLA closed above 10 day SMA so I do expect continuation tomorrow. I would have liked to see better volume but still decently bullish.

Similar threads

- Replies

- 50

- Views

- 8K

- Replies

- 10

- Views

- 4K

- Replies

- 106

- Views

- 10K

- Replies

- 5

- Views

- 5K