hmmm... Huge ~30 point move in a few days. Considering selling some calls on my core shares. What are people thinking? I'm wondering about selling a 180 for next week for ~$2 at the open. The benefits of selling it now is I get more for it [at the same share price] and can close for profit if we get a pullback. However, normally I like to wait for Tuesday of the selling week to get a sense of things and see where the call walls are. Not much in the way of large call walls for next week at this point. If it goes against me I can easily roll out to 200 which was my exit point.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Wiki Selling TSLA Options - Be the House

- Thread starter adiggs

- Start date

I’m looking at my watch right now and - tomorrow ain’t over yet

I like your optimism.

For many of my friends with millions of dollars invested in Tesla and busy day jobs, it makes sense for them to buy and hold. Maybe sprinkle in some covered calls or buy puts as insurance from time to time. Guys like me though, who have much smaller bank rolls, more time on my hands, and a deep fascination with phycology and technical analysis, prefer to trade tsla in hopes of making more during rallies while avoiding downside risk.

From my experience, the most money and the highest success rate will be made trading with the trend and identifying reversal points. So how do you identify the direction of the trend and how do you know when it has reversed? Here's my 2 sense:

There are small trends inside of bigger trends inside of even bigger trends. Most people know that, but what they may not know is which trend they are going to trade.

Just before P&D (4/2/23) I mistakenly traded the short-term uptrend despite the larger trend still pointing down. The larger trend is more powerful until it’s broken.

View attachment 1036427

To identify the trend, I like using candle setups, moving averages, and trendlines. Any indicator that the stock has recently respected should be used. If the SP hits a trendline and immediately shows support/resistance that is a well respected trendline. That trendline should then be monitored closely. Same is true of moving averages.

There are times the SP is not respecting a trendline or moving average. The SP acts like they don’t exist and it goes above and below them with ease. Times like these I don’t pay much mind to the indicator since they aren’t well respected. Here’s an example during the Nov-Dec 2022 fall where the daily 21 EMA was well respected until it broke in Jan 2023.

View attachment 1036429

To identify when a trend may have reversed or is coming to an end, I like using candle setups, RSI divergences, and volume. Reversal candles are really the first major sign of a trend reversal. Most recently on Dec 28th, 2023 we had a daily bearish engulfing candle after an 8-week uptrend that kicked off the downtrend we are currently in. If there was a hierarchy of reversal candles, the 1 day reversal and engulfing candle are at the top of the list.

Divergences are a great tool to identify when the trend may be approaching its end. Pair this with trendlines and volume and predicting some moves starts to seem too good to be true. At the end of the last major uptrend in Dec 2023, we had massive bearish divergence on the hourly time frames as we approached key trendline resistance.

View attachment 1036430

Higher volume and/or a gap up/down on the day after the reversal candle is another key sign of a reversal. For example, Jan 9th, 2023 the SP gaped up the day after a 1-day reversal formed. Or on July 20th, 2023 the SP gaped down after hitting the strong downtrend leading back to its ATH. I also like to see volume increasing towards the end of a trend.

After a prolonged up or downtrend, if unsure if the trend has reversed ask yourself these questions:

After a questionable reversal, if you are still unsure ask yourself:

- Has there been a significant reversal candle both on the weekly and daily chart?

- Has the stock reached a well-respected long-term moving average or trendline?

- Has volume been significantly increasing towards the bottom both on weekly and daily?

- Have any divergences occurred?

- This point by itself is not a signal of a reversal and should only be used in combination with other factors. Divergences can last for several weeks, even months past when they first begin to form. Even then they aren’t a sign the SP has reversed, rather a warning.

When in doubt, wait and do nothing. The chart will provide more data soon enough.

- Has the SP broken a well-respected trendline or moving average in the direction of the trend you believe may have been reversed?

- Did volume increase during that break? (For example, Jan 23rd, 2023 when SP gaped up and volume increased following breaking the well respected 21 EMA. Or on Jan 3rd, 2024 when SP gaped down and volume increased after SP broke the well-respected uptrend line.

- What is the bigger picture telling you?

@bmd00 - what say you?

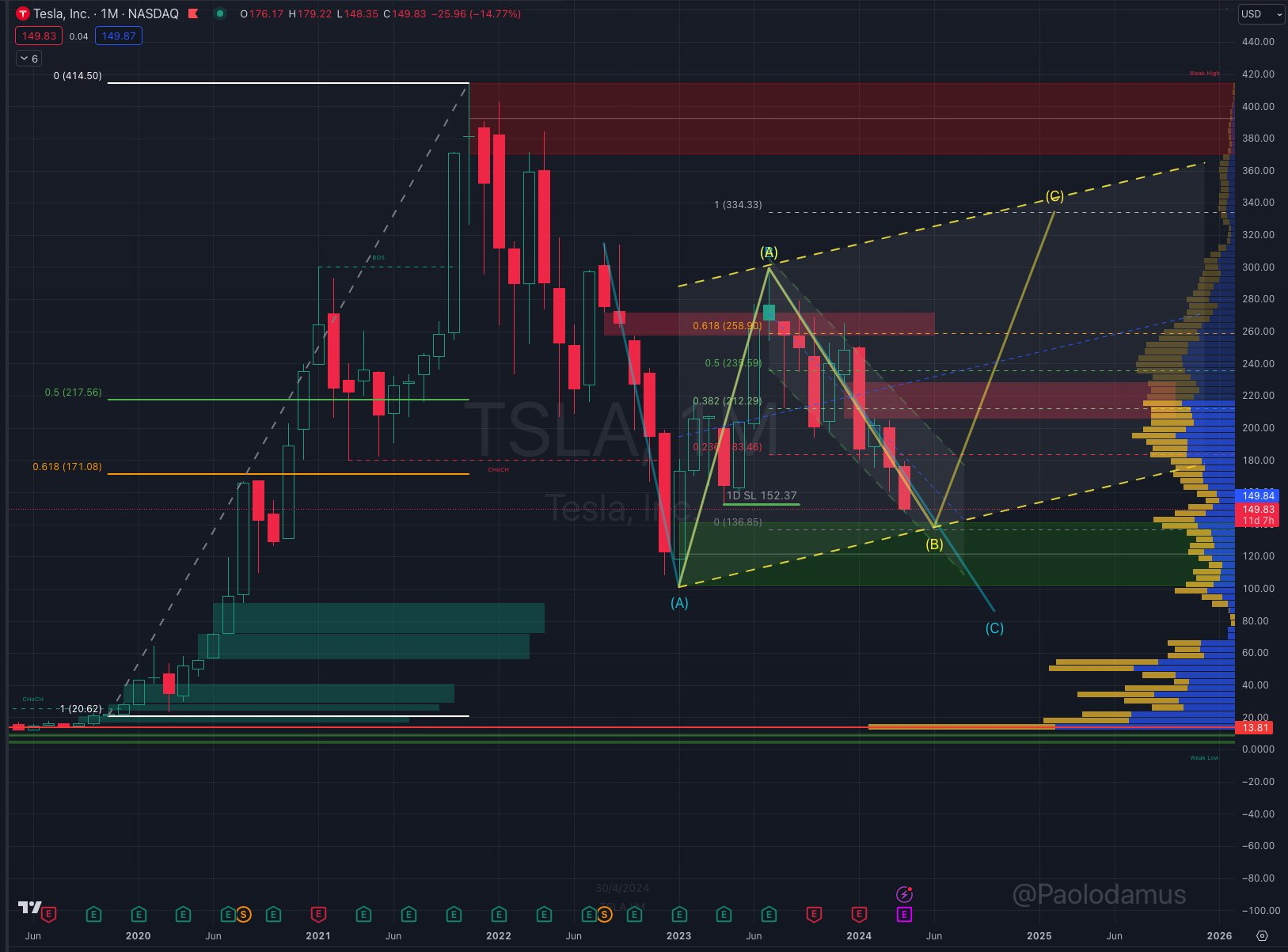

Monthly

Pre-earnings Scenario option: A higher low forms $136.85

Let's say earnings is bad, but nowhere near as bad as we thought. There's still a dip, we fill that nasty little candle gap ~$145 from Q1 '23 earnings, and the bulls buy it up around that small node on the volume profile at $136.65.

This is still a higher low, and a much higher one at that with a +35 point lead vs previous low $101.

Fib extension

A) 299.99 B) $136.86

B) $136.86  C) $334.33

C) $334.33

0.5 $235.59

0.5 $235.59

0.618 $258.90

0.618 $258.90

The trend still shifts from downtrend to uptrend, however the slope changes dramatically.

We'd still have significant resistance through multiple bearish FVG's between the 0.382, 0.5, and 0.618 resistances of this extension, but if the bulls are able to breach in this theoretical example, the target is significantly higher.

The $334.33 is +19 points higher than the previous market structure from Sept '22 and if we ever get into this scenario its a potential ChoCh to the upside.

$334.33 is +19 points higher than the previous market structure from Sept '22 and if we ever get into this scenario its a potential ChoCh to the upside.

Remember things move very slowly at the monthly chart range, but it is easier to see the whole forest here.

Extensions and retracements at this time range take several quarters, if not years to play out.

(Credit: Paolodamus)

Pre-earnings Scenario option: A higher low forms $136.85

Let's say earnings is bad, but nowhere near as bad as we thought. There's still a dip, we fill that nasty little candle gap ~$145 from Q1 '23 earnings, and the bulls buy it up around that small node on the volume profile at $136.65.

This is still a higher low, and a much higher one at that with a +35 point lead vs previous low $101.

Fib extension

A) 299.99

The trend still shifts from downtrend to uptrend, however the slope changes dramatically.

We'd still have significant resistance through multiple bearish FVG's between the 0.382, 0.5, and 0.618 resistances of this extension, but if the bulls are able to breach in this theoretical example, the target is significantly higher.

The

Remember things move very slowly at the monthly chart range, but it is easier to see the whole forest here.

Extensions and retracements at this time range take several quarters, if not years to play out.

(Credit: Paolodamus)

intelligator

Active Member

We all want something for one reason or another, so what the heck. SP rocket is great after this dry spell ... but not yet

I don't want $138 due to FOMO, I don't have cash right now, just a lousy margin loan. All good though, no sweat there. If the dip came our way, I'd cash in the Jan '25 +p180 to buy some shares !

GLTA!

I don't want $138 due to FOMO, I don't have cash right now, just a lousy margin loan. All good though, no sweat there. If the dip came our way, I'd cash in the Jan '25 +p180 to buy some shares !

GLTA!

weekly res is the 23% fib 175.60On the weekly chart, 175 area was the highest close the last 7 weeks. That gives me hope. The monthly chart looks scarier. 200 could be in the cards....

View attachment 1041785View attachment 1041786

monthly res is the 38% fib 172.78

intelligator

Active Member

Night chain says tall gamma at 170 followed by 175, dealer positioning vanna 170 or 180 would work, 175 intemediary, maybe we land at 173 end of day? Curious of the red candle @dl003 mentioned a few pages back... I'm interested in buying some puts on a strong pop, just unsure what strike or expiry.

Knightshade

Well-Known Member

Sadly the income cap is very low- like 93k for a family of 4, and WA is not a cheap state to live in.

thenewguy1979

"The" Dog

I could have made money inversing future guy that week.to be fair, the last time he said "data does not lie", we crashed instead of going to 220.

Who would of thought a guy claiming from the future got the future wrong?!

This chart always hurts my brain.

What do you look at and how do you interpret it?

Thank you for asking.What are you interpreting from this?

@Max Plaid and everyone else, does it make sense to sell a few -P170 1/17/25 @$25 to pay to BTC some ITM CC's (-C165 5/17) if it becomes necessary?

Meaning is -P170 (net ~$145) a favorable R:R for 10 months from now, since the trend at least currently is up. Is that how you do a flip roll, or is that meant to be a different type of strike/DTE?

Or better to just roll up and out as it gets closer if possible?

Meaning is -P170 (net ~$145) a favorable R:R for 10 months from now, since the trend at least currently is up. Is that how you do a flip roll, or is that meant to be a different type of strike/DTE?

Or better to just roll up and out as it gets closer if possible?

Knightshade

Well-Known Member

Xpeng already has an L2 FSD equivalent like that that works everywhere in China.

Wake me up when someone actually gets to useful >L2 in a consumer vehicle.

(useful is there to avoid someone bringing up Mercedes system with more disclaimers than a job application to be a stewardess for Elons jet)

Well not sure I'm worth asking for advice, given how I got shafted with the earnings! My thoughts, NFA...@Max Plaid and everyone else, does it make sense to sell a few -P170 1/17/25 @$25 to pay to BTC some ITM CC's (-C165 5/17) if it becomes necessary?

Meaning is -P170 (net ~$145) a favorable R:R for 10 months from now, since the trend at least currently is up. Is that how you do a flip roll, or is that meant to be a different type of strike/DTE?

Or better to just roll up and out as it gets closer if possible?

For me, the TSLA fundamentals didn't change, other than Musk saying he thought they'd sell more cars in 2024 than 2023 - a tall order if you ask me, requires 500k deliveries QoQ for the rest of the year, which I don't see happening, I'm not even sure they have the production capacity for that. Based on the numbers, TSLA should be $90 right now

The big stock pump effort from Musk since the poor P&D has been relentless and culminated with the shareholder deck and a well scripted earnings call that promised a lot, but remains to be seen what is actually delivered, this changed the sentiment, for the moment, and has driven the stock up on FOMO. I really don't buy into this right now, but I have no clue where it will stop. We've seen in the past TSLA go on these bull runs based on nothing, can be 175 is the top, or maybe it reclaims 300, zero idea

People claim TSLA was "oversold" and was already down 40% this year. Well yes, there was a good reason for that, it was over-priced end of 2023 and sales dropped hard, that's not being "oversold", that's correcting

For the TA, I'm reading from various sources that it may go up more, could drop, or perhaps trades sideways at 175, depends who you ask, and which time of day it is

I would personally not want to write puts to cover calls right now. Given all that has happened, Q2 becomes critical. If the P&D numbers are similar to Q1 then I would expect a hard crash. You always need to consider what you will do with those -p170's if it dumps. Sure, you have $25 premium to cover you down to $145, but take into account that you're also using that premium to buy back the ITM calls, so it's less than you think in the bigger picture

And yes, I know I did just write some Dec 2025 -p190's to cover ITM calls, but but but, these are straddled with calls, which are written against LEAPS, different IMO -> maybe do that, straddle them, my favourite rescue-position

I'm writing $2 premium weekly calls and puts from here, my escape for the calls is to roll to September -c240, butI have Jan +c300's to use as the long-leg of a calendar for those, and if the SP were to hit $240 then I would be able to offload the Dec 2025 +c200's and recuperate a lot of cash

SebastienBonny

Member

Decided to sit it out til after earnings, so didn't buy shares at the lows, no additional contracts,...

Anyway yesterday I repositioned a bit after taking everything said in the earnings call into consideration.

Had:

June 26 250 -P

June 24 220 -P

Oct 24 200 -C

Combined June 26 250 -P and June 24 220 -P to get 2x Dec 26 220 -P = 3000 margin improvement. Half covered by cash, other half by margin.

Once those get OTM, I'll consider rolling one back in and change the strike of the other one back higher.

Oct 24 200 -C unchanged.

Bought more shares at +- 160 and wrote a 05/31 175CC which went from +- 15 OTM to almost ITM right now .

.

As it's exactly the CB of those 100 shares I'll probably let it run and see what my possibilities are once expiration approaches.

By the looks of it, even 20-30$ ITM calls are still worth rolling one month further right now, so that could be one outcome should we rise further.

Sure looks different looking at 20-30$ ITM -p's.

Should we go down again like some predict, there could be a possibility to close early and take the profit.

Anyway yesterday I repositioned a bit after taking everything said in the earnings call into consideration.

Had:

June 26 250 -P

June 24 220 -P

Oct 24 200 -C

Combined June 26 250 -P and June 24 220 -P to get 2x Dec 26 220 -P = 3000 margin improvement. Half covered by cash, other half by margin.

Once those get OTM, I'll consider rolling one back in and change the strike of the other one back higher.

Oct 24 200 -C unchanged.

Bought more shares at +- 160 and wrote a 05/31 175CC which went from +- 15 OTM to almost ITM right now

As it's exactly the CB of those 100 shares I'll probably let it run and see what my possibilities are once expiration approaches.

By the looks of it, even 20-30$ ITM calls are still worth rolling one month further right now, so that could be one outcome should we rise further.

Sure looks different looking at 20-30$ ITM -p's.

Should we go down again like some predict, there could be a possibility to close early and take the profit.

SebastienBonny

Member

So first thing you should ask yourself: you wrote -C 165 but didn't want to lose those shares at that point?@Max Plaid and everyone else, does it make sense to sell a few -P170 1/17/25 @$25 to pay to BTC some ITM CC's (-C165 5/17) if it becomes necessary?

Meaning is -P170 (net ~$145) a favorable R:R for 10 months from now, since the trend at least currently is up. Is that how you do a flip roll, or is that meant to be a different type of strike/DTE?

Or better to just roll up and out as it gets closer if possible?

Joking aside: don't be scared about a quick run up... I wrote it here several times: I had a 215 -C when we went to +- 290 last year.

I rolled that contract on a monthly base and got it up to 240 - which I eventually closed for pennies - AND, more important, I got like 3000 bucks out of those actions as well over 6 or 7 months.

As I see it, I wouldn't try to fix this by adding more contracts to cover closing others...

All we know, one trading day later you'll regret that decision.

If you really don't want to lose the shares at all costs: just roll that contract further away for a higher SP you do want to get rid of them.

If you think we may run up higher and shares may get called away, then let the contract run, let those shares go and buy them again after (may be higher, but you can write new -C's after as well).

This is emotion. At some point, say when we were trading at 140, people were happy to sell shares at 165. Now we're 30 points higher, the situation turned, but I don't see why this is different when you're playing the options game with shares. You know you cap your gains by choosing a certain strike, if you don't want that, you need to stop writing calls against them and leave them uncovered or taking less risks (and earning less premium ofc...).

Similar threads

- Replies

- 50

- Views

- 7K

- Replies

- 10

- Views

- 4K

- Replies

- 106

- Views

- 10K

- Replies

- 5

- Views

- 5K