Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Wiki Selling TSLA Options - Be the House

- Thread starter adiggs

- Start date

Fully loaded 10/29 -p800/+p700. A few -c1000-+c1100 from yesterday but I'm already regretting those.

That image is not a roll, do you mean a new position for next week?I have a $860 covered call expiring today, obviously deep under water. Have been exploring different options to roll to next week. What are some of the risks with the below I should be aware of?

(I have ITM sold calls for next week)

Depends - if you don't want to lose them (for whatever reason, taxes, sentimental value..) get the best strike improvement possible for 1 or check 2 weeks out.I have a $860 covered call expiring today, obviously deep under water. Have been exploring different options to roll to next week. What are some of the risks with the below I should be aware of?

If you just want to get a credit, just roll to the same strike next week for a big credit.

Or split the difference - $880 for a big credit and another week.

That you could lose $75k if it gets to the long leg and you do nothing (-the $5600ish you get for the spread).I have a $860 covered call expiring today, obviously deep under water. Have been exploring different options to roll to next week. What are some of the risks with the below I should be aware of?

BrownOuttaSpec

Active Member

I did the same exact thing. Horrible premiums but at least something going and still have more dry powder for Monday.Finally went in with some -795/+745 this morning for 10/29. Saving ammo for later today or Monday. We shall see.

Sorry, I didn't add the position im closing. Was just looking at different trades that give me around 5k credit.That image is not a roll, do you mean a new position for next week?

(I have ITM sold calls for next week)

My focus is keeping my shares, I would probably just roll to $880 as you suggested.Depends - if you don't want to lose them (for whatever reason, taxes, sentimental value..) get the best strike improvement possible for 1 or check 2 weeks out.

If you just want to get a credit, just roll to the same strike next week for a big credit.

Or split the difference - $880 for a big credit and another week.

that would be badThat you could lose $75k if it gets to the long leg and you do nothing (-the $5600ish you get for the spread).

Knightshade

Well-Known Member

Finally went in with some -795/+745 this morning for 10/29. Saving ammo for later today or Monday. We shall see.

was thinking of similar myself but premiums just terrible- currently waiting to see if late afternoon they hammer down to 899 to get below this weeks $900 call wall and I can get slightly more...or if not might be a signal I could sell the spread a little higher "safely"

Did something new for me - opened a set of 1000 - 1050 BCS for next week to complete the iron condor with the 700 750 BPS I had opened yesterday. It's a relatively small position in my IRA account - doing this as much to play with and understand the concept as to generate cash as the $$ weren't that significant. I've mostly played on the BPS side, with a small dabbling in straight sold calls, so wanted to try this mechanic to understand it better.

tradenewbie

Member

I sold BCS -920/1020 yesterday for today expiry, didn't get the timing quite rite so my average premium was only around 1.2, thought it would be safe last night its unlikely to go beyond 900. This was really panic when it keeps going up to 910 earlier, although the chance of getting to 920 today is extremely unlikely, but decide to close it at 0.5 even though I should be able to close it at a lower cost.

Although the net premium was only 0.7 (was able to get $1 easily for BCS -1000/1100 if I was not that greedy and couldn't get filled earlier this week), I don't have to be in panic mode today.

So far, I open pretty much most of the BCS -1000/1100 for next week with around $1 premium, but only manage to get a few BPS because of the low premium (-680/580)

Although the net premium was only 0.7 (was able to get $1 easily for BCS -1000/1100 if I was not that greedy and couldn't get filled earlier this week), I don't have to be in panic mode today.

So far, I open pretty much most of the BCS -1000/1100 for next week with around $1 premium, but only manage to get a few BPS because of the low premium (-680/580)

Premiums for BPS for next week are indeed terrible, so I’ve gone for more naked puts. After the 5 p810 for $5.20 of yesterday I sold another 5 p810 for $5.10 just after the opening bell and just now 5 p820 for $5.10. I had to buy back some of my p750 expiring today to get that last one executed, so decided it was best to simply buy back all 20 of them for a few cents. Feels more comfortable.

samppa

Active Member

Opened a position to test managing a tricky situation:

11/5 BPS -900p/+850p @14.00. (28% compared to secured margin).

If we hold above 900 this could lose value fast. If we fall below 900 I'll see what my options are, learning in the process.

NOT ADVICE. Never had to roll BPS before so that's why I'm opening this.

Leaving plenty of cash unlocked in case of a drop next week.

Brilliant idea. I too think that put premiums are lousy and don't want to open any large bps now. I'm kind of expecting a bear raid on monday.

But a great time for experiments! So I opened -900/+800 bps for 10/29. Only 1 contract.

samppa

Active Member

Can't you just roll the 775 to say 780?I realized this morning that I screwed up yesterday. I opened a set of 775/-850 BPS. They are doing nicely up 23% right now, however my screw up is opening with the spread in $5 increments. I wanted to turn it into an IC a little bit ago and realized I can’t because the call options are in $10 increments. I have a GTC order for these to close at 50%, maybe they will close later today and I can then reopen with a $10 incremental spread size. Something to keep in mind if you are looking to leg into IC’s.

after lots of data number-crunching and re-reading of posts, i have decided to halve my TSLA and test dip my toes into the "all cash" structure

for me, this is good news coz:

- potential for more options income

- i can open more positions and go safer deeper OTM

- risk management is easier: 'more DOTM positions will have more probability of success' is better than 'less OTM positions with some probability of success'

- even with lesser credit (due to far OTM), it's still more recurring/compounding income than just pure hodl

- even if sp increases by 50% annually, account total value is still more than just pure hodl

- even if sp increased by $100 into $1000 right now, it's still unrealized gain and not income - i can't spend it and can't compound the gain

- less worrying about black swan which could literally happen overnight and wipe out my account that i need for the next 30 years (think covid 2020, Black Monday, 420 funding secured, 911, etc)

- less worrying about the daily sp swings

- combined with more trading based on IV, there is less worrying if TSLA is directionally downhill

- less worrying about margin rooms and margin calls (since more cash means less reliance on margin)

- if i need to profit on the earnings sp spike, i may just go in and out (ie buy then sell the news)

- more cash means i can sometimes play with the 10:30 MMD for quick stock daytrading (for top-up of options income)

- more income means i have more capability to kickstart and fund my kids' post-university dreams - i rather they own a business than have a dayjob waiting to be paid every 2 weeks (son wants to own an indoor basketball gym and manage a league)

as far as i know, there are at least 2 big guns here who are also in "all cash" and they seem to be doing well

this is my 2 cents!

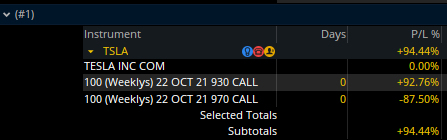

back to topic... my BCS today is probably safe; will close it soon:

for me, this is good news coz:

- potential for more options income

- i can open more positions and go safer deeper OTM

- risk management is easier: 'more DOTM positions will have more probability of success' is better than 'less OTM positions with some probability of success'

- even with lesser credit (due to far OTM), it's still more recurring/compounding income than just pure hodl

- even if sp increases by 50% annually, account total value is still more than just pure hodl

- even if sp increased by $100 into $1000 right now, it's still unrealized gain and not income - i can't spend it and can't compound the gain

- less worrying about black swan which could literally happen overnight and wipe out my account that i need for the next 30 years (think covid 2020, Black Monday, 420 funding secured, 911, etc)

- less worrying about the daily sp swings

- combined with more trading based on IV, there is less worrying if TSLA is directionally downhill

- less worrying about margin rooms and margin calls (since more cash means less reliance on margin)

- if i need to profit on the earnings sp spike, i may just go in and out (ie buy then sell the news)

- more cash means i can sometimes play with the 10:30 MMD for quick stock daytrading (for top-up of options income)

- more income means i have more capability to kickstart and fund my kids' post-university dreams - i rather they own a business than have a dayjob waiting to be paid every 2 weeks (son wants to own an indoor basketball gym and manage a league)

as far as i know, there are at least 2 big guns here who are also in "all cash" and they seem to be doing well

this is my 2 cents!

back to topic... my BCS today is probably safe; will close it soon:

A guy stops in a small town for the night while on a road trip. He asks a local which of the two motels he should stay at.after lots of data number-crunching and re-reading of posts, i have decided to halve my TSLA and test dip my toes into the "all cash" structure

for me, this is good news coz:

- potential for more options income

- i can open more positions and go safer deeper OTM

- risk management is easier: 'more DOTM positions will have more probability of success' is better than 'less OTM positions with some probability of success'

- even with lesser credit (due to far OTM), it's still more recurring/compounding income than just pure hodl

- even if sp increases by 50% annually, account total value is still more than just pure hodl

- even if sp increased by $100 into $1000 right now, it's still unrealized gain and not income - i can't spend it and can't compound the gain

- less worrying about black swan which could literally happen overnight and wipe out my account that i need for the next 30 years (think covid 2020, Black Monday, 420 funding secured, 911, etc)

- less worrying about the daily sp swings

- combined with more trading based on IV, there is less worrying if TSLA is directionally downhill

- less worrying about margin rooms and margin calls (since more cash means less reliance on margin)

- if i need to profit on the earnings sp spike, i may just go in and out (ie buy then sell the news)

- more cash means i can sometimes play with the 10:30 MMD for quick stock daytrading (for top-up of options income)

- more income means i have more capability to kickstart and fund my kids' post-university dreams - i rather they own a business than have a dayjob waiting to be paid every 2 weeks (son wants to own an indoor basketball gym and manage a league)

as far as i know, there are at least 2 big guns here who are also in "all cash" and they seem to be doing well

this is my 2 cents!

back to topic... my BCS today is probably safe; will close it soon:

View attachment 724301

Local says, "It doesn't matter, whichever you choose you'll wish you were at the other one."

So the guy kept driving, fell asleep, and crashed.

Moral of the story?

There will always be a more optimum set of actions/ trades

No matter where you go, there you are

FSD can't come soon enough

alterac000

Member

after lots of data number-crunching and re-reading of posts, i have decided to halve my TSLA and test dip my toes into the "all cash" structure

for me, this is good news coz:

- potential for more options income

- i can open more positions and go safer deeper OTM

- risk management is easier: 'more DOTM positions will have more probability of success' is better than 'less OTM positions with some probability of success'

- even with lesser credit (due to far OTM), it's still more recurring/compounding income than just pure hodl

- even if sp increases by 50% annually, account total value is still more than just pure hodl

- even if sp increased by $100 into $1000 right now, it's still unrealized gain and not income - i can't spend it and can't compound the gain

- less worrying about black swan which could literally happen overnight and wipe out my account that i need for the next 30 years (think covid 2020, Black Monday, 420 funding secured, 911, etc)

- less worrying about the daily sp swings

- combined with more trading based on IV, there is less worrying if TSLA is directionally downhill

- less worrying about margin rooms and margin calls (since more cash means less reliance on margin)

- if i need to profit on the earnings sp spike, i may just go in and out (ie buy then sell the news)

- more cash means i can sometimes play with the 10:30 MMD for quick stock daytrading (for top-up of options income)

- more income means i have more capability to kickstart and fund my kids' post-university dreams - i rather they own a business than have a dayjob waiting to be paid every 2 weeks (son wants to own an indoor basketball gym and manage a league)

as far as i know, there are at least 2 big guns here who are also in "all cash" and they seem to be doing well

this is my 2 cents!

back to topic... my BCS today is probably safe; will close it soon:

View attachment 724301

fwiw I did this early this month in my Roth where there would be no capital gains incurred from the sale of TSLA stake, and now doing the option play via cash. Since it is a Roth no margin, scary if not careful to hold enough cash to fix a bad position, and the only other way to generate new cash would be to liquidate other non-TSLA positions. I am going slow... 750|700 BPS opened yesterday for $1.02, and still waiting to see if and when I will do any BCS for next week.

That said, I am still 'balanced' with TSLA shares in my taxable account. I'm highly conflicted on generating a massive sale now due to tax implications. Also finding my trading ideas are different - for example in this account, I opened BCS 1000/1050 for next week knowing that if we hit $1000sp I will be comfortable selling off the 1050 calls and having my TSLA shares called away at $1000. If we go to $1000 next week... did someone mention Xmas party???

InTheShadows

Active Member

I considered that then thought about how I would record that in my spreadsheet and bailed on the idea. I’m also not sure 910 is near the high for the upcoming week. I think once the 10Q is out we will get some more buying. I’m more comfortable with I dare you BPS at this point than call spreads.Can't you just roll the 775 to say 780?

Similar threads

- Replies

- 50

- Views

- 7K

- Replies

- 10

- Views

- 4K

- Replies

- 106

- Views

- 10K

- Replies

- 5

- Views

- 5K